Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global energy drinks market was valued at USD 74.85 Billion in 2025. The industry is expected to grow at a CAGR of 7.10% during the forecast period of 2026-2035 to reach a value of USD 148.62 Billion by 2035. The market expansion depends heavily on power measures like strategic partnerships and distribution alliances that open the brand horizon of one’s business activity towards a quick market penetration, wider retail access, and increased consumer awareness.

Energy drink manufacturers have become more eager to join the forces with major beverage conglomerates and worldwide sporting platforms in a bid to not only increase brand reach but also optimize distribution networks. In addition, these partnerships offer opportunities in the global energy drink market and allow companies to take advantage of the already-set infrastructure, upgrade retail execution, and speed up global expansion in the face of rising category demand.

The most notable instance of this trend is the global official partnership between PepsiCo and Formula 1, which was made public in May 2025. In this case, one of the world’s fastest-growing sports platforms was fused with Sting Energy and other PepsiCo brands to create a worldwide engagement channel going beyond 200 territories and also making energy drinks more visible to the performance culture. In addition to this, in August 2025 PepsiCo and Celsius Holdings made the decision to extend their long-term strategic partnership by not only broadening the distribution of Celsius and Alani Nu products in the United States and Canada through PepsiCo’s network but also aligning the commercial strategy to serve the consumer segments better. These strategic actions demonstrate the role of partnerships and distribution alliances in transforming competitive dynamics and driving global energy drinks market growth to the next level.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

7.1%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Energy Drinks Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 74.85 |

| Market Size 2035 | USD Billion | 148.62 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 7.10% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 7.9% |

| CAGR 2026-2035 - Market by Country | India | 8.1% |

| CAGR 2026-2035 - Market by Country | Brazil | 8.0% |

| CAGR 2026-2035 - Market by Consumer | Adults | 7.8% |

| CAGR 2026-2035 - Market by Distribution Channel | Off-Trade & Direct Selling Distribution | 7.7% |

| Market Share by Country 2025 | Italy | 2.3% |

Geographic expansion is the main driver of energy drink industry growth from the point where businesses abandon old markets and come up with new locally products targeted at local consumers. The strategy allows not only the exposure, distribution but also the acceptance of the product to grow. Bloom Sparkling Energy was launched in the US in July 2024, with functional flavors, and a multi-retailer rollout followed in August–September 2025, thereby demonstrating rapid geographic adoption and scalable market penetration. Targeted launches make sure that brands get both wellness and mainstream segments without missing out on either of them.

Product innovation through continuous consumer targeting is a must for energy drinks to keep their brand growing. The global energy drinks market development is mainly attributed to the increasing focus of brands on the development of new formulations and flavors that satisfy the consumer preference trend, among which functional benefits, low-calorie, and zero-sugar options win the highest popularity. The innovations are the main factors why these brands entice the health-conscious and lifestyle-orientated buyers in their segments while they set themselves apart from the competitors. An excellent example is the introduction of Rockstar Focus by Rockstar Energy in January 2024, a product that features natural caffeine and Lion's Mane for mental focus. This item serves as a benchmark for the industry to remain innovatively committed and to provide on-demand functional offerings.

The demand in the energy drinks market is rising consistently, resulting from the measures taken by companies to upgrade their production facilities to meet the demand supply efficiently. Upgraded production lines can bring a higher output and faster delivery and maintain the product quality at a constant level. For example, in May 2025, Coca-Cola Europacific Partners (CCEP) invested USD 75 million in a new canning line in Brisbane, Australia, thereby considerably extending the production capacity of Monster Energy to sustain its growth. Energy drink firms' strategic moves to expand their capacity not only cater to the seasonal demand but also to the steady long-term consumption trends.

Experiential marketing, along with limited-edition launches, acts as a tool for increasing brand engagement, mainly among the younger generations, which impacts the growth of the energy drinks market. Such projects combine product innovation, lifestyle, and cultural experiences for the brand to be seen as more attractive and for increasing loyalty. Celsius introduced the limited-edition Spritz Vibe Sparkling Snowball Frost flavor along with immersive events in Miami in October 2025, associating consumers to the brand's wellness and lifestyle positioning. These marketing-led product introductions not only facilitate brand visibility but also encourage the consumers to try the product and make a repeat purchase in retail and digital channels that further their reach.

By participating in collaborations with artists, entertainment, and cultural sectors, major brands in the energy drinks market become more attractive to a wider audience of potential consumers while, at the same time, these collaborations serve as a way of reinforcing the lifestyle positioning of the brand. In September 2023, Rockstar Energy collaborated with Mexican artist Joaquín Nava to create a limited-edition Día de los Muertos can series, thus combining product design with cultural storytelling. The move exemplifies how brand collaborations across sectors lead to greater consumer engagement, help offerings stand out, and increase brand loyalty - thus, energy drinks become relevant beyond the traditional consumption moments.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Energy Drinks Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product

Key Insights: Based on product, the market is categorized into non-alcoholic and alcoholic energy drinks, which serve different consumer preferences. Non-alcoholic energy drinks are the most widely consumed ones. They are the main contributors to the global energy drinks market growth due to the popularization of their use for performance, focus, and lifestyle needs, and the leading brands in this category are Red Bull, Monster, and Celsius. Meanwhile, alcoholic energy drinks like those that can be found at Fever-Tree and Bacardi stores are directed at the adult segment, which is looking for ready-to-drink cocktails with the added energy effects. In both categories, the growth is supported by continuous product launches, portfolio expansion, and strategic marketing campaigns, which increase the consumer base.

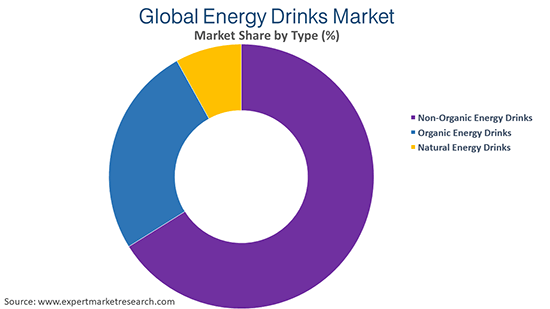

Market Breakup by Type

Key Insights: The non-organic energy drinks market usually contains products that have caffeine as a base ingredient, for instance, Red Bull and Monster, which are the most popular ones. Organic energy drinks are a small niche that includes only clean-label products such as those by Celsius Holdings and Runa. While the Natural energy drinks are all plant-based and come with additional health benefits. The main reason for the expansion of all the segments is the continuous product innovation, the portfolio expansion, and the strategic marketing that is used in each one of them.

Market Breakup by Consumer

Key Insights: Major players are using targeted portfolios to address the diverse consumer segments of the global energy drinks market with targeted portfolios from major players. Teenagers are the main target of the likes of Red Bull GmbH and Monster Beverage Corporation, which are using vibrant flavors and lifestyle marketing to increase engagement. Adults mostly focus on functional products for instance, they can choose Celsius Holdings’ CELSIUS or PepsiCo’s Rockstar Zero Sugar, which are good for performance and wellness. On the other hand, there are milder formulations that can appeal to the elderly population, thus companies like The Coca-Cola Company may use vitamin-enhanced energy variants to create a more attractive and relevant user experience for all age cohorts and increase the adoption rate among the latter.

Market Breakup by Distribution Channel

Key Insights: Energy drinks on a global scale are mainly distributed through the on-trade and off-trade & direct selling channels. On-trade distribution, which is done in places like bars, cafes, and gyms, generates significant revenue in the energy drinks market as it helps brand to conduct experiential marketing and increase the brand's visibility, and also thus, companies like Red Bull and Monster use sponsorships and partnerships to increase the number of their fans. Also, Off-trade and direct selling are represented by such outlets as supermarkets, convenience stores, and e-commerce, and they are open to new customers thanks to their respective expansion efforts and new product introductions, for example, a Cyrus retail initiative aimed at the North American market provides not only the easy access to the product for customers but also accelerates market penetration.

Market Breakup by Region

Key Insights: Leading energy drink companies tailor their strategies to local demands to continue thriving and growing in the energy drinks market. In North America, one good move by PepsiCo was to increase its stake in Celsius Holdings, which thereby helped Alani Nu and Rockstar distribution to get a good push. Consequently, Red Bull and Monster turn to flavor innovations in Europe for fresher flavor profiles and product selections to engage consumers, while Asia Pacific opts for the adoption of functional and sugar-free variants. Besides that, Latin America enhances its ability to provide quality products locally through partnerships with manufacturers. The Middle East and Africa region, on the other hand, lures internationally-based companies that are ready to invest in retail and marketing expansion to assist with the upscale of the regional market.

By product, non-alcoholic energy drinks witness notable demand

The growing preference for non-alcoholic energy drinks is supporting the growth of the energy drinks market as companies extend their portfolios with lifestyle and performance products that meet the consumers' needs. To reach more consumers, companies are introducing balanced formulations, functional ingredients, and new formats. For instance, Liquid Death revealed its sparkling energy release that will happen in January 2026 is made up of naturally sourced caffeine and is sugar-free, which gives an attractive feature to health-conscious consumers who are looking for an energy supply that makes sense. By this move, the company is demonstrating how product diversification is a growth driver for the category.

Meanwhile, the alcohol-containing energy drink segment is becoming more popular as beverage companies are diversifying their portfolios with ready-to-drink (RTD) alcohol products that have dynamic branding combined with alcoholic formulations. These products are intended for adult consumers who want to try new beverage experiences. A compelling example is the 2023 launch of the alcoholic drink line, The Beast Unleashed, by Monster Beverage Corporation features 6% ABV flavors inspired by the energy drink portfolio, thus, signaling a strategic move beyond the conventional non-alcoholic offerings. Hence, this diversification makes the market more attractive to adult lifestyles.

By type, non-organic energy drinks display a steady demand pattern

The non-organic category of the energy drinks market continues to be the major driving force of global consumption as a result of its wide availability and the continuous innovations in the product line by the leading brand. In this respect, companies like Red Bull GmbH and Monster Beverage Corporation are revitalizing their non-organic portfolios with new flavors and functional variants to attract their existing consumers further. For instance, Maxxx Energy introduced a new sugar-free line with functional benefits in January 2025, featuring Apple Kiwi and Blackberry Boost, to engage consumers with an active lifestyle who are seeking performance and endurance enhancement.

The natural energy drink market is gaining notable traction, due to which it is experiencing a healthy growth trend. More consumers are demanding drinks that are made from plant-based ingredients, are clean-label, and have the added benefit of functionality. Brands like GURU Organic Energy Corp. and Hiball Energy are willing to serve the market with innovative natural formulations to meet this demand. For instance, GURU Organic Energy launched the Island Breeze Punch in September 2025, which is a naturally caffeinated tropical drink without any artificial sweeteners and thus, is a perfect solution for health-conscious and wellness-oriented consumers who seek sustainable plant-based energy sources.

By consumer, teenagers contribute substantially to the market demand

Energy drink brands have always considered the teenage segment as a significant source of growth, and, as a result, they have tailored products and promotional activities that focus on youth culture and social interaction. Among others, companies are launching trendy flavors and are involved in entertainment activities to attract this lively group of people. For example, Red Bull introduced Red Bull Summer Edition White Peach in April 2025, offering a seasonal flavor with both regular and sugar-free versions that deliver the appeal of younger consumers seeking variety and fun. These activities are brand affinity strengthening and energy drink consumption occasion expansion among teenagers.

Adults substantially contribute to the growing consumption in the energy drinks market. The adult consumers seek energy drinks that can provide them with performance and wellness benefits, and consequently, brands feel the need to introduce functional formulations and expand their portfolios. In addition, targeted initiatives also contribute to the demographic's lifestyle needs at a deeper level. For example, Molson Coors, in November 2024, extended its partnership and investment in ZOA Energy thereby increasing marketing and distribution to help the brand reach energetic adult consumers who lead an active lifestyle. Such collaborations, therefore, act as a tool for greater adult involvement and portfolio diversification reinforcement in the industry.

By distribution channel, on-trade distribution generates a large amount of revenue

Energy drink brands in the on-trade distribution are taking more proactive steps to strengthen their presence in bars, restaurants, gyms, and event venues where consumer loyalty is mainly influenced by experiential engagement. To a great extent, companies are utilizing the targeted launches and partnerships that are in line with the lifestyle consumption occasions. For instance, Coca Cola Europacific Partners is launching a guava-flavored Relentless energy drink in the UK on May 10, 2025, and this is supported by the integrated marketing and cultural activations targeting Gen Z consumers. Such a plan elevates on-premise exposure and, therefore, is an attractive proposition for trial among social and active audiences.

Off-trade and direct selling channels are still significantly contributing to the energy drinks market revenue, owing to the increasing consumer preference to shop from supermarkets, convenience stores, and e-commerce platforms for consumption at home. To satisfy this demand, brands are working on increasing the number of SKUs as well as the depth of the retail network by introducing new formats and flavors. For instance, Yerbaé Brands launched a 12 oz energy line in January 2024, which offered a compact, high caffeine variant across retail outlets, thus showing how product innovations have been created to be accessible to a wider range of off-trade consumers. Such actions are crucial for retail growth and enable category visibility at both traditional and digital shelves.

By region, Asia Pacific leads the market growth

Energy drink companies across Asia Pacific are reaping the benefits of higher disposable incomes, urbanization, and the rising number of young consumers seeking convenient energy solutions. To satisfy customers' demands, brands are launching products with local ingredients, broadening their distribution channels, and changing their marketing strategies to match the tastes of the region. For instance, India experienced the 28 BLACK launch in the middle of 2025, with the brand attempting to attract consumers by providing novel flavors and very carefully planned retail partnerships. Such types of moves signal that companies are considering lifestyle positioning, market entry, and the region's significant increase of energy drink consumption as the crucial elements of their strategy.

Europe accounts for a substantial share of the energy drinks market as companies are strengthening their industry presence through distribution partnerships and product innovations that aim to attract the changing preferences of health-conscious consumers. The firms are revitalizing their portfolios and introducing locally produced flavors to raise the attractiveness of the shelf and the level of engagement. In March 2025, through a partnership with Suntory Beverage & Food Benelux, Celsius Holdings opened the doors in Belgium and Luxembourg, providing a wide range of flavors to meet the regional demand. This way shows how the benefits held by the main driver of new product launches and partnerships slowly result in sustainable growth and a competitive advantage in the European market.

| CAGR 2026-2035 - Market by | Country |

| India | 8.1% |

| Brazil | 8.0% |

| China | 7.8% |

| Mexico | 7.5% |

| Canada | 7.3% |

| USA | XX% |

| UK | 7.0% |

| France | XX% |

| Italy | XX% |

| Japan | XX% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Germany | 6.5% |

The energy drink market players are achieving a worldwide presence not only through collaborations and brand diversification but also by zeroing in on product innovations that will have appeal to different consumer groups. On the other hand, lifestyle-oriented marketing, sponsorships, and high-performance product lines are the areas where Red Bull and Monster direct their efforts, while PepsiCo and Coca-Cola make use of their vast distribution networks to build a market presence and put the product in front of the consumers. These initiatives are more about brand equity than mere geographic expansion and thus, they respond to the rising consumer demand in various regions.

In addition to the geographic expansion, many energy drinks companies are upgrading their offerings with functional and better-for-you formulations to lure health-conscious consumers. The introduction of products such as Alani Nu by Celsius and Bloom Sparkling Energy serves as an excellent illustration of a brand that is attentive to nutritious, low-sugar, and functional beverages. At the same time, firms are broadening their production facilities and staging limited-edition experiential campaigns to deeply engage consumers. It gives them not only the opportunity to be ahead of market trends but also the possibility to expand gradually in the competitive landscape of the energy drinks market.

Red Bull GmbH was established in 1984 and is headquartered in Fuschl am See, Austria. It is a global leader in the energy drinks segment. The company is most famous for its extravagant and groundbreaking marketing campaigns and for the sponsorships in sports and entertainment which have made it the number one lifestyle brand worldwide.

Monster Beverage Corporation was established in 1935 and is based in Corona, California. It is one of the major contributors to energy drinks market growth. The company produces high-caffeine beverages. Moreover, through brand acquisitions and distribution partnerships worldwide, the company has broadened its portfolio.

National Beverage Corp., established in 1985 and headquartered in Fort Lauderdale, Florida, is a producer of a diverse range of flavored beverages along with energy drinks under the Rip It brand. The company has put its main emphasis on product innovation and niche marketing for the purpose of capturing different consumer segments.

The Coca-Cola Company was established in 1892 and is headquartered in Atlanta, Georgia. It is a multinational beverage leader with an extensive portfolio, including energy drinks such as Monster and Coca-Cola Energy. Through the use of distribution networks opened globally and strategic cooperation with partners, the company is able to maintain its strong position in the energy drinks category.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include PepsiCo Inc., Celsius Holdings, Inc., Energy Beverages LLC, Reign Beverage Company LLC, HELL ENERGY Magyarország Kft., Arizona Beverage Co., and other key players.

Explore the latest trends shaping the Global Energy Drinks Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on global energy drinks market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global energy drinks market reached an approximate value of USD 74.85 Billion.

The market is projected to grow at a CAGR of 7.10% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 148.62 Billion by 2035.

Key strategies driving the market include product innovation, strategic partnerships, geographic expansion, functional and better-for-you formulations, targeted marketing campaigns, and enhanced distribution networks.

Key trends aiding market expansion include new product launches, emergence of plant-based energy drinks, and rising investments by manufacturers in research and development activities and product-marketing.

Major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Non-organic energy drinks, organic energy drinks, and natural energy drinks are the significant types of energy drinks available in the market.

Teenagers, adults, and geriatric population are studied in the market report.

The main distribution channels include on-trade distribution and off-trade and direct selling distribution.

The key players in the market include Red Bull GmbH, Monster Beverage Corporation, National Beverage Corp., The Coca-Cola Company, PepsiCo Inc., Celsius Holdings, Inc., Energy Beverages LLC, Reign Beverage Company LLC, HELL ENERGY Magyarország Kft., Arizona Beverage Co., and other key players.

Major challenges that the market face includes regulatory restrictions, health concerns over high caffeine and sugar content, intense competition, fluctuating raw material costs, and shifting consumer preferences toward healthier alternatives.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Type |

|

| Breakup by Consumer |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share