Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The maritime information market attained a value of USD 1894.48 Million in 2025. The market is expected to grow at a CAGR of 8.50% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 4283.39 Million.

Satellite communications are essential to ensuring uninterrupted, worldwide coverage of maritime data. When ships venture outside the range of terrestrial networks, satellite connections provide AIS tracking, weather reports, and crew communications globally. With the introduction of new satellite constellations, maritime connectivity is faster, more robust, and cost-effective. Expanded satellite coverage also underpins real-time data transfer, remote troubleshooting, and "floating office" features. These advances prompt the use of maritime information services among shipping businesses to facilitate safer travels and more informed operational decisions.

The maritime information market is transforming at a speed of light, catalyzed by developments in automation, artificial intelligence, IoT, and cloud computing. In October 2025, the United Kingdom Hydrographic Office and Marine AI started a project that allows Maritime Autonomous Surface Ships to read and respond to navigational information. Ships are increasingly equipped with smart sensors and onboard data analytics platforms, enabling real-time monitoring of operations, predictive maintenance, and optimized routing. This digitalization reduces operational costs, enhances safety, and improves fuel efficiency.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

8.5%

Value in USD Million

2026-2035

*this image is indicative*

| Global Maritime Information Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | 1894.48 |

| Market Size 2035 | USD Million | 4283.39 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 8.50% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 11.0% |

| CAGR 2026-2035 - Market by Country | India | 12.1% |

| CAGR 2026-2035 - Market by Country | China | 10.5% |

| CAGR 2026-2035 - Market by Application | Maritime Information Analytics | 9.4% |

| CAGR 2026-2035 - Market by End Use | Commercial | 9.5% |

| Market Share by Country 2025 | USA | XX% |

Autonomous and remotely controlled ship development is reshaping maritime information market dynamics. Hyundai Glovis, in association with Avikus, in July 2025, unveiled plans to upgrade seven mega Pure Car and Truck Carriers (PCTCs) to Level-2 Maritime Autonomous Surface Ship (MASS) by mid-2026. The ships heavily depend on maritime information systems for navigational guidance, obstacle detection, and operational coordination. High-precision AIS information, radar fusion, and environmental monitoring facilitate autonomous safe decision-making.

Global standards, such as IMO 2020 and future carbon emissions regulations push shipping firms to lower their carbon footprint. Marine data platforms today incorporate emissions monitoring capabilities that monitor fuel usage and greenhouse gas emissions. Environmental information in real-time assists ship operators to meet regulations, escape fines, and improve fuel efficiency. Increased emphasis on sustainability has driven investments in digital technologies to enhance transparency of carbon footprints and encourage more eco-friendly shipping practices.

Ports globally are embracing digitalization policies to enhance efficiency, security, and sustainability, contributing to the value of the maritime information industry. Smart ports make use of maritime information technologies, including automated ship tracking, berth allocation, cargo handling analysis, and environmental monitoring. Busan Port adopted an AI-based logistics metaverse in August 2024 to boost productivity, environmental sustainability, and safety. Greater dependency on digital maritime information at ports increases operational transparency and promotes stakeholder cooperation.

As maritime operations become increasingly digital, cybersecurity risks grow, making secure data transmission and system protection paramount. Maritime information platforms must safeguard vessel and operational data against cyberattacks, ensuring data integrity and confidentiality. Regulatory frameworks push for cybersecurity standards in shipping and ports. The need to secure sensitive maritime information drives innovation and demand for cybersecurity solutions, significantly influencing the maritime information market development and service offerings.

Maritime security threats, such as piracy, smuggling, and unauthorized intrusions necessitate sophisticated surveillance and monitoring systems. Governments and private operators invest in maritime information platforms to support real-time threat detection, vessel verification, and incident response coordination. In May 2025, the United States approved a proposal to supply India with military hardware and logistics support worth USD 131 million, enhancing India's maritime analytical capabilities. Enhanced security solutions also protect critical infrastructure and shipping lanes, driving demand for advanced maritime information technologies.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Maritime Information Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

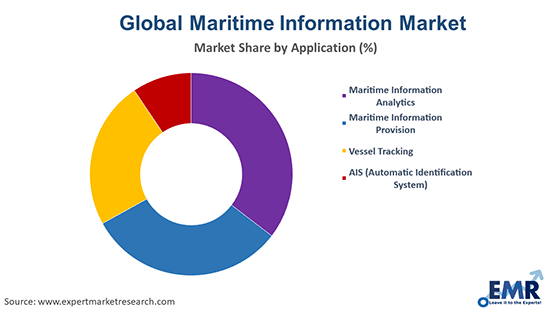

Market Breakup by Application

Key Insight: Maritime information analytics is the most dominating segment as it focuses on processing vast amounts of maritime data to derive actionable insights. Advanced analytics tools use data from various sources like AIS, weather systems, and port operations to optimize shipping routes, enhance safety, and improve fuel efficiency. In May 2023, Spire Global launched the Deep Navigation Analytics™ (DNA) platform, a space-powered solution designed to provide maritime stakeholders with essential insights. The rise of big data, AI, and machine learning has propelled the segment's growth in the maritime information industry.

Market Breakup by End Use

Key Insight: The government industry includes key sectors like defense, intelligence and security, search and rescue, government authorities, and others. Governments use maritime information for national security, surveillance of territorial waters, and protection against illegal operations. Defense forces utilize real-time ship tracking and AIS data for situational awareness and strategic operations. Intelligence organizations utilize maritime analytics to identify potential threats and maintain maritime domain awareness. Search and rescue missions are aided by accurate location and environmental information to react quickly in emergencies.

Market Breakup by Region

Key Insight: North America is the dominant maritime information market, propelled by high maritime trade activity, and high investments in digitalization. The region is favored by strong government support for maritime data analytics, vessel tracking, and safety solutions. The Canadian Hydrographic Service, an agency under Fisheries and Oceans Canada, initiated the S-100 Sea Trials in June 2025 on the St. Lawrence River, which is vital for enhanced and safe maritime navigation. The availability of prominent maritime technology solution providers and AI, big data, and satellite surveillance startups also adds weight to the market's expansion.

| CAGR 2026-2035 - Market by | Region |

| Asia Pacific | 11.0% |

| Europe | 8.1% |

| North America | XX% |

| Latin America | XX% |

| Middle East and Africa | XX% |

Vessel Tracking & Maritime Information Provision to Gain Popularity

Vessel tracking constitutes an important part of the maritime data industry and pertains to tracking a vessel's position and movement in real-time with the aid of technologies such as AIS and satellite systems. Vessel tracking provides maritime security, improves operation efficiency, and assists international regulations compliance. In February 2025, Seoul-headquartered TRADLINX launched its "Vessel Tracking Service" early this year to provide companies real-time, predictive visibility of global shipments, blending satellite data and marine databases.

| CAGR 2026-2035 - Market by | Application |

| Maritime Information Analytics | 9.4% |

| Vessel Tracking | 9.0% |

| Maritime Information Provision | XX% |

| AIS (Automatic Identification System) | XX% |

Maritime information dissemination is the most critical segment and pertains to dissemination of maritime data and intelligence to their stakeholders. It entails real-time reporting of weather, port situation, navigational warnings, and changes in regulations. Service providers gather, harvest, and provide this information through portals and platforms to keep maritime operators in the know and compliant. With global shipping becoming more complicated, the need for accurate, precise, and timely maritime information is on the rise.

| CAGR 2026-2035 - Market by | End Use |

| Commercial | 9.5% |

| Government | XX% |

Maritime Information Deployment in the Commercial Sector

The commercial maritime information market caters to varied industries. Real-time information is used in port management to streamline logistics, minimize congestion, and enhance turnaround time. Commercial intelligence systems assist companies in evaluating market trends, ship performance, and supply chain behavior to make strategic business decisions. Commercial fishing depends on maritime information for sustainable operations and resource monitoring. Shipping is improved by vessel tracking and route optimization to maximize efficiency and minimize cost. Hydrographic and chart services deliver essential navigation information, while offshore industries utilize analytics for safety and operation planning

Europe & Asia Pacific to Lead Maritime Information Demand

Europe is a significant driver of the maritime information market growth due to its geopolitical position and high-volume ports like Rotterdam, Hamburg, and Antwerp. The European Union has a robust regulatory environment that fosters the take-up of maritime information technologies for environmental regulation, safety, and operational efficiency. Europe is a key investor in maritime research and development, with innovations in vessel tracking, AIS systems, and maritime analytics. Government-private sector collaborative initiatives further support the market.

Some of the world's busiest ports such as Shanghai, Singapore, and Busan are located in the Asia Pacific, which creates high demand for maritime data services. Growth drivers are led by rapid economic expansion, growing trade, and digital adoption. The Asia Pacific market continues to grow further, fueled by investments from governments in port upgrading, vessel tracking and analytics, and is set to be a leading player in the future in maritime information services. Full maritime 5G coverage in anchorages, fairways, terminals were rolled out by Singapore in March 2023 to improve tracking, communication and performance of port operations.

| CAGR 2026-2035 - Market by | Country |

| India | 12.1% |

| China | 10.5% |

| Japan | 9.4% |

| Germany | 7.8% |

| France | 7.4% |

| Italy | 6.6% |

| USA | XX% |

| Canada | XX% |

| UK | XX% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Key players in the maritime information market are focusing on technological innovation, strategic partnerships, and data integration. Leading companies focus on enhancing satellite tracking, real-time vessel monitoring, and predictive analytics to offer value-added services to clients in shipping, logistics, and defense sectors. Investments in AI and machine learning improve route optimization and risk assessment capabilities, giving firms a competitive edge. Strategic partnerships with shipping lines, port authorities, and tech firms help expand data sources and improve service accuracy.

Market players also focus on global coverage and expanding into emerging markets to tap into growing maritime trade activities. Subscription-based models and tiered pricing strategies are commonly used to cater to diverse customer needs, from small fleets to multinational corporations. Regulatory compliance, particularly with maritime safety and environmental standards, is another focus area, ensuring data services meet international requirements. Brand differentiation through reliable, user-friendly platforms and customizable dashboards further plays a vital role.

Founded in 1979 in London, Inmarsat Global Limited is renowned for revolutionizing satellite communication in the maritime sector. It played a pivotal role in launching the Global Maritime Distress and Safety System (GMDSS). Inmarsat continues to lead with innovations in high-speed satellite broadband and global connectivity for ships, aircraft, and remote areas.

Established in 2019 and headquartered in Melbourne, Florida, L3Harris Technologies, Inc. specializes in secure communication systems, ISR solutions, and space technologies. The company is acclaimed for developing resilient satellite networks and enhancing real-time decision-making for defense and maritime operations.

Founded in 1993 in Rochelle Park, New Jersey, ORBCOMM Inc. focuses on IoT and machine-to-machine connectivity. It delivers satellite and cellular tracking solutions for global asset management. Known for its dual-mode terminals and analytics platforms, ORBCOMM supports smarter logistics, especially in maritime shipping and supply chain visibility.

Formed in 2020 and based in Arlington, Virginia, Raytheon Technologies Corporation resulted from the merger of Raytheon Company and United Technologies. It is a global leader in aerospace and defense innovation, offering cutting-edge radar systems, maritime surveillance solutions, and GPS-based technologies critical to national security and navigation.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the maritime information market are exactEarth Ltd., among others.

Stay ahead in the evolving maritime sector, download a free sample of our Maritime Information Market Report today. Discover the latest maritime information market trends 2026, key drivers, and growth opportunities. Perfect for investors, analysts, and businesses seeking strategic insights. Gain a competitive edge with data-driven decisions, get your sample now!

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 1894.48 Million.

The market is projected to grow at a CAGR of 8.50% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 4283.39 Million by 2035.

Key strategies driving the market include adopting advanced satellite and AIS technologies, integrating AI for predictive analytics, forming strategic partnerships, and expanding global coverage. Companies focus on real-time data services, cybersecurity, compliance with maritime regulations, and customized solutions to enhance operational efficiency, safety, and decision-making in maritime operations.

The key trends guiding the market include growing investments in research and development (R&D) activities by key players, technological advancements and innovations, liberalisation of world trade, and the utilisation of maritime information to boost economic growth.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The major applications of maritime information include maritime information analytics, maritime information provision, vessel tracking, and AIS (automatic identification system).

Government and commercial are the significant end uses of maritime information.

The key players in the market report include Inmarsat Global Limited, L3Harris Technologies, Inc., ORBCOMM, Raytheon Technologies, and exactEarth Ltd., among others.

North America leads the market, driven by strong maritime trade activity, and significant investments in digitalization.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share