Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The heavy construction equipment market size attained a value of USD 216.24 Billion in 2025. The market is expected to grow at a CAGR of 6.20% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 394.62 Billion.

The heavy construction equipment market revenue is surging with rapid digitalization and higher adoption of data analytics. As companies embrace data-driven decision-making, the demand for smart and connected heavy machinery rises while encouraging manufacturers to integrate digital solutions into their equipment offerings. For instance, in June 2025, Desi Machines launched a digital platform for simplifying discovery, comparison, purchase, financing, and insurance of construction, earthmoving, mining, and heavy engineering equipment in India. This digital transformation is reshaping the industry’s competitive landscape and accelerating overall market growth.

Integration of GPS, IoT, and telematics is transforming fleet management and predictive maintenance. Equipment with real-time monitoring reduces downtime while optimizing utilization and operational efficiency. In January 2025, CASE launched myCASE Construction, a telematics app offering real-time machine tracking, fuel efficiency monitoring, and remote diagnostics to optimize fleet performance and reduce downtime. These smart systems also enable remote diagnostics, improving serviceability and lowering total cost of ownership.

Base Year

Historical Period

Forecast Period

By 2050, the urban population in Asia is estimated to grow by 50%, with an additional 1.2 billion individuals.

In 2022, the value of Canada’s mineral production reached USD 74.6 billion.

In FY 2024-25, capital investment outlay for infrastructure in India reached USD 133.86 billion, comprising 3.4% of the overall GDP.

Compound Annual Growth Rate

6.2%

Value in USD Billion

2026-2035

*this image is indicative*

Rapid urban expansion is driving large-scale infrastructure projects including roads, bridges, railways, and smart cities is boosting the heavy construction equipment market value. As per the United Nations, 68% of the world population is estimated to live in urban areas by 2050. Governments and private sectors in emerging economies, notably China, India, and Brazil, are allocating massive capital to develop urban spaces. As these projects surge, the demand for heavy equipment, including pavers, excavators, and cranes are fuelling the market expansion to meet complex construction needs.

Mining operators are fast-tracking electrified fleets and deploying battery trucks and loaders to cut emissions, adding to the market growth. As per industry reports, Electrification in the mining sector can lower energy costs by 40 to 70% and decrease maintenance expenses for mobile equipment by around 30%. Battery-powered trucks, loaders, and excavators replace diesel machinery, aligning with stricter environmental regulations and sustainability goals. This shift enhances site safety by reducing noise and pollution.

Strong governmental backing through infrastructure bills and public spending is fuelling the heavy construction equipment demand. In April 2025, the Indian government incentivized domestic heavy mining equipment manufacturing to boost self-reliance, reduce imports, and support the Make in India mission. Additionally, subsidies and incentives for eco-friendly equipment further boost industry growth. This policy-driven push ensures contractors secure financing, bolstering heavy equipment sales and stimulating competition among manufacturers to offer compliant, efficient, and sustainable machinery.

Tightening emissions and noise regulations are pushing manufacturers to innovate in heavy construction equipment for developing cleaner, quieter, and more energy-efficient machines. In response, manufacturers are investing in electric and hybrid equipment, advanced filtration systems, and noise-reducing technologies. In October 2024, Zoomlion unveiled the ZTE520 hybrid electric drive mining truck, offering up to 15% energy savings and over 60,000 operational hours. These innovations help to meet compliance and enhance brand reputation and appeal to environmentally conscious buyers.

Rental services are shaping the heavy construction equipment market trends due to cost-efficiency and flexibility. Project-based contractors increasingly rent machines instead of purchasing them. In April 2025, CASE Construction Equipment introduced versatile, rental-friendly loaders, both diesel and electric plus upgraded compact track and skid steer loaders for simplifying operation, maintenance, and fleet uptime for rental businesses. This model supports access to advanced equipment without high capital commitment, encouraging manufacturers to collaborate with rental firms. In response, higher equipment utilization rates, diversified revenue streams, and broader owner networks are driving the market outlook.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Heavy Construction Equipment Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: The earth moving equipment segment is dominating the heavy construction equipment market, due to high adoption in digging and trenching for infrastructure projects. Loaders efficiently move materials on construction sites, while dozers help to shape terrain and clear land. Motor graders, such as John Deere’s 672GP, provide precise leveling crucial for road construction. This segment drives productivity in mining, infrastructure, and urban development, benefiting from technological advances, to improve performance and sustainability. Supporting these trends, in December 2024, Mahindra launched its CEV5 range, featuring upgraded EarthMaster loaders and RoadMaster graders, highlighting its focus on innovation and strong customer support.

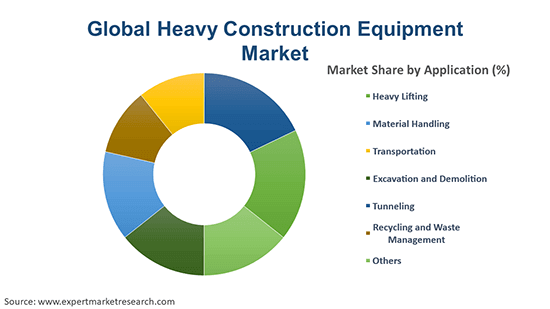

Market Breakup by Application

Key Insight: Heavy lifting is one of the leading applications of the heavy construction equipment market, as it is vital for infrastructure, industrial, and energy sector projects. Equipment, such as cranes and hoists are widely used to lift massive loads, often exceeding hundreds of tons, adding to innovations. In September 2024, Liebherr introduced the MK 1205.1 mobile construction crane to offer enhanced capacity, advanced control systems, compact design in versatile urban and industrial lifting. With the increasing urbanization and smart city projects, the demand for reliable and high-capacity lifting machinery remains robust, driving the segment’s dominance in developed and emerging economies.

Market Breakup by End Use

Key Insight: Mining dominates the heavy construction equipment market due to its high demand for robust and large-scale machinery. Excavators, dump trucks, wheel loaders, and drilling rigs have grown essential for mineral extraction and processing. The introduction of electric and autonomous mining equipment enhances productivity while reducing environmental impact. In October 2024, Scania partnered with Regroup for deploying 11 autonomous G 560 rigid tipper trucks at the Butcherbird manganese mine in Pilbara by the edn of 2025. As global demand for minerals surges driven by the energy transition and electric vehicles, mining equipment continues to see sustained investment and growth.

Market Breakup by Propulsion

Key Insight: The ICE segment is gaining traction in the heavy construction equipment industry, driven by its established infrastructure, power capabilities, and broad equipment range. Diesel-powered machines are widely used in mining, infrastructure, and large-scale construction projects, making way for innovations. In August 2024, JCB unveiled T 65D, India’s first diesel-powered telescopic boom platform, featuring a 65ft reach, four-wheel drive, and enhanced safety. ICE machines are favored in regions with limited charging infrastructure and harsh operating environments. The ICE segment further holds significant share due to its reliability and widespread application.

Market Breakup by Power Output

Key Insight: The <100 HP segment of the heavy construction equipment industry encompasses compact excavators, skid steers, mini loaders, and small telehandlers. These machines are deployed in urban construction, landscaping, and utility projects due to their maneuverability and lower operational costs. In February 2025, Hyundai launched the 66.4-HP HS80V skid steer for expanding its efficient compact equipment lineup alongside HS120V. Several brands are also offering electric, and diesel models tailored for tight spaces and environmentally sensitive sites. The rise in infrastructure upgrades and small-scale construction is also making the <100 HP segment a consistent market driver.

Market Breakup by Engine Capacity

Key Insight: The <5L engine capacity segment is growing rapidly in the heavy construction equipment market due to the widespread use of compact machinery, such as mini excavators, skid steer loaders, small wheel loaders, and backhoe loaders. These engines balance fuel efficiency, mobility, and low emissions, making them ideal for urban and residential projects while driving innovations. In February 2025, CNH began producing its 2.8-litre TREM V-compliant engine in Greater Noida, India, for construction equipment and agricultural machinery. As cities prioritize space-saving and low-noise machinery, the demand for this segment is continuing to grow, mainly with the transition to hybrid and electric systems in compact formats for supporting sustainability goals.

Market Breakup by Region

Key Insight: North America heavy construction equipment market is driven by extensive infrastructure development, mining activities, and residential construction. The United States and Canada are witnessing high demand for advanced machinery, including autonomous and electric equipment. Government infrastructure investments, such as the USD 3 billion federal investment in October 2024 to reduce carbon emissions by upgrading climate-friendly equipment and infrastructure at 55 United States ports, are boosting the equipment demand. North America also leads in adopting sustainable and advanced equipment, maintaining its stronghold in the global market via continuous innovation and robust end-user demand.

Heavy Construction Vehicles & Material Handling Equipment to Accrue Wide Usage

The heavy construction vehicles segment, featuring dumpers and tippers, is essential for transporting bulk materials, such as soil, sand, and debris on construction sites. Dumpers offer robust off-road capabilities and high payload efficiency, ideal for rugged terrains. Meanwhile, tippers provide reliable material hauling with strong durability and easy maneuverability in urban and infrastructure projects, driving innovations. In January 2025, Ashok Leyland launched AVTR 2825, India’s first 9-speed AMT tipper, featuring Hill-Start-Aid and rock-free mode for comfort. With advances in fuel efficiency and electric models emerging, this segment is evolving to meet sustainability goals while supporting large-scale construction demands.

The material handling equipment segment plays a crucial role in the heavy construction equipment market, encompassing cranes, telescopic handlers, and other machinery. Cranes enable efficient lifting and movement of heavy loads on construction sites. Telescopic handlers offer versatility in material transport and placement, especially in tight spaces. Meanwhile, rough terrain forklifts and conveyor systems support logistics and site management. This segment is vital for improving productivity and safety, with ongoing innovations focusing on automation, electric power, and enhanced load capacity to meet diverse construction needs.

Rising Heavy Construction Equipment Uses in Material Handling & Transportation

The material handling segment of the heavy construction equipment market is rapidly growing due to its critical role in moving raw materials, aggregates, and debris efficiently on construction sites. Equipment, such as wheel loaders, forklifts, and conveyors streamline the movement of bulky materials for increasing productivity and safety. As construction scales up in logistics hubs and smart infrastructure, material handling solutions is recording sustained demand to render versatility and ability to cut manual labour and operational time.

Transportation plays a pivotal role in the heavy construction equipment industry for moving materials across job sites and remote locations. Of late, dump trucks, trailers, and articulated haulers are used extensively in mining, road building, and mega infrastructure projects. The rise of autonomous and electric-powered transport vehicles is also enhancing efficiency and reducing carbon emissions. In April 2024, Sany India introduced SKT105E, India's first indigenously made, fully electric opencast mining truck to offer energy efficiency, cost savings, and sustainable mining operations, further making the segment increasingly relevant.

Huge Heavy Construction Equipment Demand in Infrastructure & Forestry and Agriculture

Infrastructure is largely contributing to the heavy construction equipment market revenue, driven by global investments in roads, bridges, railways, and airports. Equipment, such as pavers, compactors, excavators, and cranes are central to infrastructure development. Major infrastructure projects, such as China’s Belt and Road Initiative and the U.S. Infrastructure Investment and Jobs Act, propel the demand for versatile, high-capacity machinery. The need for speed, efficiency, and adherence to emissions norms keeps this segment technologically dynamic and vital to the heavy equipment market.

The forestry and agriculture segment remains significant due to its reliance on heavy-duty and specialized equipment, such as tractors, harvesters, skidders, and forwarders for land clearing, harvesting, and soil preparation. As global food demand rises and sustainable forestry practices expand, equipment with high efficiency and lower fuel consumption are recording preference. In June 2025, John Deere introduced the H Series including the 1270H/1470H harvesters and 2010H/2510H forwarders to deliver eco-performance in large-scale logging. The consistent need for food and raw materials is also ensuring steady segment growth.

Electric Heavy Construction Equipment to Record Popularity

The electric segment is gaining momentum in the heavy construction equipment industry due to sustainability demands and regulatory pressure. Electric construction equipment are largely adopted in urban projects and indoor worksites where low noise and zero emissions are crucial. In February 2025, Volvo Construction Equipment debuted its electric excavators, wheel loaders and articulated haulers to support urban, industrial, and mining applications. Additionally, hybrid-forwarders in forestry and battery-powered transport vehicles are expanding the electric footprint, boosting the segment growth.

101-200 HP & 201-400 HP Heavy Construction Equipment to Gain Traction

The 101-200 HP segment of the heavy construction equipment market features medium-sized excavators, wheel loaders, and backhoe loaders that are widely used in commercial construction and road building. Machines, such as Caterpillar’s 320 series and Komatsu’s PC200 provide robust power, fuel efficiency, and advanced automation suited for versatile site conditions. This segment balances productivity with cost-effectiveness, gaining ground in emerging markets investing in infrastructure. Growing interest in hybrid powertrains also bolsters this category, blending ICE reliability with partial electrification to reduce emissions without compromising performance.

Heavy-duty excavators, articulated dump trucks, and bulldozers are populating the 201-400 HP segment of the heavy construction equipment industry for catering to large-scale mining, infrastructure, and heavy civil projects. In January 2025, Zoomlion launched its first 400-HP hybrid tractor, DV4004, in Kaifeng, China, for offering a smarter, greener solution for global agriculture. These machines emphasize power, durability, and advanced telematics for site efficiency. The 201-400 HP segment further commands high revenue due to expensive equipment and critical project roles.

Surging Adoption of 5–10L & >10L Engine Capacity Heavy Construction Equipment

The 5–10L segment of the heavy construction equipment market powers medium-to-large construction equipment, such as mid-size excavators, bulldozers, and wheel loaders. These machines are crucial for infrastructure development, road construction, and commercial building projects. Examples include the Caterpillar 320 and Komatsu PC210LC, which utilize engines in this range to deliver optimal torque and power for demanding operations while maintaining manageable fuel consumption. This segment also balances performance with environmental compliance by incorporating Stage V or Tier 4 Final emissions technology.

The >10L engine segment represents the most specialized component of the heavy construction equipment market. These engines are reserved for high-power machinery used in mining, large-scale earthmoving, and deep foundation work, such as rigid dump trucks, large excavators, and heavy-duty bulldozers. In July 2024, Cummins debuted its new 15L X15 diesel engine for offering improved fuel efficiency, lower emissions, and reduced operating costs. Such instances are favoring the uptake of >10L engine to further generate high revenues per unit while being critical for productivity in extreme conditions, driving segment growth.

Booming Heavy Construction Equipment Industry in Europe & Asia Pacific

Europe leads the heavy construction equipment market, characterized by stringent emission regulations and the growing focus on sustainability. The adoption of electric and hybrid machinery is accelerating, supported by policies. Several companies are introducing eco-friendly models to comply with EU Stage V emission norms. Infrastructure modernization projects in Germany, France, and the United Kingdom are sustaining steady equipment demand. Europe also remains a crucial market due to its regulatory environment pushing innovation on account of the emphasis on smart construction technologies.

The Asia Pacific region is rapidly expanding in the market due to urbanization, infrastructure development, and industrialization, mainly in China, India, and Australia. As per the Asian Development Bank, over 55% of the Asian population is likely to be urban by 2030. Manufacturers, such as Sany and XCMG are capitalizing on local demand with affordable and technologically advanced equipment. Large-scale projects such as China’s Belt and Road Initiative and India’s Smart Cities mission are major growth drivers. The vast potential and rising investments are also making the Asia Pacific an increasingly important region in the heavy construction equipment market landscape.

Key players operating in the heavy construction equipment market are deploying strategies that revolve around innovation, partnerships, and global expansion. Leading companies focus heavily on research and development to integrate advanced technologies into their machinery. These innovations improve efficiency, reduce emissions, and meet evolving regulatory standards. Strategic collaborations and joint ventures are also enabling companies to access new markets and share technological expertise.

Market players also prioritize expanding their global footprint through acquisitions, distribution networks, and localized production facilities to meet regional demand and reduce logistics costs. Additionally, sustainable practices are becoming central, with an increasing shift toward low-emission and hybrid machinery to align with environmental policies. To maintain customer loyalty, firms invest in comprehensive after-sales services, including maintenance, training, and digital platforms for real-time equipment monitoring. Lastly, flexible financing and leasing options are offered to make high-cost machinery more accessible, especially in emerging markets, thereby driving overall market growth and competitiveness.

Headquartered in Moline, the United States and founded in 1837, Deere & Company is widely known for offering a comprehensive range of construction, agricultural, forestry, and turf equipment. The company’s portfolio includes excavators, loaders, and dozers, backed by advanced digital and automation technologies.

Founded in 1921 and headquartered in Tokyo, Japan, Komatsu Ltd. is a leading global manufacturer of construction, mining, and utility equipment. Komatsu's offerings include hydraulic excavators, bulldozers, dump trucks, and smart construction solutions, emphasizing productivity, safety, and environmental sustainability across various industries and infrastructure development projects.

Headquartered in Gothenburg, Sweden AB Volvo was established in 1927. The company’s Volvo Construction Equipment division delivers a wide array of machinery such as wheel loaders, articulated haulers, excavators, and compact equipment. Volvo focuses on innovation, fuel efficiency, and low-emission technologies, serving construction, mining, and urban development sectors globally.

Doosan Infracore, founded in 1937 and headquartered in Seoul, South Korea, specializes in manufacturing heavy construction machinery and offers excavators, wheel loaders, articulated dump trucks, and engine solutions. The company is known for integrating digital technologies and fuel-efficient systems to enhance equipment performance and operational reliability worldwide.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the heavy construction equipment market include Hitachi Construction Machinery Co., Ltd., Caterpillar Inc., Liebherr-International AG, CNH Industrial N.V., Kobelco Construction Machinery Co., Ltd., SANY, and XCMG GROUP, among others.

Gain a competitive edge with Expert Market Research’s latest insights on heavy construction equipment market trends 2026. This comprehensive report delivers valuable forecasts, in-depth analysis, and key industry data to guide your business decisions. Whether you're an investor, manufacturer, or industry strategist, our report provides the knowledge needed to stay ahead in this evolving sector. Download our free sample report on the global heavy construction equipment market and uncover exclusive insights into trends, opportunities, and forecasts from 2026-2035.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 216.24 Billion.

The market is projected to grow at a CAGR of 6.20% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach USD 394.62 Billion by 2035.

The key strategies driving the market include technological advancements like automation and telematics, strategic mergers and acquisitions, expansion into emerging markets, rental services growth, and sustainability-focused innovations. Manufacturers are also emphasizing fuel efficiency, electric equipment development, and smart connectivity to meet evolving construction demands and regulatory standards.

The trends of the market include the high demand for larger construction sites in emerging countries such as China, due to their rapidly growing economies and an overhaul of infrastructure.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The various types of heavy construction equipment include earth moving equipment, heavy construction vehicles, and material handling equipment, among others.

Heavy lifting, material handling, transportation, excavation and demolition, tunnelling, recycling and waste management, among others are the leading applications in the market.

Mining, infrastructure, forestry and agriculture, construction and manufacturing, vehicle transport, and public works, among others are the significant end uses in the market.

The key players in the market report include Deere & Company., Komatsu Ltd., AB Volvo, Doosan Infracore Co., Ltd., Hitachi Construction Machinery Co., Ltd., Caterpillar Inc., Liebherr-International AG, CNH Industrial N.V., Kobelco Construction Machinery Co., Ltd., SANY, and XCMG GROUP, among others.

Factors influencing growth include urbanisation, infrastructure development, technological advancements, government investments, economic growth, environmental regulations, demand from emerging markets, and the rise of rental services.

North America is the largest country-level market for heavy construction equipment, driven by infrastructure projects and technological advancements.

Challenges in the heavy construction equipment market include high costs, maintenance requirements, skilled labour shortages, and fluctuating raw material prices.

The largest market share in heavy construction equipment is held by earthmoving machinery, such as excavators and backhoe loaders.

The heavy construction equipment market is aligned through segmentation by machinery type, application, propulsion, power output, end use, and region.

Major manufacturers in the heavy construction equipment market include Caterpillar, Komatsu, Volvo CE, Hitachi, Liebherr, and CNH Industrial.

The biggest restraint in the heavy construction equipment market is the high capital investment required, limiting accessibility for small and medium enterprises.

The earth moving equipment segment is dominating the market, due to high adoption in digging and trenching for infrastructure projects.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Propulsion |

|

| Breakup by Power Output |

|

| Breakup by Engine Capacity |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share