Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The recovered paper market attained a volume of 284.01 MMT as of 2025 and is anticipated to grow at a CAGR of 2.50% during the forecast period of 2026 to 2035. One of the key drivers of the recovered paper market is the growing focus on sustainability and circular economy. Governments across the globe are enforcing strict policies to encourage recycling and minimize waste, prompting industries to use recovered paper as a raw material. This change not only saves natural resources but also minimizes carbon emissions, aligning with the world's environmental objectives. The market is thus expected to reach a volume of nearly 363.56 MMT by 2035.

Base Year

Historical Period

Forecast Period

The increasing need for sustainable and eco-friendly packaging is one of the key drivers of the recovered paper market. Firms are turning towards recycled paper products to satisfy consumer demand for greener options. The global trend towards sustainability is prompting industries to use recovered paper as a major raw material more than ever before.

Asia-Pacific is growing strongly in the market for recovered paper, driven by robust industrialization and urbanization. China, being the top recovered paper importer, plays an important role in the market. The recycling-friendly and environmentally supportive nature of the region is also likely to enhance demand for recovered paper further, thereby increasing the growth of the recovered paper market.

Leading companies operating in the recycled paper industry like DS Smith and Smurfit Kappa are now increasingly employing mergers and acquisitions as well as joint ventures to optimize the operations. This strategic maneuver focuses on optimizing productivity, curbing costs, as well as gaining a competitive edge in the upsurging market for sustainable packing.

Compound Annual Growth Rate

2.5%

Value in MMT

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The market for recovered paper is being led by two distinct forces: the demand for greener packaging and growing circular economy trends. With more consumers and businesses looking for environmentally friendly options, demand for recyclables, and especially paper, has increased dramatically. Businesses are incorporating recovered paper into their packaging to address green objectives and abide by tighter regulations on waste control, thus driving the growth of recovered paper market.

For instance, businesses such as DS Smith are at the forefront of sustainable packaging through emphasis on closed-loop recycling systems. Apart from enabling carbon footprint reduction, this system ensures a constant supply of recovered paper for manufacturing. Moreover, governmental regulations enforcing greater recycling and landfill waste minimization are also furthering paper recovery and reuse. These drivers are set to continue fueling the growth of the market as industries strive for more sustainable practices.

The recovered paper market dynamics and trends include closed-loop recycling, AI sorting, compostable coatings, and blockchain for transparency.

Firms are increasingly adopting closed-loop recycling models, wherein paper products are recycled to the same product category. This saves on the use of virgin materials, reduces waste generation, and increases sustainability by providing a continuous loop of reuse, thus pushing the growth of the recovered paper market.

The application of artificial intelligence (AI) in sorting waste has been enhancing efficiency and accuracy. AI systems have the ability to detect and sort various grades of paper, removing contamination and improving the quality of recovered materials, which is important in making high-grade paper products.

To make paper products more recyclable, firms are creating compostable coatings as substitutes for conventional plastic-based coatings. The coatings enable paper products to be composted once used, thus minimizing landfill waste and enabling the circular economy, thereby helping to create new trends in the recovered paper market.

Blockchain technology is used to trace and authenticate the path of recovered paper from one stage of the supply chain to another. It makes the process transparent, eliminates fraud, and ensures sound sourcing practices, which, in turn, builds consumer confidence and motivates the use of recycled material.

Advanced paper-to-paper recycling technologies are improving the effectiveness of recycling used paper into new high-quality paper products. These technologies are being optimized to reduce fiber degradation, allowing continuous recycling of paper products. This development decreases the dependence on virgin pulp and makes paper production more sustainable, thus shaping new trends in the recovered paper market.

Businesses are now placing more emphasis on upcycling mixed paper waste, which was previously more difficult to recycle. Improved technologies enable improved separation and treatment of mixed paper, making what was previously considered low-grade material a valuable resource. This development not only increases recycling levels but also creates new market outlets for recovered paper.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Recovered Paper Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Application

Market Breakup by Region

The market for fresh as well as recovered paper types is gaining traction in the global market because of the escalating environmental issues and the need for greener alternatives. As per the recovered paper market analysis, fresh paper, which comes from virgin pulp, is still the preferred source for high-end production, particularly in sectors such as printing and packaging.

According to the recovered paper industry analysis, recovered paper, sourced from recycled waste, is gaining substantial momentum since firms and customers are working to minimize wastage and carbon prints. Governments are also implementing tougher recycling policies, supporting further usage of recovered paper. The move towards circular economy processes and increased consumer concern for environmentally friendly products is compelling the growing uptake of recovered paper across diverse sectors, ranging from packaging to tissue production.

Leading recovered paper market players are investing in sustainability, innovation in technology, and a bigger global presence. International Paper and Smurfit Kappa, for example, are committing investments in superior recycling technologies as well as environmental packaging solutions in order to cater to increasing concerns on the environment. DS Smith and Stora Enso, for instance, are improving recycling efficiencies and diversifying into new markets to position themselves stronger. These strategic plans will help to counter growing demand for eco-friendly products and adhere to strict environmental regulations.

Established in 1968 and based in the United States, Waste Management provides strong recycling services, such as large-scale recovered paper collection and processing. Waste Management has several material recovery facilities, promoting environmentally friendly waste diversion and providing high-quality recycled fiber for packaging and manufacturing companies throughout North America.

Founded in 1934 and based in Ireland, Smurfit Kappa employs recovered paper as a key raw material in the manufacture of sustainable corrugated packaging solutions. Smurfit Kappa emphasizes circular production processes and has large-scale recycling operations in Europe and the Americas to minimize environmental footprint and virgin fiber dependence.

Established in 1940 in the United Kingdom, DS Smith is a company that deals with fiber-based packaging solutions made of recycled paper. The company operates a closed-loop recycling system where used paper and boxes are gathered to produce new packaging, thus being resource efficient and helping customers achieve their sustainability objectives in retail, industrial, and e-commerce businesses.

Founded in 1998 with headquarters in the United States, Republic Services operates more than 70 recycling facilities, recycling millions of tons of recovered paper per year. It focuses on innovating recycling facilities and collaborates with companies to keep paper waste out of landfills, which helps create a more sustainable materials management system.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players profiled in the recovered paper market include Cascades Inc., and SUEZ, among others.

Industrial-Grade Recovered Paper

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the recovered paper market reached an approximate volume of 284.01 MMT.

The market is assessed to grow at a CAGR of 2.50% between 2026 and 2035.

The major drivers of the market include rising demand for tissues, growing concern for the environment, and increasing innovation.

The rise in the usage of recycled paper for containerboard production and increase in industrial production are expected to be key trends guiding the growth of the market.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

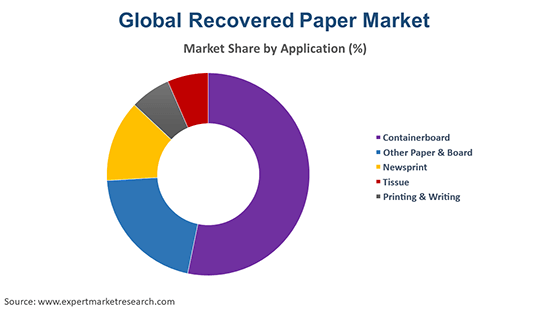

Recovered paper finds applications in containerboard, other paper and board, newsprint, tissue, and printing and writing.

The leading players in global recovered paper market are Waste Management, Inc., Smurfit Kappa Group, DS Smith Plc, Republic Services, Inc., Cascades Inc., and SUEZ, among others.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a volume of around 363.56 MMT by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share