Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

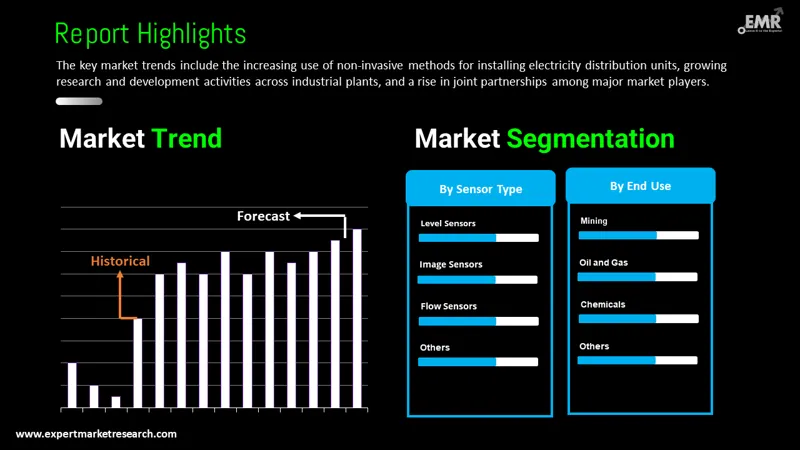

The global industrial sensors market size is projected to grow at a CAGR of 9.30% between 2026 and 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

9.3%

2026-2035

*this image is indicative*

| Region/Industry | Value | Year |

| Total Installed Energy Capacity of India | 412 thousand megawatts | 2023 |

| Revenue of Top 40 Mining Companies | USD 943 billion | 2022 |

| Electronic Industry | USD 1.7 trillion | 2022 |

| US Manufacturing Industry | USD 2.3 trillion | 2022 |

| US Chemical Manufacturing | USD 64 billion | 2022 |

| US Consumer Electronics Manufacturing | USD 738 billion | 2022 |

| China Manufacturing Industry | USD 2.01 trillion | 2022 |

Industrial sensors are devices used in industrial automation and they play a crucial role in modern industrial processes, enabling the detection, processing, analysis, and measurement of various parameters such as position, temperature, displacement, and motion in production sites. These sensors are essential for making products highly automatic, ultimately contributing to improved efficiency and cost savings in industrial operations.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Industrial sensors come in various types, including proximity sensors, temperature sensors, pressure sensors, and vibration sensors and they are designed to perform in extreme conditions, such as high or low temperatures, vibrations, and high humidity. The growth of the industrial sensors market is being driven by several factors, including the increasing adoption of Industry 4.0, the trend of industrial automation, and the need for predictive maintenance in various industries.

Advancements in sensor technologies, rising demand for smart sensors, and growing focus on safety regulations are boosting the market growth

| Date | Company | Announcement |

| April 2023 | Superior Sensor Technology | Announced two latest pressure sensor families suited to mid-pressure range applications |

| April 2023 | Siemens Smart Infrastructure | Introduced a new range of sensor bushing devices to connect buildings, industries, and energy systems |

| June 2022 | SiLC Technologies | Partnered with Cloud Light to carry out mass manufacturing of SiLC’s Eyeonic Vision Sensors, which enhances LiDAR performance by offering precise depth, prompt velocity, and dual-polarisation intensity. |

| February 2022 | Honeywell International Inc. | Launched an Indoor Air Quality (IAQ) monitor to notify building operators and owners of potential problems to improve IAQ and lower the likelihood of airborne contaminant transmission. |

| Trends | Impact |

| Increasing demand for smart and wireless sensors | Smart and wireless sensors offer advantages such as lower installation and maintenance costs, higher accuracy and reliability, and better integration with IoT platforms. This trend is expected to boost the industrial sensors market growth, especially in sectors such as manufacturing, energy, and healthcare. |

| Growing adoption of industrial IoT and Industry 4.0 | Industrial IoT and Industry 4.0 enable the digital transformation of industrial processes, enhancing productivity, efficiency, and quality. Sensors are essential components of these technologies, as they collect and transmit data from machines, equipment, and environments. This trend is expected to increase the demand for industrial sensors in various industrial applications. |

| Rising focus on environmental and safety regulations | Environmental and safety regulations impose stricter standards and requirements for industrial operations, such as emission control, waste management, and occupational health. Sensors can help monitor and comply with these regulations, by measuring parameters such as temperature, pressure, humidity, gas, and vibration. This trend is expected to drive the industrial sensors market expansion. |

| Advancements in sensor technologies and materials | Sensor technologies and materials are constantly evolving, offering improved performance, functionality, and durability. For example, nanosensors, biosensors, and optical sensors can detect and measure various physical, chemical, and biological phenomena at a nanoscale level. This trend is expected to create new market opportunities. |

To improve operational effectiveness and lower maintenance costs, manufacturing services are integrating smart and wireless sensors in a variety of ways. These sensors are used all along the supply chain to keep an eye on the state of the machinery. They can monitor a wide range of parameters, including weight, temperature, speed, and operational failures as well as changes in operation, object movement, and valve status. Smart sensors are also capable of tracking oxygen levels and the heart rate of employees to ensure their safety and well-being.

Additionally, the integration of smart sensors enables the automation of logistics industry by using GPS for tracking the fleet’s location. These factors are indicative that the industrial sensors market outlook in the forecast period will be experiencing an upward trajectory.

The use of wireless sensors in predictive maintenance enables the detection of wear, bearing misalignments, imbalances, and other deficiencies that lead to machine failures and unexpected stops in the production line. In addition, electronics sector continues to drive innovation, demanding smaller, more energy-efficient sensors to support the industrial sensors market development in context of smart devices.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Global Industrial Sensors Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Sensor Type

Market Breakup by End Use

Market Breakup by Region

Manufacturing industry is expected to hold a significant market share due to wide adoption of smart sensors for predictive maintenance

The manufacturing industry is anticipated to lead the industrial sensors market share in the forecast period, followed by the pharmaceutical and mining industries. The rising emphasis on quality control in manufacturing has led to increased demand for industrial sensors. Furthermore, the adoption of IoT sensors in manufacturing facilities has facilitated remote plant monitoring, enhanced worker safety, and reduced maintenance costs through early failure detection. The ongoing transition to Industry 4.0 and the increasing prevalence of factory automation have further heightened the importance of industrial sensors in the manufacturing sector.

On the other hand, use of industrial sensors in the pharmaceutical industry leads to enhanced product safety and improved environmental monitoring. The leakage of dangerous liquids or gases, and equipment failure can be reduced by introducing a network of connected devices with monitoring sensors, such as smoke and temperature sensors.

Furthermore, the utilisation of industrial sensors in the mining industry also offers a multitude of benefits, aiding the industrial sensors market development. By deploying IoT sensors in mining equipment, crucial data regarding machinery health, operational conditions, temperature, contamination levels, fluid levels, and vibration intensity can be obtained, enabling predictive maintenance to ensure worker safety and reduce maintenance costs.

Pressure sensors are in high demand across a wide range of domains, such as transport, energy, and manufacturing

Sensors enable monitoring and analysis of the different types of changes that take place on an industrial manufacturing site. Different types of industrial sensors are being employed across various end-uses, such as to sense pressure, temperature, infrared radiation, level, proximity, light, and smoke.

A pressure sensor is employed in different types of industrial automation settings, including water conservancy and hydropower, intelligent buildings, railway transportation, aerospace, production automation, petrochemical, military, power, oil wells, machine tools, shipbuilding, pipelines, and others. Applications across such a wide range of domains are expected to drive the industrial sensors market.

Temperature sensors, including infrared sensors, are extensively utilised across various industries. These sensors are particularly employed in domains such as medicine, military, space technology, and environmental engineering. Temperature sensors are valued for their ability to measure temperature without contact, making them suitable for applications where quick, safe, and non-invasive temperature measurement is required, such as in industrial automation processes, gas analysis, and environmental monitoring. In addition, infrared sensors are used for proximity detection, night vision, and item counting. They offer advantages such as non-contact measurement and fast response, making them a popular choice in industrial production processes. These factors can increase temperature sensors market size in the forecast period.

Furthermore, as per industrial sensors market report, smoke sensors are used in HVAC, construction site monitoring, and industrial units where chances of gas leakage and fire are high. Level sensors are chiefly employed in automobile and manufacturing segments, and other applications include household appliances such as ice makers in the refrigerator and washing machines. Proximity sensors help detect displacement of objects and are employed extensively in aviation, aerospace, and industrial domains. These sensors also find applications in restaurants, hotels, automatic doors, garages, and automatic hot air blowers. Proximity sensors are also used in security and anti-theft solutions in places that store valuable items, such as museums and vaults. These industrial sensors and their wide employment have collectively contributed to increase the industrial sensors market value.

Asia Pacific is one of the prominent regions due to the rapid industrialisation in emerging economies

Asia Pacific industrial sensors market is projected to maintain its dominance due to rapid industrialisation and urbanisation in emerging economies such as India, Japan, China, and South Korea, which are investing heavily in the development of smart manufacturing, smart cities, and smart transportation. Moreover, the presence of major industrial sensor manufacturers and suppliers in this region, such as Omron Corporation, Panasonic Corporation, Keyence Corporation, and Honeywell International Inc., also contributes to the market growth.

North America is anticipated to see substantial growth in the industrial sensors market over the course of the forecast period. This is due to the growing use of cutting-edge technologies like artificial intelligence, machine learning, cloud computing, and big data analytics across a range of industrial sectors, including automotive, aerospace and defence, chemical, and pharmaceutical. The presence of key players such as Rockwell Automation Inc., Emerson Electric Co., Sensata Technologies Inc., and Texas Instruments Inc., as well as the supportive government policies and initiatives for promoting industrial innovation and digital transformation, also boost the market growth in this region.

Europe is another important region as per, sensors market overview. The growth in this region is driven by the increasing demand for industrial sensors in various end-use industries, such as food and beverage, automotive, metal and mining, power and energy. Germany, France, the UK, and Italy are the major countries contributing to the industrial sensors market growth in this region.

Market players are engaged in growth strategies, such as expanding their product offerings, pursuing mergers and acquisitions, and forming partnerships

| Company | Year Founded | Headquarters | Product Portfolio |

| Rockwell Automation, Inc. | 1903 | Wisconsin, United States | Industrial automation power, control, and information systems |

| Honeywell International Inc. | 1906 | North Carolina, United States | Aerospace products and services, building technologies, and safety and productivity solutions |

| Texas Instruments Incorporated | 1930 | Texas, United States | Semiconductors and integrated circuits for various applications |

| Siemens AG | 1847 | Munich, Germany | Industrial automation and digitalisation technologies for various industries |

Other key players in the global industrial sensors market include Omega Engineering, Inc., Microchip Technology Inc, Panasonic Industry Co., Ltd., ams-OSRAM AG, STMicroelectronics International N.V., Renesas Electronics Corporation, Infineon Technologies AG, and TE Connectivity Ltd., among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is expected to grow at a CAGR of 9.30% between 2026 and 2035.

The major drivers of the market include the increasing application of the product in oil and gas industry, growing expansion of the pharmaceutical sector, and rapid industrialisation across the emerging economies of the world.

Key trends aiding the industrial sensors market expansion include the rising application of the product in non-invasive installation of electricity distribution units and growing research and development activities across industrial plants.

Major regions in the market report are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The increasing application of smart sensors across the manufacturing sector is a major reason for the flourishing demand for the product in this industry. In addition to this, industrial sensors provide information about energy consumption, humidity, and output of production, among others.

The different end-uses considered in the market are automotive, oil and gas, pharmaceuticals, chemicals, manufacturing, mining, and energy and power, among others.

Oil and gas industry is the most lucrative end-user of industrial sensors market due to the heightened application of the product in this industry for equipment monitoring and preparedness against unforeseen disruptions.

Pressure sensors, position sensors, level sensors, image sensors, temperature sensors, humidity and moisture sensors, and flow sensors are the different segments based on sensor type.

Position sensors is one of the most used sensors across the end-use industries like automotive, agriculture, robotics, and food and beverage, among others.

Key players in the industry are Rockwell Automation, Inc., Omega Engineering, Inc., Microchip Technology Inc, Honeywell International Inc., Texas Instruments Incorporated, Panasonic Industry Co., Ltd., ams-OSRAM AG, STMicroelectronics International N.V., Renesas Electronics Corporation, Infineon Technologies AG, TE Connectivity Ltd., and Siemens AG, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Sensor Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share