Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global sports supplements market reached a value of nearly USD 26.28 Billion in 2025. The market is assessed to grow at a CAGR of 8.60% during the forecast period of 2026-2035 to attain a value of around USD 59.97 Billion by 2035. The market growth can be attributed to the increasing interest in veganism, the rising health-consciousness, innovative product launches, the rising trend of personalised nutrition, and the development of innovative formats.

Base Year

Historical Period

Forecast Period

There is a rising consumption of sports supplements among not only traditional athletes but also wellness and fitness enthusiasts. According to Innova, 31% of global functional nutrition consumers surged their consumption of sports nutrition products in 2023, while 60% maintained their consumption. This is expected to prompt sports supplement companies to develop innovative formulas, delivery methods, and flavours to meet the evolving needs of customers.

In 2022, 1 in 8 people in the world were obese. Hence, growing concerns regarding obesity and weight management are boosting the interest towards sports supplements that promote fat loss, appetite control, and metabolism. Moreover, obesity can lead to various health issues, including cardiovascular disease, diabetes, and joint problems, hence the growing awareness regarding these risks is expected to drive the development of sports supplements that focus on prevention.

With an increasing number of customers embracing sports supplements, there is a growing interest in personalised nutrition. Brands are developing customised solutions based on specific needs of individuals, such as health conditions, fitness goals, or age groups. For instance, Persona Nutrition formulates a personalised supplement plan including minerals, probiotics, vitamins, and protein powders to meet the specific needs of an individual.

Compound Annual Growth Rate

8.6%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Sports Supplements Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 26.28 |

| Market Size 2035 | USD Billion | 59.97 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 8.60% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 10.1% |

| CAGR 2026-2035 - Market by Country | India | 11.6% |

| CAGR 2026-2035 - Market by Country | Brazil | 9.4% |

| CAGR 2026-2035 - Market by Type | Protein | 9.8% |

| CAGR 2026-2035 - Market by Distribution Channel | Online | 11.6% |

| Market Share by Country | China | 17.1% |

The sports supplements market growth can be attributed to the growing health and fitness consciousness and the rising awareness regarding the importance of nutrition for athletic performance and overall well-being. The increasing participation in fitness and sports activities is also surging the demand for performance-enhancing and recovery supplements. In 2023, nearly 242 million Americans or around 80% of all Americans 6 years and older participated in at least one fitness activity or sport, a 2.2% surge from 2022.

Innovative product launches, aimed at enhancing athletic performance, wellness, and recovery, are propelling the sports supplements demand forecast. Key players are also introducing new ingredients such as chickpea protein, hemp protein, and sunflower protein due to their digestibility and amino acid profiles. Advancements in personalised nutrition are leading to the development of customised supplements that are designed to meet the specific needs and goals of individuals.

There is a growing demand for recovery-focused sports supplements such as collagen, electrolyte drinks, branched-chain amino acids (BCAAs), and creatine to enhance recovery, minimise soreness, and improve endurance. This is creating opportunities for brands to develop innovative formulations targeting recovery times.

Sports supplement brands are increasingly leveraging social media and influencer marketing strategies to reach a new consumer base and build trust and credibility. By partnering with fitness influencers, wellness personalities, and athletes, brands are attempting to create authentic advertisements to connect with health-conscious individuals and fitness enthusiasts on a more personal level.

The increasing ageing population is surging the sports supplements market value. Supplements containing turmeric, glucosamine, omega-3 fatty acids, and collagen that support bone and joint health are witnessing a significant surge in popularity as ageing individuals focus on holistic lifestyles.

Rising demand for plant-based supplements; growing trend towards personalised nutrition; increasing emphasis on sustainability; and the development of women-centric supplements are favouring the sports supplements market expansion.

The rising vegan population globally due to rising health and ethical concerns is boosting the sports supplements market revenue. As per the World Animal Foundation, there were nearly 88 million vegans in the world, with 67% being female, in 2023. Hence, sports supplements containing chickpeas, wheat, soy, peas, and brown rice are gaining popularity due to their plant-based formulations, low sodium contents, and rich amino acid profiles. Such supplements are also lower in fat, easier to digest, and free from antibiotics and hormones typically present in animal-based products. The increasing launches of innovative plant-based sports supplements further complement the market. Between September 2022 and August 2021, 41% of plant-based sports nutrition launched globally contained pumpkin seeds, whereas 31% contained hemp protein and 23% included sunflower protein.

The rising trend towards personalised nutrition is creating lucrative sports supplements market opportunities. Key players are increasingly offering protein powders tailored to the specific fitness goals of individuals, blending different protein sources based on the dietary preferences of an individual. The rise of genetic testing that reveals genetic variations influencing exercise recovery, nutrient metabolism, and risk of certain deficiencies enables supplement companies to offer highly targeted products. Moreover, advancements in technologies such as artificial intelligence (AI) are expected to offer more precise and data-driven supplement recommendations tailored to individual preferences and needs.

The growing focus on sustainability amid the rising environmental consciousness is shaping the sports supplements market trends and dynamics. With customers becoming more aware of products that support health and performance and align with animal welfare, sustainability, and environmental responsibility, the demand for sustainably sourced sports supplements is rising. There is also an increasing usage of upcycled ingredients such as fruit powders or plant proteins to create new sports supplements, lower food waste, and contribute to a more sustainable supply chain. Furthermore, key players are shifting towards sustainable packaging solutions, including compostable, plastic-free, and recyclable plastics. They are also adopting sustainable manufacturing practices such as lowering water usage, minimising energy consumption, and reducing overall waste, decreasing the overall environmental impact of supplement production.

Women have different nutritional requirements than men, especially related to bone health, hormones, and metabolism. This, coupled with increasing women's participation in sports and fitness activities, such as running, strength training, yoga, and CrossFit, among others, is driving the demand for sports supplements specifically designed for women. Moreover, an increasing number of women are focusing on building lean muscles and weight management, which is boosting the development of sports supplements such as fat burners, low-calorie protein powders, and meal replacement shakes that support muscle toning and fat loss. In the forecast period, the increasing awareness regarding women’s health issues such as menopause, post-partum recovery, and hormonal imbalances and the development of specialised supplements for concerns like mood swings, PMS, and metabolism changes are expected to boost the sports supplements market revenue.

The growing demand for plant-based and vegan sports supplements is driven by the increasing global vegan population, which reached nearly 88 million in 2023, with 67% of them being female. As consumers seek health-conscious and ethical alternatives, plant-based supplements made from ingredients like chickpeas, soy, peas, and rice are becoming more popular. These products are known for their low sodium content, rich amino acid profiles, and benefits like easy digestion and the absence of antibiotics and hormones found in animal-based products. Innovative plant-based products, such as those with pumpkin seeds, hemp protein, and sunflower protein, are also rising. Simultaneously, the trend toward personalised nutrition is gaining traction, with supplements tailored to individual fitness goals and genetic profiles. Advances in AI and genetic testing are allowing for more targeted, data-driven product recommendations. Sustainability is another key driver, with consumers increasingly preferring eco-friendly packaging, sustainable ingredients, and environmentally responsible manufacturing practices, which lower the carbon footprint of supplement production.

The growth of the sports supplements industry can be impeded by inconsistent regulations across different countries regarding the efficacy, safety, and ingredient labelling of sports nutrition products. Overconsumption or misuse of sports supplements, particularly performance enhancers and stimulants, can result in health issues such as dehydration, heart problems, or digestive issues.

Some sports supplement brands make misleading health and performance claims, reducing customer trust. Moreover, various consumers perceive sports supplements as unnecessary, which can limit the market growth, especially among individuals preferring whole foods.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Sports Supplements Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

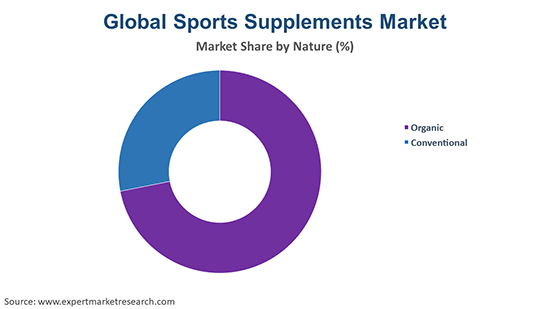

Market Breakup by Nature

Market Breakup by Type

Market Breakup by Distribution Channel

Market Breakup by Region

| CAGR 2026-2035 - Market by | Type |

| Protein | 9.8% |

| Non- Protein | XX% |

| CAGR 2026-2035 - Market by | Distribution Channel |

| Online | 11.6% |

| Hypermarkets and Supermarkets | 9.6% |

| Pharmacy and Drug Stores | XX% |

| Specialty Stores | XX% |

| Others | XX% |

| CAGR 2026-2035 - Market by | Region |

| Asia Pacific | 10.1% |

| Latin America | 8.2% |

| North America | XX% |

| Europe | XX% |

| Middle East and Africa | XX% |

By Nature Insights

As per the sports supplements market analysis, organic sports supplements are made from ingredients grown without the use of synthetic herbicides, pesticides, and fertilisers. They are typically more expensive than their conventional counterparts due to their higher production costs and small-scale farming operations. The increasing health consciousness, the growing trend of sustainability, and the rising demand for clean-labelled and vegan products are fuelling the organic sports supplements demand growth.

Meanwhile, conventional sports supplements use ingredients produced using standard farming and manufacturing practices. As they are mass-produced and typically contain both natural and organic ingredients, conventional sports supplements are more cost-effective than their organic counterparts, making them accessible to a wide customer base.

By Type Insights

Protein supplements are estimated to grow at a CAGR of 9.8% during the forecast period of 2026-2035 as they are extensively used by athletes, fitness enthusiasts, and bodybuilders to surge their protein intake for weight management and muscle recovery, among others. Whey protein, casein protein, plant-based proteins, collagen protein, and egg white protein are the most common types of protein supplements. The increasing popularity of protein powders, ready to drink shakes, and bars due to their convenience and portability is fuelling the sports supplements market development.

| Market Share by | Country |

| China | 17% |

| USA | XX% |

| Canada | XX% |

| UK | XX% |

Meanwhile, non-protein supplements, including amino acids, beta alanine and L- carnitine, and creatine, target energy, hydration, endurance, cognitive performance, and immune function. As athletes and fitness enthusiasts aim to improve recovery, performance, and mental focus, the demand for non-protein supplements is increasing.

By Distribution Channel Insights

Online channels are estimated to grow at a CAGR of 11.6% between 2026 and 2035 amid the robust growth of the e-commerce sector. Consumers increasingly buy sports supplements online due to the availability of a wide range of products, convenience, competitive pricing, and easy access to customer reviews and product comparisons. Various online retailers and specialised fitness supplement websites also offer subscription-based services, ensuring the regular delivery of products at discounted rates.

Meanwhile, customers prefer supermarkets and hypermarkets as one-stop shopping destinations, making it easier for them to purchase protein supplements. Such stores are typically located in accessible areas, such as busy streets, shopping malls, and residential neighbourhoods, making them easily reachable. Competitive pricing, price transparency, and promotions and discounts on bulk purchases offered by supermarkets and hypermarkets are boosting the segment’s growth.

Personalised recommendations and guidance regarding supplements offered by drug stores and pharmacies are creating lucrative sports supplements market opportunities. Pharmacies and drug stores typically sell protein supplements from reputable and established brands and also stock protein supplements designed for specific health needs, which is further bolstering the segment expansion.

North America Sports Supplements Market Dynamics

As per a study by Glanbia Nutritionals, in the United States, consumers are utilising a range of sports nutrition products as pre-workout products (61%), post-workout products (52%), and intra-workout products (46%). The rising demand for protein-based supplements in the region also fuels the North America sports supplements market expansion. Besides, consumers in the region are increasingly seeking holistic wellness products that offer benefits such as stress reduction, immunity support, and mental clarity beyond athletic performance.

| CAGR 2026-2035 - Market by | Country |

| India | 11.6% |

| China | 9.7% |

| Brazil | 9.4% |

| Mexico | 8.0% |

| Australia | 6.9% |

| USA | XX% |

| Canada | XX% |

| UK | XX% |

| Germany | XX% |

| France | XX% |

| Italy | XX% |

| Japan | XX% |

| Saudi Arabia | XX% |

Europe Sports Supplements Market Trends

As per the sports supplements market regional analysis, flavour innovations and the rising popularity of less-sweet sports supplements in Europe are driving the market. The surging vegan population in the region is significantly boosting the demand for plant-based/vegan sports supplements. In October 2024, Designs for Health launched Performance Peptides, a plant-based bioactive peptide solution aimed at consumers interested in active nutrition. The protein supplement promotes muscle strength, endurance, recovery, and performance in the geriatric population. Furthermore, consumer purchases of clear protein powder in Europe surged by 216% in 2023 as compared to 2022. With advancements in protein technology, clear protein powders boast a refreshing taste and texture similar to juice and water, boosting their usage in sports nutrition products.

Asia Pacific Sports Supplements Market Overview

The sports supplements demand growth in the Asia Pacific is being fuelled by the growing health and fitness-consciousness and an increasing number of individuals aiming to improve their athletic performance. One in five (22.4%) Australian adults aged 18–64 years met their physical activity guidelines in 2022, a surge from one in six individuals in 2017-18. The surging popularity of gyms, fitness clubs, and wellness trends such as yoga and marathons in the region is further fuelling the market expansion. Besides, sports and energy drinks that combine energy-boosting ingredients with electrolytes, vitamins, and other performance-enhancing components are increasingly gaining popularity. In April 2023, Kirin launched its first Food with Function Claims (FFC) sports nutrition beverage with immune health benefits in Japan, tapping into active consumers’ demand for multifunctional products.

Latin America Sports Supplements Market Outlook

Latin America is home to a large number of young individuals engaging in endurance sports, bodybuilding, running, and fitness classes. This is driving the demand for sports supplements to support muscle performance, growth, and recovery. Improving internet penetration and rising digital literacy are prompting customers to purchase sports supplements from online channels due to their convenience and competitive prices. In addition to this, the rising focus on mental wellness and cognitive performance in the region is boosting the demand for sports supplements that support stress relief and improve focus.

Middle East and Africa Sports Supplements Market Drivers

Growing health and fitness consciousness in the region, driven by the rising prevalence of health issues like diabetes, hypertension, and obesity are fuelling the Middle East and Africa sports supplements market expansion. The rising participation in fitness activities, including running, gym memberships, and recreational sports, is surging the demand for sports supplements among fitness enthusiasts to improve endurance, boost energy, and surge performance during workouts. In addition to this, the rising number of sports events (2022 FIFA World Cup) is boosting customer interest in sports performance solutions, including supplements.

Key sports supplements market players are expanding their product portfolio and introducing new formulations to cater to the surging demand for customisation and variety and targeting specific customer bases. Sports supplements companies are also prioritising clean-label formulations that are free from artificial additives, preservatives, and fillings.

Hormel Foods, LLC, headquartered in Minnesota, United States, is a prominent food company recognised for manufacturing a wide range of shelf-stable, meat-based, and refrigerated food products. Founded in 1891, some of its most popular brands are Jennie-O Turkey, Spam, Hormel Chili, and Skippy, among others. With the growing preference for nutritious and cleaner eating options, the company has forayed into the dietary supplements and sports nutrition segments.

General Nutrition Centers, Inc., established in 1935, is a leading distributor and retailer of health and wellness products. Headquartered in Pennsylvania, United States, the company is recognised for its expansive product offerings in areas like minerals, vitamins, weight management, herbal supplements, and sports nutrition.

Post Holdings Inc., founded in 1895, is a diversified consumer packaging goods (CPG) company based in Missouri, United States. The company offers its products and services across different sectors such as protein-based products, cereals, nutrition, snacks, and convenience foods.

Cardiff Sports Nutrition Limited, headquartered in Cardiff, United Kingdom, is a company that is engaged in the development, manufacturing, and distribution of sports nutrition products. The company offers performance-oriented and high-quality supplements designed to support fitness enthusiasts, athletes, and individuals pursuing active lifestyles.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 26.28 Billion.

The sports supplements market is assessed to grow at a CAGR of 8.60% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 59.97 Billion by 2035.

The major market drivers include rising population, growing urbanisation, rising disposable incomes of the consumers, increasing availability of health clubs and gyms, and the changing lifestyles of the consumers.

The rising number of consumers choosing sports as a career and the increasing awareness of fitness along with the growing adoption of balanced diets are the important trends observed in the market.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading nature types in the market are organic and conventional.

The major types of sports supplements in the market are protein and non-protein.

The significant distribution channels in the market are hypermarkets and supermarkets, pharmacy and drug stores, specialty stores, and online, among others.

The key players in the global market for sports supplements are Hormel Foods, LLC, General Nutrition Centers, Inc., Post Holdings Inc., and Cardiff Sports Nutrition Limited, among others.

High competition leading to price wars, dependence on marketing and endorsements, and stringent regulations and compliance requirements in different regions will hamper the market growth.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Nature |

|

| Breakup by Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share