Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global cooking wine market size reached around USD 421.16 Million in 2025. The market is projected to grow at a CAGR of 3.90% between 2026 and 2035 to attain nearly USD 617.45 Million by 2035.

Base Year

Historical Period

Forecast Period

According to the estimates from the US Bureau of Labour Statistics, the average yearly expenditure on consumer products has grown by about 9% in 2022 compared to 2021.

AAK AB, ECOVINAL S.L, and Gourmet Classic Limited are a few of the major companies in the market.

There are various types of cooking wines, including rice wine, fortified wines like sherry, and dry and sweet red and white wines.

Compound Annual Growth Rate

3.9%

Value in USD Million

2026-2035

*this image is indicative*

| Global Cooking Wine Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | 421.16 |

| Market Size 2035 | USD Million | 617.45 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 3.90% |

| CAGR 2026-2035 - Market by Region | Latin America | 4.2% |

| CAGR 2026-2035 - Market by Country | Canada | 4.2% |

| CAGR 2026-2035 - Market by Country | Australia | 4.1% |

| CAGR 2026-2035 - Market by Type | Red | 4.0% |

| CAGR 2026-2035 - Market by Distribution Channel | Convenience Store | 4.4% |

| Market Share by Country 2025 | USA | 17.3% |

Cooking wines contain a high alcohol percentage (ABV) of 16% and above. Red wine contains good HDL cholesterol and natural compounds like Resveratrol that help protect blood vessels and reduce inflammation. The wide variety of cooking wines, convenience, and doorstep delivery offered by e-commerce platforms such as Amazon.com are further contributing to the increase in the adoption of cooking wines.

Some of the factors driving global cooking wine market growth are the rise in disposable income and growing consumer spending, which are supporting the trend of food tourism. This further encourages the addition of cooking wines by food service providers to offer an extensive culinary experience to tourists. Additionally, the showcasing of dishes prepared with wine on social media platforms and cooking shows is exerting a substantial influence on consumer buying patterns.

Table: Popular types of Wines

| Wine Types | Popular Varieties |

| White Wine | Chardonnay, Riesling, Sauvignon Blanc, Chennin Blanc, and Pinot Gris |

| Red Wine | Cabernet Sauvignon, Pinot Noir, Zinfandel, Merlot and Shiraz |

| Rose | Zinfandel, Cabernet, and Shiraz |

| Sparkling | Pinot Noir, Chardonnay, Pinot Blanc and Pinot Meunier |

| Fortified | Port, Sherry, Madeira, and Marsala |

Health benefits associated with low-alcohol wine; social media influence; the growth in food tourism; and rising penetration of e-commerce channels propel the market growth of cooking wine

| Trends | Impact |

| Health advantages associated with low-alcohol wine | Reduced blood pressure, improved cholesterol profiles, and a decreased risk of cardiovascular ailments are driving the incorporation of low-alcohol wine into a wide range of culinary creations. |

| Social media influence | Cooking shows and social media platforms that feature wine-prepared food have a big impact on consumer purchasing habits. |

| Growing popularity of culinary tourism | Restaurants and cafes are attempting to provide tourists with unique culinary experiences, further increasing the inclusion of wine in dishes to improve the flavour. |

| Growing penetration of e-commerce | E-commerce platforms increase the availability of a variety of cooking wines of different brands, improving its adoption. |

Majorly, red dry and white dry wines are used for cooking purposes. This is due to the lesser residual sugar in drier wines. In 2022, the global wine production was estimated between 257.5 and 262.3 mhl, with an estimated average of 259.9 mhl.

Furthermore, there is a rising popularity of low-alcohol wine for use in cooking. There is an opportunity to expand in emerging markets where culinary trends are just picking up. The growing interest in food and beverage culture, authentic travel experiences, and increasing knowledge about cuisine through social media platforms and online resources is generating cutting-edge eating experiences, including food tours, cooking lessons, and wine tastings. This further increases the inclusion of wine in cuisines, further contributing to the cooking wine market growth.

"Global Cooking Wine Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Packaging

Market Breakup by Application

Market Breakup by Region

| CAGR 2026-2035 - Market by | Type |

| Red | 4.0% |

| White | 3.9% |

| Others (Rose, Dessets, Sparkling, Fortified) | XX |

| CAGR 2026-2035 - Market by | Region |

| Latin America | 4.2% |

| Asia Pacific | 4.1% |

| North America | XX% |

| Europe | XX% |

| Middle East and Africa | XX% |

| CAGR 2026-2035 - Market by | Country |

| Canada | 4.2% |

| Australia | 4.1% |

| Italy | 4.1% |

| China | 4.0% |

| France | 4.0% |

| UK | 3.8% |

| USA | XX% |

| Germany | XX% |

| Japan | XX% |

| India | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

| CAGR 2026-2035 - Market by | Distribution Channel |

| Convenience Store | 4.4% |

| Online | 4.2% |

| Supermarket and Hypermarket | XX% |

| Others | XX% |

Red wine is expected to hold a significant market share due to its health benefits.

Red wine accounts for the largest cooking wine market share as antioxidants and natural compounds, such as resveratrol in red wine reduce cholesterol and risks of diabetes, increasing its inclusion in dishes by health-conscious individuals.

Merlot is a dark blue–coloured wine grape variety. Wine manufactured from this grape is a smooth red wine with a low tannin content. This wine cooks well with proteins, like the Cabernet and Pinot noir red wines. Such wines are predominantly used in the preparation of pan sauce, roasts and meaty stews.

Meanwhile, white wine is tart, tangy, or sweet and is typically used to add acidity to recipes containing seafood, poultry, and dairy products.

Glass bottles are widely used to package cooking wine due to their aesthetics and durability

Glass bottles dominate the global cooking wine market share. In France, 94% of consumers prefer glass wine bottles to other types of packaging due to their sustainability. Glass packaging is the preferred choice for its durability, impermeability, and versatility in design, and is considered healthy for preserving the quality and freshness of food and beverages.

Meanwhile, the demand for plastic bottles for packaging wine is likely to increase in the forecast period. This can be attributed to their benefits such as shatterproof, lightweight, and reduced greenhouse gas emissions.

Key players are increasingly launching plastic wine bottles made from recyclable materials to capitalise on the growing trend of sustainability. For instance, in July 2023, Amcor Rigid Packaging partnered with Rubin Winery to launch a premium wine bottle, BLUE BIN, made from 100% recycled polyethylene terephthalate (rPET) plastic.

Market players are increasing their collaboration, partnership, and research and development activities to gain a competitive edge in the market

| Company Name | Year Founded | Headquarters | Products/Services |

| AAK AB | 2005 | Sweden | Cooking sherry, marsala cooking wine, and white cooking wine. |

| ECOVINAL SL | 1997 | Spain | Red Cooking Wine, White Cooking Wine, Chardonnay Cooking Wine, Cabernet Sauvignon Cooking Wine, and Cooking Wine variants made with Port, Madeira, Sherry, and Brandy. |

| Gourmet Classic Limited | 1998 | United Kingdom | Cabernet Sauvignon, Chardonnay, Italian Red, Italian White, and Mulled cooking wine. |

| Mizkan America Inc. | 1981 | United States | features a range of renowned brands, including Ragú®, Bertolli®, Holland House®, NAKANO®, Nature’s Intent®, World Harbors® etc. |

Other key players in the cooking wine market include Marina Foods, Inc., World Finer Foods, LLC, and Eden Foods, Inc., among others.

Europe is anticipated to hold a dominant position in the cooking wine market in the forecast period. Europeans, including German, British, and French individuals, spend around 16% of their expenditure on food. According to industry reports, about 3%–5% of European tourists are culinary tourists. The growing trend of food tourism across Europe that involves the indulgence of various cuisines is encouraging the greater adoption of wine in dishes.

| Market Share by | Country |

| USA | 17% |

| Canada | XX% |

| UK | XX% |

| Germany | XX% |

The North America cooking wine market is being driven by the increasing number of wineries in the United States. Popular wine brands include Franzia, Barefoot Cellars, Carlo Rossi, and Sutter Home. The rising expenditure on fine dining in North America is increasing the inclusion of wine in dishes to improve flavour and provide improved customer satisfaction.

The Asia Pacific region holds a growing market share. The presence of vineyards regions of China including Shandong, Hebei, Ningxia, and Shanxi consumers and businesses to access a wider variety of cooking wines, including imported ones. There is an opportunity for producers to innovate with cooking wine flavours and types, catering to local tastes and preferences.

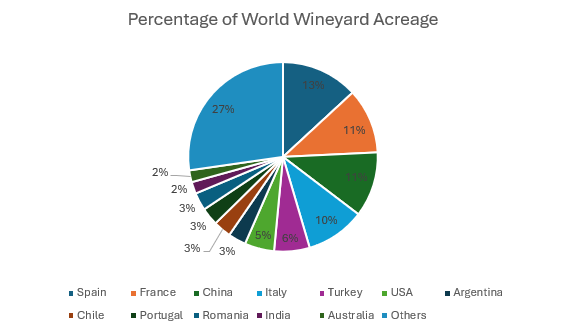

Figure: World Vineyard Acreage by Country, 2020

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global cooking wine market value was USD 421.16 Million.

The market is projected to grow at a CAGR of 3.90% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 617.45 Million by 2035.

The market drivers include health benefits associated with low alcohol wines, expanding vineyards, and growing penetration of e-commerce.

The key trends include growing popularity of culinary tourism and rising social media influence promoting the incorporation of cooking wine in food.

The different types of cooking wine include red and white, among others.

The major applications of cooking wine include B2B and B2C.

The major players in the market include AAK AB, ECOVINAL SL, Gourmet Classic Limited, Mizkan America Inc., Marina Foods, Inc., World Finer Foods, LLC, and Eden Foods, Inc., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Packaging |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share