Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global commercial air conditioner (AC) market size stood at around 21.29 Million Units in 2025. Efficient air conditioning systems not only boost property values but also assist businesses in meeting regulations related to indoor air quality and energy consumption. The industry is expected to grow at a CAGR of 4.40% during the forecast period of 2026-2035 to attain a volume of 32.75 Million Units by 2035, owing to the shifting lifestyles and rising product demand in high-temperature areas.

Base Year

Historical Period

Forecast Period

According to the UK Government, the production value of window and wall air conditioning systems in 2022 exceeded GBP 189 million.

The German Federal Statistical Office reported that the revenue from domestic air conditioner manufacturing reached €2.23 billion in 2023.

Industry reports indicate that the Indian air conditioner market is expected to grow to $9.8 billion by FY26, up from $3.8 billion in FY21.

Compound Annual Growth Rate

4.4%

Value in Million Units

2026-2035

*this image is indicative*

The commercial air conditioner (AC) market growth is rapidly growing due to urbanisation, rising temperatures, and a demand for energy-efficient solutions. Key benefits include enhanced indoor comfort for improved productivity, better air quality through advanced filtration, and energy efficiency that lowers operating costs and carbon footprints. The EIA's Commercial Buildings Energy Consumption Survey (CBECS) suggests that implementing artificial intelligence could lead to an 8% to 19% reduction in energy use and carbon emissions by 2050. When combined with energy policies and low-carbon power generation, it could potentially decrease energy consumption by around 40% and carbon emissions by 90% compared to typical business scenarios in 2050.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Efficient air conditioning systems not only boost property values but also assist businesses in meeting regulations related to indoor air quality and energy consumption. Additionally, modern units are built for durability, which lowers maintenance costs. Overall, the market meets the cooling needs of businesses while improving energy efficiency and supporting environmental sustainability, further driving demand in the commercial air conditioner (AC) market. In August 2024, Johnson Controls-Hitachi Air Conditioning launched the Centrifugal Chiller VG and S Series, offering high-energy-efficient cooling solutions in Hong Kong. These models utilize R513a refrigerant (GWP 573) and environmentally friendly R1234ze refrigerant with an ultra-low Global Warming Potential (GWP <1), contributing to reduced greenhouse gas emissions in the region.

Incorporation of IoT technology in commercial ACs, demand for energy-efficient commercial ACs, and growing number of commercial spaces are boosting the commercial air conditioner (AC) market.

The incorporation of Internet of Things (IoT) technology in commercial air conditioners is transforming the industry. Smart systems facilitate remote monitoring and control, allowing users to manage energy consumption more efficiently. Features like predictive maintenance, real-time performance analytics, and mobile app integration improve user convenience and operational efficiency. As businesses aim to optimise energy usage and cut costs, the demand for smart, connected AC units is rising, fueling innovation and growth in the commercial air conditioner (AC) industry. In April 2023, Soracom, Inc., a leading provider of IoT connectivity, announced that Mitsubishi Electric Europe B.V. selected Soracom to enhance MELCloud™, its next-generation cloud-based remote management system for air conditioning, heating, and heat recovery/ventilation products.

Growing awareness of environmental concerns and increasing energy prices have heightened the demand for energy-efficient commercial air conditioners. Manufacturers are creating systems that utilize advanced technologies, such as variable refrigerant flow (VRF) and inverter technology, to enhance energy efficiency. Regulations promoting energy efficiency standards also encourage businesses to adopt eco-friendly solutions. This trend in the commercial air conditioner (AC) market not only reduces operating expenses but also supports corporate sustainability goals, positioning energy-efficient systems as a top priority. In January 2024, Mojave Energy Systems, aimed at transforming air conditioning, began taking orders for its innovative commercial liquid desiccant air conditioner, ArctiDry, at the AHR Expo in Chicago, showcasing its patented technology at booth S7996. Mojave's ArctiDry technology sets new benchmarks in efficiency and addresses significant environmental challenges.

Rapid urbanisation and the growth of commercial spaces are driving demand for the commercial air conditioner (AC) market, particularly in emerging markets. Stricter regulations on energy consumption and indoor air quality are pushing businesses to invest in advanced systems. Additionally, the rising replacement market and cost sensitivity influence purchasing decisions in this sector. The Bureau of Energy Efficiency (BEE) has established energy efficiency standards for air conditioners in India, outlining Seasonal Energy Efficiency Ratios for all five-star levels. These standards apply to both unitary and split-type air conditioners, requiring compliance during the specified period. New, stricter standards will be implemented from January 1, 2026, to December 31, 2028, aiming to reduce energy consumption and promote the adoption of energy-efficient units, thereby supporting India's overall energy security goals.

The integration of smart technologies in HVAC systems is revolutionising the commercial air conditioning market. Smart HVAC systems, enabled by the Internet of Things (IoT), allow real-time monitoring, remote management, and predictive maintenance, significantly enhancing energy efficiency and reducing operational costs. According to the International Energy Agency (IEA), adopting smart HVAC technologies can reduce energy consumption in commercial buildings by up to 30%, contributing to global sustainability goals. Additionally, advancements in artificial intelligence (AI) are enhancing HVAC systems' capabilities, enabling predictive maintenance and optimising temperature settings based on occupancy patterns. For example, Google’s DeepMind used AI to reduce energy usage in its data centre cooling systems by 40%, showcasing the potential of smart technology in managing HVAC efficiency. These innovations align with increasing demand for sustainable and efficient solutions, propelling the adoption of smart HVAC systems in commercial spaces globally and supporting the commercial air conditioner (AC) market growth.

The commercial air conditioner (AC) demand growth has significantly increased in recent years due to shifting lifestyles and rising product demand in high-temperature areas. The combined effects of ozone depletion and the El Nino effect have resulted in a gradual rise in the world average increasing population rapid industrialisation and urbanisation have been contributing to the growth of the market.

During the forecast period, rising per capita income and deteriorating environmental conditions are expected to be key drivers of demand for energy-efficient air conditioners. Furthermore, rapid commercialization, a booming construction sector, a growing replacement market, energy efficiency regulations, and technological advancements are anticipated to significantly boost the commercial air conditioner (AC) demand. In May 2024, Walton launched a 6-star rated, highly energy-efficient AC, backed by a robust research and innovation team comprising both domestic and international engineers. Walton’s ACs feature numerous advanced technologies, including 6-Star energy-saving technology, anti-corrosive 'Coatec' technology, air plasma, an integrated 5-inch colour TFT display, 3-in-1 convertible technology, UV care, remote finder, intelligent inverter, frost clean, offline voice control, Bluetooth control, and a smart app solution.

As concerns about health and well-being continue to rise, there is an increased emphasis on improving indoor air quality (IAQ) in commercial spaces. Modern air conditioning systems now feature advanced filtration technologies, UV-C lighting, and air purification capabilities to minimize pollutants, allergens, and pathogens. The commercial air conditioner (AC) market dynamics and trends are being driven by businesses prioritising indoor air quality (IAQ) to foster healthier environments for employees and customers, making it a crucial selling point for commercial AC products. This shift reflects a wider commitment to health, safety, and well-being in workplace environments. In August 2024, R-Zero, a leader in smart building solutions, announced the launch of a RESET-certified indoor air quality (IAQ) monitor and connected dashboard, designed to visualise and respond to IAQ data on demand. These solutions are intended for use in offices, schools, and healthcare facilities, helping to enhance occupant comfort, and operational performance including HVAC fault detection and energy efficiency.

The commercial air conditioner (AC) industry faces several restraints that hinder growth. High initial costs deter businesses from upgrading to advanced systems while fluctuating energy prices create uncertainty about the viability of energy-efficient solutions. Regulatory challenges complicate compliance with varying standards, and intense competition can lead to price wars, reducing profit margins.

Technological complexity poses installation and maintenance challenges, and stricter environmental regulations necessitate costly investments. Economic downturns may reduce spending on air conditioning systems, while limited consumer awareness of energy-efficient benefits can slow adoption. Additionally, global supply chain disruptions impact production and availability, further complicating commercial air conditioner (AC) market dynamics.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Commercial Air Conditioner (AC) Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

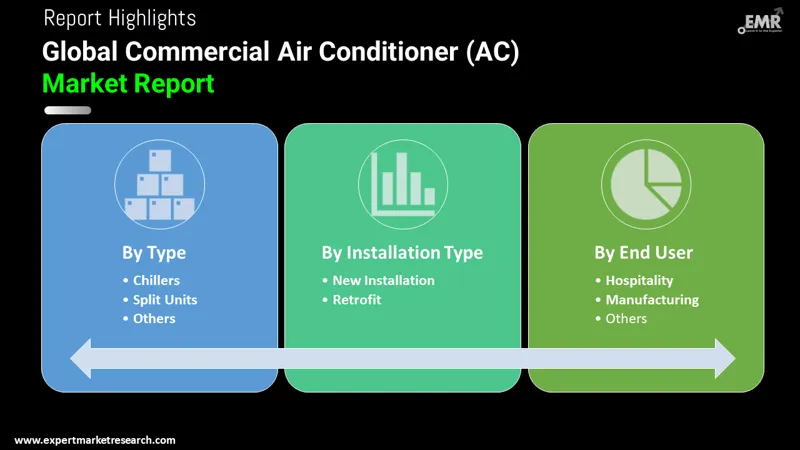

Market Breakup by Type

Market Breakup by Installation Type

Market Breakup by End User

Market Breakup by Region

Market Analysis by Type

Chillers are highly energy-efficient, significantly reducing consumption compared to traditional systems, leading to lower operating costs in large commercial spaces. They are scalable, allowing for adjustments based on facility size and usage changes. Chillers deliver centralised cooling, maintaining uniform temperature control across various zones and allowing for flexibility in refrigerants and cooling techniques. Their durability and minimal maintenance needs make them a cost-effective cooling option, contributing to the commercial air conditioner (AC) market revenue. In May 2024, Oregon-based manufacturer G&D Chillers launched a new propane (R290) commercial and industrial chiller for the U.S. market, claiming to be the first in the industry to reintroduce propane as a natural refrigerant. The Elite R290 was unveiled at the Craft Brewers Conference in Las Vegas, showcasing over 30 years of experience in producing chillers for various industries. G&D aimed to lead the adoption of propane as a sustainable chilling solution in North America.

Split units are simple to install, needing little ductwork, which makes them perfect for retrofitting existing buildings. They allow for zoning, enabling separate temperature control in various areas, enhancing comfort while conserving energy and driving demand in the commercial air conditioner (AC) market. Generally, more economical than chillers, split units come in multiple configurations for flexible installation. They operate quietly and often use inverter technology for improved energy efficiency, leading to significant savings. In April 2024, Mitsubishi Heavy Industries Thermal Systems began mass production of its KXZ3 series of commercial multi-split air conditioners, featuring R32 refrigerant and available in three models: 22.4kW, 28kW, and 33.5kW. By combining individual units, a maximum output of 100.05kW can be achieved to meet diverse application needs.

Market Analysis by End-Use

Commercial air conditioning enhances indoor air quality in healthcare facilities by employing advanced filtration and ventilation to reduce pollutants and pathogens, promoting healthier environments for patients and staff. Energy-efficient systems lower operating costs while ensuring a quiet atmosphere conducive to recovery, and zoning capabilities allow for tailored climate control across different areas. In 2019, the Central Bureau of Health Intelligence (CBHI) reported a total of 23,581 government hospitals and 22 central government hospitals, contributing significantly to the growth of the commercial air conditioner (AC) market. Reliable temperature regulation is essential for ensuring patient comfort and the proper functioning of medical equipment.

Effective commercial air conditioning in educational environments creates comfortable spaces that are vital for concentration and productivity, positively impacting student performance. Consistent temperature control ensures comfort for both students and staff throughout the year. Additionally, the flexibility of installation options allows these systems to adapt to various configurations, meeting diverse institutional needs. In 2022, 81.1% of college students attended public institutions, marking a 2.3% increase from 2021, according to the Census Bureau. The National Centre for Education Statistics reports that the U.S. has a total of 5,999 colleges, driving the commercial air conditioner (AC) demand growth as energy-efficient systems lower utility costs while enhancing air quality by reducing allergens.

Europe Commercial Air Conditioner (AC) Market Analysis

Europe currently has the highest demand for commercial air conditioners (AC), with Germany, Italy, and France as major contributors to the sector. Germany aims to be climate-neutral by 2030, sourcing only energy-efficient and eco-friendly cooling products and services, which fuels the growth of the commercial air conditioner (AC) market. In March 2024, the European Parliament revised energy performance regulations to target climate-neutral buildings by 2050, with the REPowerEU initiative aiming to install 10 million heat pumps by 2025. This has spurred increased demand for air-to-water systems, which emit less CO2 than traditional fossil fuel heating solutions.

North America Commercial Air Conditioner (AC) Market Trends

The North American commercial air conditioner (AC) market value is poised for significant growth, driven by leading brands like Trane, Carrier, and Lennox. These systems facilitate zoning for individual temperature control, improving comfort and energy efficiency. They provide scalable solutions suitable for various business sizes, ensuring reliability in extreme conditions. In July 2024, Samsung Electronics announced its plans to introduce energy-efficient air conditioners that utilized artificial intelligence to reduce power consumption by up to 30%. These units were to be marketed through a joint venture with Lennox, a leading U.S. distributor of AC systems. The air conditioners could detect people in a room and adjust the cool air flow accordingly. According to Samsung, these automated features could potentially cut energy consumption by as much as 30%.

Asia Pacific Commercial Air Conditioner (AC) Market Insights

In India, companies such as Voltas Ltd., Blue Star Ltd., LG Electronics India Pvt. Ltd., Daikin India Pvt. Ltd., and Hitachi Cooling & Heating India Pvt. Ltd. highlight the expanding commercial air conditioner (AC) market share in the Asia-Pacific region. This growth is fueled by rising temperatures due to climate change, increasing the demand for effective cooling solutions. Stricter energy efficiency regulations and advancements in smart technologies are also driving the adoption of more efficient air conditioning systems. As of January 2024, the Production Linked Incentive (PLI) Scheme for the air-conditioning sector has been a "game changer," with domestic value addition rising from 25% to 45% in just 18 months, as noted by Panasonic Life Solutions India. The scheme aims to enhance value addition to 75% by FY28 by promoting domestic component production, and the government has selected 42 companies for the initiative, with 26 focusing on air-conditioning components and 16 on LED components.

Latin America Commercial Air Conditioner (AC) Market Analysis

Key markets in the region include Brazil, Mexico, and Argentina, where there is a high demand for air conditioners. The Latin America commercial air conditioner (AC) market is expanding as economic growth in the region boosts demand for commercial infrastructure, leading to a heightened need for efficient air conditioning solutions in various sectors, including retail, healthcare, education, and hospitality. In Brazil, the government introduced new regulations in 2020 mandating that air conditioners must achieve a higher ISEER rating. These updated standards aim to phase out most fixed-speed AC units from the market by 2026.

Middle East and Africa Commercial Air Conditioner (AC) Driving Factors

The African commercial air conditioner (AC) market growth is expanding as air conditioning improves productivity and employee satisfaction in commercial environments while aiding vital sectors like healthcare and hospitality. Furthermore, the increasing demand for these systems drives economic growth by generating employment in manufacturing, installation, and maintenance. The Ozone and Climate Friendly Cooling in West and Central Africa (ROCA) project encourages the use of ozone- and climate-friendly cooling technologies in Burkina Faso, Cameroon, Mali, and Senegal. Launched in April 2021, it will continue until March 2025.

Market players specialise in HVAC systems and energy management, emphasizing sustainability through innovative technologies that enhance energy efficiency and lower carbon footprints. They serve various sectors, positioning themselves as trusted partners for organisations pursuing operational excellence. Committed to environmental sustainability, they produce energy-efficient products for residential, commercial, and industrial clients globally.

Established in 1885 and headquartered in Cork, Ireland, Johnson Controls specializes in HVAC systems, fire and security solutions, and energy management services. The company focuses on sustainability and innovation, serving various sectors to enhance operational efficiency and reduce environmental impact.

Founded in 1958 and based in Seoul, South Korea, LG Electronics is a global leader in consumer electronics and HVAC solutions. The company emphasises energy efficiency and advanced technology, providing innovative products that enhance comfort and performance in residential, commercial, and industrial applications.

Established in 1921 and headquartered in Tokyo, Japan, Mitsubishi Electric is known for its advanced HVAC systems, automation, and energy solutions. The company prioritizes innovation and sustainability, serving diverse markets with cutting-edge technology that enhances energy efficiency and operational performance.

Founded in 1924 and headquartered in Osaka, Japan, Daikin is a leading manufacturer of air conditioning systems and refrigeration solutions. The company is committed to environmental sustainability, producing energy-efficient products designed to meet the needs of residential, commercial, and industrial customers worldwide.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the commercial air conditioner (AC) market reached an approximate volume of 21.29 Million Units.

The market is assessed to grow at a CAGR of 4.40% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach around 32.75 Million Units by 2035.

The major drivers of the industry, such as the increasing population, rapid industrialisation and urbanisation, rising disposable income, and growing technological advancements, are expected to aid the growth of the market.

The key market trends guiding the growth of the industry include the constantly worsening atmospheric conditions and the growing demand for energy-efficient AC units.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Chillers, split units, packaged unit, and variable refrigerant flow (VRF), among others are the different types of the product.

The major installation types considered within the market report are new installation and retrofit.

The end user includes healthcare, educational/ institutional, public/ government, retail, hospitality, and manufacturing.

The major players in the industry are Johnson Controls International plc, LG Electronics Inc., Mitsubishi Electric Corporation, and Daikin Industries Limited, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Installation Type |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share