Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global polycarbonate market size reached a volume of 5.25 MMT in 2025. The demand for the product is expected to grow at a CAGR of 3.30% in the forecast period of 2026-2035. By 2035, the polycarbonate market demand is estimated to reach a volume of 7.26 MMT.

Base Year

Historical Period

Forecast Period

Polycarbonate, renowned for its lightweight nature and high thermal insulation properties, is gaining popularity as a construction material for applications such as facades, roofings, and windows. In 2024, the construction sector in the US was valued at nearly USD 2.1 trillion. As the expansion of the construction industry boosts advancements in construction methods and smart buildings, the use of polycarbonate materials in light-transmitting walls, transparent insulation, and energy-efficient designs is rising.

There is a growing emphasis on enhancing the sustainability of the building and construction sector as it is one of the largest emitters of greenhouse gases and accounts for 37% of global emissions. Polycarbonate, due to its properties such as UV resistance, thermal insulation, and durability, is increasingly used in eco-friendly building projects. In the forecast period, the introduction of stringent building codes and regulations by governments globally to reduce greenhouse gas emissions is anticipated to provide lucrative polycarbonate market opportunities.

Polycarbonate is an essential material in the production of consumer electronics such as laptops, televisions, smartphones, and tablets, among others, due to its properties such as thermal stability, impact resistance, and optical clarity. Hence, the expansion of electronic manufacturing globally is surging the consumption of polycarbonate. For instance, the value of electronics production in India stood at USD 101 billion in FY 2023. Moreover, the robust growth of the electronics industry is expected to bolster the demand for customised polycarbonate solutions with properties such as flame and scratch resistance.

Compound Annual Growth Rate

3.3%

Value in MMT

2026-2035

*this image is indicative*

The Asia Pacific is the major supply market, accounting for around 60% of the market share. China’s recent capacity addition is likely to reduce Asia’s polycarbonate import reliance in the coming years. With the growing demand in the region, the capacity is also witnessing an expansion, along with the utilization of the plants to their full potential. The growing electronics industry is majorly driving the demand in the region. There is no cheaper alternative to polycarbonate available in the region, which is propelling the market growth for polycarbonate further. Covestro AG, one of the key players, began to build its new production line for manufacturing polycarbonate films in Thailand in 2018. The production line is expected to expand the capacity for films, thus, expanding the region’s supply to meet the rapidly growing demand.

The Asia Pacific region is followed by Europe and North America as the other major regional markets for polycarbonate. In both Europe and North America, the demand for polycarbonate is being driven by the growth of the automotive and construction industries. In North America, the rising demand for industrial-grade polycarbonate is driving the consumption of the product, which is used in the automotive and electronics sectors. While the region is a net exporter of the substance, North America also imported from South Korea due to domestic supply constraints

In Europe, construction is the leading application sector for polycarbonate, with roofing, windows, and partition walls accounting for over three-fourths of its applications in the construction industry. The medical industry is also contributing to the demand in Europe. The region is a net importer of the product, and the market is supported by the capacity expansions taking place within the Asia Pacific region. South Korea is a leading exporter of polycarbonates to the region. The supply in Europe is also expected to improve in the coming years with planned capacity additions.

Rising demand for electric vehicles (EVs); surging use of polycarbonate in packaging; growing emphasis on sustainability; and technological advancements and innovations are favouring the polycarbonate market expansion.

Due to its lightweight properties and high-impact resistance, polycarbonate is used in electric vehicles to extend their driving range and battery life, improve driving experience, and enhance vehicle and occupant safety during collisions. The transparency, design flexibility, and mouldability of polycarbonate are surging the creation of aesthetically pleasing and modern EVs.

Polycarbonate, boasting excellent impact resistance and durability, is increasingly used in durable and robust packaging in sectors such as food and beverages, electronics, and pharmaceuticals to protect content from damage during handling and transportation. Besides, the high-strength, transparency, and premium appearance of polycarbonate are boosting its demand in packaging high-end luxury goods, pharmaceuticals, and cosmetics.

The growing emphasis on sustainability is shaping the polycarbonate market trends and dynamics. Key players are developing bio-based polycarbonate by utilising renewable feedstocks like plant-based materials to reduce the reliance on fossil fuels. Moreover, the rising adoption of circular economy models is leading to the development of advanced recycling technologies for reusing and recycling polycarbonate.

Advancements in material science are leading to the creation of more durable and stronger polycarbonate formulations with improved heat and impact resistance. In addition, technological advancements and innovations are expected to the development of customised formulations of polycarbonate that offer varying levels of heat resistance, strength, clarity, and chemical resistance.

Polycarbonate, also known as bisphenol A polycarbonate, is a transparent plastic used to make shatter-resistant frames and light eyeglass lenses, among other products. Polycarbonates (PCs) refer to a category of carbonate, containing thermoplastic polymers in its chemical structures. Polycarbonates applied in engineering are solid, hard materials, and some grades are optically transparent. These are easily moulded and thermoformed. These properties help them find extensive applications in a wide variety of industries.

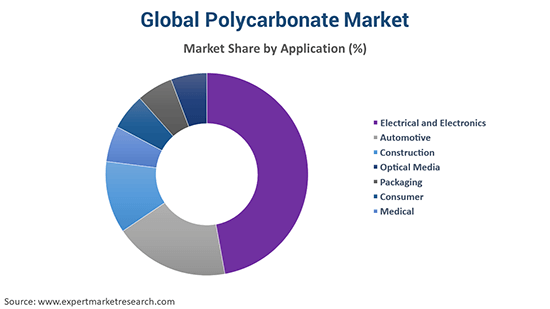

Market Breakup by Application

Market Breakup by Region

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The growing demand from the automobiles industry is driving the polycarbonate market growth across the globe. The polycarbonate industry growth is also aided by the growing economies and the rising disposable of consumers, especially in emerging economies like India, China, and others. Moreover, the increasing demand for consumer goods is also providing a push to polycarbonate market growth.

Blends of polycarbonate with different polymers, namely, ABS, thermoformed PC films, and polyester, are witnessing a rising demand across industrial sectors. The growing demand for these blends is providing an impetus to the polycarbonate market growth. The industrial-grade polycarbonates are also being increasingly demanded by the consumers, thus, aiding the overall growth of the polycarbonate market. Polycarbonates are being used in the medical industry for making appliances like a surgical instrument, as well as other substitutes used in surgeries. Other new and advanced technologies in the industry, like sensors, service robots, and LED luminaires, are pushing the polycarbonate market growth further.

The growing demand in North America is due to the growth of the end-use industries like the automobiles sector. Polycarbonate is used in automobiles due to its lightweight feature, as well as high impact resistance. In Europe, the polycarbonate market is significantly driven by the growing household industry. The region is also witnessing an increasing demand from the electronics industries.

Key polycarbonate market players are focusing on the development of speciality polycarbonate grades for use in sectors such as electronics, automotive, and construction. Polycarbonate companies are also incorporating nanotechnology into polycarbonate materials to enhance their strength, wear and tear resistance, and thermal stability.

Covestro AG, established in 2015 and headquartered in Leverkusen, Germany, is a prominent manufacturer of high-quality polymer materials and components. The company offers innovative processes, methods, and products to enhance sustainability. It serves various sectors, including building and living, mobility, and electrical and electronics. In FY 2023, the company generated sales of EUR 14.4 billion.

SABIC, founded in 1976 and headquartered in Riyadh, Saudi Arabia, is one of the largest chemical and petrochemical manufacturers in the world. The company’s products and services are used in various sectors such as packaging, hygiene and healthcare, consumer products, electrical and electronics, building and construction, and packaging, among others. Boasting 31,000 employees and serving customers in more than 140 countries, the company boasts 11,000 patents and pending applications.

Teijin Limited, established in 1918 and headquartered in Tokyo, Japan, is a technology company that serves segments in two businesses, including healthcare solutions and high-performance materials. It comprises 170 companies and employs 20,000 people in 20 countries. In the fiscal year ending in March 2024, the company posted consolidated sales of JPY 1,032.8 billion.

Trinseo S.A., founded in 2010 and headquartered in Pennsylvania, United States, is a speciality materials company that serves various sectors, including consumer goods, buildings and construction, mobility, and medical, among others. Its business segments include polystyrene, engineered materials, latex binders, and plastics solutions. In 2023, the company generated net sales of USD 3.7 billion.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the polycarbonate market are Mitsubishi Chemical Corporation, and Formosa Plastics Corporation, among others.

United States Polycarbonate Sheets and Films Market

Polycarbonate Price Trends and Forecast Report

Polycarbonate Procurement Intelligence Report

Polycarbonate Films Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market attained a volume of 5.25 MMT.

The market is projected to grow at a CAGR of 3.30% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a volume of 7.26 MMT by 2035.

The major drivers of the market are rising disposable incomes, increasing population, increasing demand for consumer goods, and growth of end-use industries.

The key trends guiding the growth of the global polycarbonate market includes the introduction of new and advanced technologies and rapid growth of economies.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Electrical and electronics, automotive, construction, optical media, packaging, consumer, and medical are the leading applications of polycarbonate in the market.

The major players in the market are Covestro AG, SABIC, Teijin Limited, Mitsubishi Chemical Corporation, Formosa Chemicals & Fibre Corporation, and Trinseo S.A., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share