Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Mexico white goods market size was approximately USD 11.71 Billion in 2025. The market is estimated to grow at a CAGR of 4.10% during 2026-2035 to reach a value of USD 17.50 Billion by 2035.

Base Year

Historical Period

Forecast Period

Mexico exports home appliances such as refrigerators to countries including the United States, Colombia, Canada, and Peru.

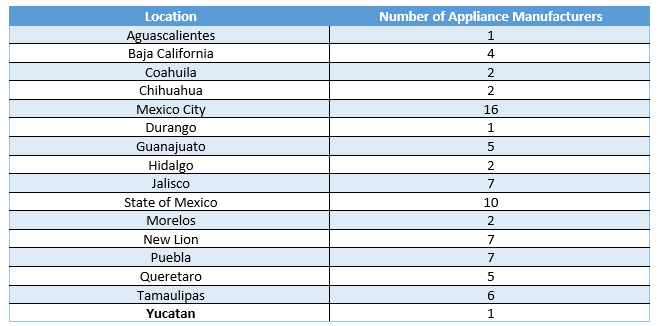

Mexico has the presence of around 189 companies manufacturing large home appliances that include refrigerators, freezers, and washing machines and dryers.

Major regions of home appliance manufacturing are Baja California, Baja California Sur, Coahuila, Chiapas, Chihuahua, and Mexico City, among others.

Compound Annual Growth Rate

4.1%

Value in USD Billion

2026-2035

*this image is indicative*

Mexico’s climatic conditions, such as warm and humid weather with some parts experiencing cold temperatures below 12 °C, make heating and cooling systems a necessity. Additionally, there is a rise in demand for sustainable and energy-efficient air conditioners in the region.

Foreign investments by electronic manufacturers in Mexico have significantly increased due to the availability of skilled labour in the country, its proximity to major economies like the US and Canada, and favourable free-trade government initiatives.

Table: Number of appliance manufacturers in the Mexican region by location

Rising popularity of energy efficient white goods; established global manufacturers in the country; prominent investment opportunities; and significant export opportunities are impacting the market Mexico white goods market expansion

| Date | Company | Event |

| May 2023 | Carrier Mexico | Carrier announced its plans to inaugurate an eighth manufacturing facility in Nuevo Leon, further fortifying its presence in the northern Mexico metropolitan area. |

| May 2023 | Whirlpool | Whirlpool announced an exclusive strategic move to centralize French Door refrigerator production in Mexico, leveraging the plant's established success. |

| Jul 2022 | Atotech | Atotech marked a successful commencement of production and official inauguration of its new facility in Querétaro, Mexico, allowing for significant expansion of its production capacity in the region. |

| Jul 2022 | Samsung | Samsung allocated a substantial investment of $500 million to amplify its household appliance production in Mexico |

| Trends | Impact |

| Smart and energy-efficient white goods are gaining popularity | Rapid technological advancements have elevated white goods from basic appliances to smart, energy-efficient systems, supporting the Mexico white goods market development. These advanced appliances offer remote control, sensors, and self-diagnosis, enhancing user convenience. Moreover, growing consumers awareness about energy efficiency and product features drives informed purchases. |

| Presence of several global manufacturers | The Mexican white goods market is distinguished by the presence of numerous global brands with strong reputation. To sustain the competition, manufacturers in this market often establish partnerships with retailers that span both traditional brick-and-mortar stores and online platforms. This strategic collaboration yields a distribution network that significantly simplifies consumer access to white goods. |

| Significant investment opportunities | Due to the favourable eco-system for electronics and appliance manufacturing in Mexico, key manufacturers including BSH Group and Hisense Group, have announced million-dollar investments to set-up new appliance plants in the country. |

| Significant export market | Due to the U.S.-Mexico-Canada Agreement (USMCA), it is possible to export goods made in Mexico duty-free to either the US or Canada. |

Production facilities in Mexico manufacture a range of appliances, encompassing washing machines, air conditioners, stoves, electric water heaters, and vacuum cleaners. During the year 2022, investments exceeding USD 1.15 billion were channeled by the refrigerator and washing machine manufacturers, along with other household appliance producers, into Mexico's thriving market.

The industrial zones in Mexico, particularly those situated near the northern border, have gained prominence as crucial hubs for household appliance manufacturing. The Mexico white goods market growth is influenced by factors including the strategy of nearshoring and stimulation provided by the United States-Mexico-Canada Agreement (USMCA). Approximately 25 new industrial parks were expected to be inaugurated by 2023, augmenting the overall availability of industrial spaces across Mexico. Presently, manufacturers of household appliances account for roughly 12% of the total occupied space within existing industrial areas.

“Mexico White Goods Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product

Market Breakup by End Use

Market Breakup by Distribution Channel

Market Breakup by Region

By product, air conditioners can be further divided into split AC and window AC. Refrigerators are categorised into single-door, double-door, and side-by-side. Washing machines are sub-divided into fully automatic and semi-automatic while dishwashers are categorised into built-in dishwashers and portable dishwashers. Microwave ovens include convection, grill, and solo as the major types.

Based on product, refrigerators dominate the Mexico white goods market share, with smart refrigerators witnessing increased popularity

Smart refrigerators integrated with AI and IoT technology are increasingly gaining popularity in Mexico. Such refrigerators can be remotely controlled, help optimise maintenance and repair, enhance energy efficiency, and reduce the loss of cold air.

Meanwhile, occurrences of heat waves across Mexico have been significant, contributing to greater sales of air conditioners to cool down residences and reduce the risk of heat strokes.

Further, with the growing trend of sustainability, low-maintenance and energy-efficient washing machines that use less amount of water and detergent have gained preference in the country.

Based on distribution channel, hypermarkets and supermarkets account for a significant share of the Mexico white goods market

Supermarkets in Mexico conduct campaigns and provide discounts on various kinds of white goods during different seasons, attracting more sales. Hypermarkets and supermarkets such as Walmart have been focusing on expanding their presence in Mexico, meeting the growing demand for white goods.

Several electronic stores are situated in prime locations of Mexico such as New Mexico, providing greater convenience to customers seeking to buy white goods.

Increasing digitisation and the rising number of online channels across the country support the purchase of white goods through online platforms.

The market players are focusing on strategies like consumer differentiation, expansion into related product lines, and establishing unique selling propositions for their brands

| Company | Founded | Headquarters | Services |

| Controladora Mabe, S.A. de C.V. | 1960 | Chapultepec, Mexico | The diverse product portfolio encompasses items like air conditioning units, water heaters, dishwashers, refrigerators, freezers, dispensers, washing machines, and integrated laundry centres, among other offerings. |

| Whirlpool México, S. de RL de CV | 1911 | Apodaca, NL, Mexico | Prominent products encompass floor and built-in stoves, grills, ovens, bells, microwaves, dishwashers, refrigerators, wine cellars, minibars, compact units, washing machines, tumble dryers, and washer dryers, among a diverse range of offerings. |

| Electrolux Comercial, SA de CV | 1919 | Chihuahua, Mexico | Various products offered include single-door and double-door fridges, bottom freezers, duplexes, French door refrigerators, wine coolers, top load and front-loading washers, as well as coffee makers, kettles, blenders, and wireless vacuum cleaners, among other offerings. |

| Samsung Electronics México | 1969 | Queretaro, Mexico | The product portfolio encompasses refrigerators, washing machines, vacuum cleaners, air conditioners, and kitchen appliances. |

Other notable players operating in the Mexico white goods market include LG Electronics Mexico, SA de CV, Carrier México, Daikin Airconditioning Mexico, S DE RL DE CV, Hamilton Beach Brands, Inc., and Panasonic de Mexico SA de CV, among others. The manufacturers are upgrading their product portfolios and incorporating the latest capabilities to innovate their offerings and meet the evolving demands of consumers.

With central Mexico’s Queretaro being one of the most competitive and sustainable areas in the country, many companies are making investments to strengthen their manufacturing capabilities in the area and boost their regional presence.

The increasing population and improving quality of life of people favour the use of white goods. As of 2020, Tijuana, Mexicali, and Ensenada were the municipalities of Baja California with the highest population.

Tijuana, in Baja California, is a prominent electronics manufacturing hub with around 200 major companies like Panasonic, Samsung, Jabil, Eaton, and Leviton. The region offers a skilled, competitive, and cost-efficient labour force, along with a well-integrated binational and regional ecosystem.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market attained a value of USD 11.71 Billion in 2025.

The market is estimated to grow at a CAGR of 4.10% during 2026-2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 17.50 Billion by 2035.

The key trends of the market include increased integration of smart technology to improve the convenience and functionality of white goods, a rise in the demand for energy-efficient appliances, and the growing popularity of compact white goods due to increasing urbanisation.

The key regional markets for white goods are Baja California, Northern Mexico, The Bajío, Central Mexico, Pacific Coast, and Yucatan Peninsula.

The various distribution channels include hypermarkets and supermarkets, electronic stores, online, and others.

The major end uses considered in the market report include commercial and residential sectors.

The key players in the market include Controladora Mabe, S.A. de C.V., Whirlpool México, S. de RL de CV, Electrolux Comercial, SA de CV, Samsung Electronics México, LG Electronics Mexico, SA de CV, Carrier México, Daikin Airconditioning Mexico, S DE RL DE CV, Hamilton Beach Brands, Inc., and Panasonic de Mexico SA de CV, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by End Use |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share