Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global core banking solutions (CBS) market was valued at USD 19.12 Billion in 2025. The industry is expected to grow at a CAGR of 14.56% during the forecast period of 2026-2035 to reach a value of USD 74.44 Billion by 2035.

The core banking solutions market is experiencing dynamic growth, driven by regulatory technology integration and AI-powered process automation. Traditional systems are being replaced with composable architectures that support open banking frameworks and fintech collaboration. In the United Kingdom alone, over 75% of financial firms have shifted to digital-first operations as of 2024, encouraged by the Financial Conduct Authority's Digital Sandbox and data-sharing initiatives.

Innovative use cases like AI-led credit scoring, ESG-linked product configuration, and event-driven architectures are expanding applications beyond core functionalities, accelerating the core banking solutions market dynamics. Meanwhile, neobanks and challenger institutions are driving demand for scalable, low-latency platforms.

With real-time settlement capabilities, integration with blockchain consortia, and API-first design, CBS platforms are being overhauled to meet fast-evolving compliance and customer experience expectations. Players in the core banking solutions market are increasingly offering CBS-as-a-service, often bundled with AI operations, fraud analytics, and customer behaviour modelling tools. The shift to microservices-based systems also enables faster feature deployment and cost-efficient scaling.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

14.56%

Value in USD Billion

2026-2035

*this image is indicative*

Environmental, Social, and Governance (ESG) modules are now being embedded into CBS to automate green financing workflows, accelerating the core banking solutions market development. For example, NatWest has piloted ESG scoring features in its SME loan management interface using core platform integrations. Governments in the European Union and United Kingdom are tightening sustainability-linked disclosures under SFDR and TCFD mandates, accelerating demand for core banking tools that can capture, calculate, and audit ESG-linked financial data. Vendors are developing modules that track carbon credit utilisation and automate climate risk scoring. These innovations make it easier for banks to stay compliant while launching ethical finance products through their core systems.

Core banking solutions providers are embedding open APIs to support PSD2-compliant integrations with fintech partners. HSBC and Barclays are deploying plug-and-play fintech modules for functions like spend categorisation and financial health analytics. As per idustry reports, there will be a 427% more Open Banking API calls worldwide by 2029, signalling widespread CBS adoption. CBS vendors are offering integration accelerators and sandbox environments to facilitate ecosystem collaborations. These advancements are transforming banks into data-driven platforms, fostering quicker time-to-market and innovation through third-party application embedding.

Core systems are now embedding machine learning engines that automate product recommendations and spending alerts, reshaping the core banking solutions market dynamics and trends. Lloyds Banking Group has begun embedding generative AI for customer profiling directly into its CBS. With the Bank of England encouraging responsible AI experimentation through Project Rosalind, this trend is gaining institutional credibility. Vendors are offering AI-accelerated CBS upgrades with explainable AI (XAI) dashboards. These help banks shift from transactional to experiential services that drive customer retention.

Several vendors in the core banking solutions market are integrating blockchain rails to enable instant settlement for cross-border and high-value domestic payments. The Digital Euro pilot has catalysed this shift. Core banking systems are being modified to integrate with ISO 20022 messaging standards and smart contract layers for automated settlement triggers. Finastra recently partnered with R3 to create Distributed Ledger Technology platform for syndicated lending community. Such integrations are helping reduce counterparty risk, enhance transparency, and eliminate reconciliation inefficiencies, particularly in correspondent banking corridors.

Microservices architectures are allowing banks to decouple services and scale features independently, driving further development in the core banking solutions market. This agility is crucial in the wake of real-time payment mandates like the United Kingdom’s New Payments Architecture (NPA). Banks are refactoring CBS into containerised services, deployable on hybrid cloud. For example, Engine by Starling is a neobank-developed, cloud native core banking solution with a wide range of pre-built capabilities, allowing for speed to market and limited external integrations. Vendors are now offering Kubernetes-native core platforms with CI/CD pipelines, enabling banks to launch features like dynamic credit lines or interest rebalancing without downtime.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

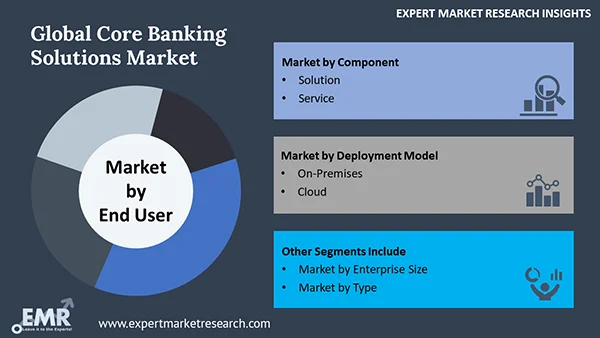

The EMR’s report titled “Global Core Banking Solutions Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Component

Key Insight: While solution platforms form the core of modern banking transformation, service offerings are becoming indispensable for operational resilience, boosting the core banking solutions market development. Solutions offer scalable, API-first infrastructure with modules like fraud detection and ESG scoring. Meanwhile, services cater to the execution layer, ensuring smooth integration, maintenance, and compliance. The blend of customisation flexibility from solutions and lifecycle support from services is becoming a key success metric for CBS deployments, especially in regulated and high-volume environments.

Market Breakup by Deployment Model

Key Insight: On-premise core banking solutions have gained ground in compliance-heavy markets due to its customisability and security. However, cloud is leading the charge in emerging markets and digital-first banks owing to faster deployment, elasticity, and cost savings. Both deployment models have their strongholds, and many banks are adopting hybrid CBS strategies to gain both resilience and speed. The push towards regulatory clarity on cloud adoption is also reducing enterprise hesitation.

Market Breakup by Enterprise Size

Key Insight: Large enterprises dominate the core banking solutions market due to their need for robust, high-capacity platforms with layered functionalities and tight regulatory adherence. In contrast, SMEs are rapidly expanding their footprint by choosing flexible, cost-effective SaaS core banking suites. While the former drives innovation in scalability, security, and performance, the latter prioritises agility, interoperability, and speed-to-market.

Market Breakup by Type

Key Insight: Enterprise customer solutions dominate the global core banking solutions market by enabling consistent user experience and full-cycle relationship management across segments. Loans are growing rapidly as banks and fintechs modernise legacy systems for speed, compliance, and decentralised credit delivery. Deposits and “others” category including payments or wealth modules also play a supportive role in boosting the demand, often bundled into end-to-end platforms.

Market Breakup by End User

Key Insight: Banks dominate the demand for core banking solutions as they modernise operations and expand service offerings. Meanwhile, credit unions and community banks are accelerating adoption to digitise localised services and gain scale. Other end users, such as fintechs, neo-banks, and non-banking institutions, are exploring lean-core solutions for focused offerings like payroll loans or gig-worker finance.

Market Breakup by Region

Key Insight: North America dominates the core banking solutions market with advanced cloud adoption, real-time capabilities, and fintech collaborations. Europe follows with strong regulatory compliance, green finance integration, and legacy modernisation. Asia Pacific is the fastest-growing market, driven by digital-native banks, financial inclusion, and mobile-first ecosystems. Latin America is evolving through fintech-led disruption and government-backed open banking initiatives, particularly in Brazil and Mexico. The Middle East and Africa are gaining momentum with Sharia-compliant core platforms, digital wallet integrations, and scalable cloud solutions tailored for underserved populations.

By Component, Solution Accounts for the Dominant Share of the Market

The solutions segment registers the dominant share in the core banking solutions market due to their evolving functionalities, from handling transactions to offering real-time analytics, fraud monitoring, and customer experience personalisation. Banks are preferring end-to-end platforms that cover loans, deposits, payments, and regulatory compliance in a unified system. For example, EdgeVerve’s Finacle platform has been widely adopted across Asia and the Middle East for its modular solution capabilities. These platforms are increasingly supporting ISO 20022, embedded AI, and ESG-linked reporting tools. Their role in supporting omnichannel customer engagement and integrated digital onboarding is also elevating their priority across banks of all sizes.

As per the core banking solutions market report, services are growing rapidly as banks outsource CBS maintenance, upgrades, and custom module developments. Managed services and professional consultation are in demand, particularly for mid-tier banks that lack deep technology capabilities. Finastra, for instance, has expanded its banking-as-a-Service offering, which includes ongoing patching, compliance updates, and infrastructure scalability on Azure. Additionally, post-deployment analytics, API governance, and migration strategy formulation are bundled into services. This segment is witnessing strong growth in Europe and Asia Pacific, where local compliance requirements often demand ongoing CBS reconfiguration.

By Deployment Model, On-Premises Clock in the Biggest Share of the Market

On-premises deployment remains dominant in the core banking solutions market among large, legacy institutions wary of data sovereignty and cybersecurity. These systems offer complete control over configurations, vital for Tier-1 banks in tightly regulated geographies. Banks such as Barclays continue to operate hybrid models with mission-critical CBS hosted on-premise while extending peripheral services to the cloud. Vendors offer on-premise CBS with in-house customisation kits, allowing granular control. On-premise setups also allow integration with in-branch legacy infrastructure and often meet compliance certifications like ISO 27001 and SWIFT CSP faster, making them a preferred route in jurisdictions with strict data localisation mandates.

Cloud deployment is fast gaining traction in the core banking solutions industry due to cost-effectiveness, scalability, and rapid deployment cycles. Banks in Asia and Africa are deploying legacy setups with cloud-native CBS. Core banking platforms like Mambu and Temenos SaaS offer containerised deployments with zero-downtime upgrades. The United Kingdim’s Financial Conduct Authority now supports cloud-based innovation via the Digital Sandbox and has released guidance for cloud outsourcing. These moves are de-risking cloud CBS investments. As per industry reports, cloud-native banks can reduce IT infrastructure costs by up to 40% and accelerate time-to-market by 30 to 40%.

By Enterprise Size, Large Enterprises Secure a Substantial Share of the Global Market

Large enterprises dominate the core banking solutions market revenue shares due to their vast customer base, complex product portfolios, and high demand for scalable and secure infrastructure. These institutions prioritise integrated platforms that unify retail, corporate, and digital banking on a single core. They are also pushing towards modular upgrades and embedded AI capabilities to enhance agility. Moreover, they are adopting hybrid cloud models to reduce legacy system dependency while ensuring compliance and security.

Small and medium enterprises (SMEs) are emerging as the fastest-growing segment in the core banking solutions industry. They are embracing SaaS-based core banking solutions that are low-cost, API-friendly, and easy to integrate with third-party apps. This shift is fuelled by digital-native SMEs and neobanks catering to underserved demographics. Players targeting this segment are focusing on plug-and-play architecture, open banking compatibility, and marketplace integrations. SMEs prefer agile vendors offering subscription pricing and sandbox trials.

By Type, Enterprise Customer Solutions Clock the Major Share of the Industry

Enterprise customer solutions remain the cornerstone of core banking solutions demand, driven by the increasing need for unified customer views, omnichannel experiences, and lifecycle banking. These solutions are evolving to include contextual intelligence, allowing banks to offer real-time recommendations and predictive servicing. Innovations include integrated CRM-core modules, biometric-powered authentication layers, and AI-driven relationship scoring. With increasing B2B focus, banks are deploying tailored dashboards for SME and corporate clients, blending lending, payments, and cash flow management into a single interface.

As per the core banking solutions market report, the loans segment is seeing the fastest innovation as lenders pivot towards AI-based credit scoring, blockchain-secured disbursement, and embedded finance capabilities. Modern core systems for loan management now include dynamic repayment modelling, cross-lender syndication tools, and regulatory compliance automations for buy-now-pay-later and micro-credit products. The demand is surging from fintech firms and challenger banks offering lending-as-a-service. Many vendors are also rolling out no-code loan origination modules that allow rapid deployment across regions. For example, Thought Machine’s Vault is enabling banks to launch digital lending products within weeks.

By End User, Banks Occupy a Significant Share of the Market

Banks continue to dominate the core banking solutions market as they overhaul legacy infrastructure to compete with digital-first players. With increased demand for modularity, traditional banks are adopting microservices-based architecture and deploying real-time APIs for smoother integration across functions. Vendor collaborations now focus on delivering core-to-edge digital continuity, with inbuilt KYC, AML, and ESG tracking tools. By leveraging open banking frameworks, banks are also unlocking third-party monetisation and embedded finance opportunities.

Credit unions and community banks are the fastest-growing segment accelerating the core banking solutions adoption, driven by the need for cost-efficient, scalable platforms. These institutions are deploying cloud-first cores with built-in analytics, helping them understand local market dynamics and provide hyper-personalised offerings. The emphasis is on mobile-first banking, real-time fund transfer support, and AI chatbots for customer service. They are also integrating fintech services to attract younger demographics. Vendors catering to this segment focus on low-code configurability, community banking templates, and local language UX capabilities.

By Region, North America Hold the Leading Position in the Global Market

North America dominates the core banking solutions market, led by the United States’ push toward real-time banking, open API ecosystems, and cloud-first transformation. Major banks are aggressively modernising legacy cores to support predictive analytics, real-time compliance, and hyper-personalisation. The region is also seeing strong adoption of BaaS (Banking-as-a-Service) among non-traditional financial players such as telecom providers and e-commerce platforms. Regulatory agility, combined with a high fintech partnership index, accelerates innovation cycles. Additionally, cybersecurity features are deeply embedded in core upgrades, with biometric-driven access and behavioural risk engines gaining traction.

The fast-paced growth of the Asia Pacific core banking solutions market is powered by the rise of digital-first banks, government-backed financial inclusion, and an unbanked population demanding mobile-centric banking. Countries like India, Indonesia, and the Philippines are witnessing the rapid adoption of next-gen core systems that are user-friendly, modular, and cloud-native. APAC banks are keen adopters of low-code/no-code platforms for agile deployment and product innovation. Additionally, regulatory bodies are actively supporting open banking frameworks and real-time settlement infrastructures.

The core banking solutions market players are prioritising modularity, composable architecture, and cloud-native designs. Real-time processing, fraud detection, and AI-based credit scoring have become baseline expectations. Players are also innovating around open banking compliance and embedding ESG metrics into core workflows. There is also a strong demand for low-code customisation tools, enabling banks to self-manage updates.

Collaborations with fintechs, RegTechs, and data analytics firms are common to enhance service capabilities for core banking solutions companies. Opportunities lie in green banking modules, blockchain-backed identity, and hyper-personalisation. AI-led process automation, microservices architecture, green finance integration, composable banking platforms, and fintech-core banking collaborations are transforming how core banking systems are developed, delivered, and scaled. For players, regional adaptation, cyber resilience, and sandbox-ready environments are key growth levers.

Established in 1997 and headquartered in Paris, France, Capital Banking Solutions focuses on offering end-to-end core banking platforms for mid-sized banks and wealth managers. The company provides cloud-based and on-premises systems that feature omnichannel banking, risk management tools, and compliance frameworks. Their offerings are especially popular among institutions aiming for fast deployment and regional compliance with a strong UX layer.

Founded in 2014, EdgeVerve is a subsidiary of Infosys that delivers the Finacle core banking suite. Its systems support retail, corporate, and universal banking across multiple geographies. EdgeVerve is known for its high customisability, AI-led automation, and support for open banking. Their recent innovations include conversational banking modules and intelligent process automation.

Headquartered in London and formed in 2017, Finastra is the result of a merger between Misys and D+H. The firm offers core banking platforms tailored to both tier-1 banks and credit unions. Their Fusion system integrates digital lending, treasury, and trade finance. Finastra has been focusing on ecosystem openness, enabling clients to plug into fintech APIs and third-party apps through their FusionFabric.cloud platform.

Founded in 1984 and headquartered in Wisconsin, United States, Fiserv is a global leader in fintech and payment solutions. Its core banking platform is widely used among banks and credit unions seeking enterprise-grade resilience and modern digital capabilities. Fiserv integrates AI, fraud detection, and digital lending, and has expanded into embedded finance and payment innovation through acquisitions like First Data.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Another key player in the market is Oracle Corporation among others.

Explore the latest trends shaping the Core Banking Solutions Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on Core Banking Solutions Market Trends 2026.

United States Private Banking Market

Australia Commercial Banking Market

Australia Investment Banking Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the core banking solutions market reached an approximate value of USD 19.12 Billion.

The market is projected to grow at a CAGR of 14.56% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 74.44 Billion by 2035.

Key strategies driving the market include prioritising ecosystem partnerships, adopting hybrid-cloud cores, building plug-and-play service models, customising solutions with low-code tools, and embedding ESG metrics to align core functionalities with broader business objectives.

The key trends aiding the market include the rising demand for digital banking services like mobile wallets, the emergence of advanced software services, and the surging adoption of cloud computing.

The major regional markets for core banking solutions are North America, Latin America, the Asia Pacific, Europe, and the Middle East and Africa.

The major components of core banking solutions are solution and service.

On-premises and cloud are the significant deployment models of core banking solutions.

The major enterprise sizes included in the market report are large enterprises and small and medium enterprises.

The different types of core banking solutions are enterprise customer solutions, loans, and deposits, among others.

The significant end users of core banking solutions are banks and credit unions and community banks, among others.

The major players in the market are Capital Banking Solutions, EdgeVerve Systems Limited, Finastra Limited, Fiserv, Inc., and Oracle Corporation, among others.

The key challenges are migrating legacy infrastructure, ensuring real-time interoperability, meeting evolving compliance demands, and managing high implementation costs.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Component |

|

| Breakup by Deployment Model |

|

| Breakup by Enterprise Size |

|

| Breakup by Type |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share