Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Saudi Arabia prefabricated building and structural steel market size was valued at USD 2.07 Billion in 2025. The industry is expected to grow at a CAGR of 5.20% during the forecast period of 2026-2035 to reach a value of USD 3.44 Billion by 2035. The organic growth of the market stems from local steel production doubling its capacity as well as vertical integration of the prefabrication value-chain, which together are deepening the construction ecosystem in Saudi Arabia.

As large-scale projects continue to unfold under Saudi Vision 2030, the requirement for uniform, structurally strong steel and prefabricated components of high quality has been a major cause for producers to scale up their operations and establish backward linkages. Besides ensuring material availability, integrated production also becomes more cost-efficient and delivery faster, which is very important for developments that are time-bound like NEOM and the Red Sea Project.

In line with this, Saudi Iron & Steel Company (Hadeed) made public its completion of the acquisition of AlRajhi Steel Industries Company in July 2024. This move is in harmony with the wider changes initiated by the state to promote domestic industrial self-reliance and advanced manufacturing. The interaction between the increased capacity and vertical integration is likely to raise the level of competition, supply security, and speedy adoption of prefabricated construction systems in the rapidly transforming construction landscape of Saudi Arabia, and expanding the Saudi Arabia prefabricated building and structural steel market scope.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5.2%

Value in USD Billion

2026-2035

*this image is indicative*

The demand for prefab units for fast deployment to satisfy tight timelines and quality requirements is a major factor driving the Saudi Arabia prefabricated building and structural steel market expansion due to giga-projects. One example is the contract that SIBS AB got in May 2023 to provide 2,174 turnkey apartments to NEOM, which is a clear indication of how modular building companies are being chosen for large-scale residential applications in future urban developments. Off-site construction, thus, emerges as a viable solution for developers to meet the demand for workforce housing and permanent residential under time pressure.

The market growth is attributed to the higher usage of prefabricated solutions for residential blocks of a large area, particularly in cases where quality, sustainability, and repeatability are taken into consideration. SIBS, for instance, secured an additional order in October 2023 to supply 1,300 more apartments to NEOM, thus, indicating a noteworthy transition towards factory-finished, relocatable modules equipped with solar panels and made of low-energy materials. The point is that building owners and developers are not only embracing the modular systems for the sake of rapidness, but also for the sake of sustainability and modern living standards.

The increased demand for modular accommodation for workforce housing and site logistics is boosting the growth of the Saudi Arabia prefabricated building and structural steel market, as major projects require a rapid provision of complete camp infrastructure. It is worth mentioning that Red Sea International Co. signed a contract with a value of SAR 29.1 million in August 2023 for the design, manufacturing, and installation of prefabricated buildings for a housing compound in NEOM. The contract serves as proof that modular manufacturers are addressing the trend of "temporary but high standard" accommodation. It is a demonstration of how prefab companies are exploiting the demand not only for permanent housing but also for the industrial and construction support sectors.

Increasing vertical integration and domestic consolidations of steel and fabrication businesses in Saudi, which help supply construction steel and prefab components more efficiently supporting the market growth. As an illustration, in September 2023, Saudi Iron & Steel Company (Hadeed) and Al Rajhi Steel Industries signed a merger agreement, with the Public Investment Fund (PIF) purchasing Hadeed to create a national steel champion. Around this trend, the players of the market are integrating from steel production through fabrication to the supply of prefab modules, thereby lessening import dependence and making project schedules more efficient.

The ongoing transition to low-carbon and green steel production, which is in harmony with the rising trends in the Saudi Arabia prefabricated building and structural steel market of sustainable prefabrication and the requirements of high-end constructions. As an example, Essar Group declared in October 2023 that it would invest USD 4 billion in a low-carbon steel plant at Ras Al-Khair, with the aim to provide cleaner steel for local construction. In fact, this acts a signal that sustainability-driven investments are fortifying the upstream materials segment of the prefab and structural steel ecosystem in Saudi Arabia.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Saudi Arabia Prefabricated Building And Structural Steel Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

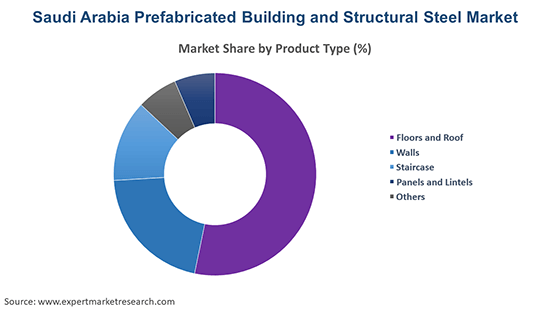

Prefabricated Building Market Breakup by Product Type

Key Insights: The Saudi Arabia prefabricated building and structural steel industry is expanding across all major product types, floors and roofs benefit from faster factory finished modules; walls gain from modular panelisation with enhanced insulation; staircases are delivered as preassembled units for consistent quality; panels and lintels allow for large openings and rapid structural assembly; and the others category (façade pods, utility modules, mezzanines) addresses specialized accommodation and MEP needs. For example, in March 2025, 3XNest signed a strategic partnership with a Saudi company to introduce foldable modular homes and units for labour housing and fast deployment residential projects in the region.

Structural Steel Market Breakup by Component

Key Insights: H-type and I-type beams are prioritized for high-rise and industrial projects due to their structural strength and span capabilities, with firms like Hadeed and Al Rajhi Steel expanding production capacity. Columns are being prefabricated for rapid installation, while angles are increasingly integrated into bracing and secondary frameworks. Companies including Essar Steel and Alfanar are also developing customized profiles under the “others” category to cater to specialized commercial, residential, and infrastructure needs, reflecting a shift toward modular, high-precision construction solutions.

Market Breakup by End-Use Sector

Key Insights: Residential end-use sector substantially contributes to the rising Saudi Arabia prefabricated building and structural steel market value driven by rapid urbanisation and the need for fast, high-quality housing, with companies like AMANA launching a modular factory in Rabigh to support residential and hospitality projects. Institutional growth is fuelled by schools, hospitals, and government buildings seeking modular solutions to reduce on-site work. Commercial adoption rises in offices, retail, and hotels for speed and flexibility, while industrial sectors leverage large-span steel frameworks and off-site components for factories, warehouses, and logistics hubs, ensuring faster project execution across Saudi Arabia.

By product type, floors and roofs are registering substantial demand globally

The market growth is driven by the rising acceptance of prefabricated floor and roof modules that deliver structural strength and rapid install time. Factory finished decks and roof panels reduce onsite labour and cut schedule risk for high-rise and large residential developments. For example, a 200,000 sqm modular production facility was inaugurated in 2025 by China Harbour Engineering Company (CHEC) in Riyadh to support major housing programmes and expedite floors & roof assemblies. This trend reflects how manufacturers are scaling capacity and standardising modules to meet the fast-track demands of Saudi giga projects.

The growth of the is Saudi Arabia prefabricated building and structural steel market is driven by greater utilisation of prefabricated wall panels offering insulation, fire resistance and rapid installation, matching developer demands for quality and speed. Modular wall systems are increasingly specified for residential and hospitality schemes where thermal and acoustic performance matter. For instance, CIMC Modular Building Systems signed an agreement in May 2025 to deliver an 11,000 m² modular hotel in Saudi Arabia, including finished wall panel modules designed for fast erection. The push by suppliers to integrate walls as pre-engineered modules is reshaping how projects are built in Saudi Arabia.

By components, I- type beams dominate in terms of adoption and usage

The Saudi Arabia prefabricated building and structural steel market growth is driven by the increasing use of I type beams in industrial, warehouse, and large-span constructions due to their efficient material use and structural flexibility. Companies such as Al Ittefaq Steel Products Co. (ISPC) are expanding production capacity and automating fabrication to meet rising demand. For example, in September 2024, ISPC reported significant orders from mega-projects in Saudi Arabia, highlighting how I type beams are becoming a preferred choice for modular and large-scale industrial construction.

Growth in this segment is driven by demand for steel angles, channels, T-beams, and other custom profiles in secondary frames, façades, and specialized modules. Firms such as Alghanim Industries are investing in modular steel production and advanced fabrication techniques to meet project-specific needs. In February 2025, Alghanim launched a new facility in Sudair capable of producing 100,000 t annually of structural steel and prefab profiles, supporting fast-track construction and innovative architectural designs.

By end-use sector, residential category shows robust growth

Residential demand in the Saudi Arabia prefabricated building and structural steel market is being driven by the need for fast-tracked, high-quality housing solutions that support urban growth and worker accommodation. Modular specialists like Dorçe Prefabricated are responding with turnkey factory built homes designed for harsh environments and rapid installation, aligning with the Kingdom’s housing strategy. Their systems deliver finished units that reduce onsite work, increase productivity, and allow developers to meet tight project schedules.

Commercial developments such as offices, retail centers and hospitality venues are deploying prefabricated structural steel and modular systems to meet tight timelines and upscale branding, while industrial sectors leverage large span frameworks, scalable modules and high precision fabrication. In July 2025, leading player Zamil Steel expanded its structural steel production capacity in Saudi Arabia, delivering 15,000 metric ton steel buildings for landmark industrial and commercial projects in 2025.

Essentially, domestic manufacturing capacities are being expanded by Saudi Arabia prefabricated building and structural steel market players while production practices are made sustainable in order to harmonize with the goals of Vision 2030 of Saudi Arabia. In order to ensure delivery that is not only faster but also cost-efficient, companies such as Essar Group and Hadeed are investing in low-carbon steel as well as vertically integrated supply chains. These moves not only improve the level of local value addition but also decrease the country's dependence on imports and are in line with the requirements of green building.

Without a doubt, innovation is at the core of leadership in the market as the enterprises decide to integrate advanced automation and modular technologies in prefabrication. Among others, SIBS AB and Red Sea International Co. are implementing ultra-precise modular units together with the use of eco-friendly materials to both shorten their project timelines and keep high quality. Through factory-built, energy-efficient designs, they exemplify the growing trend in the Saudi prefabricated building and structural steel market toward smart, scalable, and modular solutions, reflecting the sector’s rapid evolution and modernization.

Red Sea International was started in 1992 and is a prefabricated building solutions and modular construction systems company based in Riyadh. The company is mainly engaged in the delivery of residential, commercial, and industrial projects of the turnkey type, providing fast-track deployment along with high-quality standards.

Zamil Steel was established in 1977 and is a structural steel and prefabricated building systems manufacturing company located in Dammam, Saudi Arabia. The company is a pioneer in offering innovative solutions for the industrial, residential, and commercial sectors while emphasizing modularity, durability, and efficient project execution, further solidifying its position in the Saudi Arabia prefabricated building and structural steel market landscape.

SBSMFG is a full-fledged prefabricated building and steel solution provider with headquarters in Riyadh and establishment dating back to 1985. The company is engaged in modular housing, steel frameworks, and turnkey construction projects, thus enabling it to serve large-scale developments everywhere in the Kingdom.

Kirby Building Systems was established in 1970 and carries on its activities from the regional headquarters in Saudi Arabia. It offers the solution of an engineered steel building to industrial, commercial, and residential sector projects. To attract fast-track construction demands, the company assists by providing high-quality prefabricated structures and prompt on-site assembly.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players operating in the market include Bait Al-Jazeera Prefab House, Katerra, Dorçe Prefabricated Building and Construction Industry, and other regional and international manufacturers.

Explore the latest trends shaping the Saudi Arabia Prefabricated Building And Structural Steel Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on Saudi Arabia prefabricated building and structural steel market trends 2026.

Weathering Steel Market

Stainless Steel Market

Structural Steel Market

Electrical Steel Market

South Korea Steel Market

Saudi Arabia Structural Steel Market

Steel Market

North America Stainless Steel Market

Europe Stainless Steel Market

Asia Pacific Stainless Steel Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the Saudi Arabia prefabricated building and structural steel market reached an approximate value of USD 2.07 Billion.

The market is projected to grow at a CAGR of 5.20% between 2026 and 2035.

By 2035, the industry is estimated to reach a value of about USD 3.44 Billion.

Key strategies driving the market include vertical integration of steel and prefabrication operations, adoption of automation and advanced modular technologies, investment in sustainable and low-carbon steel, and expansion to support giga-projects and fast-track construction.

The key trends guiding the market include the environmental consciousness and the increasing construction of green buildings as well as the rising demand for affordable housing.

The major product types considered in the market report are floors and roof, walls, staircase, and panels and lintels, among others.

The various components of prefabricated building and structural steel are H-type beam, I-type beam, angels, and columns, among others.

The significant end uses of prefabricated building and structural steel are residential, institutional, commercial, and industrial.

The market faces challenges such as high initial investment costs, skilled labor shortages, supply chain dependencies, and regulatory compliance requirements for large-scale modular and steel construction projects.

The residential sector contributes the largest share, driven by demand for rapid, high-quality modular housing and workforce accommodation aligned with urbanization and Vision 2030 projects.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Prefabricated Building Market Breakup by Product Type |

|

| Structural Steel Market Breakup by Component |

|

| Breakup by End Use |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share