Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India school market attained a value of USD 59.92 Billion in 2025. The market is expected to grow at a CAGR of 10.70% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 165.60 Billion.

The implementation of the National Education Policy (NEP) 2020 is transforming the India school market for promoting holistic, flexible, and multidisciplinary learning. Of late, schools are upgrading curricula, integrating vocational subjects, and prioritizing skill-based education. NEP mandates technology integration via platforms and the creation of the National Digital Education Architecture. These reforms are elevating infrastructure, pedagogical quality, and monitoring, benefiting underserved regions and raising benchmarks for private institutions. Government intervention is also enabling EdTech integration, smart classrooms, and vocational training, creating new revenue streams and market growth opportunities.

The growing emphasis on skill-based and vocational education is driving the school market in India by aligning learning with employability. Under NEP 2020, vocational training is largely integrated for encouraging hands-on learning in areas, such as coding, financial literacy, AI, agriculture, and design thinking. Several schools are offering vocational subjects, boosting enrollment in schools that provide these options. In May 2025, 257 Delhi schools introduced vocational training programs for offering practical courses in IT, healthcare, retail, beauty, and prevocational lifeskill subjects. This shift is creating new demand for trained faculty, specialized infrastructure, and curriculum providers, fueling market growth.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

10.7%

Value in USD Billion

2026-2035

*this image is indicative*

The rise in the number of government schemes to enhance foundational education is driving the India school market revenue. In November 2024, The Union Cabinet of India approved the PM Vidyalaxmi scheme for providing monetary support to meritorious students to assist them in pursuing higher education. These reforms are elevating infrastructure, pedagogical quality, and monitoring, benefiting underserved regions and raising benchmarks for private institutions. Government intervention is also enabling EdTech integration, smart classrooms, and vocational training, creating new revenue streams and market growth opportunities.

EdTech platforms are expanding through AI-based personalization, AR/VR integration, and local hybrid centres, benefiting the India school industry. AI tools are helping to analyse student performance to deliver tailored lessons and real-time feedback for improving learning outcomes. Several platforms are offering immersive AR/VR content to make complex concepts interactive and engaging. In September 2024, SparkVR introduced its AR and VR-based edtech solutions across schools and universities in India to enhance immersive learning experiences. Additionally, hybrid centres in tier-2 and tier-3 cities are combining digital content with physical tutoring, making quality education more accessible.

With schools incorporating sustainability into curricula and campus operations, the India school market is gaining traction. Institutions are adopting eco-friendly infrastructure alongside environmental education programs to teach students about climate change, conservation, and responsible consumption. In August 2024, St Aloysius Gonzaga School launched the 'Go Green' Project to promote eco-friendly community practices. This is aligning with global sustainability goals and appealing to environmentally conscious parents and investors, prompting schools to invest in green certifications and practices.

The growing popularity of activity-based learning models is influencing the India school market dynamics. These approaches focus on hands-on activities, collaborative work, and tackling real-world problems to boost student engagement and deepen understanding. In May 2025, the New Delhi Municipal Council (NDMC) teamed up with top schools in Delhi to create activity-based learning hubs for enhancing programs in environmental studies, arts, inclusive education, music, and sports. This transition is sparking a greater need for new classroom resources, teacher training, and curriculum design services.

AI-powered platforms are revolutionizing the India school industry by offering personalized learning experiences to cater to unique profile of each student. These systems sift through data like learning speed, performance patterns, and engagement levels to adjust content and assessments on the fly. In February 2025, the India-based company Meritus announced plans to train 72,000 teachers across Asia by rolling out AI-enhanced educational techniques. This strategy aligns perfectly with the NEP 2020’s emphasis on tech integration and outcome-based learning, fostering growth and adoption in both public and private education sectors.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “India School Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Breakup by Level of Education

Key Insight: The primary segment, covering classes 1 to 5, in the India school market is growing rapidly due to the country’s large young population and government focus on universalizing early education. In March 2024, India’s Ministry of Women and Child Development launched the National Curriculum for Early Childhood Care and Education for children aged 3 to 6 years. Private players are expanding to cater to growing demand for quality early childhood education. Digital platforms are also emphasizing foundational skills, making primary education a critical sector in the market.

Breakup by Ownership

Key Insight: The government segment dominates the India school market by catering to millions of students, especially in rural and underprivileged areas. According to industry reports, government school admissions for children aged between 6-14 years hit 66.8% in 2024. Operated by central and state governments, these schools provide free education, textbooks, mid-day meals, and uniforms. Despite infrastructural and quality challenges, these schools play a crucial role in universalizing elementary education. Their dominance also lies in accessibility and scale, forming the foundation of India’s public education system.

Breakup by Board of Affiliation

Key Insight: Central board of secondary education (CBSE) is leading the India school market, governing thousands of schools nationwide. As per industry reports, there were 28,960 CBSE schools across India as of January 2024. These schools offer a standardized curriculum with a focus on science, mathematics, and holistic development. Popular schools are actively working on preparing students for national competitive exams, makes this board highly preferred by parents and students. Continuous updates to curriculum and integration of digital learning are also reflecting the segment’s adaptability and wide reach.

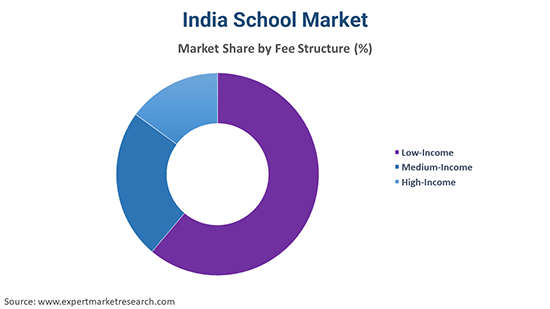

Breakup by Fee Structure

Key Insight: The low-income segment constitutes the major portion of India school market, especially in rural and semi-urban areas. These schools operate with minimal infrastructure, government funding, and limited resources. In March 2025, the Indian government revealed plans of building 200 free boarding schools for low-income families. Initiatives, such as the Mid-Day Meal Scheme and free uniforms are also helping to improve enrollment and retention. The dominance of this segment lies in its sheer volume, making it the primary focus for public education policies and reforms.

Breakup by Region

Key Insight: North India contributes largely to the India school market in terms of infrastructure, enrollment, and private school concentration. In August 2024, the Education Ministry of India disclosed the construction of 14 new government schools across Delhi. Uttar Pradesh, Haryana, and Punjab also host several premier schools including The Doon School, Delhi Public School, and Mayo College. The region also benefits from strong parental focus on competitive exam preparation and English-medium education. Investments in digital learning and extracurricular excellence are further boosting North India's dominance.

Upper Primary & Secondary Education to Gain Traction in India

The upper primary segment, encompassing classes 6 to 8, of the India school industry is crucial for building on foundational knowledge and preparing students for secondary school. This segment is recording hefty investments in infrastructure and digital learning tools to enhance engagement. School chains, such as Delhi Public School and Ryan International are emphasizing STEM education and extracurricular development at this level. Government efforts are continuing to address dropout rates and gender disparities, while edtech solutions are helping with personalize learning, reflecting the rising importance of this segment.

Secondary education in the India school market has grown vital as students are preparing for board examinations due to influenced career pathways. This segment is marked by intense competition among schools affiliated with CBSE, ICSE, and state boards. Private schools are investing heavily in science labs and coaching programs. In April 2025, DPS Indirapuram launched India's first institutional AI and Robotics Lab in a bid to integrate AI into its curriculum. The rise of career counselling and skill-based electives is also reflecting the shifting priorities towards holistic development, adding to the segment growth.

Local Body & Private Aided Schools to Witness Popularity in India

Local body schools are gaining popularity in the India school market as they are run by municipal and panchayat institutions and serve urban and semi-urban populations. These schools cater to lower-income families and follow state board curricula for offering free education and basic facilities. Despite limited budgets, some local bodies are introducing innovations like digital classrooms and skill training programs. These schools are also significant in urban governance and public service delivery, maintaining strong enrolment numbers especially in densely populated cities.

Private aided schools are privately managed and receive government aid for teacher salaries and other operational costs. As per industry reports, the number of private schools in India grew by 14.9% from 2014–15 to 2023–24. In Maharashtra and Tamil Nadu, these schools serve middle- to lower-income families by blending affordability with better infrastructure. Many convent and missionary schools fall under this category and are known for academic rigor and discipline. The demand for these schools is further growing as they follow state board syllabi and maintain relatively low fees due to government support.

CISCE & State Government Boards to Drive School Preference in India

The Council for the Indian School Certificate Examinations (CISCE) segment is gaining popularity in the India school market for its rigorous curriculum and strong emphasis on English proficiency, arts, and sciences. Schools including The Cathedral and John Connon School and La Martinière College follow CISCE. The board is favoured for its comprehensive syllabus, critical thinking focus, and global recognition. CISCE schools also attract many urban and international students seeking a balanced education with a strong academic foundation.

State government boards in the India school market include schools under respective state education departments offering region-specific curricula tailored to local languages and culture. These boards cater largely to rural and semi-urban populations whilst having the highest enrolment numbers nationwide. According to industry reports, 8.9 lakh students enrolled for the Karnataka State Board for Class 10 in 2024. Ongoing efforts to modernize curricula and digital infrastructure to enhance educational quality and relevance in state board schools is supporting segment growth.

Medium-Income & High-Income Schools to Garner Huge Demand in India

The medium-income segment of the India school market is rapidly growing, especially in tier-2 and tier-3 cities. These schools offer better facilities than government schools but are affordable for middle-class families. For example, schools affiliated with CBSE or ICSE in cities, such as Nagpur and Kochi are charging moderate fees while providing quality education, digital classrooms, and English-medium instruction. This segment balances scale and aspirations, contributing significantly to the rise of edtech and blended learning in India, making it a powerful driver of educational transformation.

The high-income school segment of the India school industry plays a prominent role in shaping elite education standards. These include international schools and elite private institutions in metro cities. These schools offer overseas curricula, air-conditioned campuses, and global exposure. In December 2024, Finland International School opened a cuttingedge Guwahati campus by blending Finland’s studentcentric pedagogy with India’s NEP and ICSE curriculum. This segment sets benchmarks in innovation, and infrastructure, influencing aspirations and practices in the broader Indian school landscape.

Surging School Penetration in South & West India

South India school market is poised for expansion due to its consistent emphasis on quality education. Tamil Nadu, Karnataka, and Kerala have strong public-school systems and a thriving private school ecosystem. Bengaluru houses numerous international for catering to expat and IT families. Tamil Nadu’s early adoption of technology in classrooms and Kerala’s near-total literacy rate are showcasing systemic strength. Moreover, South India is recognized for producing high academic achievers, particularly in competitive exams and Olympiads.

West India, with Maharashtra leading in both number and diversity of schools, is influencing the India school industry. Mumbai and Pune host several prestigious institutions, such as Dhirubhai Ambani International and Symbiosis. English-medium and STEM-focused schools are rapidly expanding, particularly in tier-2 cities. In March 2025, Goa’s first STEM laboratory was opened at Murgao School in Sada, Goa, to boost coding, robotics, innovation statewide. Maharashtra’s focus on digital learning tools and teacher training is also boosting education quality.

Key players in the India school market are employing strategies that focus on infrastructure development, digital transformation, and affordable scalability to meet the needs of a diverse and expanding student population. Digital integration, edtech collaborations and smart classroom technologies are helping schools to enhance engagement and learning outcomes. Schools are increasingly adopting learning management systems, online assessments, and AI-powered analytics to personalize education and track performance. Schools are aligning with NEP 2020 by introducing coding, robotics, financial literacy, and multilingual content.

Partnerships with organizations, such as CBSE, NCERT, and private content providers are helping to deliver updated learning materials. Franchise and chain-model expansion by brands, including DPS, Ryan International, and Orchids International are allowing rapid scaling with standard quality. Meanwhile, rural and budget school operators are focusing on low-cost digital tools, CSR-funded infrastructure, and teacher training. Additionally, many players are targeting parent engagement through mobile apps, progress reports, and feedback systems, while integrating ESG principles and hybrid learning models to address socio-economic diversity.

Founded in 1860 and based in Kolkata, India, St. Xavier’s Collegiate School offers education from lower kindergarten to Class 12. The school follows the ICSE and ISC curriculum and is renowned for holistic development, academic excellence, and a strong emphasis on discipline and values.

Introduced in 1845, La Martinière College is based in Lucknow, India and comprises separate institutions for boys and girls while being affiliated with the ICSE/ISC boards. The school is known for its high academic standards, colonial heritage and co-curricular programs while focusing on character-building and leadership among its students.

The Doon School, founded in 1935 and located in Dehradun, India is a prestigious all-boys boarding school providing education under the ICSE, ISC, and IB Diploma Programme. The school focuses on academics, sports, leadership, and global citizenship to attract students from across India as well as abroad given its elite reputation.

Founded in 1948, Shree Swaminarayan Gurukul International School is based in Rajkot, Gujarat. The school offers CBSE as well as state board curricula across its multiple campuses to emphasize spiritual learning, discipline, and character development besides academic and extracurricular excellence.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the India school market are Little Flowers Public Sr. Sec. School, The Mother’s International School, Bombay Scottish School, St. John's High School, Sainik School, Modern School, Greenwood High International School, and Emerald Heights International School, among others.

Explore the latest India school market trends 2026 with Expert Market Research. Download your free sample report today for insights on school types, policy shifts, and digital learning innovations shaping the future of Indian education. Make confident decisions with trusted data—get your India school market report now to stay ahead.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 59.92 Billion.

Key strategies driving the market include increased private sector participation, adoption of digital learning tools, NEP 2020 implementation, focus on skill-based education, expansion in tier-2/3 cities, and rising demand for English-medium instruction. Public-private partnerships and government schemes like PM SHRI also support infrastructure and quality improvements nationwide.

The key market trends guiding the growth of the school market include rapid advancement in technology and shift from traditional to digital teaching methods, which involves the use of smart classes and augmented reality.

The major regional markets in the market are North India, East and Central India, West India, and South India.

Primary, upper primary, secondary, and higher secondary are the major levels of education in the industry.

The significant ownership-types in the market include government, local body, private aided, and private unaided, among others.

Central Board of Secondary Education, Council for the Indian School Certificate Examinations, and State Government Boards, among others, are the major board of affiliation in the industry.

The major fee structures for school include low-income, medium-income, and high-income segments.

The key players in the market report include St. Xavier's Collegiate School, La Martinière College, The Doon School, Shree Swaminarayan Gurukul International School, Little Flowers Public Sr. Sec. School, The Mother’s International School, Bombay Scottish School, St. John's High School, Sainik School, Modern School, Greenwood High International School, and Emerald Heights International School, among others.

The market is projected to grow at a CAGR of 10.70% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 165.60 Billion by 2035.

The government segment dominates the market by catering to millions of students, especially in rural and underprivileged areas.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Level of Education |

|

| Breakup by Ownership |

|

| Breakup by Board of Affiliation |

|

| Breakup by Fee Structure |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share