Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India coconut oil market is expected to grow at a CAGR of 7.50% in the forecast period of 2026-2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

7.5%

2026-2035

*this image is indicative*

| India Coconut Oil Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | XX |

| Market Size 2035 | USD Million | XX |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 7.50% |

| CAGR 2026-2035 - Market by Source | Organic | 9.5% |

| CAGR 2026-2035 - Market by Application | Food and Beverage | 8.6% |

| Market Share by Country 2025 | Organic | XX% |

Coconut oil has anti-inflammatory, anti-fungal, and anti-microbial properties, due to which it is used as a preventive healthcare measure. It is extensively used in major industries like cosmetics and personal care as well as food and beverages, among others, which is expected to support the India coconut oil demand growth.

The health benefits associated with the use of coconut oil is surging its use in cooking. The high smoke point and antioxidant properties of coconut favour its use in frying, baking, and sautéing activities. As coconut oil is enriched with diverse flavours, it is extensively utilised in the cooking of traditional cuisines in the country. Moreover, the growing vegan population in the country is leading to a surge in the incorporation of coconut oil as a substitute for butter, contributing to the India coconut oil market expansion.

With the rising demand for healthy bakery and confectionery products, coconut oil is extensively used to boost the nutritional profile in the bakery industry. In addition, the high content of saturated fatty acids and the resistance to oxidative rancidity make coconut oil ideal for use in infant formulas, which is expected to increase the India coconut oil industry revenue.

Coconut Oil Import and Export Trends in India and Growing Indian Cosmetics Industry

There is a strong and growing demand for Indian coconut oil in several key markets, however, fluctuations in import values across different years indicate the influence of various market dynamics, such as economic conditions, trade policies, and supply chain factors. The consistent demand from the UAE, Saudi Arabia, and the United States highlights these countries as significant markets for Indian coconut oil, while emerging markets like Tanzania represent opportunities for further expansion. The overall trend underscores India's position as a key exporter of coconut oil, with ongoing potential for growth in both established and new markets.

As per India Brand Equity Foundation, the Indian cosmetics industry is anticipated to expand to US$ 20 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 25%. The growing cosmetics market in India is expected to drive coconut oil demand. In comparison, the global cosmetics industry is growing at a CAGR of 4.3% and is expected to reach US$ 450 billion by 2025.

According to the International Trade Centre (ITC) Trade Map data, India's import data for coconut oil and its fractions, whether or not refined but not chemically modified, reveals notable trends over the years from 2019 to 2023. The total import value from global markets has fluctuated significantly. In 2019, India imported coconut oil worth USD 2,315 thousand, which saw a sharp decline to USD 411 thousand in 2020. The year 2021 experienced a minimal increase with imports valued at USD 31 thousand, followed by a more substantial rise in 2022, reaching USD 118 thousand. By 2023, the import value further increased to USD 162 thousand.

In 2019, India exported coconut oil worth USD 19,330 thousand, which increased significantly to USD 29,277 thousand in 2020. The upward trend continued in 2021 with exports reaching USD 43,713 thousand. However, there was a slight dip in 2023 to USD 38,512 thousand. This fluctuation suggests varying global demand and potential shifts in international market conditions affecting Indian exports.

According to the India coconut oil industry analysis, the United Arab Emirates (UAE) has consistently been a major importer of Indian coconut oil. In 2019, the UAE imported USD 9,489 thousand worth of coconut oil, which increased to USD 10,009 thousand in 2020. The upward trend continued in 2021 with imports worth USD 11,224 thousand, peaking at USD 14,046 thousand in 2022, before slightly decreasing to USD 12,057 thousand in 2023. Saudi Arabia also saw a steady increase in imports from USD 1,591 thousand in 2019 to USD 4,479 thousand in 2022, before declining to USD 4,165 thousand in 2023.

The United States emerged as a significant market, with imports rising from USD 419 thousand in 2019 to USD 5,042 thousand in 2021. However, imports dropped to USD 2,655 thousand in 2023. Qatar demonstrated steady growth, increasing from USD 1,246 thousand in 2019 to USD 2,549 thousand in 2023. Other notable importers include Tanzania, which saw a remarkable increase from USD 48 thousand in 2019 to USD 1,669 thousand in 2021, and maintaining high import levels at USD 1,470 thousand in 2022 and USD 2,113 thousand in 2023.

| 2025 Market Share by | Source |

| Organic | XX% |

| Conventional | 74.8% |

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “India Coconut Oil Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Source

Market Breakup by Type

Market Breakup by Application

Market Breakup by Distribution Channel

Market Breakup by Region

| CAGR 2026-2035 - Market by | Source |

| Organic | 9.5% |

| Conventional | XX% |

| CAGR 2026-2035 - Market by | Application |

| Food and Beverage | 8.6% |

| Pharmaceuticals | 8.1% |

| Cosmetics | XX% |

| Industrial | XX% |

| Others | XX% |

As the prevalence of various health-related issues in India is significantly surging, virgin coconut oil is increasingly preferred in cooking owing to the high content of minerals and vitamin E. The increasing production of virgin coconut oil in India owing to its versatile uses is augmenting the India coconut oil market development.

With the rising demand for virgin coconut oil in North American and European regions, its export is increasing. Moreover, the rising availability of diverse and cost-effective virgin coconut oil is boosting its sales and coconut oil consumption in India.

The market benefits from the robust growth of the cosmetics and personal care industry in India. As coconut oil contains essential minerals and oils, it is incorporated as a moisturising agent in cosmetics and skincare products, thereby fuelling demand growth. Furthermore, the growing trend of do-it-yourself skincare, popularised during the COVID-19 pandemic, is increasing the use of coconut oil in personal care.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The report presents a detailed analysis of the key players in the India coconut oil market, looking into their market shares and latest developments like mergers and acquisitions. Some of the leading coconut oil producers in India are:

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The India coconut oil market is projected to grow at a CAGR of 7.50% between 2026 and 2035.

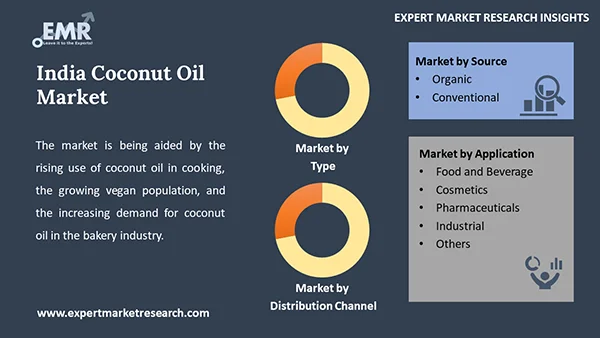

The market is being aided by the rising use of coconut oil in cooking, the growing vegan population, and the increasing demand for coconut oil in the bakery industry.

Key trends aiding the market expansion are the growth of the cosmetics and personal care industry, the growing trend of do-it-yourself skincare, and the increasing production of virgin coconut oil.

The key Indian markets are North India, East and Central India, South India, and West India.

The various sources of coconut oil are organic and conventional.

The major types of coconut oil are virgin, extra-virgin, and refined, among others.

The various applications of coconut oil are food and beverage, cosmetics, pharmaceuticals, and industrial, among others.

The significant distribution channels in the market are supermarket and hypermarket, convenience store, and online, among others.

The major players in the market are Cocoguru Coconut Industries Private Limited, Sri Sellandiamman Oil Mill, Marico Limited, Patanjali Ayurved Limited, Forest Essentials, Kama Ayurveda Pvt. Ltd., Mahavir Coconut Industries, Dabur Ltd, Organic India Private Limited, Kayal Agro Foods, Shalimar Chemical Works Private Ltd, Old Goa Oils and Foods Private Limited, and JSP FOODS, among others.

Vulnerability to price fluctuations, inconsistency in product quality, and reliance on favorable weather conditions for coconut cultivation are the key challenges in the industry.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Source |

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Trade Data Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share