Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Middle East and Africa ceiling tiles market attained a volume of 1107.00 Million Sq. Metres as of 2025 and is anticipated to grow at a CAGR of 9.70% during the forecast period of 2026 to 2035. The rising demand for sustainable and energy-efficient building materials in the Middle East and Africa is boosting the ceiling tiles market. Construction activities, especially in residential and commercial spaces, are on the rise, fueled by ceiling tiles that enhance energy efficiency and aesthetic appeal. The market is thus expected to reach a volume of nearly 2793.92 Million Sq. Metres by 2035.

Base Year

Historical Period

Forecast Period

The Middle East and Africa ceiling tiles market is increasingly focusing on sustainability, with an increased demand for recycled material-based tiles and low-VOC coatings. This trend follows environmental regulations and consumer demand for eco-friendly solutions, offering opportunities for B2B businesses to provide sustainable products that comply with these changing standards.

Technological developments in ceiling tiles include smart capabilities like IoT-integrated sensors for lighting management, air quality sensing, and occupancy sensing. Such developments are responding to growing demand for energy-saving and high-tech building products that enable B2B firms to differentiate their products and address the requirements of contemporary construction projects, thereby increasing the growth of the Middle East and Africa ceiling tiles market.

The growth in the number of commercial spaces, such as office buildings, hotels, and shopping spaces, is fueling the demand for ceiling tiles with improved features such as noise reduction and visual appeal. B2B businesses can leverage this trend by offering customized solutions that augment the functionality and design of commercial interiors.

Compound Annual Growth Rate

9.7%

Value in Million Sq. Metres

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The Middle East and Africa ceiling tiles market is experiencing steady growth, supported by urban growth and rising infrastructure investment. Accelerating development in commercial property, particularly in areas such as healthcare, education, and retail, is generating substantial demand for ceiling solutions that are both aesthetically pleasing, durable, and functional. Moreover, growing smart cities and mega projects in nations such as the UAE and Saudi Arabia are driving up the demand for advanced building materials, such as acoustic and energy-efficient ceiling tiles, appropriate for today's building standards. Such factors have been driving the growth of the Middle East and Africa ceiling tiles market.

Another growth driver is the growing sense of indoor environmental quality. Ceiling tiles that accommodate improved acoustics, thermal insulation, and indoor air quality are becoming popular among developers and builders. In addition, with increasing focus on green buildings, there is increased demand for environmentally friendly and recyclable ceiling products that adhere to international standards of sustainability. Firms within the region are also looking at launching tiles with enhanced resistance to humidity and microbial growth, for extreme climates and high-traffic areas, creating further market potential for innovative ceiling solutions throughout the region.

Sustainable materials, smart acoustics, 3D printed designs, and health-focused antimicrobial, air-purifying innovations are therefore shaping the Middle East and Africa ceiling tiles market dynamics and trends.

Manufacturers are increasingly adopting sustainable materials such as recycled metals, bio-fibers, and low-VOC composites. This is facilitated by green building codes and consumers seeking sustainable interiors, which have propelled the application of LEED-certified and carbon-neutral ceiling tiles in commercial and institutional buildings, thus pushing the growth of the Middle East and Africa ceiling tiles market.

Next-generation ceiling tiles are now featuring embedded sensors and acoustic optimization technology. These sound-absorbing tiles dynamically adjust sound absorption based on noise levels to increase speech intelligibility and comfort in open offices, airports, and hospitals, blending functionality with aesthetics and smart-building integration.

3D printing enables complex, personalized ceiling tile patterns with quicker manufacturing and less waste. Architects utilize it to design distinctive visual features customized to brand or cultural styles, enhancing regional design variety in high-end hotels, shopping malls, and government facilities, thereby helping to create new trends in the Middle East and Africa ceiling tiles market.

Post-pandemic, there has been a demand for health-focused tiles. High-tech tiles now come with antimicrobial coatings and built-in air-purifying properties, such as photocatalytic surfaces that cut down on airborne pathogens, best-suited for healthcare facilities, schools, and public places in expanding urban hubs in MEA.

The Middle East and Africa ceiling tiles market is experiencing high momentum with the introduction of Knauf Danoline's acoustical gypsum tiles, which are in demand for merging sophisticated looks with industry-leading sound absorption. Widely used in offices, schools, and auditoriums, the tiles have customizable perforations and eco-friendly materials, making them perfect for design-driven and sustainable projects. Their performance and appearance are creating new standards in the region, thereby shaping new trends in the Middle East and Africa ceiling tiles market.

One emerging innovation gaining attention is smart ceiling tiles that are AI-enhanced. These tiles are already undergoing pilot trials and will integrate acoustic performance with live environmental sensing, monitoring noise, temperature, and occupation rates. For use in commercial and healthcare settings, they hold the potential to transform interior infrastructure in the Middle East and Africa region by providing increased comfort, energy savings, and intelligent building capabilities.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Middle East and Africa Ceiling Tiles Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Installation Type

Market Breakup by Materials

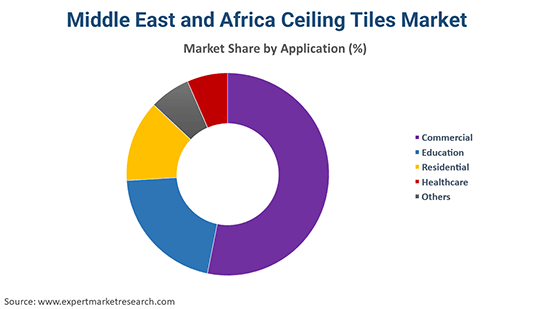

Market Breakup by Application

Market Breakup by Country

Modular ceiling tiles are becoming increasingly popular in the Middle East and Africa because they are versatile, simple to install, and affordable. As per Middle East and Africa ceiling tiles market analysis, they can be easily maintained and replaced, which makes them suitable for high-traffic commercial areas such as offices and shopping environments. The design and functional flexibility have made them a favorite among contemporary architecture.

According to the Middle East and Africa ceiling tiles industry analysis, non-modular ceiling tiles, however, are favored for their clean, sleek look. They are commonly utilized in upscale residential or commercial applications where style and consistency are important. While less versatile than modular, their long life and high-end finish render them appropriate for luxury environments, leading to increased popularity within the region.

Leading Middle East and Africa ceiling tiles market players are emphasizing innovation, sustainability, and customization to meet the rising demand for high-performance ceiling tiles. They will supply products that blend the aesthetic appeal with the functional value of energy-efficient, acoustic, and eco-friendly solutions. Moreover, Middle East and Africa ceiling tiles companies are investing in local manufacturing capacity, cutting-edge technologies such as smart ceiling systems, and eco-friendly materials to address the changing needs of the region in both commercial and residential building projects.

Founded in 1905 and based in France, Saint-Gobain Gyproc provides a broad spectrum of ceiling solutions such as acoustic, fire-resistant, and eco-friendly tiles. Their products, with performance and aesthetic appeal, serve commercial and residential applications, with a focus on energy efficiency, sound management, and simplicity of installation.

Established in 1932 and headquartered in Denmark, Knauf Danoline is a company that focuses on acoustic ceiling solutions, producing gypsum-based tiles that achieve sound absorption with design flexibility. Applied in offices, schools, and public buildings, their products are designed with flexibility in perforations, finishes, and sizes to suit different design requirements.

Founded in 1985, and based in Saudi Arabia, USG Boral offers a variety of gypsum-based ceiling solutions such as fire-resistant, soundproof, and moisture-resistant tiles. Their products serve commercial, residential, and industrial applications, emphasizing high-quality products and sustainability, providing innovative and dependable solutions for a wide range of applications.

Established in 1967 with its headquarters in the United Kingdom, SAS International provides high-end ceiling solutions, such as metal and acoustic tiles. Renowned for their high-quality, design-oriented products, their tiles are utilized in commercial environments, delivering integrated systems that optimize acoustic capabilities and environmental consciousness, emphasizing customization.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the global Middle East and Africa ceiling tiles market are Mada Gypsum, RAM Metal Industries LLC, and AYHACO Gypsum Products Manufacturing, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the Middle East and Africa ceiling tiles market reached an approximate volume of 1107.00 Million Sq. Metres.

The market is assessed to grow at a CAGR of 9.70% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a volume of around 2793.92 Million Sq. Metres by 2035.

The major drivers of the market are thriving construction and hospitality sector, rising disposable incomes, growing western influence, rising living standards, rapid urbanisation, increasing demand for premium construction materials, and growing technological advancements.

The key trends guiding the growth of the market include the availability of customised product range to the consumers and the development of ceiling tiles with improved durability and bio-degradable characteristics.

The major countries in the market are Saudi Arabia, the United Arab Emirates (UAE), Nigeria, and South Africa.

Modular ceiling tiles and non-modular ceiling tiles represent the leading installation types in the market.

Gypsum, mineral fibre, metal, glass wool, and stone wool, among others are the leading ceiling tiles materials in the market.

The applications include commercial, education, residential, and healthcare, among others.

The major players in the Middle East and Africa ceiling tiles market are Saint-Gobain Gyproc, Knauf Danoline, USG Boral, SAS International, Mada Gypsum, RAM Metal Industries LLC, and AYHACO Gypsum Products Manufacturing, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Installation Type |

|

| Breakup by Material Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share