Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global explosives market attained a volume of 17.44 MMT in 2025. The industry is expected to grow at a CAGR of 5.20% during the forecast period of 2026-2035. By 2035, the market is expected to reach 28.95 MMT.

The global explosives market is experiencing strong growth with the growing mining and construction industries. Increased demand for coal, metals, and key minerals like lithium and cobalt, which are crucial for electronics and renewable energy, has fueled the demand for effective and safe blasting solutions. For instance, Omnia Holdings reported a surge in its explosives business due to rising exploration budgets for green and battery minerals. Mining operations in nations such as China, Australia, and India are especially driving demand for bulk explosives. Besides, development of infrastructure projects in the emerging economies is fueling the market further, as explosives are essential for tunneling, road construction, and quarrying activities. The preference for more cost- and high-performance explosives like emulsion and ANFO-based types further favors explosives market growth.

In addition, the defence industry is helping the market grow as a result of the increase in geopolitical tensions and military modernization initiatives. Nations like the United States, China, and India are boosting their defense spending, which is translating into higher procurement of explosives for use in weapons production. Russia is constructing a major new explosives facility at the Biysk Oleum Plant in Siberia, aiming to produce up to 6,000 metric tons of high explosives annually, such as RDX or HMX. This development is part of Moscow's strategy to bolster its firepower amid the prolonged war in Ukraine.

Innovations in technology, including the use of electronic detonators and automated blast measurement systems, are optimizing operations to become more efficient and safer, favouring the explosives market. In April 2025, BAE Systems unveiled new explosives and propellants for defense applications, featuring advanced formulations that reduce reliance on traditional materials and enhance sustainability. These are designed for munitions with improved durability and lower environmental impact. With tighter environmental regulations, manufacturers are also spending on cleaner formulations, which shows that they are moving toward sustainability without compromising on explosive performance.

Base Year

Historical Period

Forecast Period

The global upsurge in coal, metal, and rare earths mining is greatly enhancing the explosives industry. Blasting remains vital for effective extraction, especially in mineral-resource rich areas, which is driving sustained demand for industrial as well as bulk explosives for mining operations.

The adoption of advanced explosives, such as emulsions and electronic detonators, is rising due to improved safety, precision, and lower environmental footprint. These technologies help reduce accidental detonations and enable enhanced blast control, promoting efficiency in construction, quarrying, and mining operations across the globe, thereby increasing the growth of the explosives market.

Global defense spending reached USD 2.1 trillion in 2021, echoing an ongoing uptrend. States are updating arsenals, scaling up purchases of explosives for use as ammunition or for tactical applications. This demand, which remains high in North America and especially in Asia, is a driving factor for the defense explosives industry.

Compound Annual Growth Rate

5.2%

Value in MMT

2026-2035

*this image is indicative*

| Global Explosives Market Report Summary | Description | Value |

| Base Year | MMT | 2025 |

| Historical Period | MMT | 2019-2025 |

| Forecast Period | MMT | 2026-2035 |

| Market Size 2025 | MMT | 17.44 |

| Market Size 2035 | MMT | 28.95 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 5.20% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 6.0% |

| CAGR 2026-2035 - Market by Country | India | 6.9% |

| CAGR 2026-2035 - Market by Country | China | 5.7% |

| CAGR 2026-2035 - Market by End Use | Metal Mining | 5.9% |

| CAGR 2026-2035 - Market by End Use | Coal Mining | 5.6% |

| Market Share by Country 2025 | Italy | 2.5% |

Manufacturers are now producing more environmentally friendly explosives with less toxic emissions and biodegradable materials. In March 2024, Swedish mining company Boliden partnered with Hypex Bio to implement HPE explosives at its Kankberg mine. This initiative aims to decrease the necessity for nitrogen water treatment and reduce carbon dioxide emissions by 400 tons annually. These developments are meant to reduce the environmental impact, comply with stricter regulatory requirements, and attract environmentally aware industries, particularly in mining and construction industries that want to keep up with international sustainability efforts, thus pushing the growth of the explosives market.

The demand for customized explosives with special requirements for use is on the increase, which is further supporting the explosives market. Businesses are providing bespoke blasting products depending on geology, project size, and safety factors. The trend increases accuracy, lowers the risks of operation, and maximizes blasting efficiency, particularly in advanced mining, quarrying, and infrastructure development. In September 2024, Orica introduced the Next Gen SHOTPlus suite at MINExpo in Las Vegas. This digital platform offers intelligent blast design and modeling capabilities, enabling real-time tracking and collaborative blast planning. It allows for dynamic adjustments based on geological data, enhancing accuracy and safety in blasting operations.

The explosives industry is experiencing more mergers and acquisitions as businesses try to increase product offerings and consolidate regional presence. Bigger players are purchasing smaller companies with niche technologies to enhance competitiveness, promote innovation, and address the increasing global demand for high-end blasting solutions, thereby helping to create new trends in the explosives market. In 2024, Heritage Environmental Services completed the acquisition of EBV Explosives Environmental Company from General Dynamics. This move aims to expand Heritage's incineration services and leverage EBV's expertise and equipment to offer a comprehensive set of waste management services.

Explosives firms are expanding into the growing markets of Africa, Southeast Asia, and Latin America aggressively. Urbanization growth, mining exploration, and infrastructure development in these markets are propelling demand for explosives, leading firms to set up local manufacturing bases and distribution channels for increased market penetration. In 2022, South Africa exported USD 67.7 million worth of Prepared Explosives, becoming its third-largest exporter globally. Furthermore, Prepared Explosives ranked as the 193rd most exported product in South Africa in the same year.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Explosives Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

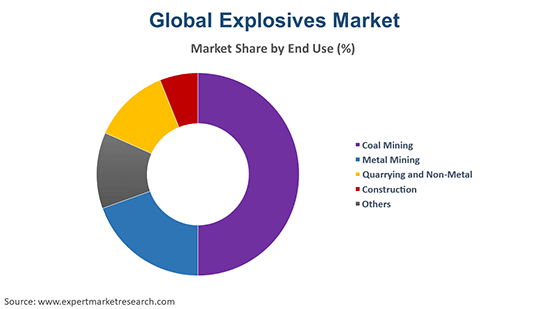

Market Breakup by End Use

Key Insight: Coal mining continues to be among the dominant segments in the explosives market, as explosives are needed for blasting large quantities of rock in order to gain access to coal seams. As world energy demand, especially that of coal, continues to remain high in some areas, the demand for explosives in this segment continues to grow. Metal mining, prompted by the mounting need for fundamental metals such as copper, gold, and lithium, also accounts for a sizeable share of the market. Explosives are crucial for extracting ore and smooth processing, given that massive scale mining depends on blasting to gain access to underground mineral deposits.

Market Breakup by Region

Key Insight: Asia Pacific dominates the global explosives market driven by high-volume mining activities in China, Australia, and India, which use bulk explosives extensively in coal and metal extraction. Rapid infrastructure development, including roads, tunnels, and smart cities—has further pushed demand for industrial explosives. China’s dominance in rare earth and battery mineral production, India’s ongoing smart city projects, and Australia’s mining exports have solidified the region’s leadership in both consumption and production of explosives. In 2024, China increased its rare earth mining output quota to 270,000 tons, a 5.9% rise from the previous year, underscoring its commitment to maintaining dominance in the rare earth sector.

| CAGR 2026-2035 - Market by | Country |

| India | 6.9% |

| China | 5.7% |

| UK | 4.8% |

| USA | 4.6% |

| Germany | 4.3% |

| Canada | XX% |

| France | XX% |

| Italy | XX% |

| Japan | 3.6% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Rising Urbanization and Infrastructure Projects Drive Demand for Explosives in Quarrying and Construction

Quarrying and non-metal mining have been in greater demand as a result of growing infrastructure development and urbanization across the world. Quarrying is essential for the production of materials such as limestone, granite, and sand, which are utilized in the construction industry.

Likewise, the construction industry is fueling explosives market expansion, as they are required for excavation, road construction, and tunneling operations. Urbanization and infrastructure development across the globe are increasing the application of explosives for construction activities, such as demolitions and extensive digging, further fueling market growth.

Mining and Infrastructure Driving Demand in Latin America and Middle East and Africa

Latin America and the Middle East and Africa are emerging as high-potential markets in the global explosives market, driven by resource-rich geographies and a surge in industrial activity. In Latin America, Chile and Peru are rapidly expanding their mining sectors, particularly for copper and lithium—two critical minerals essential for electric vehicle batteries and renewable energy storage. Governments in these countries are supporting mining-friendly policies, while global players are increasing their presence through joint ventures and technological investments. Brazil is also witnessing a rise in infrastructure development, including hydroelectric and transportation projects, boosting the need for controlled blasting solutions using high-performance explosives like ANFO and emulsions.

In the Middle East and Africa, abundant mineral reserves and ambitious infrastructure agendas are stimulating explosives demand. Countries such as the Democratic Republic of Congo, Ghana, and South Africa are witnessing heightened activity in gold, cobalt, iron ore, and bauxite extraction, attracting foreign direct investment and boosting regional explosives consumption. The Middle East, especially Saudi Arabia under its Vision 2030 initiative, is rolling out large-scale megaprojects—including NEOM, metro systems, and industrial cities—where tunneling and excavation work rely on reliable explosive products. The UAE and Qatar are also investing in construction and oilfield services, adding further momentum to explosives market development. These regions are expected to emerge as strategic markets for global and regional explosives manufacturers aiming to tap into long-term, resource-led growth.

Leading explosives market players are investing in innovations that provide safety, efficiency, and environmental sustainability. They are spending money on intelligent blasting technologies, such as electronic detonators and real-time monitoring systems, to make blasts more precise and environmentally friendly. They are also designing environment-friendly explosives with lower emissions and biodegradable materials to ensure compliance with stringent environmental laws and to ensure sustainable practices in mining, construction, and defence industries.

Key players in the global explosives market are also actively investing in advanced technologies to enhance safety, precision, and environmental compliance. The adoption of electronic detonators and AI-powered blasting systems is becoming more prevalent, aiming to optimize blast outcomes and reduce environmental impact. These innovations are particularly significant in mining operations, where precision and safety are paramount.

Enaex S.A., founded in 1920 and based in Chile, is engaged in the supply of high-performance explosives for mining. Enaex supplies various explosives, such as bulk emulsions, ANFO, and detonators. Enaex also deals with the creation of environmentally friendly explosives for sustainable mining.

Established in 1905 in Norway, Yara International ASA is a global industry leader in the supply of industrial explosives and fertilizers. Among its explosives products is ammonium nitrate-based products that find applications in quarrying, construction, and mining. Yara focuses on providing solutions for enhanced safety and efficiency in explosive operations.

Orica, founded in 1874 and with headquarters in Australia, is a global leader in commercial explosives supply. Its products are electronic detonators, blasting systems, and bulk explosives, catering to industries such as mining, construction, and quarrying. Orica is committed to innovation to drive productivity and environmental performance in blasting activities.

MaxamCorp. Holding, with headquarters in Spain and established in 1872, is a global leader in the production of explosives. Maxam offers a vast portfolio of products such as bulk explosives, detonators, and specialized solutions for construction and mining. Maxam operates with the aim of enhancing safety and sustainability in explosive technologies.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players profiled in the explosives market include Austin Powder Company, Sasol Limited, and Dyno Nobel Inc, among others.

Explore the latest trends in the Global Explosives Market 2026 and stay ahead of industry shifts. Download a free sample report to access valuable data, key growth forecasts, and insights on emerging opportunities. For custom requirements or analyst support, contact us today and get expert guidance tailored to your business needs.

Middle East and Africa Explosives Market

Latin America Explosives Market

North America Explosives Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate volume of 17.44 MMT.

The market is projected to grow at a CAGR of 5.20% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a volume of around 28.95 MMT by 2035.

Key strategies driving the market include developing eco-friendly and smart explosives, expanding production capacity to meet mining and defence demand, strengthening supply chain resilience through partnerships, and enhancing customer engagement with tailored solutions. Innovation and regional expansion remain critical to addressing safety, regulatory, and market growth challenges globally.

The key trends guiding the growth of the explosives market include the growth opportunities of battery materials, like lithium and cobalt, and increasing demand from the construction industry.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The major end uses of explosives in the market are coal mining, metal mining, quarrying and non-metal, and construction, among others.

The key players in the market report include Enaex S.A., Yara International ASA, Orica Limited, MaxamCorp. Holding, S.L., Austin Powder Company, Sasol Limited, and Dyno Nobel Inc, among others.

Asia Pacific dominates the market led by high-volume mining activities in China, Australia, and India, which use bulk explosives extensively in coal and metal extraction.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| Report Features | Details |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share