Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global injection moulding machine market size was valued at USD 17.06 Billion in 2025. The market is further projected to grow at a CAGR of 3.70% between 2026 and 2035, reaching a value of USD 24.53 Billion by 2035.

Base Year

Historical Period

Forecast Period

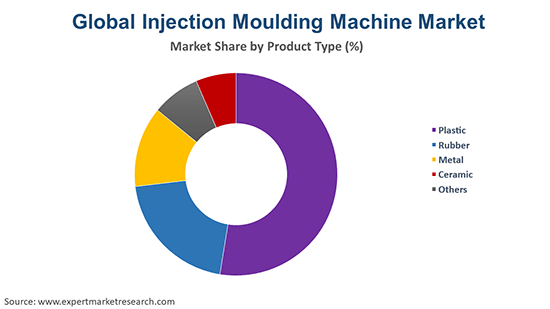

The plastic segment led the market, accounting for over 76.6% share of global revenue in 2022.

USA had 434 contract injection moulding manufacturing businesses as of 2023.

Globally, over 5 million metric tons of plastic parts are produced using injection moulding each year.

Compound Annual Growth Rate

3.7%

Value in USD Billion

2026-2035

*this image is indicative*

An injection moulding machine is a device that produces plastic parts by injecting molten material into a mould. The injection unit and the clamping unit are the two primary components of the machine. The injection unit melts the plastic granules and injects them into the mould cavity under high pressure. The clamping unit holds the mould closed and applies force to keep the parts in shape. The moulded parts are then ejected and cooled.

Some of the factors driving the injection moulding machine market growth are the increasing demand for plastic products in various industries such as automotive, packaging, medical, and consumer goods and the technological advancements in injection moulding machines that improve their efficiency, productivity, and quality. Moreover, the rising awareness about the environmental benefits of using plastic as a substitute for other materials and the supportive government policies and initiatives that promote the adoption of injection moulding machines is leading to injection moulding machine market development.

Increasing adoption of electric and hybrid machines, rising demand from packaging industries, and advancements in automation have expanded the injection moulding machine market size

| Date | Company | Event/News | Details |

| January 2024 | Haitian International Holdings Ltd. | Acquisition of Niigata Machine Techno USA | Niigata USA, a manufacturer of injection moulding machines, is now fully owned by Haitian International Holdings Ltd. |

| November 2023 | Chen Hsong | Participation in Plast Eurasia Istanbul 2023 | Chen Hsong showcased their SPARK and MK6 series of injection moulding machines, with the SPARK series being their best-selling all-electric product. |

| October 2023 | Engel Group | Participation in Fakuma 2023 | Engel Group highlighted their all-electric injection press, the e-motion 765/280 T, which is being used to produce the world’s lightest 1.3-liter pail. |

| October 2023 | Wittmann Battenfeld | Participation in Fakuma 2023 | Wittmann Battenfeld introduced its new all-electric EcoPower B8X injection press, which offers a finer gradation of injection units for more accurate dosing. |

| April 2023 | The Japan Steel Works Ltd. | Launch of JLM3000-MGIIeL injection moulding machine | JSW launched their ultra-large size magnesium injection moulding machine to address growing demands for increased product functionality. |

| Trends | Impact |

| Increasing adoption of electric and hybrid machines | Electric and hybrid machines offer higher efficiency, lower energy consumption, and reduced environmental footprint. |

| Advancements in automation and digitalisation | Automation and digitalisation technologies enhance the performance and productivity of injection moulding machines. They enable faster and more accurate processes, improved quality control, and reduced waste and downtime. |

| Expansion of end-use industries in emerging markets | The growth of various end-use industries, such as automotive, consumer goods, electronics, and construction, in emerging regions, such as Asia-Pacific, Latin America, and Middle East and Africa, drives the demand for injection moulding machines. |

| Development of new materials and designs | The innovation and research in new materials and designs, such as bioplastics, composites, nanomaterials, and micro-moulding, offer biodegradability, recyclability, strength, and durability. |

The injection moulding machines market outlook is being positively shaped due to the rising demand for such machines by automotive industries across regions. Injection moulding machines are used to manufacture a wide range of vehicle components, including bumpers, electrical housings, exterior body panels, and dashboards.

Furthermore, rising research and development expenditure has led to the development of new technologies such as advanced hydraulic systems for large parts, electrical systems for small and complex components, and hybrid systems that can operate for both large and small parts, thereby saving costs. These factors are expected to boost injection moulding machines market growth in the coming years.

Injection moulding machines are also used to manufacture shipment containers, PET bottles, containers, and more to contain, protect and handle several items. The process of injection moulding is versatile, offers consistent results and renders efficient packaging component cycle times. The trend of reduced wall thickness in packaging market requires lower clamping and injection pressures and leads to increased demand for injection moulding machines.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

"Global Injection Moulding Machine Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Machine Type

Market Breakup by Clamping Force

Market Breakup by Sales

Market Breakup by End Use

Market Breakup by Region

Automotive segment holds a significant market share due to increasing demand for high-performance plastic components for producing lightweight cars

Amongst end users, automotive segment is anticipated to lead the injection moulding machine market share in the forecast period due to the increasing production of lightweight and fuel-efficient vehicles, which require high-performance plastic components. Injection moulding machines are used to manufacture various automotive parts, such as bumpers, dashboards, door panels, lighting systems, and engine covers.

The demand for injection moulding machines in the packaging industry is driven by the increasing demand for plastic packaging products, such as bottles, caps, containers, trays, and films. Injection moulding machines are used to produce various types of plastic packaging products with high durability, flexibility, and recyclability. The packaging segment is expected to witness a steady growth rate due to the growing awareness of environmental issues, such as plastic waste and pollution, and the adoption of biodegradable and bio-based plastics.

According to injection moulding machine market analysis, electrical and electronics segment may witness growth due to the increasing demand for plastic products, such as connectors, switches, sockets, circuit boards, and cables. Injection moulding machines are used to produce various types of plastic products with high precision, accuracy, and functionality.

The healthcare segment is the fastest-growing segment of the global injection moulding machine market because of the increasing demand for plastic products, such as syringes, vials, tubes, implants, and devices. Injection moulding machines are used to produce various types of plastic products with high hygiene, safety, and biocompatibility. The healthcare segment is expected to witness a robust growth rate owing to the rising demand for medical supplies and equipment.

Hydraulic injection moulding machines are widely used due to their high injection pressure and ability to produce larger components

Hydraulic injection moulding machines use hydraulic fluid to power the movement of the injection unit and the clamping unit. The injection moulding machine market estimates that hydraulic injection moulding machines are the most widely used type of injection moulding machines as they offer high injection pressure, fast cycle time, and high clamping force, which are suitable for producing large and complex parts.

All-electric injection moulding machines, on the other hand, use electric motors to power the movement of the injection unit and the clamping unit. All-electric injection moulding machines are the most energy-efficient and environmentally friendly type of injection moulding machines, as they do not use any hydraulic fluid and generate no emissions. All-electric injection moulding machines also offer high precision, low noise level, and low maintenance cost, which can increase the injection moulding machine market growth.

Hybrid injection moulding machines offer the advantages of both hydraulic and all-electric injection moulding machines, such as high injection pressure, fast cycle time, high clamping force, low energy consumption, low noise level, and low maintenance cost. Hybrid injection moulding machines use hydraulic fluid to power the clamping unit and electric motors to power the injection unit. According to injection moulding machine market report, hybrid injection moulding machines are gaining popularity, especially in the automotive industry, where they are used to produce lightweight and high-strength parts.

The injection molding machine market has been witnessing steady growth, driven by increasing demand across various industries, including automotive, packaging, consumer goods, healthcare, and electronics. Injection molding machines are essential for producing plastic parts with precision and efficiency, contributing significantly to the market's overall share.

The automotive industry is one of the leading contributors to the injection molding machine market share. These machines are widely used to manufacture automotive components, including bumpers, dashboards, and various other plastic parts that require high precision and durability. The rising demand for lightweight vehicles, driven by the need for fuel efficiency and reduced emissions, further boosts the adoption of injection molding machines in this sector.

The packaging industry also plays a crucial role in the injection molding machine market. With the growing demand for sustainable and recyclable packaging solutions, manufacturers are increasingly adopting injection molding machines to produce high-quality, lightweight packaging materials. The healthcare sector, particularly in the production of medical devices and equipment, is another key contributor to the market share, given the stringent requirements for precision and hygiene.

Hydraulic injection molding machines hold a significant share of the market, owing to their high efficiency and ability to handle large-scale production. However, electric injection molding machines are gaining traction due to their energy efficiency, precision, and lower operational costs. Hybrid machines, which combine the benefits of both hydraulic and electric machines, are also witnessing increased adoption, particularly in industries that require high-speed production with consistent quality.

Asia-Pacific dominates the global injection molding machine market share, primarily due to the presence of a large number of manufacturing industries in countries like China, India, and Japan. The region's robust industrial base, coupled with growing investments in advanced manufacturing technologies, contributes to its leading position in the market. North America and Europe follow closely, with significant market shares driven by demand in the automotive and healthcare sectors.

North America is one of the prominent regions due to increasing demand for plastic products across industries

North America is one of the leading regions in the injection moulding machine market due to the presence of established players, high adoption of advanced technologies, and increasing demand for plastic products in sectors such as automotive, packaging, medical, and consumer goods. The US is the dominant country in the region, followed by Canada. Some of the key players occupying majority of injection moulding machine market share in North America are Husky Injection Molding Systems Ltd., Milacron Holdings Corp., and Engel Austria GmbH.

The robust automotive industry of Asia Pacific is one of the key drivers propelling the value of injection moulding machines market in this region. Injection moulding machines are used in various automotive components, including lighting systems, bumpers, instrument panels, rear bumpers and still covers. The rising demand for automobiles in the major Asian countries is boosting the sales of injection moulding machines in the region. The region also offers low-cost labour, raw materials, and energy, which attract foreign investments and expansions. The increasing demand for plastic products in sectors such as construction, electronics, agriculture, and consumer goods are also fuelling the injection moulding machine market growth in the region.

The market in Middle East and African region is expected to witness a significant growth rate owing to the increasing investments in infrastructure, energy, and petrochemical sectors, which create a demand for plastic products. The region also benefits from the availability of natural gas and oil, which are the key raw materials for plastic production. Some of the key players operating in the Middle East and Africa injection moulding machine market are Arburg GmbH + Co KG, KraussMaffei Group GmbH, Negri Bossi S.p.A., and Wittmann Battenfeld GmbH.

Injection moulding machine companies are establishing strategic partnerships, acquisitions, and launching new products, to cater to the diverse needs of the consumers

| Company Name | Year Founded | Headquarters | Products/Services |

| Japan Steel Works, Ltd. | 1907 | Tokyo, Japan | Plastic injection moulding machines, steel products, power generation equipment, industrial machinery, etc. |

| Chen Hsong Holdings Limited | 1958 | Hong Kong, China | Plastic injection moulding machines, robots, auxiliary equipment, etc. |

| Nissei Plastic Industrial Co., Ltd. | 1947 | Nagano, Japan | Plastic injection moulding machines, moulds, peripheral equipment, etc. |

| Haitian International Holdings Limited | 1966 | Ningbo, China | Plastic injection moulding machines, robots, automation solutions, etc. |

Other key players in the global injection moulding machine market include ENGEL AUSTRIA GmbH and Sumitomo Heavy Industries, Ltd, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the injection moulding machine market reached an approximate value of USD 17.06 Billion.

The market is expected to grow at a CAGR of 3.70% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 24.53 Billion by 2035.

The rising demand for injection moulding machines in the healthcare sector, rapid urbanisation, and surging investments in technical innovations to reduce production costs and scrap are some of the major market drivers.

Key trends aiding injection moulding market expansion include the robust growth of the automotive sector, increasing R&D expenditure to develop new technologies by key players, and the surging usage of injection moulding machines to manufacture shipment containers.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The different types of materials manufactured through injection moulding machines are plastic, metal, rubber, and ceramic, among others.

The different machine types in the market are hydraulic, hybrid, and all-electric.

Injection moulding machines can be divided by clamping force into 0–200 ton-force, 201–500 ton-force, and above 500 ton-force.

The different end uses of injection moulding machine include automotive, consumer goods, packaging, electrical and electronics, and healthcare, among others.

Key players in the market are Japan Steel Works, Ltd., Chen Hsong Holdings Limited, Nissei Plastic Industrial Co., Ltd., Haitian International Holdings Limited, ENGEL AUSTRIA GmbH, and Sumitomo Heavy Industries, Ltd, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Machine Type |

|

| Breakup by Clamping Force |

|

| Breakup by Sales |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share