Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global medical devices market was valued at USD 597.48 Billion in 2025 driven by the prevalence of chronic diseases and technological advancement across the globe. The market is expected to grow at a CAGR of 6.20% during the forecast period 2026-2035 and attain a market value of USD 1090.36 Billion by 2035.

Base Year

Historical Period

Forecast Period

The World Health Organization reveals that chronic diseases result in around 41 million deaths annually, making up 74% of total global deaths. The increasing incidence of chronic diseases impacts the market landscape significantly.

Technical advancements are among the major market trends influencing the market. In April 2024, Fresenius patented a blood treatment system with multiple pumps for ECMO treatments, improving treatment efficiency with parallel blood flow paths and pumps for various fluids.

In April 2024, Abbott’s TriClip heart valve repair device received FDA approval to treat tricuspid regurgitation, where the heart valve fails to close properly, causing blood to flow backwards. Rising approvals from regulatory authorities is expected to boost the market value of medical devices.

Compound Annual Growth Rate

6.2%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Medical equipment is the instruments, apparatus, or machines used for the diagnosis, prevention, or treatment of illnesses and diseases. They are used to improve the health by assisting in the identification and supervision of health issues. They are also used in operations and long-term illness control which enhance the well-being of individuals and play a vital role in both regular and urgent medical treatment.

There are various classifications of medical devices including diagnostic devices like X-ray machines, therapeutics devices such as insulin pumps, surgical devices like instruments, and life-support devices like ventilators, monitoring devices such as blood pressure monitors and assistive devices like hearing aids for healthcare. Healthcare professionals and patients rely on medical devices in hospitals, clinics, and homes for diagnosing conditions, monitoring vital signs, administering treatments, and assisting in rehabilitation. These devices are essential in modern healthcare, elevating patient results, increasing productivity, and facilitating sophisticated medical procedures.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Prevalence of Chronic Diseases Spurs Market Growth

The global medical device market is experiencing growth due to the rising prevalence of chronic diseases like cardiovascular conditions, diabetes, cancer, and respiratory disorders. The World Health Organization reports that chronic diseases (also known as non-communicable diseases) result in around 41 million deaths annually, making up 74% of total global deaths. Factors such as aging populations, unhealthy lifestyles, and pollution are necessitating advanced diagnostic and therapeutic devices to provide effective long-term care. Controlling diabetes depends on CGMs and insulin pumps, whereas heart problems necessitate pacemakers and stents. The rise in cancer diagnoses has caused a higher need for imaging devices, while respiratory illnesses have created a demand for inhalers and ventilators. In February 2024, the International Agency for Research on Cancer (IARC), a World Health Organization (WHO) cancer agency examined the global impact of cancer. The study revealed that approximately 20 million new cancer diagnoses and 9.7 million fatalities were recorded in 2022.

There is also a high demand for orthopedic devices to help with chronic pain and mobility problems in aging populations. Healthcare facilities are dedicating resources to enhance patient care and results by investing in state-of-the-art equipment, highlighting the significance of innovation and accessible healthcare solutions in the medical device market.

Technological Advancements to Boost the Global Medical Device Market Demand

Technological progress has fueled the global need for medical equipment, leading to the development of more precise and less intrusive devices. The custom production of medical devices has been transformed by 3D printing, enhancing patient comfort and the results of surgical procedures. These advancements are changing how patients are treated by offering ongoing monitoring, detecting problems early, and increasing medical services, especially helpful in areas with limited access. In April 2024, Abbott’s TriClip heart valve repair device received FDA approval to treat tricuspid regurgitation, where the heart valve fails to close properly, causing blood to flow backwards. Additionally, in April 2024, Fresenius patented a blood treatment system with multiple pumps for ECMO treatments, improving treatment efficiency with parallel blood flow paths and pumps for various fluids.

The market is witnessing several trends and developments to improve the current scenario. Some of the notable trends are as follows:

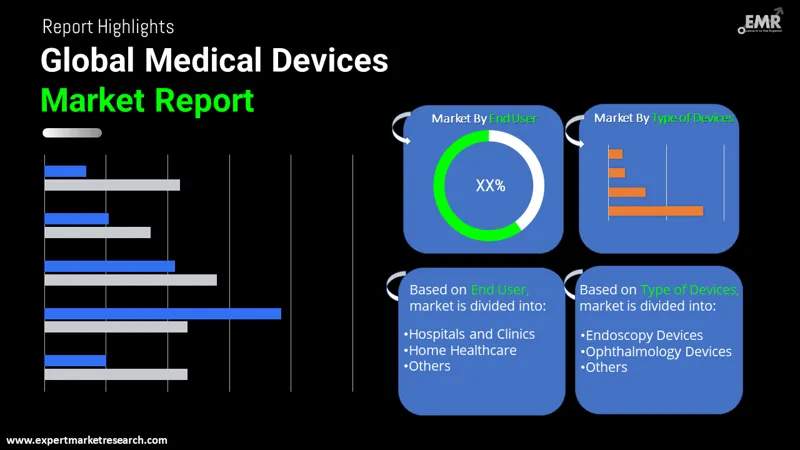

“Medical Devices Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type of Device

Market Breakup by Application

Market Breakup by End User

Market Breakup by Region

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Segmentation Based on Application to Witness Growth

Based on the application, the market is segmented into cardiology, oncology, neurology, orthopedics, respiratory, diabetes care, ophthalmology, and others.

Cardiology is a leading area of focus in the medical device industry and is expected to hold a substantial market share during the forecast period. The market value can be attributed to the high incidence of cardiovascular diseases such as coronary artery disease, heart failure, and arrhythmias. This leads to an increase in the need for cardiology devices like pacemakers, stents, defibrillators, and cardiac monitoring systems. Ongoing advancements in cardiology devices are predicted to enhance patient results, lower danger, and bolster the management of chronic conditions, meeting the urgent demand for heart care.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Based on region, the market report covers North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

North America is expected to dominate the market due to its advanced healthcare infrastructure, substantial healthcare spending, and significant emphasis on research and development. The growth is driven by the presence of leading manufacturers and early adoption of technology, meeting rising demands from chronic illnesses and an aging population.

Europe's robust healthcare system and regulatory framework have resulted in a significant market share of the global market for medical devices. Countries such as Germany, the UK, and France possess strong industrial foundations and significant healthcare expenditures. The market growth in this region is due to technological advancements and the increased need for less invasive medical devices. Positive reimbursement policies also encourage the uptake of advanced medical devices.

The key features of the market report include strategic initiatives including recent partnerships and collaborations by the leading players. The major companies in the market are as follows:

Medtronic plc, an American Irish company, is a global leader in medical technology. Their portfolio includes ablation systems, acute extracorporeal therapy solutions, airway monitoring, brain monitoring, and more. In March 2023, they collaborated with NVIDIA to build an AI platform for medical devices.

Johnson & Johnson researches, develops, manufactures, and sells pharmaceutical products and medical devices through its operating companies. In May 2024, Johnson & Johnson acquired Shockwave Medical, enhancing their position in cardiovascular intervention.

Fresenius Medical Care AG & Co is a renowned company offering services, products, and care coordination for individuals with chronic kidney failure. In February 2024, the company received FDA clearance for its 5008X Hemodialysis System. In April 2024, they patented a blood treatment system with multiple pumps for ECMO treatments, improving treatment efficiency with parallel blood flow paths and pumps for various fluids.

Abbott Labs, a healthcare company, manufactures and sells pharmaceuticals, diagnostics, nutrition products, and medical devices. In April 2024, their TriClip heart valve repair device received FDA approval to treat tricuspid regurgitation, where the heart valve fails to close properly, causing blood to flow backwards.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market are Baxter International, Inc., BD, Cardinal Health, Dentsply Sirona, F. Hoffman-La Roche Ltd., GE HealthCare, Koninklijke Philips N.V., Siemens Healthcare GmbH, Smiths & Nephew plc, Stryker, and Terumo Corporation.

Implantable Medical Devices Market

3D Printing Medical Devices Market

Philippines Medical Devices Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type of Device |

|

| Breakup by Application |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share