Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Guatemala gelatine market size is expected to grow at a CAGR of 8.50% between 2026 and 2035, driven by the growing utilisation of gelatine in food and beverages and nutraceuticals.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

8.5%

2026-2035

*this image is indicative*

Gelatine is a tasteless, colourless, and water-soluble animal protein obtained from the connective tissue, bones, and skin of animals such as pigs and bovine that contain collagen. In addition to being used to stabilise foam food products like ice cream and marshmallows, gelatine is also utilised to manufacture jellied meats, soups, sweets, aspics, and moulded desserts. As gelatine contains collagen, it can help improve joint, hair, skin, and nail health, increasing its applications in nutraceuticals and pharmaceuticals.

The EMR’s report titled “Guatemala Gelatine Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Raw Material

Market Breakup by End Use

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

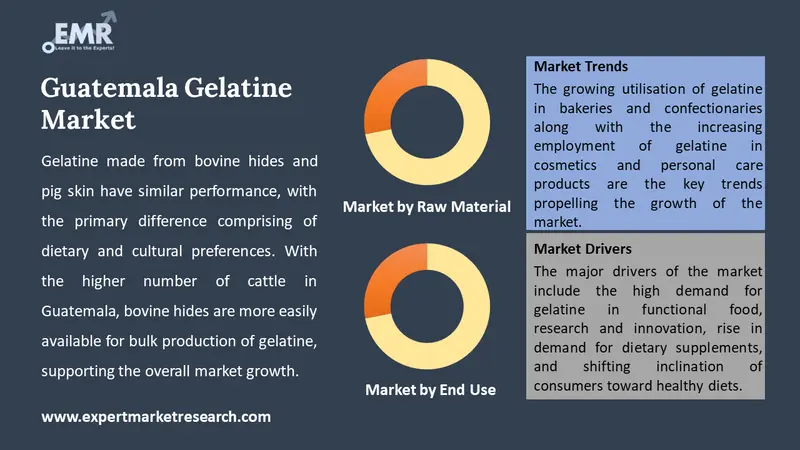

Bovine hides account for a significant share of the Guatemala gelatine market by raw material due to the larger number of cattle used in animal farming in the country as compared to hogs. For gelatine production, by-products of the meat industry are typically used as raw materials, such as bovine hides, bone, and pig skin as they have high concentrations of raw collagen. Gelatine made from bovine hides and pig skin have similar performance, with the primary difference comprising of dietary and cultural preferences. With the higher number of cattle in Guatemala, bovine hides are more easily available for bulk production of gelatine, supporting the overall market growth.

The food and beverages sector is a leading end use for the Guatemala gelatine market, due to their role in improving the texture as well as nutritional value of foods and beverages. The use of gelatine in the food and beverage industry is increasing as a result of the rising demand for desserts, functional food items, functional beverages, baked goods, jellies, marshmallows, yoghurt, confectionary products, and processed foods. Additionally, gelatine is frequently used in desserts, baked goods, and dairy products among others, because it replaces carbohydrates and lipids in many recipes. Meanwhile, research into the nutritional benefits of gelatine, and the growing awareness among consumers of the advantages of collagen are likely to surge the end uses of gelatine in nutraceuticals in the coming years.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis. The report gives a detailed analysis of the following key players in the Guatemala gelatine market, covering their competitive landscape and the latest developments like mergers, acquisitions, investments, and expansion plans.

GELITA AG was established in 1875 with its headquarters in Baden, Germany and is one of the top producers of collagen proteins globally. GELITA offers a variety of collagen proteins, including non- or partially water soluble collagens, collagen peptides with known body-stimulating properties, and custom gelatines. Collagen proteins of the company are used in many items as natural stabilisers and emulsifiers.

PB Leiner, founded in 1880, is one of the major producers of premium gelatines and collagen peptides in the world. The company, which has its headquarters in Vilvoorde, Belgium, caters to food, pharmaceuticals, health, nutrition, and technical applications from its seven production facilities, which are dispersed across Asia, Europe, North America, and South America.

Nitta Gelatine Inc., headquartered in North Carolina in the United States, was established in 1918 and is one of the top producers of collagen and gelatine-related goods worldwide. Nitta Gelatine produces a variety of gelatines of the technical, food, and medicinal grades in manufacturing facilities that are dependable, secure, and ecologically friendly. The company is also known for producing Wellnex Collagen Peptides, a protein with advantages for the health of the skin, bones, and joints that have been scientifically verified.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other market players include Gelco International and Gelnex, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 8.50% between 2026 and 2035.

The major drivers of the market include the high demand for gelatine in functional food, research and innovation, rise in demand for dietary supplements, and shifting inclination of consumers toward healthy diets.

The growing utilisation of gelatine in bakeries and confectionaries along with the increasing employment of gelatine in cosmetics and personal care products are the key trends propelling the growth of the market.

The various raw materials in the market are pig skin, bovine hides, and bone, among others.

The different end uses of gelatine in the market are food and beverages, nutraceuticals, pharmaceuticals, photography, and cosmetics, among others.

Gelatine is derived from animal collagen, which is a protein that can be found in bones, skin, tendons, and ligaments of animals such as pigs or cows.

Gelatine has high protein content and also contains amino acids which can help improve gut health, hydrate skin, lower blood sugar, and improve strength of bones and joints.

Gelatine is a good thickener because of its ability to increase viscosity and its positive interaction with carrageenan. Its fat-like melting qualities help low-fat dairy products to be smooth and have a fat-mimicking effect, while its gelling capabilities stabilise low-fat (dairy) spreads.

Gelatines has no flavour and no colour, and when used as an emulsifier in ice cream, it keeps the ice cream fresh and gives it its texture.

The major players in the Guatemala gelatine market are GELITA AG, PB Leiner, Nitta Gelatine Inc., Gelco International, and Gelnex, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Raw Material |

|

| Breakup by End Use |

|

| Market Dynamics |

|

| Trade Data Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share