Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global PE films market reached a volume of almost 64.71 MMT in the year 2025. The PE films industry is further expected to grow at a CAGR of 3.80% between 2026 and 2035 to reach a volume of almost 93.96 MMT by 2035.

Base Year

Historical Period

Forecast Period

PE films, due to their lightweight properties, excellent barrier resistance, and customisation, are widely used in the rapidly growing e-commerce sector as a cost-effective, efficient, and protective packaging. As per the Indian Brand Equity Foundation, the Indian e-commerce sector is projected to reach USD 325 billion by 2030. As the e-commerce sector expands in both developed and developing countries, the demand for PE films to wrap parcels and secure bulk shipments is rising.

PE films are highly customisable, which makes them ideal for printing different types of visuals and information. Companies are increasingly printing product information, logos, promotional materials, and brand messaging on PE films to create a strong brand identity. With businesses in diverse sectors such as retail, e-commerce, and food and beverages using PE films for branding and packaging, key players in the PE films market are expanding their production capabilities.

Due to their cost-effectiveness, versatility, and lightweight nature, PE films are one of the most widely used materials in flexible packaging. In 2022, flexible packaging accounted for 21% of the USD 180.3 billion packaging market in the US. With flexible packaging representing a significant share of the packaging market, high-performance and innovative PE films that can enhance the shelf life, protection, and appeal of products are being developed.

Compound Annual Growth Rate

3.8%

Value in MMT

2026-2035

*this image is indicative*

The global PE films industry is being driven by the significant growth in the Asia Pacific market, which is expected to grow at the rate of 2-3% in the forecast period of 2026-2035. The Asia Pacific market is driven by the high end-use demand from the food and beverage sector. The region has excellent potential for suppliers of PE films as the supply base is relatively fragmented in the region. The major suppliers in the region are extending their capacity to cater to the increasing demand. The PE films market is also being driven by the rising end-user demand from the fast-moving consumer goods (FMCG) sector, particularly from the packaged food industry.

The global PE films market is going through several transformations in the form of advancements and innovations. Down gauged films, also known as thinner gauged films, are becoming popular in the market due to the cost-effectiveness of the product. There has also been a shift from environment harming products such as petroleum-based resin to more sustainable products such as nature-friendly products, like paper-based formats, starch, and biodegradable film options, and many more. The manufacturers are focusing on the customization of the product, based on film types and printing colours, among others, thus, aiding the growth of the PE films market further.

Innovations in food packaging; growing environmental consciousness; growing demand for Machine Direction Oriented (MDO)-PE films; and technological advancements are favouring the PE films market expansion.

Innovations in food packaging are shaping the PE films market trends and dynamics. Food and beverage manufacturers are preferring high-barrier PE films that can provide superior protection against moisture, oxygen, and light and extend the shelf stability of perishable foods.

With the growing environmental consciousness, there is a rising demand for PE films made from recyclable polyethylene and plant-based polyethylene (bio-PE). Key players are also adopting circular economy models by reducing waste and promoting recycling. In the forecast period, the introduction of government initiatives aimed at encouraging the adoption of eco-friendly packaging is expected to revolutionise the PE films market landscape.

MDO-PE films, renowned for their improved tensile strength, puncture resistance, tear resistance, and barrier properties, are gaining significant popularity in packaging applications requiring durable and strong materials that can withstand rough handling and transportation. Moreover, these films are recyclable, which is boosting their appeal in sectors focused on lowering plastic waste.

Advancements in extrusion processes like cast film extrusion and blown film extrusion aimed at enabling the production of PE films with improved strength, uniformity, and thinner profiles are propelling the market. The development of advanced additive technology is expected to surge the creation of high-performance PE films with specialised properties like heat-sealing strength, puncture resistance, and printability for use in applications such as pharmaceutical and e-commerce packaging.

PE films, an acronym for polyethylene film, is a substrate, which is used in the production of grocery bags and food packaging. In addition, the PE film is usually thermoformed and manufactured into medical packaging, plastic bottles, and other packaging applications.

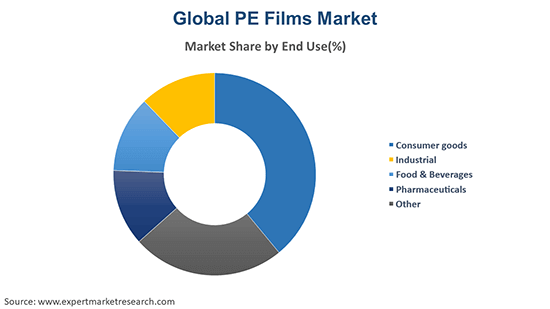

Market Breakup by End Use

Market Breakup by Region

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The global PE films market is being driven by the rise in the usage of stretch and shrink films. These films are extensively used in packaging and non-packaging applications owing to its physical properties, like stress, tear strength, and durability, among others, thus, aiding the market growth. The demand for food, beverages, and consumer goods products in the developing regions have increased, resulting from the growing urbanisation and inflating disposable income of the middle-class population, which is propelling the demand for PE films in these regions. The manufacturing machineries and production processes in the industry are stimulated with technological innovations, as a consequence of dynamic consumer preference, giving PE films an edge over other competing packaging counterparts, thus, providing an impetus to the market growth of PE films.

The market for PE films will be dominated by the Asia Pacific, due to the demand from the end-use industries such as packaged food and beverage packaging applications, invigorating the market growth for PE films. In the next five years, cost containment and sustainability will be the focal points in the product development in the industry. In this segment, the key focus of product development of major manufacturers will be the usage of biodegradable and sustainable films, among others. The PE films market is being driven by its technical properties like its light weight and ease of fabrication.

The packaging industry is focusing more on sustainability, as the demand increases from the developed regions such as North America and Europe. Rising pollution has led the countries in developing regions such as the Asia Pacific, particularly China and India, to look for a sustainable packaging solution. This has resulted in growing green practices due to anticipated new regulations associated with environmental sustainability to lower the carbon footprint.

Key PE films market players are focusing on product innovations and developing speciality, high-performance, and lightweight PE films with improved properties such as tensile strength, barrier resistance, and flexibility for use in diverse applications. PE films companies are also capitalising on the growing trend of sustainability by offering biodegradable and recyclable PE films and adopting circular economy models.

Amcor plc, founded in 1896 and headquartered in Zurich, Switzerland, is a company that develops and manufactures packaging solutions for different sectors, including medical, pharmaceuticals, food and beverages, and home and personal care products. The company is focused on developing sustainable, lightweight, reusable, and recyclable packaging solutions that meet the evolving needs of its customers. With 41,000 employees, the company has a presence in nearly 40 countries in the world.

Proampac Holdings Inc., founded in 2015 and headquartered in Ohio, United States, is a prominent manufacturer of foil, flexible film, and fibre packaging solutions. It serves various sectors, including food and beverage, e-commerce, foodservice, grocery and retail, home and personal care, healthcare, pet, and lawn and garden, among others. ProActive Sustainability® provides innovative sustainable flexible packaging products to help customers achieve their sustainability goals.

Coveris Management GmbH, headquartered in Austria and founded in 2013, is a prominent European packaging company that manufactures sustainable and flexible solutions. Boasting 30 production sites and 4,100 employees, the company’s annual sales exceed EUR 1 billion.

Berry Global Inc., established in 1967 and headquartered in Indiana, United States, is one of the largest packaging companies in the world. Employing 40,000 global employees across more than 250 locations, the company partners with its customers to design and manufacture innovative products. It serves diverse markets, including homecare, food and beverages, DIY, healthcare and pharma, agriculture and horticulture, pet care, and beauty and personal care, among others.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the PE films market are Klöckner Pentaplast Group, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market attained a volume of almost 64.71 MMT.

The market is projected to grow at a CAGR of 3.80% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about 93.96 MMT by 2035.

The major market drivers include rapid urbanisation, rising disposable incomes in middle-class households, technological innovations, growing green practices, and rising end-user demand from fast-moving consumer goods.

The rise in the usage of stretch and shrink films and the increasing demand for food and beverages are the key trends augmenting the market growth.

The major regions in the PE films market are North America, Latin America, Europe, Middle East and Africa, and Asia Pacific.

The various end uses in the market are food and beverages, pharmaceuticals, consumer goods, and industrial, among others.

The major players in the market are Amcor plc, Proampac Holdings Inc., Coveris Management GmbH, Berry Global Inc., and Klöckner Pentaplast Group, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share