Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global silica sand market attained a volume of 433.56 MMT in 2025. The silica sand market value is estimated to grow at a CAGR of 4.44% during 2026-2035 to reach a volume of 669.45 MMT by 2035.

Base Year

Historical Period

Forecast Period

Silica sand provides efficiency in the flow of oil and gas in hydraulic fracturing. China hydraulically fractured about 2,740 shale gas wells from 2012 to 2022, pushing the growth of silica sand market.

In April 2024, the production of insulating glass accounted for 9,868.000 sq m by China.

In 2023, global sales of electric cars reached 14 million, 95% of which were sold in China, Europe, and the United States.

Compound Annual Growth Rate

4.44%

Value in MMT

2026-2035

*this image is indicative*

Rapid urbanisation, infrastructure investments, and population growth drive silica sand demand.

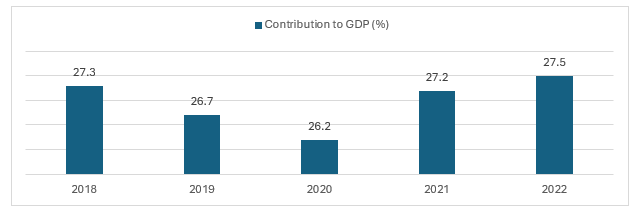

Growth in the construction, glass, and foundry building industries, subsequently engendered by fast urbanisation and population growth, has been driving the global silica sand ecosystem. Thus, with the world population expected to reach 9.7 billion by 2050, with urbanisation going up to 68%, the demand for silica sand has massively gone up. The government is increasingly investing in infrastructure, and the urban population is growing, notably in emerging markets like China and India. This further perpetuates building and construction growth, accelerating the silica sand demand globally.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Other developments include the USA's Inflation Reduction Act and China's Public Housing Plan, which are both targeted at tenements with 6.5 million units in further driving the demand for silica sands. Revenues of the largest 100 building contractors are up by 3.2% for 2022 - this shows that this sector is on its growth trajectory. Some of the factors influencing the growth of the global silica sand market include economic growth, infrastructural development, and urbanisation.

Figure: Global Industrial Sector (including Construction) Contribution to Global GDP, 2018-2022

Oct 17, 2023

SCR-Sibelco N.V. (Sibelco), had completed its second tranche investment of $24 million into their joint venture company, Cape Silica Holdings Pty Ltd, ahead of schedule as per the joint venture with Diatreme Resources Ltd.

July 2022

Polar Night Energy began producing sand batteries that store energy from renewable energy sources, like the wind, by heating silica sand. The batteries will, according to the company, be able to heat houses during winter and also reduce CO2 emissions.

Another major driving force in the market has been the thriving glass-manufacturing industry. Silica sand utilised in the manufacture of glass covers a wide area of application, starting from window panes and container glasses to even electronic display glasses. Along with rapid technological development and high demand for electronic gadgets, solar panels, and other eco-friendly packaging materials, so also is the increase in demand for value-added quality glass. The construction and automobile industries are adding to this demand as new products are being developed in building materials and vehicle windows. This increasingly strong demand for value-added glass products fuels the demand of the silica sand market, therefore framing it as a critical part of modern technologies and infrastructure.

Silica sand is crucial for solar energy generation

One important emerging trend driving the growth of the market is in solar energy generation. It acts as a heat transfer fluid in CSP plants, thereby absorbing the solar energy and storing it. Solar PV generation increased 26% in 2022 from that of 2021. Surging demand for solar power supports the silica sand market, given the application of silica in the manufacturing process of solar panels. High-purity silicon, mainly produced from silica sand, is used in the manufacture of PV cells in solar panels, pushing the silica sand market dynamics and trends.

Due to the imperative of climate change goals and government incentives, as global demand surges, there is a rising need for efficient and cost-effective solar technology. This is evidenced by solar power infrastructural investments and increasing efficiencies in solar panel performances. It finds manifestation in the increased demand for silica sand amidst an increased pace of solar farms and residential solar installations across the world. The silica sand market, therefore, is bound to grow with the overall increase in the renewable energy sector, as the material would continue playing a vital role in the sustainable creation and use of renewable energy.

Silica sand is vital for hydraulic fracturing in increasing oil production.

Another significant trend visible in the marketplace is the rise of hydraulic fracturing or fracking as a means of oil and gas production. Frac sand is used in hydraulic fracturing. It is pumped down wells and into the oil-bearing strata to enhance permeability and the flow rate of oil. Its chemical purity helps to resist chemical attacks in anti-corrosive environments. In 2023, an estimate of 3.04 billion barrels was directly produced from the tight-oil (shale) resources in the USA, accounting for about 64% of the country's total crude oil production, a factor that removes silica sand market growth challenges from the global market.

Ultra-fine silica sands and ceramic proppants further facilitate resource extraction efficiency and improve well performances. A good example could be the unprecedented increase in demand for high-quality silica sand that was associated with the rapid development of shale oil and gas production in the United States.

Silica sand offers growth in advanced water filtration technology applications.

One of the emerging opportunities within the silica sand market pertains to its application in enhanced water filtration systems. Increasing global shortages and rising problems with water contamination are driving the need for more effective methods of water purification. Silica sand comes into play in new generations of water treatment systems because of its high filtration capacity and durability, especially within modular and decentralised filtration units. Recent water treatment advances, involving nanofiltration and advanced oxidation processes, are some of the developing aspects that indicate silica sand can play a crucial role in enhancing efficiency and cost-effectiveness. By leveraging silica sand in such filtration systems, the market could further position this emerging sector of sustainable and available water solutions to ensure a promising and socially viable avenue for silica sand industry growth.

Environmental concerns and regulations impede silica sand market growth.

Factors like environmental concerns and regulatory challenges are major deterring factors in the growth of the global market. It is known that extraction of silica sand degrades the environment by destroying habitats and depleting the water table. For instance, the sand mining industry has received much criticism and regulatory constraints by states like Wisconsin because of the possible consequences this may incur on local ecosystems and communities in the United States. The regulatory factor involves strict regulations and laws concerning environmental protection, which increases the cost of operation and limits production capacities. These environmental and regulatory challenges affect the flow of silica sand market revenue by raising the price of silica sand due to disturbance in supply chains, hampering the growth of the overall market.

The market grew over the last five years, driven mainly by growing industries in construction and the manufacture of glass. Growing infrastructural development and urbanisation in a number of developing economies, including China and India, are driving the demand for silica sands. The presence of major projects and increased investment in the construction and technology sectors drives the silica sand market revenues ahead.

However, the market also faces environmental concerns and regulatory pressures. Sand mining has raised issues related to environmental degradation and water resource depletion, leading to stricter regulations and higher operational costs. While moving forward, the market will keep on growing at a moderated pace because of environmental and regulatory challenges. Future growth is more likely to be driven by technological advancements in sustainable mining practices and specialised glass products. A careful balance between demands of the market and environment sustainability will prove crucial for the long-term success of the sector.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Silica Sand Industry Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Application

Market Breakup by Region

Glass manufacturing is growing due to high demand in construction and electronics.

As per silica sand market analysis, the demand for the silica sand will be high as glass manufacturing is pivotal in several industries, and hence, the attention for the segment will also be significant. Glass manufacturing will see growth at a CAGR of 5.2% during the forecast period. This growth is driven by increasing applications in construction, automotive, and electronics sectors.

Demand for silica sands is increasing through specific drivers in the different industries that use it. The foundry industries are facing an increase in demand because of the expansion in the manufacture of automobiles and industrial machinery, most of which require precision in metal castings. The chemical production industries are similarly experiencing growth on account of improved technology and growing demand for silicon-based chemicals that will increase demand for silica sand. Construction: Booming infrastructure development coupled with urbanization drive the demand for silica sand in concrete and asphalt mixtures. The paints and coatings industry has been facing increasing demand due to many industries focusing on durable and high-performance coatings. Ceramics and Refractories: High-temperature-resistant materials are increasingly demanded in aerospace, energy, and other similar industries along with advanced ceramics, pushing the growth of the silica sand industry.

As water and air qualities continue to degrade, the filtration industry is on the rise, thus increasing demand for effective filtration media like silica sand. Hydraulic fracturing to access previously unreachable reserves by the oil and gas industry is giving a tremendous boost to the demand for silica sand as a proppant. Lastly, in recreational and niche uses, the increasing popularity of sports and artistic leisure activities using sand is driving demand upward. Each of these sectors has its growth drivers, indicating the reliance on silica sand to meet the requirements of several industries and consumers.

North America Silica Sand Market Trends

According to the silica sand industry analysis, the crucial propellant factors for silica sand in North America include the growing oil and gas industry and infrastructural development. Hydraulic fracturing, which is being increasingly done to meet the demand for crude oil supply, has raised the demand for silica sand due to its use as a proppant. As an example, shale oil production in the United States has more than increased to over 9.6 million barrels per day in 2023, for which silica sand plays an essential role. In addition, infrastructure projects under schemes like the United States. The Infrastructure Investment and Jobs Act, which provided a funding of USD 1.2 trillion for its development, further supports the demand for building materials, one of which is silica sand. This powerful energy industry growth, alongside considerable investment in infrastructure, drives the silica sand market in North America.

Europe Silica Sand Market Insights

The demand in Europe is partly driven by the drive for high-quality glass products and the growth in the construction sector. The rise of sustainable building practices along with advancements in green technologies like energy-efficient windows and solar panels increases demand for specialised glass, which is often fabricated from high-purity silica sand. For instance, Europe's commitment to carbon emission reductions and improvements in energy efficiency has driven the use of advanced glass solutions in both building retrofits and new construction. Also, large infrastructure projects at the helm of investment plans by the European Union further drive the silica sand industry in Europe. This combination of technological advancements in the production of glass, and the extension of infrastructure development across Europe, is driving the market.

Asia Pacific Silica Sand Market Driving Factors

With rapid industrialization and urbanisation, growing investments in infrastructure are expected, and the Asia Pacific will be the leading region in the silica sand market, leading with a 5.1% CAGR through 2032. The rapid development of the construction sector, with large projects in urban areas and more investment by the government in infrastructure, stimulates the demand for silica sand.

For example, China's ambitious plan to expand its urban areas and India's gigantic infrastructure projects, such as the Smart Cities Mission, have greatly increased silica sand consumption. Further demand of the silica market in the nations is driven by the growing glass manufacturing sector, particularly those serving electronics and solar panels. The demand in the Asia Pacific region is expected to outshine that in other regions due to economic growth and substantial investments in infrastructure and technology, establishing the region's dominance in the global market.

China and India hold a significant position in the global construction sector, driving the demand for silica sand. The construction sector in China is anticipated to maintain a 6% share of the country's GDP until 2025 while in India, the construction sector constituted 9% of the GDP in 2023, accelerating the silica sand market share in Asia Pacific.

Latin America Silica Sand Market Opportunities

Expanding construction activities and increasing investments in infrastructure development propel the silica sand industry in Latin America. The rate of urbanisation and infrastructure projects concerning roads and residency in Latin American countries such as Brazil and Mexico are significantly increasing due to demand for silica sand. For instance, huge infrastructure projects in Brazil include expanding roads and transportation systems as well as accommodation projects that demand huge consumption of silica sand. Besides that, demand from building and automobile industries also gives a boost to the market. These, along with economic development and increased urbanisation in Latin American countries, drive the silica sand demand growth forward.

Middle East And Africa Silica Sand Market Dynamics

The factors such as rapid urbanisation and heavy infrastructure development in the Middle East and Africa drive the market for silica sand. The region's growing construction industry, working on projects of Saudi Vision 2030 and furthering the legacy created by Expo 2020 in the UAE, sees an unprecedented surge in the demand for silica sand. Huge investments in residential and commercial projects, along with infrastructure projects, are acting as major contributors in cities such as Dubai and Riyadh. The market also grows with the increasing application of silica sand for high-performance glass manufacturing in architectural applications. Efficient water filtration systems are in demand in arid regions, thus giving further demand for silica sand. These factors propel the silica sand market opportunities in the Middle East and Africa.

The startups in the silica sand industry have been working on innovations related to sustainable mining methods and advanced processing technologies. In addition, they work in improving the efficiency of extraction methods and their ecological influence on the environment while processing silica sand. A key trend of the silica sand market is that many startups have been developing value-added silica sand products for high-tech applications such as advanced glass manufacturing and water filtration. In fact, such startups want to take advantage of such emerging market opportunities and help in growing the industry by addressing the environmental concern and finding other uses of silica sand.

US Silica Holdings, Inc was founded in 2008 and is one of the major silica sand players. The company provides top-grade silica sand for hydraulic fracturing, industrial applications, and environmental services. US Silica follows principles of sustainability and efficiency in response to growing demand for its specialty sand products using advanced technologies in mining and processing.

TeraWatt Infrastructure is a relatively new company, founded in 2020. The company provides innovative silica sand to high-performance applications in advanced glassmaking and renewable energy technologies. It develops sustainable mining practices with state-of-the-art processing capabilities that will meet emerging demands for technology and energy.

Silica sand market players are increasingly broadening their approach toward sustainability and efficiency in mining and processing to develop more qualitative, specialised sand products for a wider range of applications, including hydraulic fracturing, advanced glass making, and water filtration. Innovation in greener practices and technology-driven solutions forms the core of the market leaders’ strategies, aiming at marketplace demand combined with environmental concern. Few of the silica sand companies that are leading the market are:

Is a subsidiary of JFE Holdings, Inc. The company was formed in April 2022 after a merger of JFE Mineral Company, Mizushima Alloy Steel Company, and JFE Materials Company.

Provides material solutions, specialising in sourcing, transformation, and distribution of specialty industrial minerals, including silica, clays, feldspathoids, and olivine. Headquartered in Belgium, the company operates with 200 production sites across 31 countries, 6 technical centres, and has a workforce of around 4,683 employees.

Headquartered in Japan, Mitsubishi Corporation has a wide range of businesses across multiple industries and operates with eight industry-specific business groups namely environmental energy, materials solution, mineral resources, urban development and infrastructure, mobility, food industry, smart life creation, and power solution.

Was formed by the merger of Fairmount Santrol and Unimin and is a top provider of mineral and material solutions for the Industrial and Energy markets. Founded in 2018, the company offers a diverse range of high-quality products, specialised technical expertise, and the most comprehensive and accessible distribution network.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the global silica sand market are Tochu Corporation, US Silica Holdings Inc, Euroquarz GmbH, Manley Bros. of Indiana, Inc, Badger Mining Corporation, and Perniagaan Usahasama Membalak Sdn. Bhd. (PUM Group), among others.

May 20, 2024

Covia, a top provider of mineral-based and material solutions for various industrial markets, has finalised its previously announced acquisition of R.W. Sidley's Industrial Minerals Division. This division offers high-quality, silica-based products used in filtration, industrial, and sports applications.

March 2024

ERGA Innovation Center conducted research on the possibility of silica sands from the Egyptian deposit by using dry magnetic separation. The objective of the tests was to minimize the iron oxide content and improve the quality of silica sand for further use in the glass production industry.

Latin America Silica Sand Market

Saudi Arabia Silica Sand Market

Asia Pacific Silica Sand Market

Middle East Silica Sand Market

Filter and Abrasive Grade Silica Sand Market

Construction-Grade Silica Sand Market

Foundry & Mold-Grade Silica Sand Market

Hydraulic Fracturing Sand Market Trends

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market attained a volume of 433.56 MMT in 2025.

The market is estimated to grow at a CAGR of 4.44% during 2026-2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a volume of 669.45 MMT by 2035.

The factors driving the market growth are increasing construction activities, expansion of the glass manufacturing sector, rising metal casting works, and expansion of the oil and gas sector.

Key trends aiding market expansion include the growing applications of silica sand, rising infrastructural developments in emerging economies, and increasing demand from the glass industry.

The key regional markets for silica sand are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

Glass manufacturing is expected to account for the largest share in the forecast period.

The key players in the market include JFE Mineral & Alloy Company,Ltd, SCR-Sibelco NV, Mitsubishi Corporation, Covia Holdings LLC, Tochu Corporation, US Silica Holdings Inc, Euroquarz GmbH, Manley Bros. of Indiana, Inc, Badger Mining Corporation, and Perniagaan Usahasama Membalak Sdn. Bhd. (PUM Group), among others.

In August 2025, the global spending on construction stood at USD 1.98 trillion, representing a 7.4% increase since 2019.

The applications include glass manufacturing, foundry, chemical production, construction, paints and coatings, ceramics and refractories, filtration, oil and gas and others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share