Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India paneer market was valued at INR 727.68 Billion in 2025. The industry is expected to grow at a CAGR of 14.20% during the forecast period of 2026-2035 to attain a valuation of INR 2745.37 Billion by 2035.

Base Year

Historical Period

Forecast Period

The Indian dairy sector is expected to witness a growth of 13 to 14 per cent in the current financial year 2024-25.

The value-added dairy products such as paneer contributed around 40% to the revenue of the dairy sector.

The revised National Programme for Dairy Development scheme was expected to be implemented from 2021-22 to 2025-26 with a budget of Rs 1790 crores, improving the quality of milk and other dairy products such as paneer.

Compound Annual Growth Rate

14.2%

Value in INR Billion

2026-2035

*this image is indicative*

Paneer has been a widely used dairy product in Indian traditional cuisine. It is a non-fermentative and non-renneted type of cheese obtained by curdling the milk with an acid such as lemon juice. Uttar Pradesh (UP) dominated the Indian paneer market in 2020 and held the largest market share.

The factors driving the growth of the India paneer market include various applications of paneer and its product premiumisation. The market for paneer is rising on account of the ease of availability and accessibility of the paneer in retail stores as well as supermarkets, along with the increased consumer demand towards the different varieties of paneer such as skim milk paneer, protein-enriched filled paneer, filled paneer, fibre enriched low-fat paneer, masala paneer, spiced paneer, and vegetable impregnated paneer among others.

Rise of Health-Conscious Consumers

Paneer is gaining popularity as a rich source of protein, especially among vegetarian consumers in the country. It can be an optimal choice for gym-going individuals or people looking to lose weight due to its low carbohydrate and rich protein content. 100 grams of paneer contains around 18 to 20 grams of protein, making it a valuable source of protein.

As per the India paneer industry analysis, the popularity of paneer has been rising in South India as vegetarian consumers increasingly prefer paneer to potatoes due to its low-carb content. This has also fuelled the demand for paneer-based Dosa such as Paneer Cheese Dosa and Paneer Masala Dosa, among others, over Masala Dosa. Gun Powder Paneer has gained popularity in Andhra Pradesh, whereas paneer is also being used as a variant of traditional South Indian dishes. For instance, Paneer 65 is a paneer variant of Chennai’s Chicken 65 dish, which is becoming popular among vegetarian and health-conscious consumers.

Growing Popularity of Paneer in Ready-to-Cook Segment

The rapid urbanisation and busy lifestyle of working professionals in metropolitan areas have boosted the demand for convenient and ready-to-cook food products. This has led the market players to readily invest in a wide variety of paneer such as cubes, slices, and grated, among others. For instance, companies such as ITC and Tata Sampann have heavily invested in paneer-based meal kits and frozen snacks.

As of March 2024, the ready-to-cook market in India is expected to grow by 45% in the next 5 years, which has also presented significant India paneer market opportunities. Moreover, food delivery platforms such as Blinkit, BigBasket, Swiggy Instamart, and Zepto, among others, offer wide varieties of RTC paneer-based products such as paneer makhani mix, shahi paneer mix, and matar paneer mix, among others.

July 2024

Ananda Dairy, a leading provider of dairy products, announced an awareness campaign to educate consumers about the benefits of packaged paneer compared to loose paneer, with a special focus on the purity and quality of the packed paneer, which is expected to boost paneer market consumption in India.

March 2024

Deep Indian Kitchen, a well-known provider of restaurant-quality Indian food, announced the launch of the traditional dish, Matar Paneer, which was expected to be available in the frozen aisle and made from scratch to offer an authentic taste.

There is an expansion of the food service sector, including hotels, restaurants, and catering (HoReCa) in the urban and semi-urban regions of the country. Paneer-based dishes are a staple part of Indian cuisine, which has fuelled the growth of paneer-based dishes in the institutional sector, boosting the India paneer demand.

As per the data from IBEF (India Brand Equity Foundation), the Indian hotel sector is expected to witness a growth of 7 to 9% by the financial year 2025, owing to the growth of weddings and business travel. The hospitality sector is further expected to reach around USD 24.61 billion in 2024. Moreover, as per the India Food Services Report-2024 by the National Restaurants Association of India, the food services sector was expected to grow at a CAGR of 8.1% between 2024 and 2028. Casual dining restaurants are the fastest-growing segment in this sector, which is expected to boost the growth of paneer-based cuisines.

One of the major concerns in the paneer sector is the quality and adulteration issue as several small-scale businesses may dilute milk with water or non-standard coagulants, during paneer production which can affect its quality. For example, officials of the Food and Drugs Administration (FDA) recovered around 314kg of adulterated paneer worth Rs 53,000, from Sinnar, Maharashtra. A large amount of refined palm oil and glycerol monostearate was found at the site, which are common adulterants in paneer.

As per the India paneer market dynamics and trends, price sensitivity is another major concern in the market as paneer can be expensive compared to other protein sources such as lentils or eggs, presenting a challenge to the paneer providers. For instance, 1 kg paneer can be available at a minimum price ranging between Rs 180 to 200, which is expensive compared to lentils whose price can be around Rs 120.

The rapid growth of cold chain logistics in the country has made the distribution of milk and milk-based products easier in the country. There have been increased investments in modern dairy processing plants, refrigerated transport and storage, among others, which can positively impact the India paneer demand forecast.

Favourable government initiatives are also boosting the cold chain infrastructure in the country. For instance, the Pradhan Mantri Kisan Sampada Yojana (PMKSY) central sector scheme which was launched in 2017 is expected to continue till 2026 with an investment of around INR 4600 crores. One of the major components of this scheme was the Integrated Cold Chain and Value Addition Infrastructure, under which the cold storage capacity of 8.38 lakh MT was created till 2022, greatly supporting the transportation and storage of fruits, vegetables, dairy-based products, and meat and poultry, among others.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Paneer can be used in combination with other vegetables to prepare semi-dry, savoury dry and gravy delicacies. The usage of paneer in various snacks, such as pakoras (nuggets) and mishti and sandesh (a popular bengali sweet) is also attracting people across the country, and is, thus, expected to increase the demand for paneer over the years to come. Moreover, the presence of essential nutrition elements in the Indian culinary tradition, such as dietary fibre, calcium, phosphorus, vitamin B, vitamin D, omega-3, and omega-6 fatty acids, is significant. Therefore, paneer aids in keeping several diseases at bay while helping to maintain a healthy body. “India Paneer Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:

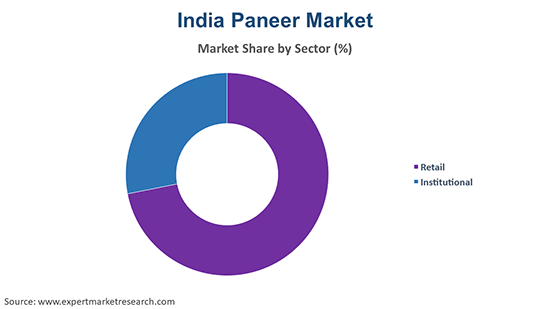

Based on sector, the market is bifurcated into:

Based on region, the market is bifurcated into:

By Sector Insights

The retail segment accounts for a major paneer market share in India owing to the rising availability of paneer in supermarkets, hypermarkets, and retail stores, among others, to offer easy access to consumers. Paneer consumption has witnessed significant growth in recent years, especially among middle-class and health-conscious consumers.

The retail sector of India is expected to reach a staggering value of around USD 2 trillion by 2032, with online shoppers in India reaching 500 million in 2030. As of 2023, grocery retail accounted for around 74% of the total retail, which further offered lucrative opportunities for paneer growth.

Karnataka India Paneer Market Drivers

This state is expected to hold a significant share of the market due to the presence of the well-organised dairy sector as well as the Karnataka Cooperative Milk Producers Federation (KMF). Bengaluru, the capital of Karnataka, has gotten the title of Veggie Valley of India as one-third of the vegetarian orders were from this city as per the analysis of Swiggy. The top dishes ordered in this city included masala dosa, paneer biryani, and paneer butter masala, which further boosted the demand of India paneer market.

There is also a strong shift towards online grocery platforms and organised retail in the state which have further facilitated the growth of the paneer market in this region.

The strong presence of dairy cooperatives such as Pradeshik Cooperative Dairy Federation (PCDF) and Ananda Dairy, among others, is boosting the paneer growth in the state. The large-scale production of cow and buffalo milk in the state is also expected to maintain a steady supply of milk for paneer production, fuelling the growth of the India paneer industry.

Technological advancements in cold storage and supply chains have facilitated the storage and distribution of paneers in the state, ensuring their freshness and longevity.

Maharashtra is also expected to establish its prominence in the market due to the presence of milk producers such as Parag Milk Foods which contain well-equipped dairy processing capacity. This company is offering high-end paneer products under the brand names Gowardhan and Go.

The shift in dietary preference of the consumers towards healthy and nutritious food products such as paneer as well as the popularity of cloud-kitchen and restaurants in urban areas such as Mumbai and Pune is boosting the demand for paneer, which is a key ingredient in various food products such as rolls, wraps, pizzas, and Indian cuisines.

Several startups are readily capitalising on the trend of health-consciousness by offering healthy paneer-based products such as organic, low-fat, and protein-rich, among others. With the rising popularity of online food and grocery delivery, several startups have launched their products in online grocery stores to reach a large number of consumers. Moreover, some startups in India paneer market are offering clean-labelled and organic paneer products which can appeal to ethically conscious consumers.

Country Delight

This startup is known for its minimally processed and fresh dairy products and implements a farm-to-table model which ensures superior quality of its products. It offers hormone-free milk and other dairy products which appeal to health-conscious consumers. This startup also has its own app through which consumers can order paneer and other dairy-based products, further aiding the India paneer demand growth.

Storia Foods

This is one of the up-and-coming startups in the food and beverages sector and has entered the dairy market through its consortium of dairy products such as paneer. Its products are clean-label and nutritious which greatly appeals to the eco-conscious consumers. Furthermore, the company has been gradually establishing its presence in retail stores and e-commerce platforms to expand its market reach.

The report presents a detailed analysis of the following key players in the India paneer market, looking into their capacity, market shares, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions. Major companies in the market are expanding their paneer offerings by the launch of new paneer varieties such as low-fat paneer and fibre-enriched paneer. Several companies are also expanding their milk processing capacities to meet the growing demand for milk-based products such as paneer.

Established in 1973 and based in Gujarat, GCMMF is widely known in the country for its Amul brand, which is one of the largest milk producers in the country. Its product portfolio includes milk, butter, cheese, ghee, and paneer, among others.

It is a subsidiary of the National Dairy Development Board (NDDB) which was established in 1974. The company is well known for its product range which includes milk, butter, paneer, curd, ice cream, fresh fruits, vegetables, and edible oil, among others, which can boost the India paneer market revenue.

Established in 1974, KMF is well-known for its brand, Nandini, which is one of the major dairy providers in South India. This company supports rural farmers and ensures a stable milk supply in South Indian states such as Karnataka.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market are Tamil Nadu Cooperative Milk Producers Federation Ltd (TCMPF), Pradeshik Cooperative Dairy Federation Ltd (PCDF), Ananda Dairy Ltd, Parag Milk Foods Limited, and Hatsun Agro Product Limited, among others.

January 2024

Maggi announced the launch of an innovative range of new Paneer spice mixes under the brand name, MAGGI Paneer-ae-Magic. This spice range is expected to offer a convenient food solution without any compromise on its taste and quality and also enhance the India paneer market value.

September 2022

Godrej Tyson Foods, a major company in the agribusiness sector, announced the launch of a new paneer snack under its brand, Godrej Yummiez. This new product is an addition to its range of paneer-based frozen snacks such as Tandoori Paneer Nuggets and Kadhai Paneer Nuggets, among others, which can contribute to the India paneer industry revenue.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In the forecast period of 2026-2035, the India paneer market is projected to grow at a CAGR of 14.20%.

The major drivers of the market such as rising disposable incomes, increasing population, ease of availability, expanding distribution channels, and the product’s extensive use as a part of the Indian traditional cuisine are expected to aid the market growth.

The growing product premiumization of the product and the rising availability of different paneer varieties such nutrient-enriched and flavoured variants.

The major regions in the Indian market are Uttar Pradesh, Bihar, Madhya Pradesh, Maharashtra, Haryana, Odisha, Jharkhand, Delhi, Karnataka, Tamil Nadu, Gujarat, Andhra Pradesh and Telangana, West Bengal, Kerala, Rajasthan, and others, with Uttar Pradesh accounting for the largest market share.

The leading sectors in the Indian market are retail and institutional sectors.

The leading players in the industry are Gujarat Co-operative Milk Marketing Federation Ltd, Mother Dairy Fruits & Vegetables Pvt Limited, Karnataka Co-operative Milk Producers Federation Limited, Tamilnadu Cooperative Milk Producers Federation Ltd (TCMPF), Pradeshik Cooperative Dairy Federation Ltd (PCDF), Ananda Dairy Ltd, Parag Milk Foods Limited, and Hatsun Agro Product Limited, among others.

In 2025, the market attained a value of nearly INR 727.68 Billion.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about INR 2745.37 Billion by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Sector |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share