Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global sulfuric acid market attained a volume of 301.86 MMT in 2025 and is projected to expand at a CAGR of 1.50% through 2035. The market is further expected to achieve a volume of 350.32 MMT by 2035. Growing investments in metal refining and semiconductor manufacturing are increasing acid consumption, pushing suppliers to expand high-purity production capacities and strengthen regional logistics networks for stable and contamination-free supply.

Global producers are modernizing plants to meet stricter emission norms and strengthen supply resilience. For example, by March 2025, Mosaic completed upgrades at its concentrate-to-sulfuric-acid conversion facilities, integrating heat-recovery systems that reduce SO₂ emissions while improving operational stability. This refinement matters because fertilizer producers across North America have reported recurring supply gaps during peak seasons, while modernized sulfur burning units help stabilize the downstream phosphate production chain, boosting the overall sulfuric acid consumption. The upgrade aligns with recent regulatory tightening under the United States EPA’s Clean Air Act, where continuous SO₂ monitoring systems are becoming mandatory for large acid plants.

The sulfuric acid market is also observing an accelerated focus on circular feedstock streams as operators attempt to decouple production from volatile elemental sulfur availability. In June 2025, P&P Industries and Arya Engineers formed partnership to offer fully integrated, end-to-end solutions for the design, manufacturing, and delivery of complete sulfuric acid plants. Smelter-derived sulfuric acid is also gaining importance, particularly as Latin America and Asia boost their non-ferrous metal output. Companies are also investing in advanced scrubbing units, digital combustion control, and higher-efficiency converters to enhance yield and minimize energy waste, which has become a rising cost concern for large producers.

In parallel, downstream buyers, especially from batteries, electronics, wastewater treatment, and mining, are also seeking transparent sourcing, lower embedded emissions, and consistent purity thresholds. Such sulfuric acid market trends are pushing suppliers toward new dosing standards, improved material handling systems, and larger storage capacities at regional distribution hubs.

Base Year

Historical Period

Forecast Period

In the food processing sector, sulfuric acid is extensively used as a food preservative, flavour enhancer, acidulant, stabiliser, and emulsifier. Reportedly, the food processing sector in India is estimated to reach USD 1,274 billion in 2027, as per the Indian Brand Equity Foundation. As the food production sector expands globally due to evolving lifestyles and rising income levels, the demand for specialised grades of sulfuric acid is increasing.

Sulfuric acid plays an essential role in wastewater treatment by lowering the pH levels of wastewater, flueing gas desulphirisation, and removing phosphates, heavy metals, and contaminants from wastewater. Hence, increasing wastewater treatment activities amid rising water scarcity issues and the growing urban population are boosting the sulfuric acid market revenue. Reportedly, wastewater treatment facilities in the United States process nearly 34 billion gallons of wastewater per day.

Sulfuric acid is extensively used in the heap leaching process in copper mining, hydrometallurgical processes like pressure acid leaching (PAL) in the extraction of cobalt and nickel, as well as cyanide leaching process for gold and uranium extraction. In 2022, mineral production in Canada reached USD 74.6 billion. With mineral production growing amid the growing need for raw materials like copper, gold, and lithium in sectors such as energy, construction, and electronics, the demand for sulfuric acid is increasing.

Compound Annual Growth Rate

1.5%

Value in MMT

2026-2035

*this image is indicative*

| Global Sulfuric Acid Market Report Summary | Description | Value |

| Base Year | MMT | 2025 |

| Historical Period | MMT | 2019-2025 |

| Forecast Period | MMT | 2026-2035 |

| Market Size 2025 | MMT | 301.86 |

| Market Size 2035 | MMT | 350.32 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 1.50% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 1.7% |

| CAGR 2026-2035 - Market by Country | India | 2.0% |

| CAGR 2026-2035 - Market by Country | China | 1.6% |

| CAGR 2026-2035 - Market by Application | Fertilizers | 1.8% |

| CAGR 2026-2035 - Market by Application | Chemicals | 1.4% |

| Market Share by Country 2025 | France | 3.0% |

Producers are prioritizing upgrades to sulfur combustion and converter trains to reduce SO₂ emissions and reclaim heat. Heat-recovery boilers, low-NOx burners, and continuous emission monitoring systems are being deployed to meet tightening national air standards and to reduce fuel intensity, boosting the sulfuric acid market value. In May 2024, Energy Recovery, Inc. announced USD 15 million in contracts to supply its PX Pressure Exchanger energy recovery devices. Several industrial decarbonization and clean-air grant programs in Europe and North America are offsetting capital costs, enabling faster modernization.

Suppliers are moving beyond elemental sulfur dependence by integrating smelter off-gas acid plants, refinery streams, and recycled sulfur from chemical loops. Smelter-derived acid is becoming key as mining and non-ferrous production grows in Latin America and Asia Pacific. In January 2021, Nuberg bagged a 500 MTPD sulfuric acid plant project that was based on the latest Double Contact Double Absorption (DCDA) process technology. This diversification trend in the sulfuric acid market provides secure regional supply for fertilizer and battery material producers. Trade and export-credit agencies are supporting co-investment models linking miners, refiners, and acid producers to create vertically integrated value chains that are attractive to institutional buyers.

Demand from battery manufacturers, semiconductor fabs, and specialty chemicals is driving investments in higher-purity, low-metal sulfuric acid grades and tightly controlled impurity specs. Producers are adding additional purification steps, dedicated product lines, and laboratory QA that provide traceable certificates of analysis, accelerating the sulfuric acid market value. In November 2024, Ecovyst Inc. announced the launch of its AlphaCat advanced silica products focused on enabling the advancement of biocatalysis. Such specialty streams command a premium price and enable partnerships with high-value customers that require stable impurity profiles for electrolyte production, wafer cleaning, and advanced chemical synthesis.

Process automation, online titration, and digital batch traceability are converting QA from reactive testing to a continuous, auditable capability. Plants are adopting online analyzers, digital dosing protocols, and machine-readable certificates to satisfy institutional procurement rules. In September 2025, BUOYANCY AEROSPACE launched thin-film sulfuric Anodising line, setting a new benchmark in process control and scalability. This sulfuric acid market trend reduces disputes over concentration or contamination and shortens acceptance cycles for large buyers.

Buyers and regulators are focusing on embedded emissions. Producers are trialing fuel switching, electrified steam generation, and offset-free process improvements to lower scope-1 emissions per ton of acid. Some firms are offering “low-carbon” sulfuric acid tranches with verified lifecycle accounting to meet corporate procurement ESG mandates. In October 2025, Arkema completed a EUR 40 million modernization of its Lacq/Mourenx site, cutting SO₂ emissions by 40%, redefining the sulfuric acid market dynamics. Such product differentiation is creating premium channels for sellers and compelling conventional producers to accelerate sustainability programs to remain competitive in tendered supply pools.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Sulfuric Acid Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

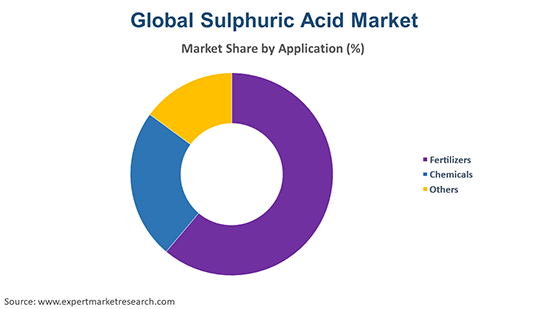

Market Breakup by Application

Key Insight: Fertilizers anchor sulfuric acid demand with seasonal, volume-driven procurement for phosphate processing, incentivizing large regional tanks and contract stability. Chemicals represent the fastest-growing application as battery, semiconductor, and specialty synthesis needs push for high-purity grades, traceability, and technical collaboration. Other applications such as metal finishing, wastewater treatment, and pigment production require flexible small-batch logistics and varied concentration options.

Market Breakup by Region

Key Insight: Asia Pacific remains the volume nucleus owing to fertilizers, mining, and electronics, while the sulfuric acid markets in North America and Europe are emphasizing modernization, emissions control, and specialty grade production. Latin America is scaling smelter-linked acid streams tied to mining growth, and Middle East and Africa are rapidly expanding capacity to serve agriculture and resource processing. Regional policy, feedstock availability, and proximity to high-value downstream manufacturing are the primary driving factors.

Fertilizer applications secure the dominant market share owing to phosphate and superphosphate production

Fertilizer manufacture remains the single largest consumer of sulfuric acid, globally, because this acid is integral to wet-process phosphate production, superphosphates, and complex NPK feedstocks. Producers servicing fertilizer complexes are investing in long-term supply contracts, captive storage, and seasonal logistics to match peak planting cycles. Recent plant modernizations have focused on ensuring stable concentration, reduced contamination by heavy metals, and improved batching for safe blending into fertilizer slurries, accelerating growth in the sulfuric acid market.

Chemical industries consuming high-purity sulfuric acid such as electrolyte processors for batteries, semiconductor wafer cleaners, and specialty chemical syntheses, represent the fastest-growing demand pool owing to electrification, microelectronics expansion, and green chemical pathways. In March 2025, Cornerstone Chemical Company, operator of the Cornerstone Energy Park, announced the sale of its Sulfuric Acid operations to Ecovyst, a global provider of advanced materials, specialty catalysts, sulfuric acid and regeneration services. Battery anode/cathode processing and electrolyte formulation require ultra-low metal contaminants and consistent titration, prompting acid suppliers to invest in purification trains and dedicated packaging to avoid cross-contamination.

Asia Pacific currently secures the dominant market position due to large fertilizer and mining demand

Asia Pacific leads global sulfuric acid consumption due to its dominant fertilizer industry, large mining and smelting footprint, and expanding electronics and battery manufacturing hubs. Regional acid producers are scaling capacity and investing in stricter emission controls to meet domestic environmental regulation while also serving export markets. In October 2024, Yashvardhan Chemical Industries announced that the company will produce sulfuric acid (70-98%) with a capacity of 90,000 tons. Integrated value chains linking phosphate rock processors, smelters and acid plants are being promoted by regional trade bodies, which improves feedstock access and reduces logistic friction.

Middle East and Africa are emerging as the fastest-growing regional hubs driving heavy demand in the sulfuric acid market. These markets are driven by large mining projects, expanding fertilizer capacities, and industrial downstream investment. New smelters and integrated mineral processing hubs across Africa are producing smelter-grade SO₂ streams that are enabling local acid manufacture for nearby fertilizer and mineral processing plants. Gulf producers are investing in downstream chemical parks and export logistics, positioning themselves as suppliers for regional agriculture projects.

| CAGR 2026-2035 - Market by | Country |

| India | 2.0% |

| China | 1.6% |

| Canada | 1.5% |

| Germany | 1.2% |

| Australia | 1.2% |

| USA | XX% |

| UK | XX% |

| France | XX% |

| Italy | 1.1% |

| Japan | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Leading sulfuric acid market players are focusing on cleaner operations, differentiated purity grades, and stronger integration with fertilizer, battery material, and specialty chemical customers. Companies are prioritizing emission-control upgrades, heat-recovery systems, and digital process monitoring to meet tightening air-quality rules while lowering operational costs. A major opportunity lies in high-purity acid streams required for Li-ion battery electrolytes and semiconductor etching, where firms offering traceable, low-metal grades are winning long-term contracts. Partnerships with mining and smelting companies are also expanding as producers secure diversified SO₂ feedstock streams to stabilize margins.

At the same time, sulfuric acid companies see potential in regional tank terminals, on-site supply solutions, and value-added technical services that help customers optimize concentration handling and batch consistency. Therefore, supply reliability, sustainability credentials, and technical collaboration are becoming the decisive factors influencing competitive positioning.

INEOS Group, established in 1998 and headquartered in London, operates one of the largest integrated chemical portfolios, including sulfuric acid production tied to its refining and petrochemical assets. The company focuses on supply stability, modernized converter systems, and cleaner SO₂ capture processes across its plants.

Founded in the year 1865 and headquartered in Ludwigshafen, Germany, BASF SE maintains sulfuric acid capacity embedded within its large-scale chemical complexes. Its competitive edge lies in producing high-purity grades for battery materials and specialty chemicals. BASF leverages integrated feedstocks, extensive QA labs, and continuous emission-control technologies to provide reliable contract supply.

DuPont de Nemours, Inc., established in 1802 with its head office located in the United States, delivers sulfuric acid solutions mainly for electronic chemicals, catalysts, and high-purity industrial applications. DuPont emphasizes ultra-clean production, impurity control, and advanced packaging to support semiconductor and specialty process requirements. Its offerings include tailored concentration ranges and technical assistance for precision etching and surface treatment lines.

PVS Chemicals, Inc., headquartered in Michigan, United States, and founded in 1945, is a global manufacturer, distributor, and marketer of basic chemicals. The company excels in logistics-driven supply models, supported by rail, bulk trucks, and regional terminals. PVS offers refined and specialty concentrations for metal treatment, water processing, and industrial manufacturing. Its operations emphasize safe handling, stringent QA standards, and compliance with evolving environmental regulations.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Chung Hwa Chemical Industrial Works, Ltd., among others.

Unlock the latest insights with our sulfuric acid market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate volume of 301.86 MMT.

The market is projected to grow at a CAGR of 1.50% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about 350.32 MMT by 2035.

Stakeholders are investing in emission-optimized upgrades, expanding high-purity production lines, strengthening logistics networks, forming feedstock partnerships, and deploying digital QA tools to win long-term contracts and meet rising sustainability and traceability expectations.

The key market trends include the increase in the demand for electronic-grade sulfuric acid and rising applications of sulfuric acid in chemicals.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Fertilisers and chemicals, among others, are the leading applications of sulfuric acid in the market.

The key players in the market include INEOS Group, BASF SE, DuPont de Nemours, Inc., PVS Chemicals, Inc., and Chung Hwa Chemical Industrial Works, Ltd., among others.

Producers face tightening emission regulations, volatile sulfur feedstock prices, rising demand for specialty high-purity grades, complex logistics for safe bulk movement, and increasing customer requirements for traceability, sustainability certification, and supply-chain transparency.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share