Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global drilling fluids market value reached USD 10.72 Billion in 2025. The drilling fluids industry is further expected to grow at a CAGR of 2.60% between 2026 and 2035 to reach a value of almost USD 13.86 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

2.6%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Drilling Fluids Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 10.72 |

| Market Size 2035 | USD Billion | 13.86 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 2.60% |

| CAGR 2026-2035 - Market by Region | Latin America | 2.8% |

| CAGR 2026-2035 - Market by Country | India | 3.0% |

| CAGR 2026-2035 - Market by Country | China | 2.9% |

| CAGR 2026-2035 - Market by Type of Chemicals | Xanthan Gum | 3.1% |

| Market Share by Country 2025 | Mexico | 2.2% |

The drilling fluids market provides essential fluids for drilling operations in the oil and gas industry, known as drilling muds. These fluids offer multiple benefits: they reduce friction and cool equipment, facilitate cuttings removal, control subsurface pressure, stabilise wellbore walls, and prevent corrosion.

They also support geological formation evaluation, reduce environmental impact, improve cost efficiency, and adapt to various drilling conditions. Overall, drilling fluids are essential for effective and safe drilling operations which contributes significantly to the growth of the drilling fluids industry.

The global drilling fluids market demand is driven by the growing number of drilling operations and recovering oil prices. In the Asia Pacific, India and Australia have witnessed the continued performance of drilling operations despite having low crude prices. Future demand for drilling fluids is expected to rise, propelling the industry further. The drilling fluids help in eliminating cutting from the formation, along with smooth drilling operation and completion.

According to BP Energy, China produced 194.0 million tonnes of oil in 2020, and this figure rose to 198.9 million tonnes in 2021, reflecting a steady annual growth rate of 2.4%. In 2021, China accounted for 4.7% of global oil production, highlighting its significant role in the global oil supply. This substantial contribution drives drilling fluid market revenue, as increased oil production to meet global energy needs boosts the demand for advanced and efficient drilling fluids.

According to BP Energy, Iran's oil production increased from 143.2 million tonnes in 2020 to 167.7 million tonnes in 2021, marking a 17.4% growth. Kuwait's output rose slightly from 130.3 million tonnes in 2020 to 131.1 million tonnes in 2021, a 0.9% increase. Oman saw its production grow from 46.1 million tonnes in 2020 to 46.8 million tonnes in 2021, reflecting a 1.8% rise. Syria experienced a significant surge in oil production, from 2.0 million tonnes in 2020 to 4.6 million tonnes in 2021, representing a remarkable 134.8% increase. Other Middle Eastern countries collectively produced 9.2 million tonnes in 2020, increasing slightly to 9.3 million tonnes in 2021, a 1.7% growth. Overall, the total oil production in the Middle East rose from 1,294.9 million tonnes in 2020 to 1,315.8 million tonnes in 2021, indicating a 1.9% increase.

According to BP Energy, North America's natural gas production in 2020 was led by the United States, which produced 915.9 billion cubic metres. Canada followed with 165.7 billion cubic metres, and Mexico contributed 30.5 billion cubic metres. In 2021, U.S. production increased to 934.2 billion cubic metres, marking a 2.3% rise. Canada’s output grew to 172.3 billion cubic metres, reflecting a 4.3% increase. In 2021, North America's natural gas production totalled 1,135.8 billion cubic meters, marking a 2.4% increase from 2020 and representing 28.1% of global production. This substantial output drives the drilling fluids industry revenue, as these fluids are crucial for efficient natural gas extraction.

Solvay S.A.

Newpark Resources, Inc.

Baker Hughes Company

BASF SE

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global Drilling Fluids Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type of Chemicals

Market Breakup by Region

| CAGR 2026-2035 - Market by | Country |

| India | 3.0% |

| China | 2.9% |

| Saudi Arabia | 2.7% |

| Canada | 2.7% |

| UK | 2.6% |

| USA | XX% |

| Germany | 2.3% |

| France | XX% |

| Italy | XX% |

| Japan | XX% |

| Australia | XX% |

| Brazil | XX% |

| Mexico | XX% |

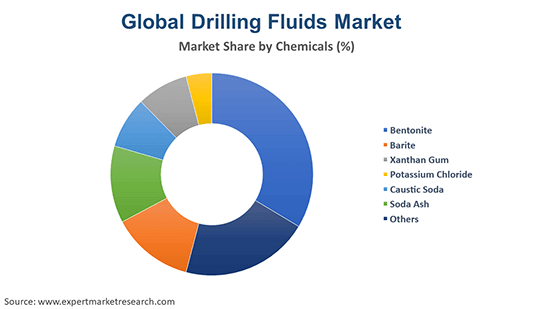

The drilling fluids market dynamics and trends are driven by a growing demand for bentonite. This increase is attributed to its expanding use in foundry and metal casting applications within the automotive and oil and gas sectors, which is fuelling the growth of the bentonite industry.

The supply of barite, on the other hand, highly corresponds to oil and gas prices, as the use of barite in drilling fluids represents the single largest consuming industry. The demand for barite is expected to increase due to the improvement in oil prices and shale gas drilling in the United States. China has set out to achieve the production of 30 billion cubic metres of gas by drilling more shale gas wells by the year 2021, which will increase domestic consumption and decrease the availability of barite for exports.

The Xanthan gum helps in reducing water viscosity in various applications. The demand for xanthan gum is expected to increase due to its usage in the food and oil and gas industries, providing impetus to the drilling fluids industry growth. The xanthan gum demand is expected to remain rapid due to the supportive European and the United States administrations, encouraging the use of the chemical in the form of stabiliser, emulsifier, thickener, and gelling agent.

The production of caustic potash is expected to continue to increase in the United States, as it offers lower energy costs than the other western regions. The utilisation rate is expected to increase in the United States, further boosting the supply in the region. In the forecast period, few capacity additions are predicted for caustic potash, especially in the Asia Pacific region, keeping the export market in focus.

The companies specialise in oilfield services such as drilling, evaluation, and completion, offering innovative solutions to improve exploration and production efficiency.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market attained a value of approximately USD 10.72 Billion.

The market is projected to grow at a CAGR of nearly 2.60% in the forecast period of 2026-2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach around USD 13.86 Billion by 2035.

The major drivers of the market are recovering oil price, increasing frequency of drilling operations, and growing rig count.

The key trends guiding the growth of the market include the increasing environmental concerns associated with wastewater treatment and rising concern towards handling solid waste.

The market is broken down into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

The market is broken down into bentonite, barite, xanthan gum, potassium chloride, caustic soda, and soda ash.

The competitive landscape consists of Solvay S.A., Ecolab Inc., Newpark Resources, Inc., Baker Hughes Company, BASF SE, and Halliburton Energy Services, Inc., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type of Chemicals |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share