Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India exotic flowers market size was valued at USD 32.17 Billion in 2025. The industry is expected to grow at a CAGR of 17.40% during the forecast period of 2026-2035 to reach a value of USD 160.00 Billion by 2035. The market is actively expanding as floriculture evolves from traditional cultivation into a dynamic, commercially driven industry.

The industry is being propelled by high production volumes, value-added services, technological integration, and growing global demand, all of which create new opportunities for farmers, entrepreneurs, and floriculture businesses. Currently, India cultivates flowers over 285,000 hectares, producing more than 2.2 million tons of loose flowers and around 950,000 tons of cut flowers annually. Beyond cultivation, the industry is actively diversifying into landscape design, greenhouse management, park and garden development, contracting, and maintenance services, adding multiple revenue streams. For example, in Thally village near Hosur in Krishnagiri district, Tamil Nadu, a dedicated “Centre for Cut Flowers” has been established. It leverages sensor-driven irrigation, greenhouse cultivation, and advanced post-harvest handling techniques. The facility is helping local farmers shift into high-value flowers such as roses, chrysanthemums, gerberas and orchids, and transforming the area into a premium floriculture hub.

A new exotic flower breed gaining popularity in India is the Dutch tulip, now cultivated in regions like Kashmir and Himachal Pradesh through advanced greenhouse techniques. Farmers are adopting imported bulbs and controlled-environment farming to ensure year-round production and vibrant color quality. Supported by state horticulture departments, these tulip varieties are increasingly sought after for luxury décor, weddings, and exports. The annual Tulip Festival in Srinagar showcases these exotic blooms, highlighting India’s expanding capacity for premium flower cultivation.

India is also strengthening its international presence, exporting 19,677.89 MT of exotic floriculture products worth INR 717.83 crore (86.63 million USD) in 2023–24 to markets such as the United States of America, Netherlands, United Arab Emirates, United Kingdom, Canada, and Malaysia. Technological interventions, including IT-enabled distribution, virtual marketplaces, cataloguing, branding, and quality assurance, are further driving efficiency, market reach, and profitability. By combining commercial expansion, innovation, and global integration, the market is actively transforming into a high-value, export-oriented, and technology-driven sector, generating income, employment, and sustainable growth offering significant opportunities in the India exotic flowers market.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

17.4%

Value in USD Billion

2026-2035

*this image is indicative*

| India Exotic Flowers Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 32.17 |

| Market Size 2035 | USD Billion | 160.00 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 17.40% |

| CAGR 2026-2035 - Market by Variety | Lavender | 22.3% |

| CAGR 2026-2035 - Market by Type | Cut Flowers | 20.6% |

| CAGR 2026-2035 - Market by Sector | Organized Sector | 21.1% |

| Market Share by Sector | Unorganized Sector | 72.3% |

India exotic flowers market growth is gaining momentum as the Clean Plant Programme (CPP), launched in August 2024, accelerates the production of virus-free, high-quality planting material. Backed by an investment of INR 1,765 crores, the initiative is enabling nurseries to adopt advanced propagation systems and improve plant health standards. By ensuring superior-quality flowers and stronger export readiness, the program is actively driving productivity, enhancing growers’ income potential, and positioning India as a competitive hub for premium exotic flower cultivation.

In the recent years, ongoing scientific research is transforming traditional floriculture. The successful blooming of Eustoma in Odisha by the National Botanical Research Institute (NBRI) in September 2025 demonstrates how polyhouse farming enables exotic varieties to thrive in Indian conditions. This initiative reduces import dependence and empowers farmers with high-yield opportunities, generating up to INR 2 lakh per acre per season. By expanding floriculture clusters, offering training, and supplying planting material, NBRI is driving sustainable livelihoods and fueling India exotic flowers market revenue.

The exotic flowers market is booming in India, as innovation and technology actively transform floriculture. In June 2023, initiatives like CSIR-CFTRI’s Freshness Keeper demonstrated how research meets industry, extending flower freshness, improving cultivation techniques, and creating value-added products to boost profitability. By helping farmers reduce waste and deliver premium blooms to markets, and integrating AI, automation, and sustainable practices, the sector is empowering growers, expanding supply chains, and meeting rising consumer demand. These dynamic efforts are propelling the market toward greater growth and global competitiveness.

India exotic flowers market dynamics are transforming through sustainable practices and streamlined supply chains. Woman-led startups like Hoovu are partnering with local farms, cutting delivery times to 12–24 hours, and sealing flowers to extend freshness. They are repurposing floral waste into value-added products, reducing environmental impact and creating new revenue streams. By boosting farmer income, minimizing losses, and promoting eco-friendly operations, such initiatives are actively strengthening the market, driving growth, and shaping a resilient, profitable, and sustainable floriculture ecosystem.

The Indian exotic flowers market is gaining momentum as farmers across the country embrace high-value floriculture, supported by modern techniques, better infrastructure, and government initiatives. Rising awareness of export potential and profitable cultivation is encouraging growers to diversify from traditional crops. In Meghalaya, this trend is exemplified by the state’s INR 240 crore floriculture mission, launched in August 2025, which equips farmers with resources and market access, aiming to generate INR 600 crore in returns and position the region as a rising hub for exotic flower production.

Read more about this report - REQUEST FREE SAMPLE COPY

The EMR’s report titled “India Exotic Flowers Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: Loose flowers continue to thrive on deep-rooted cultural demand, supported by consistent use in temples, festivals, and daily rituals. Farmers are capitalizing on short growth cycles and localized varieties, while government-backed floriculture clusters enhance productivity and quality. Meanwhile, cut flowers are gaining momentum through export-oriented cultivation, advanced greenhouse practices, and improved cold chain infrastructure, meeting rising domestic and global demand from gifting, décor, and hospitality sectors.

Market Breakup by Variety

Key Insight: Lotus and hibiscus are witnessing sustained demand in India exotic flowers market, supported by their deep cultural and decorative significance. In October 2025, the National Botanical Research Institute announced plans to introduce the premium ‘Namoh 108’ lotus variety for cultivation in Uttar Pradesh, boosting interest ahead of Diwali. Tulips and lavender are gaining popularity through climate-controlled farming and lifestyle décor trends, while orchids, carnations, lilies, and other premium blooms sustain momentum in luxury floral design and year-round gifting preferences.

Market Breakup by Sector

Key Insight: The organized sector is accelerating growth by integrating modern supply chains, professional bouquet designs, and retail partnerships, appealing to urban consumers and corporate clients seeking quality and consistency. Meanwhile, the unorganized sector continues to thrive on traditional markets, roadside vendors, and local fairs, driven by cultural demand, affordability, and wide regional reach. Together, these sectors sustain the exotic flowers market, balancing structured innovation with deep-rooted consumption patterns, and ensuring both premium and everyday flowers remain accessible across India.

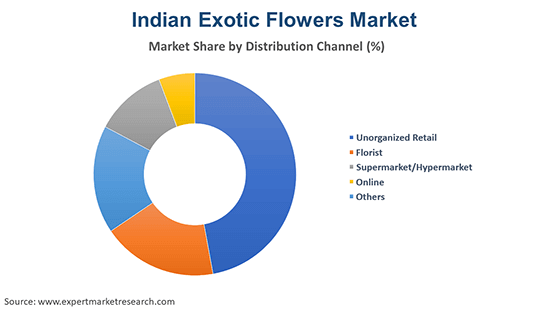

Market Breakup by Distribution Channel

Key Insight: Unorganized retail continues to cater to local demand through roadside stalls and weekly markets, leveraging convenience and cultural buying habits. Florists drive personalized and decorative sales, offering curated arrangements for events and rituals. Supermarkets and hypermarkets are expanding flower visibility with ready-to-buy bouquets, attracting urban shoppers seeking quality and convenience. In September 2025, Delhi-based OyeGifts launched its Diwali Special Express Gift Hampers with fresh flowers and same-day delivery, propelling the online gifting and floral retail category, thereby strengthening the India exotic flowers market growth.

Market Breakup by Cut Flowers Producing States

Key Insight: West Bengal drives cut flower production with its well-established rose and gladiolus farms, supported by skilled labor and favorable climatic conditions. Karnataka and Maharashtra enhance output through advanced polyhouse cultivation and export-oriented floriculture initiatives. Uttar Pradesh benefits from high-yield varieties and organized supply chains, while Orissa leverages emerging infrastructure to increase production of premium flowers. Other states contribute through specialized seasonal crops, collectively strengthening India’s cut flower market, meeting rising domestic demand, and expanding international trade opportunities.

Market Breakup by Loose Flowers Producing States

Key Insight: Tamil Nadu accounts for a significant share of loose flower cultivation, benefiting from favorable climate and traditional demand for daily rituals and festivals. Karnataka and Madhya Pradesh leverage fertile soils and strong floriculture support schemes, boosting consistent production. Mizoram is emerging as a key player with expanding export potential for exotic varieties, while Gujarat’s adoption of modern cultivation techniques enhances yield and quality. Other states contribute through niche and seasonal production, collectively driving growth in India’s loose flower market and supporting both domestic consumption and international trade.

By type, strong demand is observed for cut flowers

The cut flower segment is witnessing strong growth in India, driven by rising consumer demand for premium ornamental blooms, floriculture diversification, and adoption of high-value varieties. Innovation in breeding, propagation, and cultivation techniques is expanding both the quality and availability of cut flowers, enabling farmers and florists to meet evolving market needs. Companies like HilverdaFlorist, for example, launched their 2024 Gerbera and Cut Flower catalogues in September 2023, introducing over 40 new varieties and showcasing global best practices. Such initiatives actively enhance market offerings, strengthen supply chains, and contribute to revenue growth in the exotic cut flower sector.

| CAGR 2026-2035 - Market by | Type |

| Cut Flowers | 20.6% |

| Loose Flowers | XX% |

Loose flowers generate substantial revenue in the India exotic flowers industry, driven by expansion in production and cultivation practices. Increasing adoption of high-yield varieties, modern farming techniques, and efficient post-harvest management is enhancing both quality and output. This growth is actively enabling farmers to meet rising domestic and international demand, strengthening supply chains, and creating new revenue opportunities. By focusing on scalable and efficient production, the segment is driving profitability, supporting livelihoods, while fueling sustained market development.

By variety, lavender register remarkable market growth.

Lavender has emerged as a key revenue-generating category in exotic flowers market, driven by its high-value cultivation in regions like Bhaderwah, Jammu & Kashmir. In June 2023, under the CSIR-Aroma Mission, CSIR-IIIM supported over 2,500 farmers in adopting lavender farming, providing elite RRL-12 planting material, distillation units, and end-to-end training for cultivation, processing, and marketing. Farmers switching from maize to lavender saw incomes rise significantly, while the segment spurred women’s employment, entrepreneurship, and rural development, making lavender a profitable contributor to India’s exotic floriculture industry.

| CAGR 2026-2035 - Market by | Variety |

| Lavender | 22.3% |

| Tulips | 20.7% |

| Lotus | XX% |

| Hibiscus | XX% |

| Others | XX% |

Tulips are witnessing rising demand in India exotic flowers industry, driven by growing consumer preference for premium ornamental blooms and expanding domestic production. The CSIR-Indian Institute of Integrative Medicine (IIIM), Jammu, is spearheading tulip indigenization under the CSIR Floriculture Mission, reducing the country’s dependence on imports. The Bonera Field Station in Kashmir has scaled up production from 10,000 to over one lakh bulbs within two years, creating profitable opportunities for local farmers. This initiative aligns with the Viksit Bharat 2047 vision, fostering self-reliance, rural prosperity, and sustainable floriculture growth.

By sector, unorganized category to record significant sales

The unorganized sector generates substantial revenue in the India exotic flowers market from strong local demand and traditional consumption patterns. Roadside vendors, small florists, and itinerant sellers deliver fresh flowers for daily rituals, festivals, and community events, keeping the market active year-round. Farmers and small-scale sellers adapt quickly to changing consumer needs, manage supply efficiently, and operate with low investment, sustaining profitability. This direct, community-driven model keeps the unorganized sector vibrant, supports livelihoods, and continually drives growth across India’s floriculture landscape, reinforcing its cultural and economic relevance.

| CAGR 2026-2035 - Market by | Sector |

| Organized Sector | 21.1% |

| Unorganized Sector | XX% |

The organized sector of the India exotic flowers industry is expanding rapidly through structured retail channels and professional supply chains. Startups like La Fleur are bringing fresh, locally sourced bouquets to supermarkets, malls, and corporate clients, creating a consistent, quality-driven consumer experience. By directly sourcing from growers, maintaining cold-chain logistics, and offering pre-designed bouquets, these ventures reduce wastage and improve profitability. Strengthening the organized retail segment in this way formalizes the market, attracts new customers, and actively boosts India exotic flowers market value.

| 2025- Market Share by | Sector |

| Unorganized Sector | 72.3% |

| Organized Sector | XX% |

By distribution channel, unorganized retail register remarkable growth

Unorganized retail is fueling the exotic flowers market across India, bringing vibrant orchids, lilies, and tulips to local florists, event planners, and neighborhood shops with unmatched speed and flexibility. Its deep-rooted network ensures blooms reach buyers exactly when they are needed, responding instantly to seasonal spikes and festive demands. By keeping supply chains nimble and adaptable, these retail shops continuously boost the market, turning everyday flower purchases into a seamless experience for traditional consumers.

Meanwhile, the online platforms are revolutionizing the India exotic flowers market, delivering curated bouquets, rare varieties, and luxury floral experiences directly to doorsteps. Tech-savvy buyers engage through apps, social media, and subscription models, driving unprecedented growth. By blending convenience, personalization, and premium offerings, this segment ignites the market’s fastest expansion, redefining how consumers discover, purchase, and celebrate exotic blooms across the country.

By cut flower producing state, Maharashtra has emerged to be a hotspot

Maharashtra’s cut flower production is witnessing significant growth, driven by favorable climate, modern farming techniques, and high-yield varieties. Key regions like Pune, Solapur, Nashik, and Aurangabad offer ideal conditions for year-round cultivation of roses and other commercial cut flowers. Farmers are increasingly adopting polyhouses, advanced irrigation, and post-harvest care to improve bloom quality and shelf life. These improvements ensure steady supply to domestic and international markets, enhance farmer incomes, and strengthen Maharashtra’s position as a major hub for India’s cut flower industry.

Uttar Pradesh has emerged as a powerhouse for cut flower production in the India exotic flowers market, driven by fertile alluvial soils, favorable subtropical climate, and abundant irrigation facilities. Farmers increasingly adopt modern cultivation techniques, including hybrid varieties, polyhouse farming, and mechanized post-harvest handling, enhancing yield and flower quality. Government schemes and subsidies for floriculture inputs, along with robust local and national market linkages, further incentivize production. Rising domestic demand for fresh cut flowers in weddings, festivals, and corporate events positions Uttar Pradesh as a key contributor to India’s cut flower supply chain.

By loose flower producing state, Mizoram continue to lead market growth

Mizoram is witnessing a surge in loose flower production, driven by growing export opportunities. The state marked a key milestone in March 2025 by exporting its first shipment of Anthurium flowers to Singapore, highlighting its potential in international markets. Government support, combined with favorable agro-climatic conditions, is enabling farmers to scale cultivation, improve quality, and access global buyers. This momentum is strengthening the state’s floriculture sector, boosting farmer incomes, and positioning Mizoram as a rising hub for high-value exotic flowers in the India exotic flowers market landscape.

The surge in loose flower production in Tamil Nadu is being driven primarily by rising domestic demand from temples, festivals, and everyday rituals. Farmers are responding to this consistent and culturally rooted demand by expanding cultivation of jasmine, marigold, hibiscus, and roses. The steady market demand encourages investment in modern farming techniques and efficient supply chains, enabling higher yields and better quality, while ensuring that Tamil Nadu remains a key hub for meeting the country’s everyday floral needs.

Leading India exotic flowers market players, such as Ferns N Petals, May Flower, ArenaFlowers and Phoolwala, all of whom are elevating premium-variety offerings to meet rising gifting and décor demand. These firms are investing in superior logistics and inventory networks to guarantee freshness of rare blooms, while simultaneously expanding online retail platforms and metropolitan-city supply chains. Many are building partnerships with specialised growers of orchids, lilies and other exotic varieties to secure exclusive product lines and add value through longer vase life, distinctive colours and seasonal rarity.

In parallel, producers and export-oriented exotic flowers companies such as Karuturi Global Limited and Soex Flora are strengthening their cultivation and post-harvest infrastructure by deploying greenhouse systems, controlled-environment farms and cold-chain logistics. These strategies reduce the spoilage of high value cut flowers and enable year-round supply of exotic stems. They are also leveraging sustainability credentials, renewable energy, organic fertilizers, minimal packaging, to appeal to niche export markets and domestic premium consumers alike, thus positioning themselves for both volume growth and brand differentiation.

Founded in 1994 and headquartered in New Delhi, Ferns N Petals has blossomed into India’s most iconic floral and gifting brand. From boutique stores to a powerful online presence, it connects emotions through petals across cities and continents. Constantly evolving, the brand now curates an exquisite range of exotic blooms and luxury arrangements that redefine modern gifting experiences.

Established in 1999 in Delhi NCR, Phoolwala has earned a loyal following for making every celebration brighter with timely, fresh flower deliveries. Its strong logistics and same-day services ensure smiles reach doorsteps on time. By partnering with skilled local floriculturists, the brand continues to offer rare and exotic blooms that add elegance to personal and corporate gifting, further supporting the India exotic flowers market.

Launched in 2008 and based in New Delhi, ArenaFlowers stands out for its refined sense of floral artistry and digital innovation. It merges modern e-commerce efficiency with the timeless beauty of handcrafted arrangements. With a focus on sustainable sourcing and exotic varieties, the company delivers freshness, creativity, and care in every bouquet across India.

Headquartered in Mumbai and established in 1980, May Flower has long been synonymous with sophistication and floral luxury. Specialising in bespoke arrangements for elite events and corporate spaces, the brand infuses art into every design. Its curated selection of imported exotic flowers and elegant packaging continues to charm connoisseurs who appreciate the finer details of floral craftsmanship.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the industry include Elegant Floriculture & Agrotech (I) Limited, Soex Flora, and other local brands.

Explore the latest trends shaping the India Exotic Flowers Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Get a free sample report or contact our team for customized consultation on India exotic flowers market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 17.40% between 2026 and 2035.

Key strategies driving the market include sustainable cultivation practices, advanced greenhouse farming, expansion of online retail channels, export-oriented production, and partnerships between growers and floriculture brands to ensure freshness and quality.

The key trends guiding the market growth include the increasing demand for exotic flowers for religious occasions, and the surging use of exotic flowers in decorations.

The major states producing cut flowers are West Bengal, Karnataka, Orissa, Uttar Pradesh, and Maharashtra, among others, whereas the major producers of loose flowers are Tamil Nadu, Karnataka, Madhya Pradesh, Mizoram, and Gujarat, among others.

Loose flowers and cut flowers are the major types of exotic flowers.

Significant varieties of Indian exotic flowers include lotus, hibiscus, tulips, lavender, orchids, carnations, lily, and daffodils, among others.

Organised sector and unorganised sector are the different sectors considered in the market.

The significant distribution channels in the market include unorganised retail, florist, supermarket/hypermarket, and online, among others.

The key players in the market include Ferns N Petals, Phoolwala, ArenaFlowers, May Flower, Elegant Floriculture & Agrotech (I) Limited, Soex Flora, among others.

The inadequate cold chain and logistics infrastructure, and harsh weather conditions impacting flower farming are the key challenges in the industry.

In 2025, the market reached an approximate value of USD 32.17 Billion.

Maharashtra accounts for the largest share of cut flower production in India, supported by favorable climate, modern farming techniques, and strong supply chain infrastructure.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Variety |

|

| Breakup by Sector |

|

| Breakup by Distribution Channel |

|

| Indian Cut Flowers Market Breakup by Producing States |

|

| Indian Loose Flowers Market Breakup by Producing States |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share