Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global solid waste management market size reached around USD 514.36 Billion in 2025. The market is projected to grow at a CAGR of 7.00% between 2026 and 2035 to reach nearly USD 1011.82 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

7%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The Asia Pacific is the leading market for solid waste management. China is the largest importer of waste, importing nearly 776,000 metric tons of recyclable plastic in 2016. However, the country has recently imposed a ban on 24 waste materials, which includes plastic waste. While it would severely affect major exporting countries like North America, Australia, and the European countries, it will also allow local players to compete with domestic players by developing and enhancing their recycling expertise. The solid waste management market in the Asia Pacific is being driven by the rising adoption of integrated waste management and a shift away from the collect-and-dispose model, which is significantly reducing operational costs. Rising government regulations regarding sustainable waste disposal and growing technological adoption are also aiding the market growth in the region.

With the growing population and surging income levels, the per-capita waste generation, especially in high-income countries, is significantly surging. This, in turn, is prompting the requirement for optimal solid waste management. As the awareness regarding the harmful consequences of poorly disposed and uncollected solid wastes is rising, the adoption of innovative solid waste management systems is significantly growing. The introduction of various favourable government initiatives to improve waste collection systems and develop innovative waste management strategies is also invigorating the solid waste management market. Technological advancements and innovations to enhance operational and cost efficiency while decreasing energy use in solid waste management are likely to further propel the market growth in the forecast period.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Solid waste management is referred to as the process of collection and treatment of solid wastes. It offers alternatives to recycle items that do not belong to garbage or trash. Through waste management, solid wastes can be transformed and used as a valuable resource. The industrialization has led to the creation of excessive solid waste, which harms the environment. It offers a remedy to create healthy surroundings.

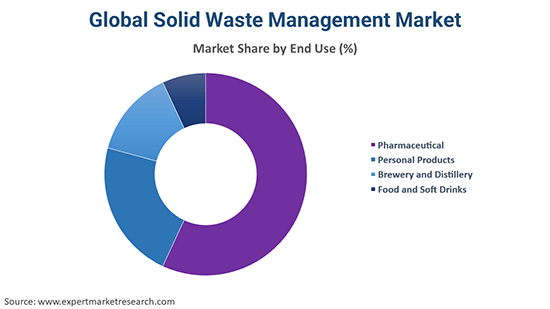

Based on end-uses, the market is segmented into:

The report also covers the regional markets of the product like:

The global solid waste management market is driven by the absence of major suppliers' presence, which is directly operational across locations in a specific region, leading to subcontracting of services. The outsourcing of waste management services to a single supplier enables buyers to leverage synergies in several services founded on service provider capabilities, propelling the market further. The synergies are present in the collection, proper waste treatment, segregation, recycling, and disposal. The appropriate segregation of recyclable waste in the nascent period and disposing it to the appropriate supplier would save considerable costs involved in the disposing of wastes, invigorating the market growth. Due to substantial resale value, the suppliers charge less for recycling or disposing of recyclables. The buyers would be able to realize the operational benefits and cost efficiency and achieve economies of scale on engaging with a single waste management supplier, providing further impetus to the market’s expansion. The buyers will be able to re-examine their budgets on a regional scale, owing to the centralized procurement through a regional model, strengthening the market.

The latest trends in the solid waste management market include an anaerobic breakdown of organic waste, drive for zero waste, innovative packaging, and using technology for waste separation, which are catalyzing the market growth. The anaerobic breakdown of organic waste involves airtight reactors, called anaerobic biogas digesters with micro-organisms, used to convert waste into biogas. The remnants can be used as fertilisers in agriculture. The converted biogas is used as energy and is moulded to fuel low-tech setups in the emerging countries. In Europe, 25% of organic waste is treated through anaerobic digestion. The use of biogas is a smart way to deal with solid waste without causing air pollution. It is also a source of renewable energy; thus, its use does not deplete or harm natural resources.

Another trend that is accelerating the market growth is innovative packaging. Many influential MNCs have started investing in innovative packaging to promote the reduction in the impact of wastes in their value chain and lowering costs at the same time, thus, enhancing the market growth. Lighter and stronger materials are preferred for packaging by companies, which makes their treatment easier. Technological advancements in solid waste management market to separate or sort the waste for suitable waste treatment, making the process easier, are further enhancing the market growth.

The report gives a detailed analysis of the following key players in the global solid waste management market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

The comprehensive EMR report provides an in-depth assessment of the market based on Porter's five forces model, along with giving a SWOT analysis.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market attained a value of nearly USD 514.36 Billion.

The market is supported by the global waste management market that is projected to grow at a CAGR of 7.00% between 2026 and 2035.

The market is being driven by the rising adoption of integrated waste management systems to reduce operational costs, the increasing use of digital technologies for optimal waste management, and the introduction of various stringent regulations regarding sustainable waste disposal.

The key trends guiding the growth of the market are increase in smart city constructions, development of innovative technologies for waste separation, and the advent of anaerobic biogas digesters to convert waste into biogas.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The significant end uses of solid waste management include pharmaceutical, personal products, brewery and distillery, and foods and soft drinks.

The major players in the global solid waste management market are Veolia Group, SUEZ Group, URBASER S.A., FCC Environment (UK) Limited, Harden Machinery Ltd., Geocycle, REMONDIS SE & Co. KG, and DS Smith Plc, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share