Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The PET bottles market attained a value of USD 52.05 Billion in 2025. The market is expected to grow at a CAGR of 3.90% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 76.31 Billion.

Of late, packaging manufacturers across the globe are increasingly adopting lightweight PET bottles to reduce costs and improve logistics. Lighter bottles require less resin, cutting raw material expenses and lowering transportation weight, leading to reduced carbon footprints. In May 2024, ALPLA launched lightweight PET bottles for wine, roughly eight times lighter than glass, to cut carbon emissions. This shift aligns with sustainability goals and appeals to environmentally conscious consumers.

The boom in e-commerce and food & beverage delivery services is significantly boosting the PET bottles market value. These platforms rely on secure, lightweight, and durable packaging, qualities that PET bottles fulfil. In June 2024, Coca‑Cola India launched its Affordable Small Sparkling Package (ASSP) comprising 250 mL PET bottles produced from 100% recycled PET and designed with reduced material use. As the online retail ecosystem matures, it creates a consistent demand for PET bottles across multiple product categories, encouraging further innovation in bottle shapes, sizes, and cap designs tailored for fast, safe delivery.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

3.9%

Value in USD Billion

2026-2035

*this image is indicative*

The surge in global consumption of packaged beverages, especially bottled water, carbonated drinks, and energy drinks, is driving the PET bottles industry growth. In February 2025, South Africa’s Oasis Water launched the country’s first fully recyclable 10 L PET dispenser bottle. Consumers prioritize convenience, hygiene, and portability, making PET the ideal packaging choice. As beverage companies expand into new markets, PET bottles offer cost-effectiveness, transparency, and brand visibility, strengthening their position.

Environmental concerns have prompted companies and governments to push for sustainable PET packaging. Recycling initiatives, such as rPET usage, closed-loop systems, and extended producer responsibility policies, are reshaping the market. Consumers also favour eco-friendly options, prompting brands to invest in bottles made from 100% recycled PET. In January 2025, Clear Premium Water debuted a 100% rPET bottle range, marking India’s first such bottle range. The emphasis on sustainability is influencing production practices, design, and material sourcing across the PET bottles value chain.

Advances in bottle design, including ergonomic shapes, resealable caps, tamper-evident seals, and built-in handles to enhance user convenience and product differentiation is adding to the PET bottles market share. In September 2023, Sidel introduced the EvoBLOW XL, an ultra‑fast blowing machine for large PET containers with 98% OEE, rPET compatibility, lightweighting and ergonomic mold handling. These innovations strengthen market appeal, particularly in personal care, beverages, and household product segments.

As sustainability becomes a global priority, significant investments are being made in PET recycling infrastructure. Governments and private players are setting up advanced recycling plants to process post-consumer PET waste. In July 2025, Veolia announced a EUR 70 million investment in the United Kingdom’s first major closed-loop recycling plant. Scheduled for start-up in early 2026, it will convert PET products into food-grade recyclate to serve British grocery brands. This trend boosts availability of high-quality rPET, enabling circular packaging models.

Automation, AI, and IoT are transforming manufacturing in the PET bottles industry by improving production efficiency, reducing defects, and enabling real-time quality control. These advances lower operational costs and increase customization capabilities. Manufacturers adopting these technologies gain a competitive edge, particularly when serving high-volume, quick-turnaround sectors. For instance, in June 2024, Berry Global integrated AI-powered predictive maintenance tools in its PET bottle production lines for reducing downtime and improving production efficiency.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

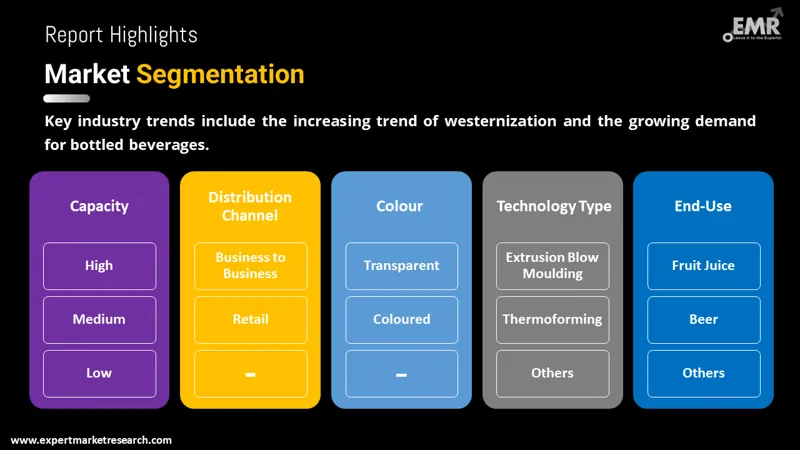

The EMR’s report titled “PET Bottles Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Capacity

Key Insight: Medium-capacity PET bottles industry is gaining traction due to their versatility and consumer preference for convenient volumes. These bottles, ranging from 500ml to 1 liter, are the standard choice for carbonated drinks, juices, and iced teas. Their balance between portability and volume makes them ideal for personal use at home or during commutes. Coca-Cola and PepsiCo, for instance, sell most of their beverages in 750ml to 1L PET bottles. This segment is highly competitive and innovation-driven, with frequent shape and label redesigns.

Market Breakup by Distribution Channel

Key Insight: Business to business (B2B) is the primary revenue contributor due to high-volume transactions with major bottlers and industrial buyers. In this format, PET bottles are supplied in bulk to manufacturers in food, beverage, and pharmaceutical industries. In July 2024, Berry Global Group rolled out its CleanStream Home and Industrial line, offering high-purity post-consumer recycled PET (PCR PET) for non-food packaging, such as trigger sprays and cleaning products. These bottles are either delivered as preforms or finished containers for further filling and packaging. This channel further emphasizes scale, cost-efficiency, and timely logistics.

Market Breakup by Colour

Key Insight: The transparent segment dominates the PET bottles market owing to consumer trust in visible contents and a growing demand for recyclable, minimalist packaging.

Transparent PET bottles are most used for bottled water, clear juices, and pharmaceuticals as they offer complete product visibility, which reassures customers about purity and freshness. Brands rely on clear bottles to reinforce cleanliness and trust. For instance, in August 2023, Berry Global designed a sleek, flat 100% rPET bottle for NEUE Water, combining sustainability, luxury aesthetics, and portability.

Market Breakup by Technology Type

Key Insight: Stretch blow moulding (SBM) is the most widely used method for manufacturing PET bottles, especially for beverages. The technique allows high precision and clarity, producing lightweight, strong bottles. Most soft drink bottles are made using SBM due to the need for high tensile strength under carbonation pressure. In July 2022, PET Technologies showcased its APF‑Max 2 linear stretch blow moulding system, capable of producing PET bottles from 0.2 L to 2.25 L at speeds up to 3,500 bph. Benefits of efficiency, clarity output, and suitability for high-speed beverage filling lines are other factors driving segment growth.

Market Breakup by End Use

Key Insight: Packaged water is the largest end-use segment of the PET bottles industry, driven by global hydration trends and rising clean water demand. Brands rely entirely on PET for portability and safety. In February 2025, Al Ain Water introduced the UAE's first locally produced 100% recycled PET (rPET) bottles for water packaging, marking a significant step towards sustainability and a circular economy. Global demand for bottled water continues to surge due to health and sanitation concerns. The segment further dominates due to the bottle’s lightweight, unbreakable nature, and clarity.

Market Breakup by Region

Key Insight: North America holds a leading position in the market, driven by high demand from beverage and pharmaceutical industries. Companies like Berry Global and Graham Packaging are major players innovating with sustainable PET solutions, including 100% recycled PET bottles for water and soft drinks. For example, ZenWTR launched ocean-bound plastic rPET bottles in the United States, combining sustainability with premium branding. The region also benefits from advanced manufacturing infrastructure, supporting efficient stretch blow moulding production for diverse bottle sizes.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Low Capacity & High Capacity PET Bottles to Gain Popularity

The low-capacity PET bottles market, generally less than 500ml, is attaining traction for on-the-go consumption along with the shift toward mobile, single-serve products. Commonly used for flavoured water, energy drinks, and single-serve juices, they cater to fast-paced urban lifestyles. For instance, 250ml water bottles are often found at conferences or in-flight services. Their compact size makes them ideal for vending machines and travel packs. The segment is growing rapidly with the rise of health drinks and functional beverages.

High-capacity PET bottles, typically larger than 1 liter, are widely used for packaged water, edible oils, and cleaning liquids. Their large volume makes them ideal for household or commercial use. In April 2023, Suntory PepsiCo Beverage Thailand launched 1.45-liter bottles of Pepsi, Pepsi Lime Flavor, and Pepsi Zero Sugar made from 100% recycled PET (rPET). They are also in strong demand in industrial and household bulk-use segments, especially in emerging economies with growing hydration and sanitation needs.

Rising PET Bottles Sales via Retail Distribution

The retail segment of the PET bottles market is crucial for brand visibility and consumer engagement, especially for new or niche product launches. Retail channels involve the direct sale of filled PET bottles to end consumers via supermarkets, kiosks, convenience stores, and e-commerce platforms. This segment reflects real-time market demand and consumer preferences, such as ergonomic designs or eco-friendly packaging. Smaller beverage companies often test new bottle formats in retail to gauge market reception.

Coloured PET bottles to Record Preference

Coloured PET bottles serve both functional and aesthetic purposes. Amber or green bottles are frequently used for beer, vitamin drinks, and medicines to block UV rays, preserving product integrity. Coloured bottles aid in brand differentiation on crowded shelves. In October 2024, Berry Global introduced the ClariPPil™ line, featuring colored PP bottles in green, light amber, and dark amber for healthcare products. These bottles are also essential for UV-sensitive products and branding but face higher recycling complexity than clear variants.

Injection & Extrusion Blow Moulding to Boost PET Bottles Production

The injection moulding segment of the PET bottles market offers tight control overweight and thickness. It is critical in preform production, enabling scale and customization in the PET bottle supply chain. Injection moulding is also typically used to create PET preforms, which are later blow-moulded into bottles. The segment is further a highly repeatable process, allowing mass production with minimal defects.

Extrusion blow moulding is used for more complex shapes and multi-layer bottles, often in non-food applications. It is suitable for thick-walled containers, such as industrial cleaners or automotive fluids. This method also serves specialized markets needing thicker or irregularly shaped PET containers. In July 2025, Tech-Long introduced its 6.0 Automatic Blow Molding Machine, emphasizing energy conservation and automation, adding to segment growth.

Higher PET Bottles Usage in Carbonated Soft Drinks & Food Bottles and Jars

Carbonated soft drinks (CSDs) remain a high-volume consumer in the PET bottles market, especially in emerging countries with growing soft drink consumption. CSDs, such as Coca-Cola, Pepsi, and Sprite use PET bottles that can withstand carbonation pressure. These bottles are specifically designed for strength, branding, and convenience. PET allows cost-effective transportation and high-speed bottling.

The food bottles and jars segment is gaining traction as PET containers are used for sauces, condiments, edible oils, and spreads. Their resistance to breakage and long shelf life makes them ideal for retail and export. For instance, ketchup or mayonnaise often comes in squeezable PET bottles. Food packaging is further expanding PET usage due to hygiene, branding potential, and consumer-friendly designs.

Thriving PET Bottles Adoption in Europe & Asia Pacific

Europe PET bottles market value is growing, largely due to stringent environmental policies promoting recycled content and circular economy goals. Major players like Indorama Ventures and ALPLA have developed transparent, lightweight PET bottles with recycled content for water, carbonated drinks, and pharmaceutical packaging. European countries actively push PET recycling mandates, accelerating adoption of rPET bottles. Premium brands in mineral water and beverages frequently opt for sophisticated PET designs, leveraging injection stretch blow moulding for quality and sustainability.

Asia Pacific is a rapidly growing market driven by expanding beverage industries in India and China. For instance, in June 2023, Coca‑Cola India, in collaboration with ALPLA and local bottlers, launched Kinley water in a one‑liter 100% recycled PET bottle. The market growth is fuelled by rising urbanization, increasing disposable incomes, and government initiatives to reduce plastic waste. The region shows strong future potential with increasing adoption of stretch blow moulding and recycled PET technologies.

Key players in the PET bottles market are employing several key strategies to strengthen their position and drive growth. Sustainability is a top priority, with companies investing heavily in recyclable and biodegradable materials to reduce environmental impact and comply with regulatory demands. This shift aligns with growing consumer preferences for eco-friendly packaging. Innovation plays a critical role, with market leaders developing lightweight bottles and enhanced barrier technologies to improve product shelf life and reduce material usage, balancing performance with cost-efficiency.

Strategic partnerships and collaborations are common, enabling companies to expand distribution networks, access new markets, and share technological expertise. Additionally, many firms focus on building robust recycling infrastructure and adopting closed-loop recycling systems to promote a circular economy, minimizing plastic waste. Marketing efforts emphasize transparency and sustainability credentials, appealing to environmentally conscious consumers. Furthermore, continuous investment in automation and digital technologies helps improve manufacturing efficiency and product consistency.

Amcor plc, founded in 1860 and headquartered in Melbourne, Australia, specializes in packaging solutions. Amcor has led innovations in recyclable and compostable materials, driving sustainability in flexible and rigid packaging. The company emphasizes reducing plastic waste while delivering high-performance packaging worldwide.

Berry Global, Inc., established in 1967 and based in Evansville, the United States, focuses on plastic packaging products. The company is recognized for developing recyclable and lightweight packaging innovations, enhancing environmental sustainability while maintaining product durability and functionality.

Graham Packaging Company Inc., founded in 1947 and headquartered in York, the United States, is known for blow molding technology in PET containers. Graham advances lightweight, durable packaging solutions that improve recyclability and reduce carbon footprints for various consumer goods.

Container Corporation of Canada, established in 1926 in Toronto, Canada, was a key player in containerboard and corrugated packaging. The company contributed to sustainable packaging development by promoting efficient materials and waste reduction in Canadian supply chains.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the PET bottles market are Alpha Group, among others.

Download your free sample of the PET bottles market report today to explore the latest PET bottles market trends 2026, key growth drivers, and competitive insights. Stay ahead in this evolving industry with expert analysis and data-driven forecasts, helping you make informed strategic decisions. Don’t miss out on essential market intelligence for your business success.

Latin America PET Bottles Market

Europe PET Bottles Market

North America PET Bottles Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The key strategies driving the market include sustainability initiatives focused on recyclable and biodegradable packaging, innovation in lightweight bottle designs and advanced barrier technologies, and strategic partnerships to enhance distribution and market access. Additionally, investments in recycling infrastructure and closed-loop recycling promote a circular economy.

The key industry trends include the rising trend of westernisation, and increased demand for bottled beverages.

The major regions in the industry are North America, Latin America, Europe, Middle East and Africa, and Asia Pacific, with Asia Pacific accounting for the largest share in the market.

High, medium, and low are the segments based on capacity in the industry.

The leading distribution channels in the market are business to business and retail, where retail is further segmented into supermarkets and hypermarkets, convenience stores, and online, among others.

Transparent and coloured are the colours available in the market.

The different types of technology are stretch blow moulding, injection moulding, extrusion blow moulding, and thermoforming, among others.

The various end-uses of the industry are packaged water, carbonated soft drinks (CSD’s), food bottles and jars, non-food bottles and jars, fruit juice, and beer, among others.

The key players in the market report include Amcor plc, Berry Global, Inc, Graham Packaging Company Inc., Container Corporation of Canada, and Alpha Group, among others.

In 2025, the market reached an approximate value of USD 52.05 Billion.

The market is projected to grow at a CAGR of 3.90% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 76.31 Billion by 2035.

The transparent segment dominates the market owing to consumer trust in visible contents and a growing demand for recyclable, minimalist packaging.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Capacity |

|

| Breakup by Distribution Channel |

|

| Breakup by Colour |

|

| Breakup by Technology Type |

|

| Breakup by End-Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share