Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Mexico paints and coatings market size reached around USD 3686.03 Million in 2025. The market is estimated to grow at a CAGR of 5.30% during 2026-2035 to reach a value of USD 6177.92 Million by 2035.

Base Year

Historical Period

Forecast Period

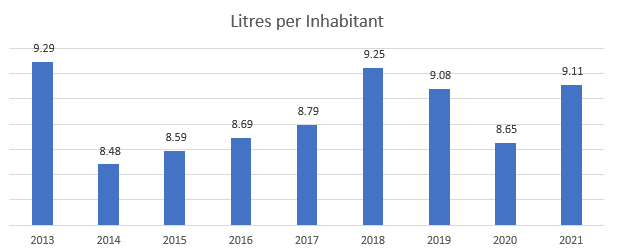

Per capita consumption of paints increased steadily from 2014 to 2018 but declined in 2019 and 2020. It rose to 9.11 litres in 2021 from 8.65 litres in 2020.

Mexico ranks as the world's seventh-largest producer of passenger vehicles, with an output of 3.5 million units in 2022, which further adds to the demand for paints and coatings for automobiles.

Mexico’s manufacturing sector draws the highest foreign direct investment (FDI) and accounted for 18.5% of the country’s GDP in 2021.

Compound Annual Growth Rate

5.3%

Value in USD Million

2026-2035

*this image is indicative*

Paints and coatings play a pivotal role in a variety of sectors, as they improve the longevity of products and provide a barrier against external damage such as corrosion. Manufacturers are investing in the production of quality paints and coatings that are easier to apply, effectively hide surface defects, efficiently bind to surfaces, and resist peeling and mildew.

Figure: Consumption of Paints per Capita (Litres per Inhabitant)

Mexico is the world’s seventh-largest producer of automobiles, with a production of 3.5 million vehicles in 2022. A key trend supporting the expansion of the paints and coatings market in Mexico is the growing use of paints and coatings by the automotive and transportation sectors.

Growth in residential construction; expanding aviation sector; increasing adoption of environment-friendly paints and coatings; and expanding automotive sector are positively impacting the Mexico paints and coatings market expansion

| Date | Company | Event |

| May 2023 | PPG Industries Inc | PPG allocated USD 44 million to upgrade five powder coating manufacturing plants in the U.S. and Latin America, with USD 30 million directed to U.S. facilities and USD 14 million to Latin American sites. |

| Aug 2022 | PPG Industries Inc | PPG invested USD 11 million to double its powder coatings capacity at its San Juan del Rio plant in Mexico, completing the expansion project by mid-2023. |

| Aug 2022 | Axalta Coating Systems Ltd. | Axalta Coating Systems Ltd. introduced its latest basecoat technology, Cromax® Gen, for the Latin American Automotive Refinish sector, aiming to enhance productivity and cost-efficiency for body shops. |

| Apr 2022 | Akzo Nobel N.V. | Akzo Nobel N.V. completed the acquisition of Grupo Orbis, a prominent paints and coatings company situated in Colombia. |

| Trends | Impact |

| Growth in residential construction | The expanding construction sector contributes to the paints demand. In 2021, the construction sector in Mexico expanded by 7.2% Additionally, the ongoing infrastructure development projects, such as the Baja California Sur Combined Cycle Power Plant, Tigres Football Club Stadium, and Lerdo-Norte IV Combined Cycle Power Plant, creating an opportunity for Paint manufacturers. |

| Expanding automotive sector | Mexico is the world’s seventh-largest producer of automobiles, with a production capacity of 3.5 million vehicles in 2022. The expanding automotive manufacturing sector is driving the need for automotive coatings, essential for shielding vehicles against corrosion. |

| Increasing adoption of eco-friendly paints | The rising concerns of environmental pollution are catering to the demand for eco-friendly paints such as low VOC paints. Low VOC paints are generally made from natural raw ingredients such as water, beeswax, plant oils and resins, and cause less emissions. |

| Expanding aviation sector | Within Latin America, Mexico is a leader in international passenger volumes. In 2022, the country recorded 49.6 million passengers. International travel constitutes 50% of Mexico's total air traffic, contributing to 22% of the regional air traffic. The expanding air travel is stimulating the demand for new aircraft and the need for paints. |

The lower labour costs and skilled workforce are strengthening Mexico’s automotive and aerospace manufacturing sectors, which in turn, aids the market for paints and coatings in Mexico.

Mexico’s automotive sector is a major contributor to the economy. Mexico is the fifth-largest manufacturer of heavy-duty vehicles globally. The country has established itself as a major vehicle manufacturing hub with the presence of prominent automobile manufacturers such as Ford Motor Co, General Motors (GM), and BMW AG. The escalating manufacturing of vehicles in the country is further driving the Mexico paints and coatings market growth.

According to World Bank, in 2022, Mexico’s manufacturing sector accounted for 21% of Mexico’s GDP. The expansion of automotive, consumer electronics, and aerospace manufacturing sector is contributing to the market growth.

Mexico is witnessing a demand for low-VOC paints and coatings that are safe for the environment and human health. Low VOC paints are also being increasingly adopted as road marking paint in Mexico.

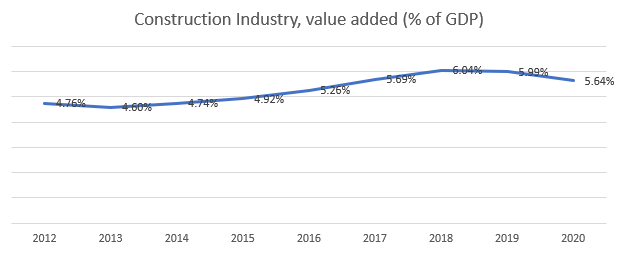

Figure: Construction Industry Value Added to GDP In Mexico, 2012-2022

“Mexico Paints and Coatings Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Raw Material

Market Breakup by Technology

Market Breakup by Application

Market Breakup by Region

Under raw materials, solvents are further categorised as acrylic, polyurethane, alkyd, and epoxy.

Under application, while the industrial segment is further categorised into automotive and transportation, general industrial, wood, aerospace and marine, and protective, the architectural segment is classified into indoor and outdoor.

Industrial applications account for the majority of the Mexico paints and coatings market share

The prominent types of paints used in the industrial sector in Mexico are acrylics, epoxies, and polyurethanes, with high solids characteristics, that can provide maximum protection from wear and tear. In 2022, the industrial sector accounted for 32.1% of Mexico's GDP.

Water-based architectural paints are widely used for walls, ceilings, and decorations on any dry surface. The increasing residential renovation activities and the increase in long-term tourism and housing in Mexico is catering to a greater demand for paints and coatings. The expansion of the housing sector is increasing the requirement for paints for decorative purposes. The demand for vacation homes in Mexico witnessed a 15% growth in 2022.

Based on raw material, resins account for a significant share of the Mexico paints and coatings market

Acrylic resins are widely deployed in architectural and automotive applications due to their durability and weatherability as coating materials. The presence of large OEMs in Mexico, including Ford, Honda, Nissan, Chrysler, and Volkswagen aid the demand for automotive coatings and refinish paints.

The automotive refinishing sector is increasing the demand for pigments that create colour-shifting and pearlescent effects. Paint fillers are incorporated into paint formulations to modify or improve the properties of the paint. Some of the common types of fillers included are calcium carbonate, talc, silica and silicates.

The market participants are providing cost-effective solutions, optimising product performance, enhancing distribution networks, and establishing strong brand recognition, all of which contribute to elevated product quality and market development

| Company | Founded | Headquarters | Services |

| PPG Industries, Inc. | 1883 | United States | The company provides paints and coatings for aerospace, architectural coatings, automotive refinish and OEM, among others. |

| Akzo Nobel N.V. | 1792 | Netherlands | Specialises in Decorative paints, automotive and specialty coatings, industrial coatings, marine, protective and yacht coatings, and powder coatings. |

| Benjamin Moore & Co. | 1883 | United States | The company offers their products under brands like Aura, RegalSelect, Ultra Spec, ben, ADVANCE, ARBORCOAT, Coronado, and Insl-x, among others. |

| Jotun A/S | 1926 | Norway | The company offers paints and coatings products for architecture and design, energy, infrastructure, and shipping. |

Other notable players operating in the Mexico paints and coatings market include Axalta Coating Systems Ltd., Nippon Paint Holdings Co., Ltd., BASF SE, WEG S.A., Pinturas Osel, S.A. DE C.V, and Sherwin-Williams Company, among others.

Puebla-Tlaxcala region in Central Mexico has the presence of manufacturing units of global companies such as Volkswagen Group and Audi. The region produces about 3,500 vehicles per day, and about 1,277,500 vehicles on an annual basis. In January 2024, Volkswagen announced an investment of USD 2 million for producing electric cars in Puebla.

Automotive manufacturing in Mexico is primarily located in the northern regions of Coahuila, Nuevo León, Sonora, among other areas. Coahuila is a significant region in the automotive manufacturing sector. General Motors, established in the region produced 722 thousand 631 units of automotives in 2023. Such developments in the country favour the Mexico paints and coatings market.

India Paints and Coatings Market

United States Paints and Coatings Market

Australia Paints and Coatings Market

North America Paints and Coatings Market

Antifouling Paints and Coatings Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market attained a value of USD 3686.03 Million in 2025.

The market is estimated to grow at a CAGR of 5.30% during 2026-2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 6177.92 Million by 2035.

The key trends fuelling the growth of the market include rapid development of eco-friendly paints and coatings and rising requirement from the automotive sector.

The key regions are Central Mexico, Northern Mexico, The Bajío, Pacific Coast, Yucatan Peninsula, and Baja California.

The market uses water-borne, solvent-based, powder-based, and other technologies.

The raw materials include resin, pigments and fillers, additives, and solvents.

The key players in the market include PPG Industries, Inc., Akzo Nobel N.V., Benjamin Moore & Co., Jotun A/S, Axalta Coating Systems Ltd., Nippon Paint Holdings Co., Ltd., BASF SE, WEG S.A., Pinturas Osel, S.A. DE C.V, and Sherwin-Williams Company, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Raw Material |

|

| Breakup by Technology |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share