Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The HIV drug market size attained a value of USD 35.05 Billion in 2025. The market is anticipated to grow at a CAGR of 4.50% during the forecast period of 2026-2035 to attain a value of USD 54.43 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.5%

Value in USD Billion

2026-2035

*this image is indicative*

Human immunodeficiency virus (HIV) is a life-threatening condition that can be transferred from one person to another through blood and/or sexual contact. It damages the immune system by destroying CD-4 cells, making the body susceptible to infections and other diseases. The rising prevalence of HIV disease has positively impacted the demand for HIV drugs. According to the estimates by the World Health Organization (WHO), 39 million people are living with HIV. Approximately 0.7% of adults aged between 15-49 years are living with this condition worldwide. The growing population density of HIV-infected people has been instrumental in the development and introduction of HIV drugs.

The HIV drugs market growth is influenced by the rising government initiatives and campaigns to create awareness amongst people regarding the causes, symptoms, and treatments of the condition. At present, highly active antiretroviral therapy (HAART) is the most prescribed treatment. It has various combinations of one protease inhibitor and other drugs. These combinations aid in increasing the number of CD4+ cells and decreasing the amount of virus in the blood. The introduction of generic drug acts is another factor that is contributing to the demand for HIV drugs, as they are cost-effective and chemically identical to branded drugs. The market is experiencing increased advancement in the treatment technologies by the market players. Such advancements are significantly expected to drive the market growth.

Expedited Drug Development to Boost HIV Drugs Market Share

In October 2023, Gilead Sciences, Inc. revealed that Sunlenca® (lenacapavir), their latest drug was well supported to treat multi-drug resistant (MDR) HIV in adults. Administered twice a year, Sunlenca is a human immunodeficiency virus type 1 (HIV-1) capsid inhibitor, used in combination with other antiretrovirals. The drug is expected to be made available in oral as well as injectable mode of administration along with multiple dosage forms. The increasing advancements to bring customization and offer precise treatment to patients is poised to drive the market for HIV drugs in the forecast period.

Surge in Clinical Trials to Meet the Rising HIV Drugs Market Demand

The market growth is poised to be driven by the rising number of clinical trials and continued efforts by researchers to discover an effective treatment novel therapy to treat HIV. For instance, in April 2023, UC Davis Health researchers deployed CAR T cell therapy to treat patients suffering from HIV . Leveraging immunotherapy, the first patient was dosed with anti-HIV duoCAR T cells to stimulate the immune system and treat the condition. The clinical trial was designed for 9 candidates, divided in 3 cohorts wherein patients from each cohort underwent different treatment combinations. This is indicative of rising application of advanced and alternative therapies to treat the fatal disease.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Breakup by Medication Class:

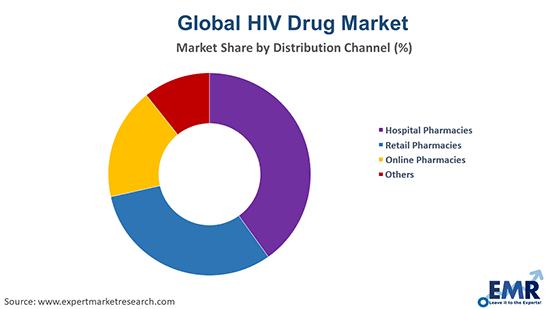

Market Breakup by Distribution Channel:

Market Breakup by End User

Market Breakup by Region

Geographically, North America is expected to lead the market share in the forecast period. The regional growth can be attributed to a well-established healthcare system, and the growing adoption of advanced treatment options for the HIV-infected population. The HIV drugs market size is significantly impacted by the increased number of research and development initiatives for new drug launches.

In September 2023, researchers at Johns Hopkins found a new injectable solution that could help manage HIV, unlike any currently available methods in the market. This new solution self-assembles into a gel under the right conditions. It releases a steady dose of the anti-HIV drug lamivudine over six weeks. The major issue that patients face while following an HIV treatment regimen is the daily management of the doses. However, this new gel treatment is poised to help people living with HIV to have a new therapy that doesn't require a daily pill regimen to prevent AIDS, making it less stressful and easy to follow.

The Asia Pacific region is also poised to experience significant HIV drugs market growth, owing to increasing infrastructure improvements and emphasis on spreading awareness about the condition amongst marginalised communities.

In February 2022, ViiV Healthcare , the global specialist HIV company, announced the US Food and Drug Administration (FDA) approval for Cabenuva (cabotegravir, rilpivirine) for every two months dosing for the treatment of HIV-1 in virologically suppressed adults. The drug constitutes an extended-release injectable suspension in a single vial dose, making it suitable for easy administration. The approval was based on the positive results from ATLAS-2M phase IIIb trial.

The key features of the HIV drugs market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:

Please note that this only represents a partial list of companies, and the complete list has been provided in the report.

United States HIV Drugs Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market attained a value of about USD 35.05 Billion in 2025 driven by increasing awareness of HIV across the major markets.

The market is anticipated to grow at a CAGR of 4.50% during the forecast period of 2026-2035 and is likely to reach a market value of USD 54.43 Billion by 2035.

Factors such as the rising incidence of HIV among people, government initiatives, increasing available treatments in the market, and new developments by market players are major factors aiding market demand.

The surge in FDA approvals to provide effective solutions to the patients is a major market trend. In October 2023, Gilead Sciences, Inc. revealed that Sunlenca® (lenacapavir), their latest drug was well supported to treat multi-drug resistant (MDR) HIV in adults

Drug classes for HIV drugs include multi-class combination drugs, nucleoside reverse transcriptase inhibitors (NRTIs), non-nucleoside reverse transcriptase inhibitors (NNRTIs), protease inhibitors (Pls), entry inhibitors, and HIV integrase strand transfer inhibitors, among others.

Distribution channels include hospitals pharmacies, drug stores, retail pharmacies, and online pharmacies, among others.

End users in the market include hospitals, and clinics, among others.

The major markets include the United States, EU-4, the United Kingdom, Japan, and China.

Key players involved in the market are Gilead Sciences, Inc., GSK Plc., Merck & Co., Inc., Bristol-Myers Squibb Company, Johnson & Johnson Services, Inc., Boehringer Ingelheim International GmbH, AbbVie Inc., Genentech, Inc., Mylan N.V., CytoDyn Inc., Daichii Sankyo Company, Limited, Pfizer Inc., Shantou Huatai Pharmaceutical Co., Ltd., Shengzhen Chongway Biotechnology Co., Ltd, and ViiV Healthcare Group of Companies.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Medication Class |

|

| Breakup by Distribution Channel |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share