Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Indian aluminium powder market reached a volume of nearly 47769.04 Tons in 2025. The market is expected to grow at a CAGR of 5.70% over the forecast period of 2026-2035 to attain a volume of 83156.54 Tons by 2035.

Base Year

Historical Period

Forecast Period

India is the second largest producer of aluminium in the world, with its primary aluminium production witnessing a growth of 1.2% in the financial year of 2024-25.

In 2023, India accounted for around 6% of the global aluminium production, offering lucrative opportunities for Indian aluminium powder market.

As of 2023, India was the third biggest consumer of aluminium across the world.

Compound Annual Growth Rate

5.7%

Value in Tons

2026-2035

*this image is indicative*

Aluminium is a metallic product with a soft finish and is lightweight, ductile, and non-magnetic. Aluminium powder is a silver-white, lightweight, and highly inflammable powder that is produced by grinding the aluminium metal sheet in the presence of a food-grade fatty acid. It can also be obtained by exposing molten aluminium to a compressed gas jet. This powder is available in different forms, including aluminium flake, atomised aluminium, and aluminium pigment powder.

The Indian aluminium powder market is being driven by rapid urbanisation and increasing commercial mining. The market is being driven by the growing commercial mining and rapid urbanisation in the country. The growing industrialisation and increased construction activities in the region are further supporting the growth of the Indian aluminium powder market.

In India, aluminium powder is used in multiple industries for various purposes, including metallurgy, chemicals, paints and pigments, explosives, and construction, among others. The product’s wide adoption across its various end-use industries is one of the main factors driving the demand in the market. As aluminium shows high corrosion resistance, it is effective in increasing the lifespan of the product, thus, resulting in increased demand in Indian aluminium powder market. Due to the beneficial properties, easy availability, and affordability of aluminium in India, the industry is witnessing significant growth.

In addition, the use of the product for the manufacture of coating paints has increased, which has further boosted its demand throughout the automotive industry. In addition, it is resistant to corrosion and can be quickly recycled due to which it is a highly durable commodity with a longer lifetime than other metals, which is also positively influencing the market.

Rising demand for aluminium from the additive manufacturing sector, growing emphasis on green manufacturing, and increased applications in the renewable energy sector are some key trends boosting the growth in Indian aluminium powder market.

Aluminium powder exhibits superior strength and light-weight properties which makes it viable in the 3D printing sector. Several end-use sectors such as aerospace, automotive, and healthcare, among others, are relying on automotive powder for the production of complex parts. Several major companies in India such as Wipro 3D are further exploring the use of metal powders such as aluminium powder for the 3D printing process, which can further aid the Indian aluminium powder demand. Mahindra & Mahindra announced on August 2023 that it aims to explore the use of more 3D-printed aluminium components in its EVs to reduce their weight and improve overall efficiency, which is expected to fuel the demand for aluminium powder. Additionally, the National Strategy on Additive Manufacturing was launched on 24th February 2022 to revolutionise the additive and manufacturing sector of India, which is further expected to boost the production of 3D printing materials, and consequently fuel the aluminium powder growth.

With the rising adoption of sustainability initiatives across the world, aluminium producers and manufacturers in India are also adopting green practices such as the usage of recycled aluminium powder as well as energy-efficient production of aluminium powder. Around 40% of the aluminium produced in India in 2023 was from recycled materials, which reduced the environmental footprint. Recycled aluminium uses 95% less energy and produces 97% fewer greenhouse gases compared to the standard form of aluminium, which makes it one of the most attractive metals for recycling. It further offers infinite recyclability as it is 100% recyclable, further driving the demand of Indian aluminium powder market. Major companies such as NALCO and Hindalco announced that they aimed to improve their aluminium recycling capacity by 15-20% by 2025, as a part of its broader sustainability goal. Such initiatives showcase a positive trend towards green aluminium powder in the market.

Aluminium powder is finding growing applications in the renewable energy sector through the development of solar panels, wind turbines, and battery storage systems, among others. Its favourable corrosion-resistant and lightweight properties make it appropriate for usage in these systems and aid the renewable energy goal of the country. India has set an ambitious target of 450 GW of renewable energy capacity by 2030 which is expected to fuel the demand for aluminium which can be used in the development of solar panel frames and have a positive impact on the Indian aluminium powder demand forecast. In March 2023, Tata Power announced that it had received an investment worth USD 486 million from a consortium by BlackRock Real Assets. For instance, Tata Power Renewable Energy Limited (TPREL) signed a Power Purchase Agreement (PPA) with Tata Motors for the development of a 12 MWp solar project at its Pune facility. Under this project, it aims to generate around 17.5 million units of electricity per year, which highlights the role of aluminium powder in reducing production costs.

Aluminium powder is finding rising growth in the aerospace and defence sectors. Efforts for the indigenisation of defence production are gaining an upward trend under the Make in India initiative, which is creating a flourishing landscape for aluminium powder, which can be used in fuel and explosives, and aiding the Indian aluminium powder demand growth. For instance, India's Defense Research and Development Organisation (DRDO) stated in August 2023 that it aims to use Indigenous materials in the production of defence materials. The defence budget of the country was INR 5.94 trillion in the fiscal year 2023-24 and a significant amount of it was allocated for the development of advanced materials such as aluminium powders in defence equipment and goods. Moreover, in February 2023, HAL (Hindustan Aeronautics Limited) announced that it aims to expand its manufacturing facility for aircraft components with the use of aluminium-based alloys, which can be often developed from aluminium powder.

Aluminium powder is widely used in the paints and coatings industry for producing metallic finishes, particularly in automotive, decorative, and industrial coatings. The growing demand for high-quality, durable coatings in industries such as automotive, construction, and packaging is driving the demand for aluminium powder in India and contributing to Indian aluminium powder market development.

Additive manufacturing (3D printing) is becoming a prominent application for aluminium powder in India, especially in industries like aerospace and automotive. The adoption of 3D printing technology for producing lightweight parts is increasing the demand for high-quality aluminium powder for this purpose.

The high energy consumption in the production of aluminium powder is hindering the market growth. The electricity prices in the country witnessed a surge for the industrial sector in 2022, which made the production of aluminium expensive. Several aluminium providers in the country were affected by this. For instance, NALCO (National Aluminium Company Limited) stated that the high energy costs reduced its profit margins by 18% year-on-year.

As per the Indian aluminium powder industry analysis, the Indian government has imposed strict environmental regulations to control the emission of greenhouse gases which can also affect some market players. For instance, Vedanta Aluminum had to temporarily shut down its operations at one of its smelting units due to environmental violations as per the Supreme Court of India. This led to a drop of 2.5% in its total production output.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Indian Aluminium Powder Market Report and Forecast 2026 to 2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Raw Material

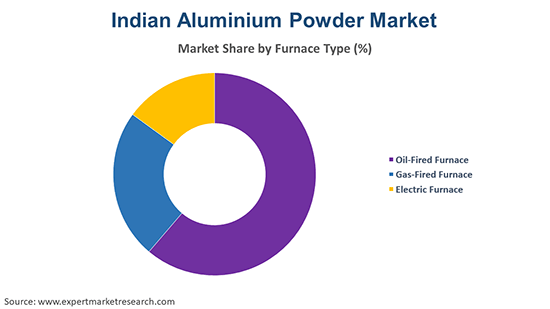

Market Breakup by Furnace Type

Market Breakup by Region

By Raw Material Insights

Currently, aluminium ingots are the most preferred material among manufacturers to produce aluminium powder as they offer high purity, typically above 99.5 %, of aluminium powder. As per the industry reports, India produced around 3.4 million tonnes of primary aluminium in 2022, and a large volume of it was converted into ingots for further use, which further contributed to Indian aluminium powder market value.

Moreover, NALCO announced in July 2023 that it aims to expand its aluminium ingot production through a significant investment of Rs 30,000 crores in the overall expansion and diversification of its capacity and operation in the next 6 to 7 years.

By Furnace Type Insights

Electric furnaces are expected to account for a significant Indian aluminium powder market share as a large number of aluminium powder production facilities rely on electric furnaces. These furnaces consume less energy compared to oil-fired and gas-fired furnaces and can be used in conjecture with renewable energy sources, making them more cost and energy-effective.

Market players such as Vedanta Aluminum aims to reduce its greenhouse gas emissions by 20% by the year 2025, which can create lucrative opportunities for electric furnace technology. Furthermore, the Ministry of Power launched financial incentives in 2023 which can support the transition from oil or gas-fired furnaces to electric furnaces for end-use sectors such as aluminium powders.

South India Aluminium Powder Market Trends

Region-wise, South India represents the largest market for the product, holding most of the industry share. This region is home to major market players such as Hindalco Industries and NALCO which have prominent aluminium manufacturing facilities in the region, including aluminium ingots and aluminium powder.

As per the Indian aluminium powder market dynamics and trends, Southern states account for around 30% of the country’s GDP, which can boost the production opportunities for aluminium powder. The region, specifically Bangalore, has established itself as a hub for the aerospace and defence sectors, which is further boosting the demand for aluminium powder in the production of aircraft components.

East India Aluminium Powder Market Growth

The Eastern region is also expected to witness substantial growth as it consists of states such as Odisha, Jharkhand, and Chhattisgarh which are known for their substantial aluminium production. The burgeoning presence of bauxite reserves and major aluminium production facilities in these states is boosting the regional Indian aluminium powder industry revenue.

NALCO, a company based in Odisha, also announced its plans to increase its aluminium smelting capacity and aluminium ingot production, which is the primary raw material used in aluminium powder production. This capacity expansion will eventually enhance the regional output in the coming years, establishing the region as a significant segment of the market.

The report gives a detailed analysis of the following key players in the market, covering their competitive landscape, capacity, and latest developments like mergers and acquisitions, investments, capacity expansion and plant turnarounds. Key players in the industry are increasingly investing in research and development activities, which is expected to aid the industry's growth over the forecast period. The players in the Indian aluminium powder market are further focusing their efforts on the sustainable development of aluminium powders from recycled metal scraps and industrial waste.

MEPCO company was established in India and has established itself as a major provider of non-ferrous metal powders such as aluminium, zinc, and copper, among others. It offers its product portfolio for various end-use sectors such as automotive, aerospace, and chemicals.

Based in Nagpur, India, it is one of the leading suppliers in the Indian aluminium powder market. The company offers a wide range of aluminium products such as aluminium powder, foils, and pastes for industrial sectors such as aerospace, explosives, and pyrotechnics, among others.

It is one of the renowned leaders in the aluminium sector, offering a wide range of aluminium-based products for both domestic and international markets. The company is a major supplier to the construction, coatings, and pyrotechnics sectors, among others.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Startups in the market are focused on enhancing developmental activities, specifically for enhancing the production technology of aluminium powder. Air-atomisation technology is being readily adopted by several companies as it improves the efficiency of yielding aluminium powder. Several startups in the market are also adopting 3D printing technology for the usage of aluminium powders in the aerospace, automotive, and healthcare sectors. Some companies are further investing in energy-efficient production techniques to reduce emissions during the production process, which can also contribute to the growth of the Indian aluminium powder industry.

Pioneer Powder (India) Pvt. Ltd.

The company mainly focuses on the production of aluminium powder for rising applications in explosives, pyrotechnics, and defence sectors. The company is known for delivering high-quality aluminium products to meet the rising demand from chemical manufacturing and metallurgical sectors as well as expanding its product line in the 3D printing area which can further aid Indian aluminium powder market opportunities.

Gravita India Ltd. (Aluminum Division)

This company is known for its recycling services and has recently entered the aluminium powder sector through the production of aluminium powder from recycled aluminium materials. It mainly offers its products for eco-friendly solutions such as specialised coatings, lightweight automotive, and energy storage, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate volume of 47769.04 Tons.

The Indian aluminium powder market is assessed to grow at a CAGR of 5.70% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach around 83156.54 Tons by 2035.

The major drivers of the market are rapid urbanisation, growth of the commercial mining explosions in the country, and rapid technological advancements.

The key trends guiding the growth of the aluminium powder market include the growing expenditure by the key players in research and development of aluminium powder and growing paints and coatings sector.

The major regions in the market are North India, South India, East India, and West India.

Aluminium ingots and aluminium scrap are the leading raw materials in the market.

The major furnace types in the market include oil-fired, gas-fired, and electric furnace.

The major players in the Indian aluminium powder market are The Metal Powder Company Limited, MMP Industries Ltd., and The Arasan Aluminium Industries (P) Ltd., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Raw Material |

|

| Breakup by Furnace Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share