Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global environmental monitoring market size is expected to rise from USD 24.14 Billion in 2025 to reach USD 44.47 Billion by 2035, growing at a CAGR of 6.30% between 2026 and 2035. The environmental monitoring market is experiencing a rapid growth due to increased awareness of sustainability and the need for efficient management of resources. With increasing concern about climate change and the environmental footprint of industries, the demand for advanced monitoring technology is increasing.

The market size is expanding at a high CAGR driven by government regulations and business initiatives to preserve natural resources. Advancements in sensor devices and data analysis further enhance monitoring capacity, providing real-time assessment of environmental conditions. With businesses looking for enhanced environmental compliance, the implementation of smart monitoring systems is becoming ever more imperative. The continued growth of this sector attests to its crucial role in sustaining ecological equilibrium and long-term sustainability.

Base Year

Historical Period

Forecast Period

In 2022, approximately 66 million tons of pollution were emitted into the atmosphere in the United States, contributing significantly to the formation of ozone, particles, acid deposition, and visibility impairment.

According to the World Health Organisation (WHO), air pollution is responsible for an estimated seven million deaths worldwide annually, with almost all the global population exposed to air pollution levels exceeding WHO guideline limits.

Some successful examples of environmental regulation include the implementation of the Clean Air Act and the Clean Water Act in the United States, as they have significantly contributed to cleaner air and water in the country.

Compound Annual Growth Rate

6.3%

Value in USD Billion

2026-2035

*this image is indicative*

Implementation of laws and initiatives targeted at decreasing pollution; industrialisation; and technological advancements in monitoring devices are impacting the environmental monitoring market development

The development of compact air quality sensors like the PurpleAir PA-II-SD has revolutionised real-time air quality monitoring for both indoor and outdoor environments. These sensors leverage advanced technology to provide accurate and continuous data on pollutants like PM2.5 and PM10.

Countries like China have implemented strict regulations to combat air pollution, leading to a surge in demand for air quality monitoring solutions. The deployment of networks like the China National Environmental Monitoring Center (CNEMC) showcases government support for environmental monitoring initiatives.

Organisations like the World Health Organisation (WHO) have been advocating for the adoption of water quality monitoring technologies to ensure safe drinking water globally. Devices such as the Water Quality Test Kit by LaMotte are gaining popularity due to increased awareness about the impact of water pollution on public health.

Cities like Singapore have implemented Smart Environmental Monitoring System (SEMS) to manage urban pollution effectively as it integrates various sensors to monitor air quality, noise levels, and weather conditions in real-time. Such initiatives demonstrate how urbanisation drives the demand for advanced monitoring technologies, fostering environmental monitoring market expansion.

The environmental monitoring market is evolving with the advent of pollution monitoring, particulate detection, biological detection, and chemical detection. Advanced environmental monitoring products now integrate temperature sensing, noise measurement, and moisture detection to provide real-time data. Water conservation is also creating demand for more efficient monitoring. Strict regulations are also forcing industries to adopt total monitoring systems that ensure compliance and environmental safety.

Sensor technology is also transforming the industry, and environmental sensors are becoming more precise and cost-effective. The incorporation of Internet of Things (IoT) enables smart environmental sensors to collect and process environmental data in real-time. Developments in nanotechnology are also making monitoring more efficient and precise. These technological improvements are creating better growth opportunities for development, allowing companies to enhance sustainability and compliance levels.

The market for environmental monitoring is expanding rapidly with government initiatives promoting sustainability and pollution control. A well-established environmental monitoring network offers accurate data collection for better decision-making. With industries and regulatory bodies collaborating, the demand for monitoring solutions continues to rise. The industry's growth is also taking place owing to the increased focus on innovative approaches and technological advancements that continue to enhance efficiency and environmental protection.

The environmental monitoring market comprises an extensive range of products including monitors, software, and services. Environmental monitors are required for monitoring air, water, and ground quality and provide real-time feedback for accurate decision-making. They are classified into fixed environmental monitors for permanent analysis and portable environmental monitors for easy, spot-type evaluations. With increasing regulatory needs, businesses are making investments in ecological monitoring software with analytics and reporting features to maximize compliance and efficiency in pollution control mechanisms.

Environmental sensors are significant tools for the detection of pollutants as well as environmental change. They comprise analogue sensors that provide simple accurate readings, and digital sensors that provide improved accuracy and compatibility. Environmental monitoring software complements them by processing vast amounts of data and extracting predictive information. All these products enhance environmental protection, optimize utilization of resources, and help companies keep up with environmental regulations.

Different types of sampling methods are employed in environmental monitoring to achieve correct data collection. Active monitoring utilizes pumps and sensors that actively take soil, water, or air samples for pollutants, thereby being most effective in detecting hazardous substances. Continuous monitoring provides 24/7 real-time data, vital in high-risk areas like urban and industrial zones. The methods are significant in regulatory compliance and early warning systems that enable rapid response to environmental risks.

Passive and intermittent monitoring offer choices according to personal needs. Intermittent monitoring collects samples at equal time intervals, thus it is economical but still offers useful information on trends. Passive monitoring, on the other hand, uses natural environmental mechanisms, e.g., diffusion, to collect contaminants over a definite period. Passive monitoring is extensively used in long-term exposure studies and low-maintenance uses, and serves in underpinning large-scale environmental research.

Environmental monitoring systems rely on many devices to detect specific pollutants and environmental conditions. Temperature detectors track changes affecting ecosystems and industrial processes, while moisture detectors help in detecting soil and air humidity, critical in agriculture and climatology research. Biological monitoring detects pathogens and microorganisms in the air, water, and soil to prevent the outbreak of diseases.

Chemical sensors identify poisonous contaminants such as heavy metals and toxins, ensuring air and water quality. Particulate matter sensors identify air pollution levels in urban and industrial areas. Noise sensors measure environmental noise, helping in keeping regulations in check and preventing noise pollution in residential and business districts.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Air pollution monitoring plays a key role in industrial, vehicle, and urban emission control. Complex air quality sensors track pollutants such as carbon monoxide, nitrogen oxides, and volatile organic compounds, aiding governments in compliance with clean air acts. Similarly, water pollution monitoring ensures safe drinking water and protects ecosystems through detection of toxins such as heavy metals, pesticides, and microbes. These monitors are critical to curbing industrial effluent and runoff effects.

Soil contamination monitoring is critical to evaluate contamination resulting from harmful chemicals, waste management, and agricultural use. Toxin content is monitored by environmental sensors to maintain soil integrity and safeguard food crop production. Noise pollution monitoring, on the other hand, assists urban planners and government agencies to handle excessive noise emissions from transport, industries, and building construction. Through the use of high-tech monitoring equipment, stakeholders can apply effective measures for pollution control, resulting in a cleaner environment.

Government bodies are critical in environmental surveillance, enforcing policy and legislation for sustainability. Large-scale monitoring networks are used for pollution management and climate evaluation by government agencies. Monitoring solutions are integrated by manufacturing and industrial corporations to meet environmental requirements and reduce their environmental impact.

The energy & utilities industry is dependent on environmental monitoring to reduce the effects of power generation, oil refining, and mining operations. Medical facilities utilize monitoring systems to monitor air and water quality in hospitals and research centers, providing a safe environment. In agriculture, farmers use environmental monitoring to maximize irrigation, identify soil contamination, and address climate-related hazards, promoting productivity with the conservation of natural resources.

The North America market for environmental monitoring is fueled by strict environmental policies, technological innovations, and escalating industrialization. The region benefits from robust governmental backing, with organizations such as the EPA (Environmental Protection Agency) implementing measures to control pollution. Growing IoT-based sensor adoption and smart monitoring solutions also propel market growth further. Increased concern regarding climate change and sustainability initiatives also fuels the need for cutting-edge monitoring technology across industries.

The U.S. environmental monitoring industry is growing due to the stricter emission regulations, increasing industrialization, and consumer health issues. Industries are constantly required to track air, water, and ground quality by laws at the state and federal level. Investment in smart cities as well as IoT-based environmental monitoring systems in the country increases the collection of real-time data. Increasing demand for renewable energy sources and sustainable methods also fuels research and development for monitoring solutions.

The European environmental monitoring market is spurred by the European Green Deal for carbon neutrality in 2050. EU policies for more stringent emissions, waste, and industrial pollution push demand for cutting-edge monitoring technologies. Regional countries are investing in smart sensors and AI-based analytics for real-time environment monitoring. Rising awareness of air quality and global warming also drive market growth.

Germany occupies a leadership role in the environmental monitoring market of Europe with robust governmental efforts, including the Federal Immission Control Act governing noise and air pollution. Germany leads the way in environment sensor advanced technology and Internet of Things-based monitoring systems adoption across the region. Industrial sustainability focus, smart city development in urban areas, and renewable energy use in Germany increase demand for effective monitoring capacity to meet regulatory compliance and green safeguarding.

The Asia Pacific environmental monitoring market is expanding exponentially with industrialization, urbanization, and rising environmental awareness. Governments in the region are enhancing pollution controls and investing in real-time monitoring technology. Rising applications of smart environmental sensors in Japan, India, and South Korea fuel market growth. In addition, climate action plans and resource management strategies fuel adoption in industry and municipalities.

China is a leading driver of the Asia Pacific environmental monitoring market due to stringent government regulations regarding air and water pollution. China has established huge environmental monitoring networks to monitor industrial emissions and enhance urban air quality. Advanced monitoring technologies such as IoT sensors and AI analytics are necessary to address increasing environmental issues and meet sustainability objectives due to China's rapid industrialization and urbanization.

The environmental monitoring market is going through high growth, driven by growing demand for advanced pollution control technologies. Big players are struggling in a fiercely competitive market with a focus on innovation, new products, and expansions to bolster market positions. With growing environment legislations and sustainability measures, firms are looking to invest in cutting-edge technology to enhance monitoring. As companies strive for conformity and productivity, the market is evolving with smarter and effective solutions.

The environmental monitoring market is witnessing significant growth, driven by growing demand for advanced pollution control solutions. Key companies are competing in a competitive market, focusing on innovation, new launches, and expansions to strengthen their market presence. With increasing environmental regulations and sustainability initiatives, businesses are investing in cutting-edge technologies to enhance monitoring capabilities. As industries strive for compliance and efficiency, the market continues to evolve with smarter and more efficient solutions.

3M provides solutions for environmental monitoring in the form of air quality monitors, particulate sensing systems, and chemical sensing technology. 3M keeps itself innovative by adopting sophisticated sensor technologies in its products. Strategies of 3M are constant new product launches and R&D investments to strengthen pollution control solutions. By expanding in growth markets and aligning with regulatory agencies, 3M deepens its footprint in the environmental monitoring business, responding to the increasing need for sustainable industrial solutions.

Danaher Corporation offers environmental monitoring equipment, focused on water quality analysis, air pollution control, and industrial emission monitoring. It fuels market development through its subsidiaries such as Hach and Pall Corporation, which provide innovative monitoring solutions. Danaher prioritizes innovation using AI-based environmental analytics and sensing technology based on IoT. Danaher adopts an expansion approach through acquisitions of top environmental monitoring companies, building a stronger footing in the competitive market and targeting industries with sustainability and regulatory adherence focus.

Emerson Electric Co. provides environmental monitoring systems for industrial use, such as air and water quality monitoring solutions. The company combines superior automation and IoT-integrated sensors to offer real-time environmental information. Emerson specializes in new product launches in smart monitoring technologies and cloud-based analytics. Through prioritizing expansion in worldwide markets and digital transformation programs, the company meets increasing demand for trusted environmental monitoring, becoming a leader in sustainability-based industries.

HORIBA Group is an expert in environmental monitoring equipment, specifically air and water quality measurement. HORIBA is a leader in chemical sensing and particulate monitoring technology. HORIBA's strategy for growth involves real-time emissions monitoring innovation and data analytics using artificial intelligence. The company solidifies its global presence through new launches in portable monitoring equipment and geographic expansion into Asia-Pacific and Europe. HORIBA aligns itself with stringent environmental regulations to ensure that its technologies are compatible with the changing demands of a competitive market.

Siemens provides environmental monitoring solutions with integrated smart automation and IoT-based sensors. Siemens offers sophisticated monitoring systems for air, water, and industrial emissions. Siemens emphasizes innovation with AI-driven environmental data analytics to enhance regulatory compliance. Siemens' growth strategy involves expansion into smart cities and digital monitoring solutions. Siemens expands with new launches in cloud-based environmental tracking, enhancing efficiency and reliability, and increasing demand for sustainable industrial and municipal monitoring solutions.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

This report provides an elaborative market analysis with revenue growth estimates at global, regional, and country-level growth rates from 2026-2035. It delves into industry trends via different sub-segments, along with an elaborate regional market dynamics analysis. The research offers a global forecast based on product, component, sampling method, end-use, and region so that stakeholders can understand emerging opportunities and trends which are shaping the environmental monitoring market. Insights are offered for strategic market growth and decision-making.

Product Outlook (Revenue, Billion, 2026-2035)

Sampling Method Outlook (Revenue, Billion, 2026-2035)

Component Outlook (Revenue, Billion, 2026-2035)

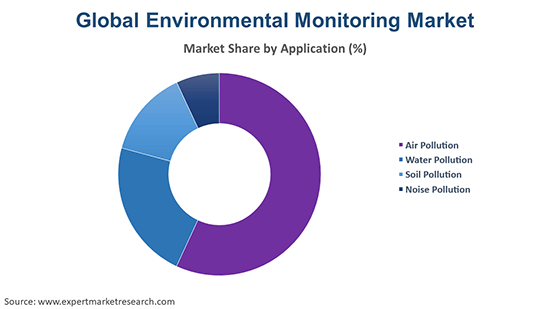

Application Outlook (Revenue, Billion, 2026-2035)

End-Use Outlook (Revenue, Billion, 2026-2035)

Region Outlook (Revenue, Billion, 2026-2035)

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global environmental monitoring market attained a value of nearly USD 24.14 Billion.

The market is projected to grow at a CAGR of 6.30% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to USD 44.47 Billion by 2035.

Major market drivers are the growing oil and gas industry, increasing global population, implementation of laws and initiatives targeted at decreasing pollution produced by air, soil, and water, and building of various environmental monitoring stations.

Key trends aiding market expansion include the development of high-end nanotechnology-based environmental monitoring products, and the increased support of various governments for pollution prevention and control.

Regions considered in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The product types in the market are environmental monitors, fixed environmental monitors, portable environmental monitors, environmental sensors, analogue sensors, digital sensors, and environmental monitoring software.

The various sampling methods include continuous monitoring, active monitoring, passive monitoring, and intermittent monitoring.

Based on components, the market can be divided into particulate detection, chemical detection, biological detection, temperature sensing, moisture detection, and noise measurement.

Key players in the market are Danaher Corporation, Emerson Electric Co., E.S.I. Environmental Sensors Inc., General Electric Company, Honeywell International, Inc., Agilent Technologies, Inc., TE Connectivity Ltd., Siemens AG, 3M, HORIBA Group, Teledyne Technologies Incorporated, and Thermo Fisher Scientific Inc., among others.

North America held the largest market share due to stringent environmental regulations and advanced monitoring technologies.

Environmental monitors, including fixed and portable monitors, dominated the market due to increasing demand for real-time pollution tracking.

The government sector led the market, driven by strict regulatory enforcement and large-scale environmental monitoring initiatives.

Air pollution monitoring held the largest share, fueled by rising concerns over industrial emissions and urban air quality.

Market research is based on product type, component, sampling method, end-use industry, regional trends, regulatory policies, and technological advancements in environmental monitoring.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Sampling Method |

|

| Breakup by Component |

|

| Breakup by Application |

|

| Breakup by End-Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share