Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

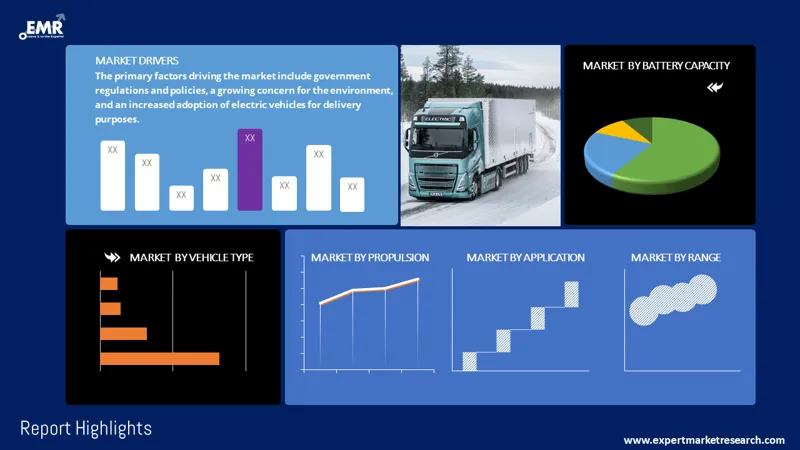

The North America electric truck market is expected to grow at a CAGR of 52.40% between 2026 and 2035. Key market drivers are regulations and policies by governments in the region, increase in environmental concerns, and adoption of electric vehicles for deliveries.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

52.4%

2026-2035

*this image is indicative*

An electric truck is a large vehicle that is fuelled by electricity with the help of batteries. It is mainly used for transportation purposes to move cargos and payloads along with other utilitarian tasks. Electric vehicles tend to be heavier than their gas counterpart but offer improved safety, lower maintenance, and reduced pollution emissions.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

"North America Electric Truck Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Breakup by Propulsion

Breakup by Vehicle Type

Breakup by Range

Breakup by Battery Capacity

Breakup by Application

Breakup by Region

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Heavy duty electric trucks are expected to account for a large share in the North America electric truck market. Long distance transportations are primarily done through heavy duty electric trucks, and these trucks also have higher storage capacities, suited for transporting cargo in high volumes.

Light duty electric trucks are capable of carrying relatively lighter loads as compared to medium and heavy-duty electric trucks, differing primarily based on the capacity of the truck and its handling strength while on the road. Accordingly, light and medium duty electric trucks are typically used for transportation purposes over short distances.

Delivery applications are expected to hold the largest share in the North America electric truck market, as currently a large portion of deliveries are conducted by traditional trucks that can be effectively replaced with electric trucks. These electric trucks are available in varying capacities for different types of deliveries and distances. They have the capability to deliver in zero emission zones because of absence of exhaust gas production. Moreover, electric trucks deliver quietly and have low operational costs and maintenance costs, resulting in greater savings for delivery providers.

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis. The report gives a detailed analysis of the following key players in the North America electric truck market covering their competitive landscape and latest developments like mergers, acquisitions, investments, and expansion plans.

AB Volvo was established in 1927 and is headquartered in Gothenburg, Sweden. It is a multinational financial services company that is involved in the production and supply of buses, trucks, and construction materials. It also provides industrial systems and marine and financial service.

Daimler Truck AG founded in 2019 is based out of Germany. It is a commercial vehicle company which manufactures trucks and buses and also provides financial services to its customers worldwide.

Nikola Corporation was founded in 2014 and has its headquarter in Arizona, United States. It is a manufacturer of heavy duty battery electric vehicles and fuel cell electric vehicles that also provides energy solutions to its customers.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other market players include Paccar Company, BYD Motors Inc., Rivian LLC, Navistar, Inc., and Workhorse, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market for electric trucks in North America is expected to grow at a CAGR of 52.40% between 2026 and 2035.

The major market drivers are regulations and policies by governments, increase in environmental concerns, and adoption of electric vehicles for delivery.

The key trends of the market are low maintenance requirements of electric trucks, reduced noise pollution, and investments by the manufacturers.

Key market players include AB Volvo, Daimler Truck AG, Nikola Corporation, Paccar Company, BYD Motors Inc., Rivian LLC, Navistar, Inc., and Workhorse, among others.

The North America electric truck market is segmented based on propulsion, vehicle type, range, battery capacity, application, and country.

An electric truck is a large vehicle that is fuelled by electricity with the help of batteries.

The primary applications of electric trucks are delivery and municipal, among others.

The various propulsion types in the market include battery electric truck, hybrid electric truck, plug-in hybrid electric truck, and fuel cell electric truck, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Propulsion |

|

| Breakup by Vehicle Type |

|

| Breakup by Range |

|

| Breakup by Battery Capacity |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share