Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Colombia plastic market attained a value of USD 5.00 Billion in 2025 and is projected to expand at a CAGR of 3.40% through 2035. The market is further expected to achieve USD 6.99 Billion by 2035. Growth in the country’s plastic demand is reinforced by agriculture’s shift toward durable drip-irrigation tubing and greenhouse films, as growers search for materials that extend crop cycles and reduce replacement downtime.

A notable shift in the industry became clearer in August 2025, when MHS introduced the new M3, a fully automated manufacturing cell designed for the high-volume production of direct-gated precision micro parts. As per the Colombia plastic market analysis, over 1.4 million tons of plastic waste was produced in 2023, pushing converters to reposition themselves to capture advanced processing capabilities and invest in bio-synthetic chemistries instead of waiting for imported solutions.

Alongside these material innovations, resin producers and compounders are redesigning melt-flow indices, mechanical profiles, and UV-stabilized blends to support Colombia’s expanding food, construction, and agricultural packaging sectors. For example, in August 2022, Pacorr disclosed the launch of an all-new fully automatic testing machine called the Melt Flow Index Tester. The testing machine is designed to test the viscosity of plastic granules. Flexible packaging converters have intensified trials with multilayer structures that cut resin consumption without compromising barrier performance, a priority for snack and poultry processors trying to manage rising raw-material volatility. Several pipe manufacturers in Bogotá and Cali also upgraded their extrusion lines to handle higher-strength PE compounds, thereby shaping the Colombia plastic market trends and dynamics.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

3.4%

Value in USD Billion

2026-2035

*this image is indicative*

Regulatory momentum remains one of the strongest driving factors shaping Colombia’s plastic sector. The Ministry of Environment continued enforcing Resolution 1407, pushing brands to meet stricter extended producer responsibility targets for post-consumer plastics. This pressure is driving local companies to redesign resin blends and packaging formats that improve recyclability without affecting barrier performance. In May 2023, LanzaTech Global and Plastipak Packaging, Inc. announced that they have successfully produced PPKNatura, the world’s first polyethylene terephthalate (PET) resin made from captured carbon emissions, thereby reshaping the Colombia plastic market trends and dynamics.

Colombia is rapidly emerging as a proving ground for bio-based plastics and enzyme-assisted degradation films. Following the government’s plan to phase out certain single-use plastics, demand for engineered biodegradable solutions has surged. Empaques del Atlántico and Plastilene Group both invested in pilot-scale extrusion lines to test starch-blend and PBAT-based materials. The Ministry of Science supported several bio-polymer R&D grants in 2023–2024, encouraging collaborations with university labs focused on enzyme-triggered breakdown pathways suited to the country’s climate, accelerating the Colombia plastic market value. In October 2025, Datwyler unveiled a new flip cap option featuring a bio-based polypropylene disc made from used cooking oil, instead of petroleum.

Colombia’s infrastructure pipeline continues to expand, driving higher consumption of engineered PE and PVC compounds. Government-backed water and sanitation projects under the Plan Maestro de Acueducto y Alcantarillado created momentum for pressure-rated piping with better stress-crack resistance. Pipe manufacturers in Cali and Medellín upgraded their extruders to handle advanced HDPE grades that meet new durability benchmarks. In October 2025, America Embalagens announced that the company is expanding its largest plant in São Paulo state with two new lines for the production of plastic tubes, exemplifying new Colombia plastic market opportunities.

Recycling capacity is expanding as municipalities and consumer brands increasingly commit to circularity targets. Colombia’s Economía Circular strategy accelerated investments in washing and pelletizing facilities, enabling more consistent supply of rPET and recycled PE. In February 2025, Fadeplast launched advanced technology for PET and rPET containers that are mainly intended for the companies in the food & beverage sector. Packaging producers now design preforms and films compatible with mechanical recycling thresholds, such as reducing ink loads and switching to mono-material structures. So these Colombia plastic market developments gradually reduce dependency on virgin resin imports and encourage brands to adopt recycled content in mainstream SKUs.

Processing plants across Colombia are upgrading automation and quality-control systems to improve efficiency amid rising labor and energy costs. Injection-molding companies are introducing smart cavity-pressure sensors and closed-loop cooling systems that stabilize cycle times, especially for caps, closures, and thin-wall packaging. In November 2025, TOPPAN Inc. and its subsidiary TOPPAN Speciality Films Private Limited installed a hybrid manufacturing line capable of producing both biaxially-oriented polypropylene (BOPP) film and biaxially-oriented polyethylene (BOPE) on the same machine, widening the Colombia plastic market scope.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

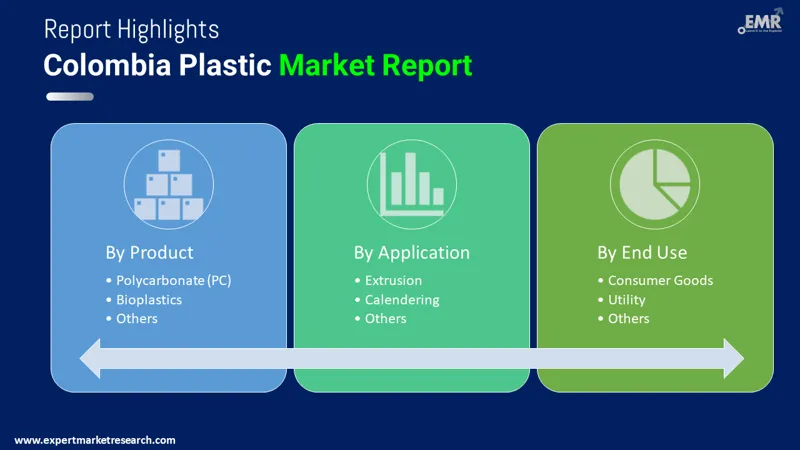

The EMR’s report titled “Colombia Plastic Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product

Key Insight: Across all the product categories considered in the Colombia plastic market report, PE benefits from its broad usability in flexible packaging, piping, and agricultural films. PP supports rigid containers and components requiring heat tolerance. PU remains essential for cushioning and insulation, while PVC continues serving construction and conduit applications. PET delivers clarity and barrier strength, catering to the beverage and personal care sectors. PS and ABS support consumer electronics and durable goods, whereas PBT and PC power engineering-grade applications needing dimensional stability. Bioplastics gain relevance where compostability or renewable content is prioritized.

Market Breakup by Application

Key Insight: Injection molding supports complex geometries and durable components across packaging, automotive, and electronics sectors. Blow molding delivers hollow packaging for beverages and household goods. Roto molding targets low-volume, heavy-duty tanks, and containers. Compression molding suits rubberized and composite parts, while casting enables niche engineering applications, driving the Colombia plastic market value. Thermoforming scales quickly for food trays and consumer packaging. Extrusion underpins film, pipe, profile, and sheet production. Calendering provides uniform PVC sheets for building and signage.

Market Breakup by End Use

Key Insight: Packaging drives plastic demand in Colombia through FMCG, pharma, and foodservice applications requiring protective, lightweight formats. Construction relies on PVC pipes, profiles, and insulation materials. Electrical and electronics need precision molded housings and connectors. Automotive emphasizes engineered polymers for durability and weight reduction. Medical devices depend on hygienic, high-clarity plastics. Agriculture uses films, irrigation components, and protective covers, boosting the Colombia plastic market penetration. Furniture and bedding manufacturers adopt foams and rigid components for comfort and structural support. Consumer goods use plastics for appliances, toys, and household items, while utilities leverage piping, conduit, and protective materials.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

By product, polyethylene (PE) leads the market growth due to versatility across packaging, construction, and infrastructure uses

Polyethylene leads the overall Colombia plastic demand growth because processors rely on its broad mechanical properties, chemical resistance, and cost stability. Converters serving food, agriculture, and basic consumer goods prefer PE since it supports lightweighting and still runs efficiently on older extrusion equipment. PE also aligns well with multilayer structures, making it suitable for barrier packaging formats used by national FMCG brands. In November 2025, NOVA Chemicals Corporation announced the launch of polyethylene resins that incorporate next-generation non-fluorinated polymer processing aid (NF-PPA).

Polyethylene terephthalate PET is expanding its share in the Colombia plastic market revenue because beverage, pharmaceutical, and personal care brands depend on high-clarity, impact-resistant packaging. PET is also favored for its recyclability, which aligns with Colombia’s circularity initiatives and retailer-led sustainability goals. Enka’s USD 40 million bottle-to-bottle recycling plant for the production of EKO PET resin, is one significant factor that has propelled this category’s growth. PET’s excellent gas barrier performance supports carbonated drinks, juices, and sensitive formulations where shelf-life protection matters.

By application, injection molding accounts for the largest share of the market revenue because it supports high-volume, precision industrial components

Injection molding dominates application because it supports Colombia’s fast-moving consumer goods, automotive components, closures, and appliance housings. The process offers repeatability, tight tolerances, and the ability to run multiple resin families without major retrofits. In November 2024, YIZUMI showcased four injection molding solutions, presented by star machines including the P250, UN500D1, UN230CE-BTP, and FF240M. Converters value injection molding for producing caps, food containers, electrical parts, and industrial fittings at high volume. Toolmakers in the region design multi-cavity molds tailored to short production cycles, enabling competitive unit economics even for mid-size processors, rapidly accelerating growth in the Colombia plastic market.

Extrusion is rapidly gaining popularity as packaging, pipe, and film producers ramp up production to meet infrastructure and consumer-goods demand. The method supports continuous, high-throughput manufacturing of films, sheets, tubing, and profiles. Extrusion lines are being configured for multilayer structures that combine strength, puncture resistance, and barrier properties with lower material use. Agricultural film makers rely on extrusion for UV-stabilized and controlled-diffusion films, while pipe producers prefer it for processing advanced HDPE grades.

By end use, packaging leads the market as brands need durable, lightweight materials for diverse applications

Packaging leads the Colombia plastic market in terms of consumption because FMCG, beverage, pharmaceutical, and personal care brands depend on lightweight and durable formats that protect product integrity. Converters supply films, bottles, trays, caps, and pouches tailored to high-speed filling lines. Retailers expect materials that balance clarity, seal strength, and shelf-life performance, pushing suppliers to refine resin blends and barrier enhancements. In August 2025, Albéa Group announced that it has entered into an agreement to acquire Amfora Packaging with operations in Colombia and Peru. Flexible packaging continues to expand due to its cost efficiency and ease of distribution in urban centers.

Automotive is growing rapidly as OEMs and tier suppliers adopt lightweight plastics to enhance fuel efficiency and durability, expanding the Colombia plastic market scope. Resin families like PP, ABS, PC, and PBT support under-the-hood components, interior trims, sensor housings, and electrical connectors. Colombian and regional assemblers require materials with heat resistance, dimensional stability, and impact strength. This has prompted suppliers to accelerate the development of engineered resins and bio-synthetic blends that can handle tougher automotive and electronics specifications.

Prominent Colombia plastics market players are focusing on sustainable feedstocks, precision processing, and accelerated commercialization. Converters are piloting bio-blend films and enzyme-assisted packaging to meet stricter extended producer responsibility rules while retaining barrier function. Multinational resin suppliers are investing in domestic rPET and stabilized PE pilot lines to shorten validation cycles and reduce import dependence.

Equipment manufacturers are bundling AI-enabled inline inspection, cavity-pressure monitoring, and predictive maintenance modules to boost uptime. Co-packing networks are expanding regional micro-facilities that enable faster SKU tests and retail pilots, reducing time-to-shelf. Colombia plastic companies offering traceability and certified recycled content are securing long-term contracts with beverage and dairy brands. Players who combine material innovation with process control and close retailer collaboration are gaining advantage in the market.

BASF SE established in 1865 and headquartered in Ludwigshafen, Germany, supplies performance additives and specialty polymers that raise thermal and mechanical performance for Colombian converters. Through local distribution partnerships, BASF offers modified polyolefin concentrates and barrier-enhancing masterbatches used in lightweight films and high-strength pipes.

Evonik Industries AG established in 2007 and headquartered in Essen, Germany, is focusing on specialty additives and functional monomers that improve recyclability and thermal performance. Evonik is supplying tailored coupling agents and polymer modifiers that help Colombian processors blend higher recycled content while minimizing mechanical loss.

Formosa Plastics Corporation established in 1954 and headquartered in the United States, is a major resin producer providing PVC, PE and engineering polymers to Latin American converters, catering to the Colombia plastic market. The company is supporting the country with stable resin supply and technical compounding services that enable pipe makers and profile extruders to run advanced HDPE and PVC grades.

Dow Chemical Company established in 1897 and headquartered in Michigan, United States, is supplying performance plastics, barrier resins, and processing aids that help Colombian converters meet demanding specifications. Dow provides oxygen-scavenging masterbatches, high-barrier coextrusion resins, and lightweighting concentrates for beverage and food packaging.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include LyondellBasell Industries Holdings B.V., ESENTTIA S.A., and Enka de Colombia SA, among others.

Unlock the latest insights with our Colombia plastic market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 5.00 Billion.

The market is projected to grow at a CAGR of 3.40% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 6.99 Billion by 2035.

Manufacturers are upgrading pilot plants, forming retailer co-development programs, investing in rPET supply, deploying AI quality controls, redesigning packs for circularity, and securing distribution partnerships.

The key trends in the market include the rising preference for bioplastics, advancements in production capabilities for plastics, and heightening demand for medical-grade plastics.

Polyethylene (PE), polypropylene (PP), polyurethane (PU), polyvinyl chloride (PVC), polyethylene terephthalate (PET), polystyrene (PS), acrylonitrile butadiene styrene (ABS), polybutylene terephthalate (PBT), polycarbonate (PC), and bioplastics, among others, are the different plastic products in the market.

Injection moulding, blow moulding, roto moulding, compression moulding, casting, thermoforming, extrusion, and calendering, among others, are the major applications of the plastics market in Colombia.

The key players in the market include BASF SE, Evonik Industries AG, Formosa Plastics Corporation, Dow Chemical Company, LyondellBasell Industries Holdings B.V., ESENTTIA S.A., and Enka de Colombia SA, among others.

Companies face volatile resin prices, limited recycling infrastructure, cold-chain gaps, regulatory uncertainty, and skill shortages that constrain scaling of advanced materials and timely product launches, and limited access to financing.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share