Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global next generation sequencing market size USD 16.61 Billion in 2025, driven by the rising demand for precision medicine, targeted therapies, and biomarkers discovery across the globe. It is poised to grow at a CAGR (compound annual growth rate) of 13.30% during the forecast period of 2026-2035, and reach USD 57.90 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

13.3%

Value in USD Billion

2026-2035

*this image is indicative*

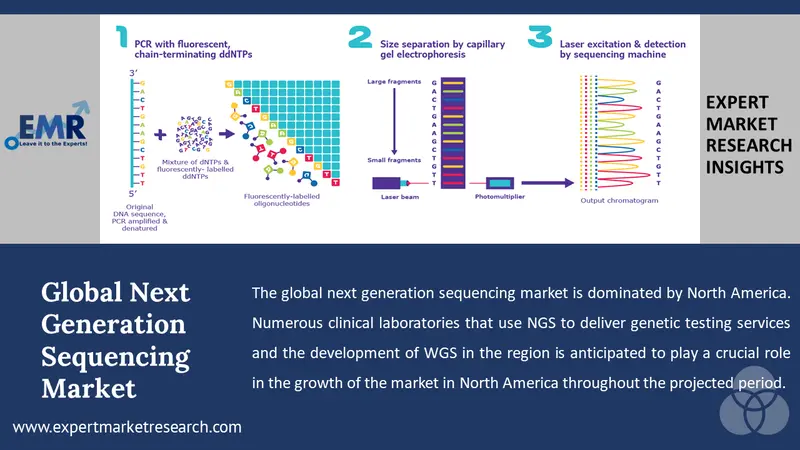

Next-generation sequencing (NGS) is transforming healthcare by enabling the rapid detection of genetic mutations and biomarkers crucial for precision medicine and targeted therapies. Widespread adoption in routine diagnostics and large-scale projects is accelerating NGS market growth. Advances in technology and sequencing cost reduction are making NGS more accessible across research and clinical settings.

DRIVER: Technological Evolution in NGS Platforms

The rapid advancement of next-generation sequencing (NGS) technologies has enhanced sequencing accuracy, speed, and scalability. Modern platforms offer high-throughput sequencing with shorter turnaround times and reduced costs, making NGS more accessible for research and clinical applications. These developments support large-scale projects, enable the detection of genetic mutations and biomarkers, and promote routine diagnostics, driving widespread adoption across pharmaceutical, biotechnology, and academic sectors.

For instance, in April 2024, Oxford Gene Technology (OGT), a global provider of genomic research and diagnostic solutions, launched the RNA-based SureSeq Myeloid Fusion Panel, an innovative NGS tool for identifying over 30 fusion genes associated with acute myeloid leukaemia (AML), including KMT2A and MECOM fusions. Designed with myeloid cancer experts, the panel uses a partner-gene agnostic approach to detect novel and rare fusions. Fully compatible with OGT’s Universal NGS Complete Workflow and Interpret software, it reduces hands-on time and simplifies data analysis, strengthening the role of NGS in precision oncology.

RESTRAINT: Substantial Upfront Costs and Infrastructure Needs

Despite its growing applications, one of the key barriers to broader adoption of NGS is the high initial capital investment required. Advanced NGS instruments and supporting infrastructure are costly, particularly for small and mid-sized laboratories. This includes not only the acquisition of sequencing machines but also auxiliary equipment, data storage systems, and specialised bioinformatics tools. The financial burden can restrict the entry of new players and limit the technology's accessibility in resource-constrained settings, particularly in emerging markets.

Moreover, ongoing operational expenses such as maintenance, reagents, and skilled personnel further increase the total cost of ownership. These financial challenges may delay or hinder the widespread implementation of NGS in hospitals and diagnostic laboratories, ultimately affecting the pace of global next generation sequencing market growth.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

OPPORTUNITY: Growing Integration of Genomics in Personalized Healthcare

The integration of genomics into precision medicine continues to present significant growth opportunities for the global NGS market. Genomic profiling through next-generation sequencing enables precise identification of genetic mutations and biomarkers, supporting tailored therapeutic strategies for conditions such as cancer, cardiovascular diseases, and rare genetic disorders. For instance, in May 2023, Pfizer and Thermo Fisher Scientific announced a collaboration to expand access to NGS-based testing for lung and breast cancer in over 30 countries across Latin America, Africa, the Middle East, and Asia regions where such testing was previously limited.

Collaborations between pharmaceutical firms, biotech companies, and research institutes are fostering innovation in companion diagnostics and NGS-based clinical assays. These trends, supported by favourable regulatory frameworks and data-sharing initiatives, are expected to expand the application of NGS in routine diagnostics, drug development, and disease risk prediction driving sustained market growth.

As precision medicine becomes central to healthcare delivery, the demand for next-generation sequencing is poised to increase significantly in the coming years.

CHALLENGE: Lack of Standardisation Across NGS Workflows

One of the pressing challenges in the market is the lack of standardisation in sequencing protocols, data analysis, and reporting procedures. Variations in sample preparation, sequencing platforms, and bioinformatics pipelines can lead to inconsistent results and limit comparability across laboratories. This inconsistency affects the reliability of NGS data, particularly in clinical settings where reproducibility and accuracy are critical. Moreover, the absence of universally accepted guidelines complicates the regulatory approval of NGS-based tests, slowing their integration into routine diagnostics.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Next Generation Sequencing Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Offerings

Market Breakup by Technology

Market Breakup by Application

Market Breakup by End User

Market Breakup by Region

The global next-generation sequencing (NGS) market is supported by a dynamic ecosystem involving platform manufacturers, reagent suppliers, software developers, research institutions, healthcare providers, and diagnostic laboratories. These stakeholders contribute to continuous advancements in sequencing technologies, improved bioinformatics capabilities, and broader clinical and research applications, ultimately driving the widespread adoption and expansion of NGS worldwide.

The offerings category emerged as the dominant segment by offerings in the NGS market due to the high demand for sequencing instruments, and reagents.

These components are essential for executing genomic workflows across research and clinical environments. Instruments such as benchtop and high-throughput sequencers are used extensively in genomic research, oncology, infectious disease detection, and hereditary disorder screening. Reagents and consumables, including library preparation kits and flow cells, are consumed regularly, ensuring consistent revenue generation. The growth in personalized medicine and biomarker-driven diagnostics has increased the demand for robust, accurate, and scalable sequencing platforms.

Furthermore, the introduction of integrated and automated systems has made NGS more accessible in clinical settings. These systems not only streamline sample processing but also minimise user intervention and reduce turnaround time. Companies are also focusing on developing portable and user-friendly sequencers to expand point-of-care testing. Compared to service-based models, owning NGS platforms provides laboratories greater control over sample throughput and data handling. Technological enhancements that support cost-effective sequencing and real-time analytics are expected to reinforce the dominance of the product segment during the forecast period.

Oncology diagnostics represent the largest application within the diagnostic segment of the NGS market, owing to the rising prevalence of cancer and the critical need for early, precise, and personalised diagnostics.

NGS allows for comprehensive genomic profiling of tumour samples, revealing critical information such as mutations, gene fusions, and copy number variations that guide targeted therapy decisions. It supports the development of precision oncology by enabling clinicians to match patients with therapies that align with their tumour’s genetic profile. Additionally, liquid biopsy applications using NGS facilitate non-invasive detection and monitoring of circulating tumour DNA (ctDNA), allowing real-time assessment of treatment response and disease progression. The growing availability of companion diagnostics, approved by regulatory bodies, underscores the integration of NGS into routine oncology practice. In clinical research, NGS is widely used in identifying novel therapeutic targets and evaluating drug efficacy in cancer trials. Furthermore, collaborations between hospitals, pharmaceutical companies, and genomic testing labs are expanding access to NGS-based cancer diagnostics. Advances in assay sensitivity, data interpretation tools, and turnaround time have also made these diagnostics more clinically viable. As cancer care increasingly moves towards precision-driven strategies, the demand for NGS-based diagnostic tools is set to grow substantially, reinforcing this segment’s market leadership.

The sequencing technology segment holds the largest share among technologies in the NGS market. This segment includes high-throughput and scalable technologies that enable parallel sequencing of millions of DNA fragments, supporting a wide range of applications such as whole-genome, exome, and targeted sequencing. Technological improvements have significantly enhanced read accuracy, speed, and cost-efficiency. These advancements continue to drive the adoption of sequencing platforms in diagnostics, drug discovery, and population-scale genome projects, making them essential to NGS market expansion.

North America held the largest share of the global next-generation sequencing (NGS) market, primarily due to its advanced healthcare infrastructure, early adoption of genomic technologies, and significant investments in precision medicine. The United States dominates the regional market, supported by strong government and private funding, a high concentration of key market players, and a growing number of genomics-based research initiatives. Large-scale population genomics programmes, such as the All of Us Research Program, along with widespread use of NGS in cancer diagnostics, reproductive health, and infectious disease surveillance, are propelling market growth.

Additionally, the region benefits from the presence of well-established clinical laboratories, biopharmaceutical companies, and academic research institutions actively involved in genomic innovation. Regulatory support from agencies such as the FDA for companion diagnostics and NGS-based tests has encouraged broader clinical adoption. Technological advancements, including improvements in sequencing platforms and data analysis tools, continue to enhance diagnostic accuracy and efficiency. The availability of skilled professionals and strong industry-academia collaborations also contributes to rapid product development and commercialisation. Moreover, increased demand for personalized healthcare solutions, particularly in oncology and rare disease management, has led to a surge in NGS-based applications across clinical and research settings in North America.

The favourable reimbursement environment, combined with ongoing investment in genomic infrastructure and strategic partnerships, is expected to maintain North America’s leadership in the global NGS market throughout the forecast period.

The key features of the market report comprise patent analysis, grants analysis, funding and investment analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:

Bio-Rad Laboratories supports the NGS market through advanced tools for DNA amplification, sample preparation, and droplet digital PCR technology. Its products enhance sequencing accuracy and enable precise quantification of genetic material. The company’s robust laboratory instruments and reagents play a critical role in genomics workflows, making Bio-Rad a key contributor to clinical diagnostics and life science research advancements.

PerkinElmer, Inc. is a global leader in life sciences, diagnostics, and analytical solutions, offering innovative technologies to advance scientific discovery and healthcare. The company provides next-generation sequencing (NGS) tools, reagents, and automation solutions that support genomics research and clinical applications. For instance, in December 2023, PerkinElmer acquired Covaris, a key player in life science innovations, to strengthen its diagnostics portfolio and expand capabilities in high-growth markets. This strategic merger is set to enhance PerkinElmer’s position in the global NGS market.

Illumina is a global leader in next-generation sequencing, offering a wide range of high-throughput and benchtop sequencing systems. Its technology underpins much of today’s genomic research and clinical applications. Known for innovation in sequencing chemistry and software, Illumina’s solutions are pivotal in precision medicine, population genomics, and diagnostics, maintaining its dominance in the global NGS market.

Thermo Fisher Scientific plays a vital role in the NGS market through its Ion Torrent platforms, sequencing reagents, and cloud-based data analysis tools. The company offers end-to-end solutions that support targeted sequencing, oncology diagnostics, and infectious disease testing. Its comprehensive portfolio, global reach, and continuous innovation make Thermo Fisher a key driver of NGS adoption across clinical and research sectors.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include F. Hoffmann-La Roche Ltd., QIAGEN, PierianDx, Eurofins Genomics, Oxford Nanopore Technologies plc. and DNASTAR, Inc.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Key players include Illumina, Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd, QIAGEN, PierianDx, Eurofins Genomics, DNASTAR, Inc., PerkinElmer, Inc., Bio-Rad Laboratories, Inc., and Oxford Nanopore Technologies among others.

The product segment dominates the NGS market, driven by the high demand for sequencing instruments, consumables, and reagents essential for high-throughput genomic analysis and routine diagnostics.

The diagnostics segment, which is further divided into cancer, infectious disease diagnostics, reproductive health diagnostics and others is expected to witness the highest growth, driven by rising demand for cancer diagnostics.

The NGS market was valued at USD 16.61 Billion in 2025 and is projected to reach USD 57.90 Billion by 2035.

The market is anticipated to grow at a CAGR of 13.30% during the forecast period 2026 to 2035, driven by advancements in genomic research.

NGS types include whole genome sequencing, whole exome sequencing, targeted sequencing, transcriptome sequencing, and metagenomic sequencing, each suited for specific clinical and research applications.

NGS genetic testing analyses multiple genes simultaneously to identify genetic mutations linked to diseases, enabling faster, accurate diagnosis and personalised treatment plans in clinical settings.

Key NGS platforms include Illumina (NovaSeq, MiSeq), Thermo Fisher (Ion Torrent), PacBio (Sequel), and Oxford Nanopore (MinION), each offering varied throughput and sequencing approaches.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Offerings |

|

| Breakup by Technology |

|

| Breakup by Application |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share