Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America paints and coatings market size attained a value of USD 43.96 Billion in 2025. The market is expected to grow at a CAGR of 3.60% between 2026 and 2035, reaching almost USD 62.61 Billion by 2035.

Base Year

Historical Period

Forecast Period

According to the Alliance for Automotive Innovation, the auto manufacturing sector injects over USD 1 trillion into the economy that drives the North America paints and coatings market.

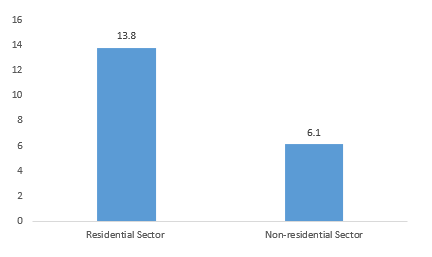

As per Statistics Canada, both residential and non-residential building construction rose by 0.3%. thus, pushing North America paints and coatings market growth.

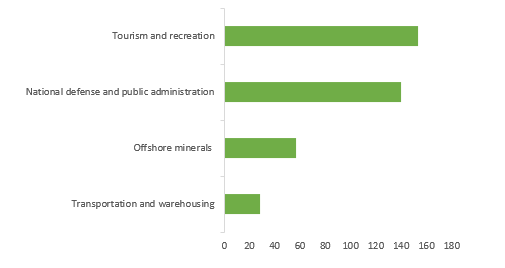

The Office for Coastal Management revealed a 7.4% GDP increase and a 10.5% sales surge in the marine economy in 2021.

Compound Annual Growth Rate

3.6%

Value in USD Billion

2026-2035

*this image is indicative*

Paints are primarily used for their aesthetic appeal, whereas coatings are mainly employed to protect surfaces from deterioration or corrosion. Both paints and coatings are commonly applied to prevent surfaces from oxidizing and being exposed to sunlight. Coatings are extensively utilised across various industries including automotive, transportation, construction, and wood industries, with a particular emphasis in construction for shielding buildings from external damage.

Additionally, paints and coatings play a vital role in various applications such as enhancing the appearance of residential and non-residential building structures, industrial equipment, industrial wood, automotive, marine, and more, aiding the North America paints and coatings market development. These materials possess structural properties such as adhesion, waterproofing, and corrosion resistance, which are applied to surfaces to prevent corrosion, rusting, and erosion, thus averting soil spoilage.

As per Statistics Canada, the construction of residential and non-residential buildings saw a 0.3% growth in December 2023 compared to November 2023. This uptick in construction activity contributes to the rising demand for the paints and coatings market in North America.

INVESTMENT IN BUILDING CONSTRUCTION, DECEMBER 2023, $ BILLION

The North America paints and coatings market development is driven by expanding architectural industry, organic paints and coatings, automotive and marine industries.

Protection and aesthetic improvement for buildings, safeguard against harsh weather and UV exposure, tailored for specific purposes like roof coatings and wall paints

Block-resistant organic paints and coatings without VOCs, made from natural ingredients, eco-friendly coatings reducing harmful effects of infrared and UV radiation

Colour retention, abrasion resistance, flexibility, and protective properties, annual injection of over USD 1 trillion into the US economy by auto manufacturing

Shield against saltwater corrosion and marine organism growth, prolong lifespan, diminish maintenance frequency, yield cost savings through rust prevention and decay mitigation

As per the North America paints and coatings market report, strict environmental regulations in the sector drive the preference for water-based paints over solvent-based ones. Poorly ventilated work environments expose workers to hazardous vapours from solvent-based products, leading many projects, such as those involving fuel storage and railroad tanks, to opt for water-based coatings.

Additionally, water-based coatings help reduce the concentration of flammable substances. State and local governments often impose regulations limiting the amount of volatile organic compounds (VOCs) businesses can emit.

"North America Paints and Coatings Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Resin Type

Market Breakup by Technology

Market Breakup by End Use

Market Breakup by Country

Acrylic resin dominates the North America paints and coatings market share owing to its outstanding color retention, durability, and resilience against weathering

Acrylic is water-based coatings that are adaptable, and suitable for architectural, automotive, and industrial uses, with fast drying and low environmental impact, favoured in diverse sectors.

Alkyd coatings are valued for strong adhesion and durability, commonly used in industrial and architectural sectors. Additionally, polyurethane coatings, known for superior finish and resistance, are widely applied in the automotive, wood, and aerospace industries.

Waterborne coatings, based on technology, pushing the North America paints and coatings market growth, primarily due to their reduced environmental footprint, emitting fewer volatile organic compounds (VOCs) than solvent-based alternatives

Water-based coatings, using water as a solvent, are eco-friendly and easy to clean. Their adaptability and safety make them popular in automotive and architectural applications, with continuous advancements improving durability and drying rates.

As per the North America paints and coatings market report, solvent-based coatings excel in adhesion, resilience, and aesthetics and are considered ideal for industrial and demanding environments. Additionally, powder coatings are eco-friendly and waste-efficient and are gaining momentum for their cost-effectiveness and superior quality, favored in appliances, automotive parts, and furniture applications.

Based on end use, paints and coatings market in North America is being supplemented by rising demands within the residential and commercial construction sectors

The architectural sector comprises various products for interior and exterior uses, such as wall paints and wood finishes, driven by global construction, urbanisation, and increased aesthetic and protective needs.

The automotive, transportation, and protective coatings sector encompasses specialised coatings sought for their superior durability, corrosion resistance, and ability to withstand extreme conditions. Technological progress drives the segment's expansion toward more efficient, eco-friendly coatings, thereby propelling the North America paints and coatings market growth.

The increasing competitiveness in the market can be characterised by the introduction of various types of paints and increasing number of mergers and acquisitions.

| Company | Year Founded | Headquarters | Divisions/Products |

| BASF SE | 1865 | Ludwigshafen, Germany | Chemicals, materials, industrial solutions, surface technologies, nutrition and care, agricultural solutions |

| PPG Industries, Inc. | 1883 | Pittsburgh, United States | Paints, coatings, optical products, speciality materials, chemicals, glass, fibreglass |

| Sherwin-Williams Co. | 1866 | Ohio, United States | Paints, coatings, floor coverings, and associated products |

| Nippon Paint Holdings Co. Ltd. | 1881 | Osaka, Japan | Paints for automobiles, ships, and industrial applications, fine chemicals, finishing agents, adhesives |

Other North America paints and coatings market key players are Benjamin Moore & Co., RPM International Inc., 3M Co., Akzo Nobel N.V., Masco Corporation, and Cloverdale Paint Inc., among others.

The United States is leading the way as the demand flourishes in the automotive, construction, and industrial fields. Green coatings are propelled by regulations and consumer consciousness, nurturing a competitive environment with continuous R&D investments. As reported by the Office for Coastal Management, the marine economy experienced a 7.4 per cent rise in its GDP contribution and a 10.5 per cent surge in sales in 2021, thus, driving the North American paints and coatings market.

ANNUAL GROSS DOMESTIC PRODUCT (VALUE ADDED) FOR MARINE SECTORS, IN USD BILLION

Canada's construction, automotive, and other sectors are also thriving, accompanied by an increasing demand for sustainable and environmentally friendly paints. This trend bolsters the demand for the paints and coatings market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the paints and coatings market in North America attained a value of nearly USD 43.96 Billion.

The market is projected to grow at a CAGR of 3.60% between 2026 and 2035.

The North America paints and coatings market is expected to reach USD 62.61 Billion in 2035.

The paints and coatings market is growing with expanding demand from architectural industry, use of organic paints and coatings, along with growing use from automotive and marine sectors.

Based on the type of resin, the market includes epoxy, acrylics, alkyd, polyurethane, polyester, and various other types.

Key players in the market are BASF SE, PPG Industries, Inc., Sherwin-Williams Co., Nippon Paint Holdings Co. Ltd (Dunn-Edwards Corporation), Benjamin Moore & Co., RPM International Inc., 3M Co., Akzo Nobel N.V., Masco Corporation, and Cloverdale Paint Inc., among others.

Based on technology, the paints and coatings market is divided into water-borne, solvent-borne, powder coating, and UV-cured coating.

The major regions include the United States of America and Canada.

Based on the end use, the paints and coatings market is divided into automotive, protective coatings, transportation, architectural, packaging and others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Resin Type |

|

| Breakup by Technology |

|

| Breakup by End Use |

|

| Breakup by Country |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share