Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global industrial hemp market size USD 7138.42 Million in 2025. The industry is expected to grow at a CAGR of 19.00% during the forecast period of 2026-2035 to reach a value of USD 40651.04 Million by 2035.

The industrial hemp industry is witnessing a marked resurgence, driven by legal reforms, advanced genetics, and shifting consumer preferences. Governments worldwide are relaxing restrictions to tap into hemp's industrial potential. For example, the United States Department of Agriculture, under the 2018 Farm Bill, legalised hemp cultivation, giving rise to over 21,400 registered growers by 2021. In Europe, the EU Hemp Strategy supports low-THC hemp farming under CAP subsidies, helping scale production in France and the Netherlands.

Notably, modern cultivars with improved fibre yield and pest resistance are reshaping profitability, boosting the industrial hemp market revenue. In India, the Uttarakhand government has sanctioned industrial hemp cultivation for commercial use, and private players are collaborating with CSIR-IHBT on bio-based textile R&D. The market is poised to grow steadily, particularly across functional nutrition, bio-composites, and green building materials. With regulatory clarity improving globally, the sector is gaining investment traction from food, textile, and construction multinationals. Furthermore, international agencies are now funding carbon sequestration projects using hemp in degraded soils, particularly across Eastern Europe and sub-Saharan Africa. These efforts are not only restoring land productivity but also offering rural employment. Meanwhile, smart farming innovations, like drone-led seed monitoring and blockchain-integrated crop tracking, are optimising yields and transparency, accelerating the demand for industrial hemp. Governments, recognising hemp’s dual benefit for climate and economy, are slowly incorporating it into sustainable agriculture strategies. The industry’s progress is being bolstered by such ecosystem-level alignment that blends technology, policy, and circular value chains.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

19%

Value in USD Million

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

| Global Industrial Hemp Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | 7138.42 |

| Market Size 2035 | USD Million | 40651.04 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 19.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 21.9% |

| CAGR 2026-2035 - Market by Country | India | 24.5% |

| CAGR 2026-2035 - Market by Country | China | 21.0% |

| CAGR 2026-2035 - Market by Source | Organic | 20.9% |

| CAGR 2026-2035 - Market by Product Type | CBD Hemp Oil | 21.5% |

| Market Share by Country 2025 | Japan | 4.2% |

Hempcrete, a lightweight and carbon-negative building material, is fast becoming a sustainable alternative to cement. Recently, hemp building materials were officially approved in the model U.S. residential building code under the International Code Council. Canada's JustBioFiber is piloting modular hempcrete panels for cold regions. As regulatory support for net-zero construction strengthens, firms are investing in hemp-based insulation and wall systems. Such developments are propelling industrial hemp demand from construction players looking to meet ESG goals while reducing material emissions.

Automotive OEMs are increasingly turning to hemp fibre composites for lightweighting vehicles, boosting the industrial hemp market dynamics. BMW and Mercedes-Benz already use hemp-reinforced door panels and dashboards. The EU’s LIFE Programme is backing automotive-grade hemp composite projects, particularly in Germany and Italy. These bioplastics reduce vehicular weight and improve fuel efficiency without compromising strength. With EV mandates tightening, especially in Europe and California, such innovations are positioning industrial hemp as a critical component for next-gen mobility solutions.

Hemp-derived protein, milk, and seed snacks are entering mainstream consumer diets as per the industrial hemp market report. Canadian firm Manitoba Harvest expanded its hemp food portfolio, with new protein-fortified yoghurts and cold-pressed seed bars. In China, several provinces offer subsidies for hemp seed processing equipment, pushing local brands like Yunnan Lvke Foods to roll out hemp protein noodles. In the United States, hemp-infused energy drinks are gaining shelf presence. The rise of plant-based and allergen-free trends is unlocking new B2B opportunities in private-label food manufacturing and HoReCa sectors.

Industrial hemp is being explored as a feedstock for second-generation biofuels and SAFs, accelerating the industrial hemp market value. Curtin University has invested USD 5.2 billion to convert biomass into aviation-grade biofuel, which also included hemp. Meanwhile, the Indian Institute of Petroleum is conducting pilot trials on hemp bio-oil blends for rural generators. IATA estimates that SAF should contribute around 65% of the emissions reductions needed in 2050. Industrial hemp is also being used in decarbonising aviation is being re-evaluated with renewed urgency.

The skincare and personal care sector is shifting towards hemp-derived cannabinoids and seed oils for their anti-inflammatory and omega-rich properties, accelerating the industrial hemp market development. For example, L'Oréal uses cold-pressed hemp seed oil, targeting young urban users. As clean beauty expands, hemp ingredients are being used in serums, balms, and shampoos, disrupting legacy formulations across APAC and North American brands. Korean K-beauty firms are also infusing hemp seed extracts in toners and cleansers, focusing on acne-prone and sensitive skin categories, fuelling demand for high-purity hemp derivatives.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Industrial Hemp Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Source

Key Insight: The industrial hemp market is broadly classified into conventional and organic sources. Conventional hemp leads the market due to its robust output per acre and wide application in legacy industrial sectors. However, organic hemp is expanding rapidly, attracting demand from niche sectors prioritising quality and traceability. The two segments are evolving with distinct focus areas: conventional for mass-scale applications and organic for value-added wellness and food verticals. Regional differentiation is also shaping supply chains, with China and India favour conventional source, while Europe and parts of North America increasingly shift towards certified organic cultivation for B2B processing.

Market Breakup by Product

Key Insight: The product landscape of the industrial hemp market includes hemp seed, fibre (bast), seed oil, CBD oil, and shivs (hurd). Hemp seed dominates the market with strong demand across functional food and feed industries. CBD hemp oil, however, is scaling fast, driven by health, beauty, and pharma convergence. Hemp fibre supports automotive, and textile uses, while hemp shivs are emerging in insulation and packaging. Hemp seed oil continues to appeal to vegan and dermatological brands. Each subsegment is being defined by its technical value and regulatory acceptance, creating distinct investment and application pathways in the market.

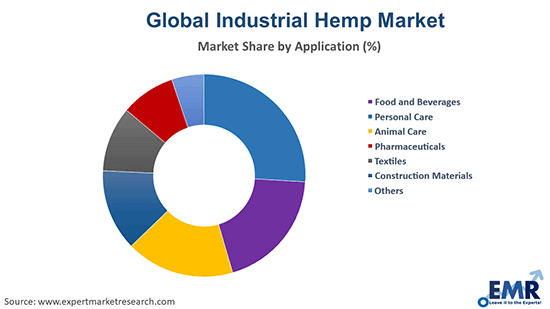

Market Breakup by Application

Key Insight: Industrial hemp applications span construction, personal care, food and beverages, textiles, pharmaceuticals, and animal care, among others. Construction dominates the market due to its eco-credentials and structural adaptability. Personal care is growing fast owing to conscious beauty and wellness trends. Food and beverages benefit from hemp's nutritional profile, while pharma taps into cannabinoids. Hemp textiles are returning in sustainable fashion circles, while the automotive and furniture sectors focus on lightweight bio-composites. Each application is shaped by end-user awareness, technology innovation, and regulatory shifts, offering unique commercial potentials across segments.

Market Breakup by Region

Key Insight: The industrial hemp market is largely dominated by North America due to legal support and diversified applications. Asia Pacific is accelerating at the fastest pace, benefiting from policy reform and agro-industrial capability. Europe remains strong in fibre and construction innovation, backed by the EU’s sustainable materials agenda. Latin America and the Middle East are emerging players, focusing on organic and arid-climate hemp varieties. Regional dynamics are also shaping regulatory standards, trade flows, and certification norms, influencing how supply chains and R&D ecosystems evolve across different geographies.

By Source, the Conventional Segment Accounts for the Largest Share of the Market

Conventional hemp continues to dominate the industrial hemp industry revenue, especially through textiles, construction, and automotive composites. This subsegment benefits from lower input costs, established farming practices, and higher acreage. In Germany, over 900 producers are growing conventional hemp on 6,000 hectares. The scalability of conventional hemp, alongside tolerance to variable climate conditions, supports its growth in industrial applications. Processing infrastructure is also more aligned with this subsegment, making it more viable for bulk manufacturing and long-term contracts.

Organic hemp is the fastest-growing subsegment in the industrial hemp market, fuelled by clean-label demands from nutraceutical, personal care, and food sectors. EU-based processors like Hempoint and Dutch Harvest reported a significant rise in organic hemp orders. The USDA’s National Organic Programme (NOP) has formalised compliance for hemp growers, making certification accessible. Startups like Greenfield Botanics are sourcing exclusive organic hemp for CBD extraction, citing premium pricing and export-ready certification. As awareness on chemical residues increases, organic hemp is carving a niche across wellness-focused industries, particularly in premium personal care and vegan dietary products.

By Product, Hemp Seed Registers the Dominant Share of the Market

Hemp seeds represent the dominant product subsegment in the industrial hemp market, with rising application in superfoods, granola, protein powders, and livestock feed. Canada remains a major exporter, with 5,800 MT of hemp cake globally, valued at USD 6.5 million, channelled towards the United States and Asian markets. Food processors value hemp seed for its high omega-3, protein, and fibre content. Additionally, several animal feed trials in Europe have validated hemp seed’s benefits in improving poultry and aquaculture growth, leading to its approval under EU feed regulations.

CBD hemp oil is the fastest growing subsegment in the industrial hemp market owing to its rising adoption across wellness, mental health, and OTC pharma applications. Companies like Jazz Pharmaceuticals and Charlotte’s Web are scaling up CBD production facilities, targeting pain relief and sleep support categories. South Korea’s MFDS has begun granting permits for CBD in skincare and functional beverages. With increasing consumer interest in alternative therapies, this subsegment is attracting pharma and wellness investment at an unprecedented pace.

By Application, Construction Materials Secures the Bigger Share of the Market

Construction materials remain the dominant application for the global market for industrial hemp due to rapid urbanisation and the push for sustainable alternatives to concrete and insulation. Governments are encouraging hempcrete housing in low-carbon zoning plans. In Europe, hemp fibreboard and plaster are being integrated into public housing under the Horizon 2030 programme. Private players are now investing in automated mixing and spraying tools to streamline hemp-based construction. The subsegment benefits from high thermal and acoustic insulation properties, aligning with net-zero and green building certification targets.

According to the industrial hemp market report, the personal care segment is the fastest-growing category due to hemp’s skin-friendly, antioxidant, and anti-inflammatory attributes. Startups like Apothecanna and India’s Boheco Life are pioneering hemp serums, body oils, and scalp treatments. In Japan, hemp extracts are being blended with fermented botanicals for anti-ageing products. Multinationals such as The Body Shop and Kiehl’s are investing in proprietary blends with hemp oil. Consumer sentiment around natural formulations is also pushing formulators towards full-spectrum extracts. E-commerce and influencer-led skincare trends are fuelling B2B ingredient partnerships, especially in the D2C clean beauty ecosystem.

By Region, North America Secures the Dominant Position of the Market

North America leads the global industrial hemp market, driven by clear federal frameworks and growing cross-sectoral demand. The United States Farm Bill 2018 legalised hemp cultivation federally, triggering a surge in acreage and downstream investment. Canada remains a global leader in hemp food exports and CBD product innovation. State-specific grants, especially in Colorado and Kentucky, have fuelled farm-to-factory supply chains. Venture capital is increasingly entering the space, supporting tech-driven processing plants. The region also boasts a robust research ecosystem, with institutions like Cornell and Alberta University working on seed genetics, pest control, and new industrial uses.

| CAGR 2026-2035 - Market by | Country |

| India | 24.5% |

| China | 21.0% |

| Canada | 18.4% |

| UK | 17.4% |

| Italy | 13.3% |

| USA | XX% |

| Germany | XX% |

| France | XX% |

| Japan | 13.1% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

The fast-paced growth of the Asia Pacific industrial hemp market is driven by China’s manufacturing edge and India’s policy opening. China holds the largest cultivation area globally, with Heilongjiang and Yunnan focusing on bast fibre and seeds, respectively. India’s state governments are issuing industrial hemp licences, encouraging startups in textiles, nutraceuticals, and biomaterials. Australia and Thailand are expanding organic hemp output, while South Korea is investing in CBD R&D and beauty exports. This regional growth is underpinned by low-cost production, skilled agro-processing, and trade-friendly pacts with EU and North American importers.

The industrial hemp market players like Ecofibre, HempFlax, and Aurora Cannabis are leveraging proprietary genetics and sustainable farming contracts. Startups are targeting value-chain gaps, like Green Boom recycles hemp waste into oil-spill absorbents. Partnerships between pharma companies and organic hemp farmers are growing, especially in EU and Japan.

Tech-driven industrial hemp companies are introducing mobile decorticators and AI-based strain selection tools. Investment in bio-refineries and blockchain-backed traceability platforms by private players, are increasing in numbers. Construction-grade hempcrete, automotive bio-composites, CBD innovations, personal care formulations, and SAF feedstock applications are some of the key trends that firms are currently focusing on. M&A activity is also increasing, particularly in CBD wellness and eco-construction verticals, as firms aim to control input-to-retail pipelines. Innovation in formulation, compliance, and end-use tailoring remains central.

Founded in 2008, and established in the United States, Terra Tech Corp. had permanently merged with the Unrivaled brand in 2021. Unrivaled is a leading cannabis operator from various states and is also a parent company of multiple dominant cannabis brands spanning consumer products, cultivation, distribution, and retail. The brand markets itself by focusing on customer experience, product innovation, and organic brand building. The Unrivaled brand has currently set its bases at locations such as California, Oregon, and Nevada, and their brands are licensed in Arizona and Oklahoma.

Hemp, Inc., established in the United States, is a publicly traded company founded to provide eco-friendly solutions that help make the world a better place to live in. The company focuses on helping the environment by ensuring that its products remain eco-friendly, healthy, and replace the petroleum-based products. Hemp, Inc. has been a pioneer of the industrial hemp market worldwide even though it is yet to be legalised in several countries, including the United States of America.

Founded in 1993, HempFlax, one of the leading players in the industry, was founded with a singular aim of restoring the age-old crop back to its glory, which they’ve been successful in doing so, thereby creating a high demand for high-quality hemp products. They have their cultivation plants established at multiple locations, including the Netherlands, Germany, and Romania, and their factories have been setup at places such as Oude Pekela, Netherlands, and Alba Lulia, Romania.

Founded in 1998, Hemp Oil Canada is Canada’s first hemp-exclusive seed processing unit and since then it has been able to establish itself among the market leaders globally. The company focuses on expanding the availability of hemp foods and building new markets to support its cause. The company’s export has now been established globally from their two state-of-art processing facility in Manitoba, Canada, and currently are the only available North American grown Hemp product suppliers for their customers.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are Hemp Growers Cooperative Ltd., CBD Biotechnology Co., Botanical Genetics, LLC, Marijuana Company of America Inc., HempMeds Brasil, American Cannabis Company, Inc., Industrial Hemp Manufacturing, LLC, American Hemp, Boring Hemp Company, Plains Industrial Hemp Processing Ltd., Ecofiber Industries Operations, Valley Bio Limited, Manitoba Harvest Hemp Foods, Bombay Hemp Company Private Limit, HPS Food & Ingredients Inc., among others.

Explore the latest trends shaping the Industrial Hemp Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on Industrial Hemp Market trends 2026.

United States Hemp Protein Market

Hemp Clothing Market

Hemp Milk Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the industrial hemp market reached an approximate value of USD 7138.42 Million.

The market is projected to grow at a CAGR of 19.00% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 40651.04 Million by 2035.

Key strategies driving the market include investing in traceability systems, forming agri-tech partnerships, diversifying end-use verticals, scaling organic certifications, and localising processing infrastructure.

The key trends propelling the market development include rising eco-consciousness, growing product awareness, evolving government policies regarding the use of industrial hemp in several countries, and the increasing demand for hemp-based products.

The major regions in the market are North America, Europe, Asia Pacific and LAMEA.

The major sources of industrial hemp in the market are conventional and organic.

The major product types in the market are hemp seed, fiber (bast), shivs (hurd), hemp seed oil, and CBD hemp oil.

The significant applications of industrial hemp include food and beverages, personal care, animal care, pharmaceuticals, textiles, construction materials, automotive, furniture, biofuel, and paper, among others.

The key market players are Parkland Industrial Hemp Growers Cooperative Ltd., CBD Biotechnology Co., Botanical Genetics, LLC, Marijuana Company of America Inc., HempMeds Brasil, Terra Tech Corp., American Cannabis Company, Inc., HempFlax B.V., Industrial Hemp Manufacturing, LLC, American Hemp, Hemp, Inc., Boring Hemp Company, Plains Industrial Hemp Processing Ltd., Ecofiber Industries Operations, Valley Bio Limited, Manitoba Harvest Hemp Foods, Bombay Hemp Company Private Limit, HPS Food & Ingredients Inc., and Unrivaled Brands, Inc, among others.

The fiber segment accounted for the largest share in the industrial hemp market due to its wide applications in textiles, bioplastics, and composites.

North America is projected to account for the largest share of the industrial hemp market due to favorable regulations, increasing investments, and high demand for hemp-based products.

The key challenges are lack of uniform regulation, high certification costs, and limited processing infrastructure.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Source |

|

| Breakup by Product |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share