Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Mexico flexible packaging market was valued to reach a market size of USD 4516.81 Million in 2025. The industry is expected to grow at a CAGR of 5.80% during the forecast period of 2026-2035. The market is driven by a growing e-commerce sector, rising pharmaceutical manufacturing, and expansion of the food and beverage sector, further aiding the market to attain a valuation of USD 7937.59 Million by 2035.

Base Year

Historical Period

Forecast Period

In the beauty and personal care sector, flexible packaging prevents ingredients from degrading or separating and protects products from the external environment. In 2023, Mexican beauty market generated a total revenue of around USD 7.6 billion of the sector’s total global sales of USD 433 billion.

In 2023, Mexico produced pharmaceuticals in over 400 laboratories, primarily located in the Mexico City metropolitan region and the states of Puebla, Morelos, Jalisco, and Mexico.

Flexible packaging equipment processes a film to produce filled bags, pouches, sticks and other flexible packages. In 2023, the demand for packaging machinery in Mexico reached a market value of USD 1.13 billion and registered an accumulated growth of 55% in the last 2 years.

Compound Annual Growth Rate

5.8%

Value in USD Million

2026-2035

*this image is indicative*

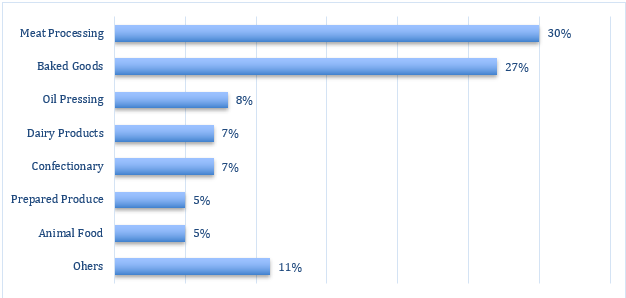

The food and beverage industry is the largest consumer of flexible packaging in Mexico. In 2023, the industry continued to be the crucial buyer of packaging machinery, representing about 50% of the country's total demand.

In the personal care and cosmetics sector, flexible packaging helps protect ingredients from degradation, separation, or loss of effectiveness over time. In 2022, Mexico was the 2nd largest cosmetics and personal care market in Latin America with the presence of cosmetics brands such as Loreal S.A. and Procter & Gamble.

Flexible packaging presents an ideal option for the online sale and at-home delivery of product categories such as cosmetics, snacks, and pet food. Local online shopping events such as Hot Sale and El Buen Fin generate demand for flexible packaging for deliveries. In 2024, Mexico was the 10th largest e-commerce market globally with an 18% y-o-y growth.

Consumers growing demand for packaged foods and beverages provides opportunities for Mexico flexible packaging market growth.

In 2023, Mexican consumers spent 34.6% of their income on foods, beverages, and tobacco, with the three main categories consisting of meat, grains, and food preparations.

Prominent food and beverages manufacturers in Mexico include Coca Cola Femsa, S.A.B. de C.V., Sigma Alimentos, S.A. de C.V., and Grupo Bimbo, S.A.B. de C.V.

Figure: Mexico Food Production Industry, Share (%) by GDP Value, 2023

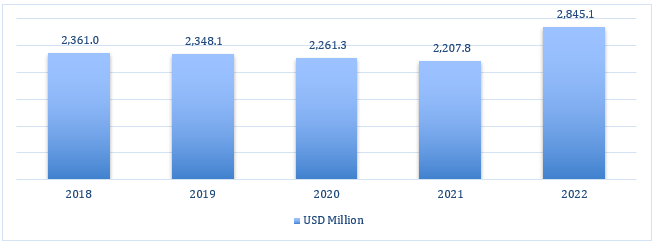

In 2023, Mexico was the 15th-largest market for pharmaceuticals in the world and the second largest in Latin America. Mexico produces pharmaceuticals in over 400 laboratories, primarily in the Mexico City metropolitan region and the states of Puebla, Morelos, Jalisco, and Mexico.

In 2023, Mexico exported 165 of the 350 pharmaceutical and API products designated as critical by the International Trade Administration to the United States. The total value of these exports surpassed USD 2.5 billion.

Figure: Annual Contribution to GDP (in USD Million) of Pharmaceutical Production in Mexico, 2018-2022

Flexible packaging weighs a fraction of rigid plastic, metal or glass containers. As a result, it reduces transportation costs due to its lighter weight and smaller volume. Flexible packaging occupies 40% less space than metal cans which helps optimise warehouse space and storage and also produces 1/10th the amount of CO2 than metal cans.

Companies are leveraging digital and flexography printing for shorter print runs and personalised packaging to enhance consumer engagement. Companies in Mexico flexible packaging market offering such services include Impressa, and Flexo Cristal de México.

Recycling of flexible packaging aims to develop circular solutions for addressing the challenges of flexible plastic waste. Circularity in post-consumer flexible plastic packaging, such as chip bags, plastic pouches, and baby food packs, is difficult due to their complex composition. Valuing this waste encourages its return and reintegration into the circular economy.

Companies are integrating technologies such as blockchain, photos, videos, the Internet of Things (IoT), and artificial intelligence (AI) that collect key data, such as the origins and amounts of the processed material. Companies deliver a certification for the neutralised waste and proof of origin and circularity for the output materials incorporated back into the economy.

Technological advances, expanding food and beverage sector, and rising pharmaceutical packaging sector drive Mexico flexible packaging market growth.

Flexible packaging uses high-barrier films and airtight seals to ensure better shelf life of food products and lowers transportation costs due to its lighter weight. The demand for packaged food is rising in Mexico owing to their convenience, easy availability and better quality. Key food and beverage companies in Mexico include Grupo Bimbo, Danone, Conagra Brands, and Unilever PLC.

In e-commerce shipping, flexible packaging can lower shipping costs and optimise space, allowing more items to be packed into delivery trucks compared to traditional corrugated cardboard boxes. As per Mexico flexible packaging market report, in 2023, the online sales market in Mexico increased by 24.6% compared to 2022. Key e-commerce sites include Mercado Libre, Amazon, Walmart, Liverpool, and Chinese Shein.

Flexible packaging consumes less energy and water in production, reduces greenhouse gas emissions and fossil fuel use, and offers a high product-to-package ratio. Its compact nature allows for significant space and freight savings during transportation and storage. This results in fewer trucks on the road and lower carbon emissions. As oer the Mexico flexible packaging market, bags and pouches use a significantly lower material than rigid alternatives, resulting in energy and water savings of up to 75% in production.

Flexible packaging solutions are produced from lightweight films and laminates and are favoured for their ability to extend the shelf life of products and reduce transportation costs. The use of resealable and easy-to-open packaging is also on the rise, offering convenience to the end-users.

A significant percentage of food products in Mexico uses flexible packaging. Companies involved in food processing and agribusiness in Mexico include Tyson, Bachoco, Driscolls, and Sunny Ridge. These companies are demanding better and greener packaging materials. In most cases, flexible packaging is designed to help extend the shelf life of food products or to comply with other marketing trends, such as higher quality graphics. Innovations in this area include high-barrier films that protect against moisture and oxygen, making them ideal for food processing and pharmaceuticals.

There is a growing demand for biodegradable, recyclable, and eco-friendly packaging in Mexico. Producers are increasingly working to meet this demand and gain a competitive edge in the Mexico flexible packaging market. In December 2024, Bioflex, a flexible packaging company in central Mexico became the first company to purchase the Reifenhäuser Group's environment-friendly Evo Fusion extrusion technology in the Americas. Through this technology, Bioflex is integrating postindustrial and postconsumer recycled materials into products.

Flexible packaging preserves the efficacy of capsules, tablets, and other drugs by protecting them from oxygen and moisture. Common forms include blister packs, IV bags, and barrier pouches for pre-filled syringes. It offers key benefits for the medical and pharmaceutical industries, including extended shelf life, energy efficiency in manufacturing, reduced shipping costs, and lower environmental impact.

In 2022, Mexico was the second-largest pharmaceutical market in Latin America and ranked among the top 15 globally. Further, as a crucial producer of medicines, such as antibiotics, anti-inflammatory drugs and cancer treatments, Mexico is expected to top USD 13 billion in pharmaceutical sales by 2028, aiding the Mexico flexible packaging market development.

Flexible packaging, especially pouches, is ideal for online sales and home delivery across various product categories. It reduces shipping costs due to its lightweight nature, ensures product integrity during transit owing to their unbreakable nature, and optimises logistics by enabling more efficient packing in warehouses. Mexico’s ecommerce market is expected to grow at a CAGR of 24% from 2024 to 2027, reaching a value of USD 184 billion by the end of that period.

Some of the common raw materials deployed by flexible packaging companies include paper, plastic, resins, films, paperboard, and adhesives. These raw materials are purchased from a variety of sources. As a result, a shortage of raw materials driven by supply chain disruption can lead to increased raw material price volatility. Increases in the price of raw materials are generally passed on to customers which can impact the Mexico flexible packaging market expansion.

While flexibility offers several advantages, it can also present challenges, particularly for products that require protection from external pressure, such as glass. Due to its pliable nature, flexible packaging may lose its shape and is vulnerable to punctures from sharp objects. In contrast, rigid containers provide superior protection, as their structure offers added support and safeguarding for the contents.

“Mexico Flexible Packaging Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

On the basis of plastic materials, the market can be divided into the following:

Based on product type, the market can be segmented into the following:

On the basis of application, the market can be categorised into the following:

By key consumers, the market can be divided into the following:

Based on region, the market can be segregated into:

Market Analysis by Plastic Materials

LLDPE is extensively adopted in the packaging sector for its superior strength and stability. LLDPE is used in stretch film, pouches, and other food packaging products.

As per the Mexico flexible packaging market analysis, the rising consumption of packaged food products is increasing the demand for LLDPE. In 2023 the total retail sales of packaged food products in Mexico was recorded at USD 96.1 billion.

LDPE heat shrink film is produced in a multi-layer system thereby increasing its tear strength and puncture resistance. The production of LDPE is carried out using components intended for close contact with food, increasing its adoption in the food and beverage sector.

Metallised BOPP films are commonly used in the flexible packaging of snacks, candies, pharmaceuticals, and toiletries, offering enhanced shelf life and effective protection against moisture and oxygen.

BOPP films are considered cost-effective, making them a preferred choice for manufacturers seeking to balance quality and affordability.

Market Analysis by Product Type

Strong demand for printed roll stock in the country:

The high efficiency and speed of roll stock make roll stock ideal for high-volume production runs. Hence it is being adopted in pharmaceuticals, pet care and food and beverages.

In October 2023, PAC Worldwide, a customised and contract packaging solutions provider, expanded into Central America with the opening of a new full-service flexible packaging facility in Mexico. The 83,000ft² factory located in Vistha San Juan del Rio will produce roll film, security bags, and pouches and other poly products.

Wide application of pouches in snacks, beverages, personal care products, and household items.:

The Mexico flexible packaging market report states that pouches are ideal for smaller production runs and are often the preferred choice for products with distinctive shapes or sizes. They offer strong shelf appeal, providing ample space for branding and product information.

In 2023, Mexico had the presence of 60,000 bakeries, creating a strong need for packaging products, such as pouches.

Market Analysis by Application

Flexible packaging is considered a great option to provide optimum food purity and protection from contamination. The multi layers in flexible packaging prevent oxygen infiltration, increasing the shelf life of products.

As per 2023 records, Mexico was the tenth largest producer in the food sector globally, representing a strong demand for flexible packaging, thereby supporting the Mexico flexible packaging market development.

Flexible packaging offers excellent barrier properties safeguarding cosmetic products from moisture, oxygen, light. Mexico is a key manufacturer of personal care and cosmetics products in Latin America with the presence of several companies such as Unilever, Colgate-Palmolive, Procter & Gamble, L’Oréal, Mary Kay Cosmetics, Natura&Co, and Avon Cosmetics.

Market Analysis by Key Consumers

The presence of a significant number of multinational manufacturing companies in Mexico and recycling initiatives supporting the Mexico flexible packaging market growth:

Large buyers or big brands demand high-volume and high-quality packaging solutions. Mexico has the presence of a significant number of multinational food and beverage companies including Nestle, Pepsico, Danone Group, General Mills, and Unilever, among others representing a strong need for flexible packaging.

In September 2021, Nestlé Mexico has signed an agreement with Greenback Recycling Technologies and Enval to build a chemical recycling plant in Mexico aimed at processing flexible plastic packaging. The plant is expected to handle 6,000 metric tons of scrap in its first full year, with potential for expansion in the future.

The thriving small-scale manufacturers in Mexico creating a demand for flexible packaging:

Small-scale consumers are required with cost-effective flexible packaging solutions. Mexico has a prominent local manufacturing sector that necessitates flexible packaging solutions. According to the National Statistical Directory of Economic Units, in 2022, the state of Guanajuato in Mexico had a total of 269,337 micro and small businesses.

In recent years, the Bajío region has emerged as the second most significant economic hub in Mexico, following Mexico City. Approximately 90% of Asian companies that have entered the Mexican market over the past decade have established operations in the Bajío area.

Coahuila and Nuevo León studied in the Mexico flexible packaging market are the leading exporters of food, beverages, and tobacco in Mexico. Meanwhile, Mexico City and its surrounding regions host a diverse array of industries, including pharmaceuticals, food processing, textiles, and consumer goods manufacturing.

The major factors driving competition in the Mexico flexible packaging market include packaging quality, competitive pricing, innovation, sustainability, customer service, and timely delivery of services. Players need to meet the needs of their customers demanding greener packaging technology and higher-quality graphics.

Founded in 1960, Sealed Air Corporation is a leading global provider of packaging solutions that integrate sustainable, high-performance materials, automation, equipment and services. The company employs 16,500 people, operates in 114 countries, has 98 manufacturing facilities, holds 2,875 patents, and runs 39 packaging design centers globally.

Founded in 1990, Emsur is a part of Grupo Lantero specialized in the manufacture of flexible packaging (lids, banners and sleeves), mainly addressed to food industry both with gravure printing process and flexography.Emsur currently has 9 production plants in 8 different countries with a workforce of over 1000 employees.

Founded in 1977 and headquartered in Canada, Winpak Ltd., part of the global packaging group is a leading manufacturer and distributor of high-quality packaging materials. Winpak specializes in three main areas of packaging – flexible packaging, rigid packaging and lidding, and packaging machinery.

Founded in 1986, Flexitek de México, S.A. de C.V. is a leading manufacturer specializing in the production of flexible packaging solutions. The company offers a diverse range of products, including printed and unprinted films, laminates, and pouches, catering to various industries such as food, beverages, pharmaceuticals, and personal care.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the Mexico flexible packaging market are Constantia Aluprint Mexico, Altopro S. de R.L. de C.V., Transcontinental Inc., Amcor Plc, and Zubex, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 4516.81 Million.

The Mexico flexible packaging market is assessed to grow at a CAGR of 5.80% between 2026 and 2035.

The Mexico flexible packaging market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 7937.59 Million by 2035.

The thriving food and beverage sector in Mexico, the increasing demand for efficient packaging products to enhance the profitability of businesses, and the rising demand for flexible packaging materials from the pharmaceutical sector are the major drivers of the market.

The key trends in the market include the growing expansion of e-commerce companies across Mexico, the rising demand for flexible pouches in the pharmaceuticals sector, and the increasing demand for consumer goods.

LLDPE (Based Brown Film), LDPE (Based Shrink Film), BOPP film, and BOPET film, are the different plastic materials used in flexible packaging.

printed roll stock, preformed bags, and pouches, among others, are the major applications of the market.

Sealed Air Corporation, EMSUR MACDONELL, S.A.U, Winpak Ltd., Flexitek de México, SA de CV, Constantia Aluprint Mexico, Altopro S. de R.L. de C.V., Transcontinental Inc., Amcor Plc, and Zubex, among others, are the key market players.

The major regions considered in the market are Central Mexico, Northern Mexico, Pacific Coast, The Bajío, Yucatan Peninsula, and Baja California, among others.

The major key consumers in the market are large buyer (Big Brands), and small player (Local Players).

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Plastic Materials |

|

| Breakup by Product Type |

|

| Breakup by Application |

|

| Breakup by Key Consumers |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share