Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Europe calcium silicate blocks market size reached around USD 885.56 Million in 2025. The market is projected to grow at a CAGR of 5.90% between 2026 and 2035 to reach nearly USD 1571.01 Million by 2035.

Base Year

Historical Period

Forecast Period

In 2022, the construction sector in Europe received a total investment of USD 1,535.4 billion, rising by 2% over 2021.

In the EU, real estate accounts for roughly 40% of total energy consumption and 36% of GHG emissions. The rising demand for sustainable construction practices and rising energy costs drives the demand for high quality insulation.

Poland's cement production in the first half of 2022 increased by 8.6% year-on-year, reaching 9.3Mt.

Compound Annual Growth Rate

5.9%

Value in USD Million

2026-2035

*this image is indicative*

Calcium silicate insulation is composed of non-combustible materials, it can tolerate exposure to fire and withstand temperatures of up to 927 degrees Celsius. Calcium silicate blocks are widely employed across different industry verticals such as cement, steel and iron, power plants, and petrochemicals due to their high efficiency and insulating properties.

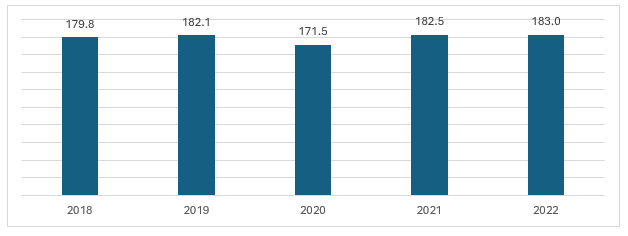

In cement production plants, calcium silicate blocks find applications as insulators, to insulate high-temperature pipes and equipment. In 2022, the EU produced around 183 Mt of cement. The EU’s five largest regional cement producers are Germany, France, Italy, the UK, and Spain.

Figure: Annual Cement Production in Europe, 2018-2022 (MT)

Expanding construction sector; Europe’s emission reduction strategies; increasing steel production; and rising adoption of calcium silicate in the residential sector are the key trends impacting the Europe calcium silicate blocks market growth.

Calcium silicate blocks are lightweight, non-combustible and durable insulating material. The expanding construction sector in Europe aids the demand for construction materials, like cement. In the cement industry, calcium silicate insulation provides a long operating life for cement production facilities combined with energy savings.

By 2030, the EU aims to reduce GHG emissions by at least 55% from the 1990 levels. Calcium silicate blocks are an ideal insulation for the industrial sector to help it save energy and space, reduce CO2 emissions and enhance safety.

In 2022, EU’s steel sector produced carbon steel alloy (77.0%), carbon steel other alloy (18.5%), and stainless steel (4.5%). The EU also produces a range of steel products, such as quarto plate, hot rolled wide strip, and wire rods. The rising steel production aids the Europe calcium silicate blocks market.

In the EU, real estate accounts for around 40% of total energy consumption and 36% of GHG emissions. The heat conductivity coefficient of calcium silicate board is 0.11. Furthermore, its insulation property is five times more than that of glass, three times greater than that of fireclay, and ten times greater than that of regular concrete. Consumers across Europe are investing in high quality insulation, such as calcium silicate blocks due to the rising costs of gas, heating oil and electricity.

Calcium silicate blocks are reusable and being a precast construction material provide time efficiency and enhance building quality. By 2030, the EU aims to reduce its energy consumption by 11.7% compared to the 2020 level. A reduction in energy consumption is expected to help the EU meet its target of reducing GHG emissions by at least 55% by 2030 compared to 1990 levels. Calcium silicate bricks/ blocks are highly energy efficient and have a lower carbon footprint (300 kgs/ton) compared to clay-fired bricks (900 kgs/ton). This is expected to significantly favour the Europe calcium silicate blocks market expansion.

Germany is a significant cement producer in Europe, with a production of 32.9 million metric tonnes in 2022. The rising demand for cement from the construction sector is expected to drive the use of calcium silicate blocks in the precalcinator, klin riser duct, firing hood, grate-cooler, tertiary air duct, and flue gas ducts due to the block’s ability to withstand high temperature.

“Europe Calcium Silicate Blocks Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by End Use

Market Breakup by Country

Based on end use, the cement industry is a major contributor to the Europe calcium silicate blocks market revenue

Calcium silicate blocks help cement production facilities save on energy costs due to their robust insulating properties. The major applications of calcium silicate blocks in the steel and iron industry include insulating blast furnace shafts, stove and bustle pipes, soaking pits, reheat and annealing furnaces, and waste heat boilers. According to industry reports, Germany is among the world’s ten largest steel producers. In January 2024, German steelmakers increased production by 4.9% to 3.07 million tons compared to January 2023.

The market players are engaging in pricing strategies, a strong distributor network, and active involvement in ESG activities, to gain a competitive advantage.

Etex Group is one of the leading global manufacturers in the building materials sector, specialising in lightweight construction solutions. Founded in 1905, The company organises its operations into five core divisions: Building Performance, Exteriors, Insulation, Industry, and New Ways.

Bauroc, the largest producer of autoclaved aerated concrete (AAC) in Northern Europe, has a diverse product portfolio suitable for various construction projects, including private homes, multistorey buildings, and industrial structures. The calcium silicate units of the company are sold under the "silroc" brand.

The company is recognised as one of the world's largest manufacturers of autoclaved aerated concrete and calcium silicate materials. Founded in 1929, Xella leads in building materials made from autoclaved aerated concrete (AAC) and calcium silicate through its brands including Ytong, Silka and Hebel.

Johns Manville is a prominent manufacturer of premium insulation and commercial roofing solutions, based in the United States. The company operates 44 manufacturing facilities, located across North America and Europe.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the Europe calcium silicate blocks market are Carmeuse Coordination Center SA, and Anglitemp Limited, among others.

In 2023, Germany produced around 2,975,752 tonnes of aluminium in total, which constituted primary aluminium and recycled aluminium production of 189, 471 tons and 2,786, 282 tons, respectively, in the same year.

During H1 2022, Poland produced about 9.3Mt of cement, up by 8.6% year-on-year from the same period in 2021.

Netherlands occupies a top position in the European chemical sector, with the presence of leading multinational chemical companies such as AkzoNobel, Royal Dutch Shell, DSM, Purac, MSD and ECN. In 2022, the Netherlands exported about EUR 49 billion worth of chemicals to countries outside the EU.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 885.56 Million.

The market is projected to grow at a CAGR of 5.90% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 1571.01 Million by 2035.

The end uses include cement industry, steel and iron industry, power plants, fertiliser, refinery, and petrochemical industry, glass industry, aluminum industry, sugar industry, and others.

The key countries are the United Kingdom, Germany, France, Italy, Poland, Spain, the Netherlands, and others.

The factors driving the market include increasing construction activities, expansion of the aluminium manufacturing sector, and rising adoption of environment friendly building materials, among others.

The trends include high demand for high quality insulating materials to enhance the energy efficiency, rising use of calcium silicate blocks as insulators to pipes, vessels, furnaces, and other high-temperature equipment, and growth of the European industrial sector.

The key players in the market include Etex NV, Bauroc AS, Xella International GmbH, Johns Manville, Carmeuse Coordination Center SA, and Anglitemp Limited, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share