Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global steel market size attained a volume of around 1709.75 MMT in 2025. The market is projected to grow at a CAGR of 1.19% between 2026 and 2035 to reach a volume of nearly 1924.46 MMT by 2035.

The growing demand in the steel market is due to the increasing infrastructure investments and expanding sectors including automotive and construction. Rising urbanization needs and an increasing need for durable materials in urban development projects have motivated the growth to a great extent. Since the automotive industry requires high-quality steel products to manufacture vehicles, it plays a significant role in steady growth. Steel usage for the production of components that are quantitatively effective is expected to be driven by the renewable energy sectors, particularly the wind and solar energy industries.

The steel sector is set to grow as global infrastructure investment rises, with a particular emphasis on developing high-performance materials in line with environmental pledges. The steel sector is expanding as demand rises for high-performance materials and sustainable, environmentally friendly solutions that align with global green standards and support modern construction and industrial needs.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

1.19%

Value in MMT

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

| Global Steel Market Report Summary | Description | Value |

| Base Year | MMT | 2025 |

| Historical Period | MMT | 2019-2025 |

| Forecast Period | MMT | 2026-2035 |

| Market Size 2025 | MMT | 1709.75 |

| Market Size 2035 | MMT | 1924.46 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 1.19% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 2.41% |

| CAGR 2026-2035 - Market by Country | India | 2.89% |

| CAGR 2026-2035 - Market by Country | China | 2.40% |

| CAGR 2026-2035 - Market by Product | Flat Steel | 2.46% |

| CAGR 2026-2035 - Market by Application | Domestic Appliances | 2.72% |

| Market Share by Country 2025 | China | 49.50% |

One significant trend that the steel industry is currently experiencing is the increased focus on sustainability brought about by the adoption of green technologies and falling carbon emissions. Since electric arc furnaces satisfy modern environmental standards, they are increasingly being used for low-carbon steel production. Steel makers are also increasingly forced to use advanced technologies for cleaner production due to growing consumer preferences for eco-friendly products. Additionally, processes are being improved by the rapid digital transformation taking place in the steel sector using IoT, AI, and data analytics. These have made the manufacturing processes of steel while maintaining the environmental standards, giving the supply chain more value, thereby expanding the market.

Another key trend driving heavy demand for steel is the growth of electric vehicles and energy-efficient construction. Strategic partnerships between automotive plus construction manufacturers with steel producers allow the latter to ensure that durable building materials are regarded as essential inputs in their sustainable operations. Moreover, innovation in steel production is encouraging full-fledged competitiveness as steel manufacturers increasingly attempt to meet the shifting demands for high-performance, energy-efficient products, thereby boosting further growth in the steel market.

The increase in demand brought about by urbanization and infrastructure development is one of the most significant trends in the global steel market. The need for steel keeps rising as cities get bigger due to population growth and development projects like high-rise buildings, bridges, and roads. The growing steel use is also greatly influenced by the automobile industry, particularly as a result of the growing popularity of electric vehicles (EVs). Steel consumption in this particular industry is rising even more as a result of manufacturers investing in new technology due to the surge in electric car sales. Steel plays a vital role in modern infrastructure and automobile manufacture. Hence, the ongoing demand is expected to continue as the demand for sustainable building materials as well as popularity of electric vehicles rises in the coming years.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The popularity of flat steel in the global steel market is growing rapidly. It has become a necessity across various industries including automotive and construction and manufacturing industries. The demand for flat steel has rapidly increased mainly because of its applicability in highly concessive and durable products such as, for example, car body panels, roofing, and appliances. The demand for lightweight, high-strength flat steel is also expected to grow in parallel with the growth of electric vehicle production, as it highly contributes to energy efficiency and performance. Thus, the increased use of flat steel is also due to demand in these infrastructure development activities and from urbanization: construction of bridges, buildings, and industrial structures. These factors put together with technology developments made in steel production would also encourage flat steel's primary role in the global market.

| CAGR 2026-2035 - Market by | Product |

| Flat Steel | 2.46% |

| Long Steel | XX% |

Long steel components, such as bars, rods, and beams, are essential to the construction of infrastructure and urbanization because they support the foundations of buildings, bridges, and skyscrapers. The need for long steel is being driven by increased construction activity worldwide, especially in emerging nations. Moreover, the increasing usage of long steel in the automotive sector for structural components also drives demand. Other market contributors include the rising trend toward renewable energy infrastructure, such as wind turbine towers and ongoing enhancement in the production technique via technological innovations concerning the quality and efficiency of long steel.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Key driving factors for carbon steel in the global steel market include its versatility, its cost-effectiveness, and its growing applications in various industries. These are increasingly used as structural components and machinery to withstand stress with required strength and durability. Moreover, continual demands for infrastructure development and industrial growth constantly fuel the market expansion for carbon steel. On the other hand, alloy steel offers high strength, resistance to corrosion, and application in high-performance. The ability to tolerate extreme circumstances supports alloy steel's demand in the automotive, aerospace, and industrial industries.

Stainless steel's durability, corrosion resistance, and aesthetic appeal are some of its main selling points worldwide. The need for stainless steel is constantly rising worldwide due to its use in a variety of industries, including food processing, automotive, and construction. Tool steel also offers hardness, wear resistance, and ability to withstand extreme stress. It is widely used in the production of tools and equipment.

The construction of structural frames, roof coverings, and infrastructure applications including bridge and tunnel construction are some of the main sectors that use steel. Owing to its ease of use and resistance to tensile and compressive stress, steel is used appropriately in residential buildings, shopping centers, and industrial structures. Steel is also used to make engine parts, car bodies, and panels. Its growth is mostly based on the growing need for lightweight, fuel-efficient materials by the automotive industry, as well as high-strength materials that propel steel developments.

Heavy industry relies on steel to produce tools, equipment, and machinery that require mechanical qualities. The main building material used in construction, mining, oil, and gas is steel. It is used in the manufacture of kitchenware, containers, and furniture. Due to its great strength and resistance to wear, steel is regarded by mechanical engineers as an important material for the manufacture of instrument panels, gears, bearings, and shafts. Steel's ability to withstand mechanical stress and its adaptability are essential for the manufacturing of durable machinery in sectors like automotive and aerospace.

Steel is widely used in the production of domestic appliances such as refrigerators, washing machines, and ovens. Their look and ability to bear the functional load makes them appropriate for functionality in household items. In the agricultural arena steel is used for machinery, silo, and equipment. The material provides wear resistance, which allows it to be ideally suited for heavy agricultural tasks and long-term durability and performance in harsh conditions.

| CAGR 2026-2035 - Market by | Application |

| Domestic Appliances | 2.72% |

| Automotive | 2.37% |

| Mechanical Engineering | XX% |

| Construction | XX% |

| Metalware | XX% |

| Agricultural | 2.58% |

| Others | XX% |

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The ongoing development in the steel market is bolstered by the heavy demand in the mining sector and greater investment made in infrastructure by the government. A rapid increase in construction activities, particularly in commercial and residential sectors, has caused an increase in steel consumption.

Australia Steel Market Trends

Growing emphasis on alternative energy sources creates demand for steel in Australia in for wind, solar, and green energy projects. Another significant user of steel is the automotive sector, specifically for the manufacture of various auto parts. Additionally, global technological advancements that prioritize high-quality, sustainable steel products are a benefit to the expansion of the steel market. Export opportunities to Asia are also a key propellant for growth in the region.

Canada Steel Market Trends

With the automotive, construction, and energy sectors driving Canada's robust steel market, demand for steel in automotive manufacturing is on the rise, given the premium quality take in the region. Besides, the construction sector, due to infrastructure development driven by urbanization, is also expected to push the demand for steel products, including beams, rebar, and sheets. The country's energy sector, particularly the oil and gas sector, will have a significant impact on steel consumption. As it transitions to more ecologically friendly and energy-efficient steel production, Canada is placing a strong emphasis on sustainable development. The market is also benefitting from the strategic trade relationship with the United States and other nations.

Africa Steel Market Trends

The African steel market is witnessing steady growth as a result of rapid urbanization means in countries such as South Africa, Egypt, and Nigeria. These countries are increasingly contributing to the growth with strong investments into construction, manufacturing, and energy projects thereby instigating a demand in steel meant for building materials, automotive components, and heavy machinery. Further, an expanded middle-class population together with industrialization in major African economies are further pushing the consumption of steel higher.

Colombia Steel Market Trends

One of the main factors driving the demand for steel in Colombia is construction. The market growth is fueled by urbanization and infrastructure development projects including building highways, bridges, and residential areas. With increased need for steel to make vehicle parts, Colombia's automotive industry also drives heavy demand. Investments in industrialization and energy sectors, including renewable energy projects, also create opportunities for specialized applications of steel. Moreover, the position of this country as a key exporter of steel has also helped spur the growth in the steel industry in South America.

Chile Steel Market Trends

The major drivers of the steel market in Chile are the strong mining and renewable energy industries. The first being driven by its ranking as one of the biggest global copper producers, providing mining, transportation, and infrastructure for it. In addition, the increasing construction activities in the region has propelled large investments in residential, commercial, and industrial projects, boosting further growth in steel consumption. Moreover, using more sustainable steel with the promotion of green technologies and renewable energy, Chile is bolstering the benefits that low-carbon production methods.

| CAGR 2026-2035 - Market by | Country |

| India | 2.89% |

| China | 2.40% |

| Brazil | 1.99% |

| USA | 1.86% |

| UK | XX% |

| Canada | XX% |

| Germany | XX% |

| France | XX% |

The companies specialise in producing and selling steel products such as billets, cold rolled sheets, colour coating plates, wire rods, thick plates, and heavy rails., and focuses on new materials, new energy, new processes, and green low-carbon manufacturing.

The Baosteel Group, established in 2000 and located in Shanghai, China, is one of the largest steel producers worldwide. A subsidiary of the Baowu Steel Group, it is one of the largest high-quality steel producers for the automobile, construction, and machinery industries. Baosteel is known for its wide bounds of production and technical modernization.

The largest integrated steel manufacturer in the Middle East, Emirates Steel was established in 1998 and has its headquarters in Abu Dhabi, United Arab Emirates. It produces long steel products for the energy, automotive, and construction industries. Emirates Steel is renowned for being a leader in the domains of luxury sustainability and steel manufacturing innovation, which continuously supports the growth of the region's infrastructure.

JFE Steel Corporation was founded in 2002 with its headquarter located in Tokyo, Japan. The corporation has grown to become an international player in the steel dimension with its premium-quality flat and long steel products. The company largely caters to automotive, construction, and energy sectors. The company has grown to be a dominant player in the global market with the development of advanced steel technology, energy-efficient production, and environmental initiatives.

ArcelorMittal, which was founded in Luxembourg in 2007, has become one of the largest producers of steel. The company serves the automotive, construction, energy, and industrial industries, among others, in more than 60 countries. ArcelorMittal is well known throughout the world for its global presence, technological innovation, and advancements in sustainability within the steel industry.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

February 2025

In order to encourage the production of green iron and its supply chains, Australia set aside A$1 billion ($636 million) for a fund, which included an initial A$500 million to save the Whyalla steelworks in South Australia. The A$500 million is a component of a larger package of A$1.9 billion from the federal and state governments to support the steel facility.

January 2025

The second phase of the production-linked incentive (PLI) program for the steel industry is set to be unveiled by Union Minister of Steel and Heavy Industries H D Kumaraswamy. About INR4,300 crore would be spent on the government's new Production Linked Incentive (PLI) program for the steel industry. The updated plan seeks to increase electrical and specialty steel production.

December 2024

In addition to establishing a joint venture for the development and operation of the Kamistiatusset Iron Ore Project, which is owned by Champion Iron Limited (CI) and situated in Newfoundland and Labrador, Canada, Nippon Steel Corporation announced its master agreement with CI and Sojitz Corporation to participate in the development of the project.

October 2024

Global steelmaking technology pioneer Danieli granted Greensteel Australia a contract to construct a rolling mill that will produce 600,000 tons annually using only green hydrogen, marking a significant advancement in sustainable steel production. Australia's New South Wales is set to host the world's first green steel factory.

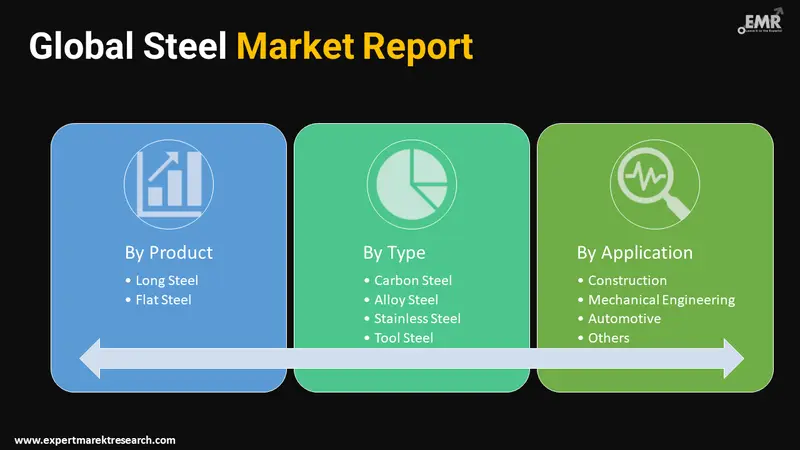

The study on the steel market delivers detailed analysis on region-level perspective depending on specific contemporary industry trends. It considers various segments, such as product, type, and application. By assessing all these segments, this report presents a thorough discussion of market drivers, regulations, and emerging opportunities observed in the market.

Product Outlook

Type Outlook

Application Outlook

Region Outlook

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global steel market attained a volume of approximately 1709.75 MMT.

The market is projected to grow at a CAGR of 1.19% between 2026 and 2035.

The steel market size is estimated to reach 1924.46 MMT in 2035.

The key driving factors of the market growth are the increasing infrastructure investments and expanding sectors including automotive and construction.

The key trends aiding the market include technological developments such as Industry 4.0, digitalisation, automation, and additive manufacturing in steel production and the growing demand for light weighted steel in automotive sector.

The different types of steel include carbon steel, alloy steel, stainless steel, and tool steel.

Based on application, the market is segmented into building and construction, mechanical engineering, automotive and transportation, metalware, domestic appliances, agricultural, heavy industry, consumer goods, and others.

The competitive landscape consists of ArcelorMittal S.A., Ansteel Group Corporation Limited, Nippon Steel Corporation, HBIS Group Co., Ltd., Jiangsu Shagang Group, POSCO Holding Inc., JFE Steel Corporation, Tata Steel Limited, Hyundai Steel Co., Ltd, China Baowu Steel Group Corporation, Baosteel Group, Emirates Steel, NUCOR, Outokumpu, and Thyssenkrupp, among others.

Based on type, the leading segment considered in the market report is flat steel.

The market is broken down into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

The leading segment considered in the market report is carbon steel, by the product analysis.

Based on application, the leading segment of the global steel market is building and construction.

The key regions considered in the market report are Australia, Canada, Colombia, Africa, and Chile.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Trade Data Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share