Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America carbon black market attained a value of USD 3.26 Billion as of 2025 and is anticipated to grow at a CAGR of 5.90% during the forecast period of 2026 to 2035. The market for carbon black in North America is fueled by increasing demand for automotive tire production, expanding industrial rubber uses, and expanding use in plastics, coatings, and inks as a result of its reinforcing and conductive qualities. The market is thus expected to reach a value of nearly USD 5.78 Billion by 2035.

Base Year

Historical Period

Forecast Period

The growth in auto manufacturing and growing demand for high-performance tires fuel carbon black demand in the automotive tire sector. Firms can take advantage by creating sophisticated carbon black grades with EV and fuel-efficient tire capabilities, keeping up with sustainability and regulatory drivers.

Carbon black relies more on industrial rubber, plastics, and coatings for strength, UV protection, and conductivity. The specialty carbon black segments are opportunities that can be opened by manufacturers to expand into new industries by innovating conductive polymers, sustainable coatings, and advanced composites, addressing high-performance applications like electronics, construction, and packaging, thus augmenting the growth of the North America carbon black market.

Increased environmental regulations and business sustainability targets are stimulating demand for recovered carbon black (rCB) from waste tyres. Businesses can profit from an advantage by investing in rCB technology, establishing joint ventures with recycling companies, and developing green alternatives for sale to capitalize on increasing consumer and business sustainability demands.

Compound Annual Growth Rate

5.9%

Value in USD Billion

2026-2035

*this image is indicative*

One of the key drivers of the growth of the market for carbon black is rising demand from the automotive industry, especially for tire production. Carbon black is employed as a reinforcing filler to enhance tire durability, fuel efficiency, and abrasion resistance. For instance, the number one carbon black producer, Cabot Corporation, raised its North American production capacity to address growing demand from tire manufacturers like Bridgestone and Michelin. Through investment in high-performance carbon black products for electric vehicles (EVs) and fuel-efficient tires, Cabot increased its revenue and enhanced its market position, also contributing to the North America carbon black market expansion.

In addition to tires, carbon black is used extensively in plastics, coatings, and industrial rubber because of its UV resistance, conductivity, and durability-enhancing capabilities. Orion Engineered Carbons, one of the leading companies in the sector, rode on this trend by creating high-performance specialty carbon black for the plastics market, thereby boosting the carbon black demand. Their emphasis on conductive carbon black for automotive components and electronic packaging greatly boosted profitability. By aiming at high-value electronics and high-end coatings applications, Orion Engineered Carbons diversified its customer base and had higher profit margins than commodity-grade carbon black producers.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Specialty applications, sustainability, plastics demand, and technological innovations in advanced industries are propelling the North America carbon black market dynamics and trends.

Specialty carbon black is found in greater application in high-grade printing inks and toners owing to its enhanced dispersion, depth of color, and longevity. As there has been growth in packaging, commercial printing, and digital printing usage, business enterprises are spending in advanced formulating to support increasing demand for high-end ink and coating applications, thus pushing the growth of North America carbon black market.

The industry is moving towards sustainable carbon black production by embracing cleaner production methods and minimizing emissions. The growth of recovered carbon black (rCB) from recycled tires is on the rise, enabling companies to reduce their carbon footprint. Top manufacturers are investing in sustainability efforts to meet regulatory and corporate ESG objectives.

Carbon black finds widespread application in the plastics sector in order to make materials more durable, resistant to UV light, and conductive. With their growing applications in automotive parts, consumer electronics, and building products, manufacturers are diversifying product lines to take advantage of increased demand for specialty carbon black reinforced high-performance plastics, and thus aiding in shaping new trends in the North America carbon black market.

New technologies are increasing carbon black's potential in emerging applications, like electronic devices using conductive polymers and lithium-ion batteries for electric vehicles (EVs). Businesses that are investing in research and development are benefiting from these high-growth segments, promising long-term profitability and leading the industry as innovation leaders.

North America carbon black manufacturers are investing heavily in smart manufacturing technologies to promote efficiency and sustainability. Birla Carbon and Cabot Corporation are among firms that are deploying automation, artificial intelligence-based quality control, and energy-saving manufacturing processes to make operations more optimal, product consistent, and environment-friendly. All these technologies support manufacturers in maintaining competitiveness while achieving strict regulatory expectations, thus boosting the demand in the North America carbon black market.

Another trend on the rise is increased use of carbon black in 3D printing and high-end composites, thereby boosting the North America carbon black market opportunities. With additive manufacturing increasingly being applied in industries such as automotive, aerospace, and healthcare, demand for high-performance carbon black systems is on the increase. Carbon black adds strength, conductivity, and durability in 3D printing materials and composite systems and is therefore a key ingredient in future industrial products.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

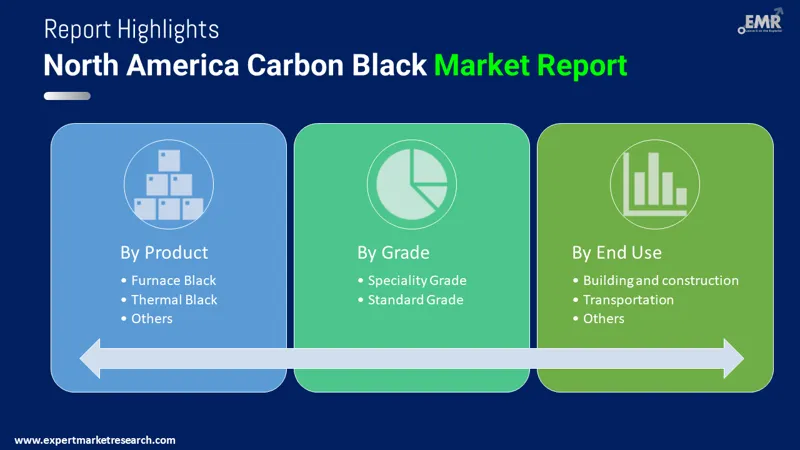

The EMR’s report titled “North America Carbon Black Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product

Market Breakup by Grade

Market Breakup by End Use

Market Breakup by Country

The market for acetylene black is growing because of its excellent electrical conductivity, which makes it critical in lithium-ion batteries, high-performance cables, and electronics. As per North America carbon black market analysis, the rise of electric vehicles (EVs) and energy storage systems also increases its market growth.

Furnace black holds the largest market share, fueled by its widespread application in automotive tires, industrial rubber, and plastic. The expansion of the automotive industry along with more demands for tough and fuel-saving tires drives its demand. Its applications in coatings, inks, and adhesives also drive additional growth.

Thermal black is also popular for its outstanding insulation and reinforcement qualities. According to North America carbon black industry analysis, it finds extensive application in high-performance rubber products, hoses, and mechanical components, with demand fueled by infrastructure development and industrial uses.

The other segment, which encompasses specialty carbon black, experiences growing demand as it has applications in high-performance polymers, coatings, and conductive compounds, underpinning sectors such as electronics, packaging, and aerospace.

The major players such as Cabot Corporation, Orion Engineered Carbons, and Birla Carbon are focusing on sustainability, technology development, and capacity increase. In the United States, Cabot is investing in battery-grade carbon nanotubes for electric vehicles, and Orion is increasing specialty carbon black production. In Canada and Mexico, producers are increasing recovered carbon black (rCB) initiatives to address increasing environmental regulations and circular economy objectives.

Founded in 1936, Houston, Texas-based Continental Carbon Company is a leader in the production of furnace black for tires, industrial rubber, and plastics. The company produces high-performance grades of carbon black with enhanced reinforcement, conductivity, and UV protection. Sustainability is its focus, including recovered carbon black (rCB) development.

Orion Engineered Carbons, founded in 2011 and headquartered in Houston, Texas, supplies a broad portfolio of carbon blacks, such as specialty and high-performance furnace black for coatings, inks, plastics, and rubber uses. The firm is growing its production capacity in North America, with a focus on sustainability and innovation in conductive and reinforcing carbon blacks.

Founded in 1927, Fort Worth, Texas-based headquarters of Tokai Carbon CB delivers furnace and specialty carbon black used in automotive, industrial, and polymer markets. Product consistency and performance are high on the priority list for this company, selling to tire companies, plastic fabricators, and coating industries in addition to maintaining green practices and energy-efficient process operations.

Established in 1973, Cancarb Limited of Medicine Hat, Alberta, Canada is a world leading manufacturer of thermal carbon black. It excels in the supply of low-surface-area and high-purity grades, covering rubber, plastic, and special applications. Envirotensive production is a focus with Cancarb using natural gas-based process for clean, sustainable, high-performance carbon black solutions.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the North America carbon black market report include Birla Carbon, and Cabot Corporation, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the North America carbon black market reached an approximate value of USD 3.26 Billion.

The market is assessed to grow at a CAGR of 5.90% between 2026 and 2035.

The major drivers of the market, such as rising disposable incomes, rising demand for end-use products, and the rising automotive industry, are expected to aid the industry growth.

The rising adoption of speciality products is expected to define the market in the coming years.

The United States of America and Canada are the major regions in the market.

The major products of the industry are acetylene black, furnace black, and thermal black, among others.

The major grades for the product in the market are speciality grade and rubber grade.

The significant end use sectors for carbon black in the market include industrial, printing and packaging, building and construction, and transportation, among others.

The major players in the market are Birla Carbon, Cabot Corporation, Continental Carbon Company, Orion Engineered Carbons S.A., Tokai Carbon CB Ltd, Cancarb Limited.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 5.78 Billion by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Grade |

|

| Breakup by End Use |

|

| Breakup by Country |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share