Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India chimneys and built-in hobs market size was valued at USD 2.12 Billion in 2025. The industry is expected to grow at a CAGR of 13.30% during the forecast period of 2026-2035 to reach a valuation of USD 7.39 Billion by 2035.

The India chimneys and built-in hobs market is gaining prominence due to rising urbanisation, evolving culinary preferences, and increasing demand for modular kitchens. Between January and March, 88,274 residential units were sold in eight major cities, increasing consumer demand by 2% year over year. Pune and Chennai led the primary sales volume with 20% and 10% YoY growth, respectively. The shift toward high-end housing, particularly in Mumbai and Delhi NCR, where ultra-luxury homes (₹100 crore and above) saw ₹7,500 crore in sales over three years, is increasing the adoption of modular kitchens equipped with chimneys and built-in hobs. These appliances are essential in compact, high-rise apartments where space efficiency is critical. Built-in hobs and chimneys are no longer considered luxury items but essential components of modern Indian kitchens.

India’s construction sector, which grew by 13.3% in Q3 2023, supports the housing boom, with developers focusing on luxury residences in cities facing housing shortages. These projects often include pre-fitted modular kitchens, boosting the India chimneys and built-in hobs market as standard amenities.

Built-in hobs, which are famous for their integration and sophistication, are becoming a norm in contemporary homes. Firms such as Faber are responding to this trend by launching built-in hobs with smart flame control, energy efficiency, and tempered glass finishes. Faber's collaborations with real estate builders have also solidified their market base. These trends augur for long-term expansion for B2B firms that follow innovation, convenience, and real estate integration in India chimneys and built-in hobs market.

Base Year

Historical Period

Forecast Period

The consistent increase in urban housing and high-end residential projects has fueled demand for modular kitchens, which has a direct impact on chimney and built-in hob sales. B2B players can capitalize on this by entering into OEM alliances with real estate developers and interior designers for bulk installations and brand exposure.

E-commerce platforms are changing B2B sales in a big way, allowing manufacturers and suppliers to reach Tier-II and Tier-III towns. This trend favors bulk procurement, centralized supply chain, and access to granular analytics, enabling B2B players to have scalable growth opportunities and lower distribution costs in non-metro markets, thereby increasing the growth of the India chimneys and built-in hobs market.

The incorporation of intelligent technologies like auto-cleaning functions, motion sensors, and energy-saving mechanisms in chimneys and built-in hobs is drawing technology-aware consumers. B2B firms can capitalize on this by providing feature-loaded, high-end products to stand out in the competitive market.

Compound Annual Growth Rate

13.3%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

| India Chimneys & Built-in Hobs Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 2.12 |

| Market Size 2035 | USD Billion | 7.39 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 13.30% |

| CAGR 2026-2035 - Market by Region | South | 17.2% |

| CAGR 2026-2035 - Market by Stove Type | Induction Hob | 14.9% |

| CAGR 2026-2035 - Market by End Use | Residential | 15.2% |

Hobs and chimneys are increasingly being equipped with smart controls such as motion sensors, Wi-Fi connectivity, and voice control. These features increase user convenience and are attractive to technology-conscious consumers. Companies such as Elica and Glen are introducing IoT-based models, in line with the rising need for smart, connected kitchen solutions in new-age Indian kitchens, thus pushing the growth of the India chimneys and built-in hobs market. These hobs are designed to meet the demands of Indian kitchens, offering both functionality and style.

Filterless and auto-clean chimneys are becoming increasingly popular as they use low maintenance with high efficiency. Time and labor are saved using these features, and hence it suits busy households. Hindware and Faber companies are particularly working on such innovations to impress buyers seeking clean and easy-to-use appliances. Another innovation in the India chimneys and built-in hobs market is the use of filterless and auto-clean technology. The KAFF NOBELO LX DHC 75 chimney, for example, uses filterless technology and has an open glass panel with automatic open capability, lessening maintenance work and increasing user convenience. These innovations not only enhance the performance of kitchen appliances but also fit into the increasing consumer movement for convenience, efficiency, and smart home technology.

Consumers are increasingly opting for integrated hobs and chimneys with slim, minimalist designs that easily fit into modular kitchens. Brands have started to provide personalised finishes such as glass, matte, or stainless steel. Faber and Kaff have launched under-counter, slim models that save space without sacrifices on usability or design, thereby helping to create new trends in the India chimneys and built-in hobs market. For instance, Miele’s Con@ctivity 3.0 enables seamless communication between hobs and chimneys, enhancing user convenience.

With increasing awareness and ambitions in tier-II cities, firms in the India chimneys and built-in hobs market are extending distribution and introducing mid-segment models. Competitive pricing, finance schemes, and local language promotion are enabling brands such as Sunflame and Prestige to reach deeper, providing innovation without pricing out cost-conscious consumers in emerging markets. Sunflame offers a range of built-in hobs, such as the SF-64 LTG, featuring toughened glass tops and auto-ignition systems, catering to the evolving needs of these markets. Similarly, Prestige has introduced models like the Vogue 4 Burner Automatic Hob, combining functionality with modern aesthetics to appeal to cost-conscious yet quality-seeking consumers.

The India chimneys and built-in hobs market benefits from a robust and expanding distribution network that includes multi-brand retail stores, exclusive brand outlets, e-commerce platforms, and local kitchen appliance dealers. Offline channels, such as large appliance showrooms and kitchen solution retailers, offer consumers the advantage of physical product inspection, expert consultation, and installation support. These outlets play a key role, especially in Tier II and Tier III cities, where trust in face-to-face service remains strong. At the same time, online retail is rapidly gaining traction, particularly among urban millennials and tech-savvy buyers. E-commerce platforms like Amazon, Flipkart, and brand-owned websites provide access to a wide range of models, competitive pricing, bundled offers, and customer reviews, enabling informed purchase decisions.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “India Chimneys and Built-In Hobs Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Chimney Type

Key Insight: In the India chimneys and built-in hobs market, consumer preferences, kitchen design trends, and functionality needs drive demand for various types of chimneys. Wall-mounted chimneys remain the most popular due to their universal design and simplicity of installation. Both traditional and modular kitchens feature these chimneys because they come in a variety of sizes and designs. Their capacity to adapt to a range of kitchen designs while offering effective suction makes them a popular option in city households.

Market Breakup by Suction Power Range

Key Insight: Chimneys with suction power between 1,000-1,500 m³/hr dominate the India chimneys and built-in hobs market, striking a balance between efficiency and affordability. These models effectively handle the heavy-duty cooking styles prevalent in Indian households, such as frying and grilling, by efficiently removing smoke, grease, and odors. Brands like Faber and Hindware offer chimneys in this range, catering to the needs of medium to large kitchens.

Market Breakup by Chimney Filter Type

Key Insight: Baffle filters are widely preferred due to their durability and ease of maintenance, making them popular in Indian kitchens where heavy frying and smoke are common. These filters employ a "cut and splash" mechanism, where curved stainless steel or aluminium plates deflect grease and oil particles, effectively trapping them while allowing smoke to pass through. Moreover, baffle filters are low-maintenance and durable. They are typically dishwasher-safe and require cleaning every 3 to 4 months, depending on usage.

Market Breakup by Hood Type

Key Insight: As per the India chimneys and built-in hobs market report, ducted hoods hold a larger market presence owing to superior smoke and odor extraction, ideal for modern, ventilated kitchens. These chimneys expel cooking fumes directly outside, ensuring a cleaner and healthier indoor environment. This feature is particularly beneficial in Indian kitchens, where cooking methods often produce substantial smoke and strong odours. The higher suction power of ducted chimneys effectively handles the heavy-duty ventilation needs of such cooking styles.

Market Breakup by Number of Burners

Key Insight: 3-4 burner built-in hobs lead the India chimneys and built-in hobs market, aligning with the average Indian family size and cooking needs. This configuration accommodates the cooking needs of medium-sized families, offering versatility for various culinary tasks. The growing adoption of modular kitchens and the preference for space-saving, integrated appliances further boost the demand for 3-4 burner hobs.

Market Breakup by Stove Type

Key Insight: Gas hobs remain the most popular due to widespread LPG availability and familiar cooking style. More than 70 per cent of Indian households use LPG as their primary cooking fuel and 85 per cent have LPG connections. This extensive penetration ensures a consistent demand for gas-powered cooking solutions, including built-in gas hobs.

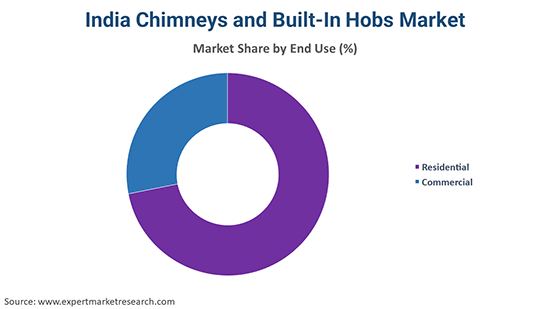

Market Breakup by End Use

Key Insight: The residential segment accounts for the bulk of sales, reflecting growing home renovation trends and rising disposable income. India's per capita disposable income is projected to reach ₹2.14 lakh in 2023-24, marking an 8% increase from the previous year. This rise in income enhances consumer purchasing power, enabling more individuals to invest in premium kitchen appliances.

Market Breakup by Region

Key Insight: Western India leads the India chimneys and built-in hobs market due to higher urbanisation, disposable incomes, and greater adoption of modular kitchens in metros like Mumbai and Pune. The region's dominance is also reflected in the significant market share it holds within India's modular kitchen industry. Factors such as the presence of a large middle-class population, increased spending on home improvements, and the availability of skilled labour contribute to Western India's leadership in this sector.

| CAGR 2026-2035 - Market by | Region |

| South | 17.2% |

| North | XX% |

| East | XX% |

| West | XX% |

Rising Popularity of Straight-Line Chimneys in Contemporary Indian Kitchens

Straight-line chimneys in the India chimneys and built-in hobs market have also become very popular, particularly in contemporary kitchen designs. Their minimalist, sleek design, straight-line chimneys suit linear cabinetry designs in contemporary kitchens. Straight-line chimneys are provided with sophisticated functions such as filterless technology and auto-cleaning features, which are most sought after by consumers for ease of maintenance and efficiency. With their streamlined look, straight-line chimneys are best suited for tiny kitchens, where they make it easy to maximise space.

Island chimneys, though less frequent, are increasing in popularity with open kitchen designs, especially with luxury homes and contemporary apartments. Island chimneys are installed on the ceiling, providing a dramatic focal point within the kitchen. The increased use of open kitchens and the requirement for strong suction systems that accommodate large cooking areas are pushing the use of island chimneys. Downdraft chimneys, while still relatively new, are also attractive to consumers who desire a more subtle alternative that can be integrated into kitchen islands or countertops as an elegant and practical solution.

Suction Capacity Segmentation in India’s Kitchen Chimneys Market

In India chimneys and built-in hobs market, kitchen chimneys with suction capacities below 1,000 m³/hr are tailored for smaller kitchens and budget-conscious consumers. These models are suitable for light cooking, such as boiling or steaming, and are commonly found in compact urban apartments.

Conversely, chimneys with suction capacities above 1,500 m³/hr cater to premium segments, including larger urban households and commercial kitchens. These high-performance models are designed to handle heavy-duty cooking, such as frying and grilling, which are prevalent in Indian cuisine.

Increasing Demand for Mesh and Charcoal Filters in Kitchen Chimneys in India

In the India chimneys and built-in hobs market, mesh filters are commonly used in budget-friendly models. These filters, typically made of aluminium mesh, are effective at trapping grease and oil particles. Charcoal filters, on the other hand, are primarily used in ductless or recirculating chimneys. These filters contain activated charcoal, which adsorbs cooking odours and smoke particles, improving indoor air quality.

Growth and Technological Advancements in Ductless Kitchen Hoods

Ductless hoods grow steadily in urban apartments where external vent installation is challenging, supported by advances in filtration technology. Advancements in filtration technology have enhanced their efficiency, with features like filterless systems and auto-clean functions reducing maintenance efforts. Models such as the Elica 60 cm 1350 m³/hr Filterless Autoclean Kitchen Chimney and the Faber 60 cm 1200 m³/hr Autoclean Chimney exemplify these innovations.

Rising Popularity of 1–2 Burner Built-In Hobs Among Urban and Small Households in India

In India chimneys and built-in hobs market, built-in hobs with 1–2 burners are gaining popularity among bachelors, small families, and urban dwellers due to their compact design and suitability for limited cooking needs. These hobs are ideal for smaller kitchens and apartments, offering space efficiency without compromising on functionality. Their growing adoption reflects the trend towards modular kitchens and urban living solutions.

Hybrid and Electric Plate Hobs Offer Convenience and Choice for Every Kitchen

Hybrid models, which combine induction and gas cooking technologies, are appealing to households seeking flexibility. These models offer the benefits of both cooking methods, allowing users to choose the most suitable option based on their cooking needs and preferences. Electric plate hobs cater to low-usage or temporary kitchen setups, providing a cost-effective solution for individuals or households with minimal cooking requirements.

Niche Commercial Demand Driven by Hospitality Sector Preferences

Commercial demand in the India chimneys and built-in hobs market is steady but limited to niche hospitality sectors like cafes and boutique restaurants where modern kitchen aesthetics and performance matter. These establishments prioritise modern kitchen aesthetics and performance, leading to a preference for high-quality, stylish appliances that enhance both functionality and ambiance. The adoption of such appliances is often driven by the need to meet specific culinary requirements and to create a distinctive dining experience that appeals to their target clientele.

South India Driving Growth Through Tech Hubs and Strategic Investments

The South India chimneys and built-in hobs market is propelled by tech hubs and metro cities embracing modern kitchen appliances. Cities like Bengaluru, Chennai, and Hyderabad are at the forefront, with consumers increasingly adopting modular kitchens and smart appliances. The region's dominance is further supported by strategic investments from major manufacturers, such as LG Electronics' establishment of a new manufacturing facility in Sri City, Andhra Pradesh, aimed at enhancing production capacity and catering to the growing demand for advanced home appliances. The new plant is expected to commence operations by the end of 2026.

North India presents a promising India chimneys and built-in hobs market with substantial growth potential. The expansion of Tier I and Tier II cities like Delhi, Chandigarh, and Lucknow is fostering a shift towards modern kitchen setups. Companies are responding by increasing their presence and targeting these emerging markets. For instance, TTK Prestige plans to expand its store count by 30% over the next four years, focusing on both large and smaller towns to meet rising demands.

Key players in the India chimneys and built-in hobs market are focusing on product innovation, expanding their portfolios with energy-efficient and smart kitchen appliances to cater to evolving consumer preferences. They are strengthening their distribution networks by enhancing offline retail presence and boosting online sales channels to reach a wider audience. Additionally, these companies invest in after-sales service and installation support to improve customer satisfaction. Collaborations with real estate developers and modular kitchen brands help increase market penetration across urban and emerging regions.

Whirlpool of India Limited, established in 1987 and based in India, offers efficient and contemporary chimneys and built-in hobs for modern-age kitchens. Their products incorporate advanced suction technology, auto-clean, and premium finishes, which attract urban homes seeking fashionable and efficient kitchen appliances.

Glen Appliances Pvt. Ltd., a 1999 Indian company, provides a wide range of chimneys and in-built hobs with a focus on innovation and long-lasting quality. Glen's products include auto-clean chimneys to multi-burner glass hobs that combine safety, performance, and innovative designs to cater to contemporary cooking needs.

TTK Prestige Limited, an Indian company established in 1955, manufactures high-performance kitchen chimneys and in-built hobs with a quality and convenience image to the user. They offer energy-saving chimneys with motion sensors and toughened glass hobs with precise flame control for Indian premium and mid-segment consumers.

BSH Home Appliances Group, established in 1967 and having its headquarters in Germany, sells chimneys and built-in hobs under the Bosch and Siemens brands in India. Its product portfolio consists of sensor-based operation and flame failure devices in European-style products, focusing on energy efficiency, safety, and hassle-free cooking for contemporary homes.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the India chimneys and built-in hobs market include AB Electrolux, FRANKE FABER INDIA Private Limited, KAFF Appliances India Pvt. Ltd., Sunflame Enterprises Pvt. Ltd, and Somany Home Innovation Limited, among others.

Explore the latest India Chimneys and Built-In Hobs Market trends 2026 to stay ahead in the evolving kitchen appliances sector. Download a free sample report or contact us today for a detailed discussion on how this market intelligence can help drive your business growth and strategic planning.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the India chimneys and built-in hobs market reached an approximate value of USD 2.12 Billion.

The market is assessed to grow at a CAGR of 13.30% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 7.39 Billion by 2035.

The major drivers of the market are rising disposable incomes, growing popularity of modular kitchen appliances, rapid urbanisation and renovation of traditional kitchens, increased availability of such appliances, and growing retail and e-commerce sector.

The key trends guiding the growth of the chimneys and built-in hobs market in India include the growing construction of smart homes, increased penetration of smart devices with wireless connectivity, and growing awareness regarding cleanliness.

The major regions in the market include South, North, East, and West India.

Wall mounted, straight line, island, and downdraft are the major chimney types available in the market.

Below 1,000 m3/hr, 1,000-1,500 m3/hr, and above 1,500 m3/hr are the major chimney suction power ranges.

Mesh filter, baffle filter, and charcoal filter are the significant filter types of chimneys.

The significant chimney hood types include ducted hood and ductless hood.

Based on the number of burners, the built-in hobs market segment includes 1-2 burners, 3-4 burners, and more than 4 burners.

Gas, induction, hybrid, and electric plate are the major stove types of built-in hobs.

Commercial and residential are the major end uses in the India chimneys and built-in hobs market.

The COVID-19 pandemic had a notable impact on the India chimneys and built-in hobs market, primarily due to disruptions in manufacturing, supply chains, and construction projects. During the lockdowns, production and distribution of these appliances slowed down significantly, as factories halted operations and labour shortages affected the supply of materials.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Chimney Type |

|

| Breakup by Suction Power Range |

|

| Breakup by Chimney Filter Type |

|

| Breakup by Hood Type |

|

| Breakup by Number of Burners |

|

| Breakup by Stove Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share