Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global telescopic handlers market value reached around USD 7.27 Billion in 2025. Ongoing infrastructure initiatives in the United States, supported by a recent USD 1 trillion infrastructure bill, have increased the need for efficient equipment like telehandlers to facilitate tasks such as lifting and transporting heavy materials. The rise in automation within construction and logistics sectors is also driving the adoption of telehandlers equipped with advanced control systems. As a result, the industry is expected to grow at a CAGR of 5.00% during the forecast period of 2026-2035 to attain a value of USD 11.84 Billion by 2035.

Base Year

Historical Period

Forecast Period

The LIFE program in the European Union promotes circular economy practices and biodiversity protection across Europe. This initiative encourages companies to adopt sustainable technologies, including electric telehandlers. As businesses increasingly focus on reducing their environmental impact, the demand for eco-friendly equipment is rising. Electric telehandlers, which offer lower emissions and reduced noise levels compared to traditional diesel models, are becoming more attractive in the construction and agricultural sectors.

The International Energy Agency (IEA) forecasts a sharp rise in global electricity demand in 2024 and 2025, with an expected growth rate of around 4%, up from 2.5% in 2023. This increase will likely boost the telescopic handlers demand, particularly those used for transporting equipment such as transformers and utility poles. Their versatility in lifting and moving heavy loads makes them essential for construction and maintenance tasks related to electrical infrastructure.

In Brazil, the government’s Logistics Investment Program aims to significantly improve logistics infrastructure, which is expected to increase demand for construction services and equipment like telescopic handlers. The expansion of logistics networks will necessitate the use of telehandlers for various applications, including loading and unloading materials at construction sites and warehouses.

Compound Annual Growth Rate

5%

Value in USD Billion

2026-2035

*this image is indicative*

Telescopic handlers are basically used to carry goods or personnel and possesses the ability to move goods from one place to another. It is mostly used for applications such as grain buckets, dirt buckets, power booms, and rotators. Moreover, these vehicles are used with different types of attachments, such as platforms and grippers. The industry is being driven by rapid technological advancements, such as the innovation of electric or lithium-ion powered telescopic handlers, and the product’s widespread applications in various industries, particularly construction, transport, and agriculture. The proliferating investments by the key industry players in research and development activities, such as the upgradation of telescopic handlers, have also propelled the telescopic handlers demand. However, the availability of alternate and more flexible equipment, such as loader cranes, and high initial investments associated with telescopic handlers may hamper the industry's growth. Over the forecast period, the increasing demand for technologically advanced systems in construction machinery due to their high rate of productivity is slated to fuel the market growth.

Increasing demand for electric telehandlers, integration of advanced technologies, and increasing emphasis on safety and ergonomic designs are the key trends propelling the market growth.

There is a significant shift towards electric telehandlers driven by the need for sustainable and environmentally friendly solutions. The proliferation of electric models is paving the way for innovation in the market, as companies seek to reduce their carbon footprint and comply with stricter environmental regulations. This trend is expected to accelerate further, particularly in urban areas where emissions standards are becoming more stringent. In 2024, multiple manufacturers have introduced electric telehandlers, including Dieci, which launched the Apollo-e, its first fully electric telehandler., contributing to the growth of the telescopic handlers market. This model features a 2,600 kg load capacity and a 6-meter lifting height, powered by a combination of lithium batteries that allow for a full day's operation on a single charge. Moreover, the Manitou MLT 625e, designed for agriculture, features a lithium-ion battery that provides up to four hours of continuous work time and can be fully charged in about three hours.

The integration of advanced technologies such as automation, telematics, and IoT in telehandlers is enhancing operational efficiency and safety. These technologies allow for better performance monitoring, predictive maintenance, and improved fleet management, making telehandlers more versatile and user-friendly and boosting the demand of telescopic handlers market. As construction companies increasingly adopt smart machinery, this trend is likely to continue growing. As per the industry reports, implementing automation can lead to a 72% reduction in manufacturing injuries under optimal conditions, showcasing the potential safety benefits of these technologies. Additionally, in a survey conducted by Omdia, over 48% of enterprise respondents indicated that integrating AI and machine learning into their IoT deployments was a priority for the future, underscoring the growing importance of these technologies in enhancing operational efficiency. These developments illustrate how the adoption of advanced technologies like automation, telematics, and IoT is transforming the telehandler market by improving both operational efficiency and safety standards across various industries.

The compact telehandler segment in telescopic handlers market is gaining traction due to its ability to navigate tight spaces on construction sites. Companies like JCB have introduced models such as the JCB 525-60E, which is designed specifically for confined spaces while maintaining a lifting capacity of up to 2.5 tons. Statistics indicate that in 2023, approximately 60% of construction projects in urban areas required equipment that could operate efficiently in limited spaces. This trend is further amplified by the growing preference for residential and commercial developments in densely populated cities. For example, the rise of mixed-use developments, which combine residential, commercial, and recreational spaces, has necessitated the use of compact telehandlers that can handle various tasks without disrupting surrounding areas.

As cities expand and infrastructure projects multiply, the telescopic handlers market value is set to increase. In 2024, global construction spending is expected to exceed USD 2 trillion, with significant portions allocated to infrastructure development. A report from Deloitte highlighted that construction output is projected to increase by 12% year-over-year, reflecting strong demand for new buildings and renovations. Countries like India are seeing massive infrastructure investments; for instance, the Indian government has committed over USD 1 trillion to infrastructure projects under its National Infrastructure Pipeline (NIP) initiative. This includes highways, railways, and urban transit systems, areas where telehandlers are essential for material handling and logistics.

There is an increasing emphasis on safety and ergonomic designs in telehandler manufacturing. Advanced control systems and ergonomic features are being incorporated to enhance operator comfort and minimise the risk of accidents on job sites. This trend of telescopic handlers market reflects a broader industry commitment to improving workplace safety standards while boosting productivity. Since 2020, all North American mobile elevated work platforms (MEWPs), including telehandlers, have been redesigned to comply with updated ANSI/OSHA A92.20 design standards. This includes new safety features such as platform load sensing, machine tilt sensing, and standardised entry gates.

Moreover, recent updates in the safety features include load stability indication systems, which help operators remain within safe lifting capacities, and backup camera technology that provides multiple views from behind the machine, enhancing situational awareness.

One of the primary restraints in the telehandler market is the high initial investment required to acquire these machines. The cost of purchasing a telehandler can be significant, often exceeding USD 100,000 depending on the model and specifications. This financial barrier can deter small and medium-sized enterprises (SMEs) from investing in telehandlers, leading them to opt for rental options instead which can hinder telescopic handlers demand growth.

The ongoing supply chain issues have been a significant challenge for manufacturers in the telehandler market. Delays in obtaining components have led to production slowdowns, affecting the availability of new machines. For instance, manufacturers like Pettibone have reported difficulties in sourcing parts, which has resulted in shipment delays and an inability to meet rising demand. These disruptions not only hinder production but also increase costs due to extended lead times.

High-capacity telehandlers are becoming increasingly popular due to their ability to lift heavier loads and reach greater heights. Innovations in hydraulic systems and structural reinforcements have enabled these machines to hoist loads exceeding 20,000 pounds, enhancing their utility in large-scale construction projects. This trend is particularly beneficial for industries requiring robust material handling capabilities, eventually influencing telescopic handlers demand forecast.

The demand for high-capacity telehandlers is driven by the need to handle larger materials in construction and industrial applications. JLG Industries reports that the rise of large-scale projects, such as big-box distribution centres, requires equipment capable of manoeuvring heavy loads efficiently. These facilities often utilise larger building materials, which necessitate the use of high-capacity telehandlers that can operate effectively in busy job sites without compromising lift capacity.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Telescopic Handlers Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Technology

Market Breakup by Lift Height

Market Breakup by Lift Capacity

Market Breakup by End Use

Market Breakup by Region

Market Insights by Type

The large telehandler segment held a significant telescopic handlers market share due to the increasing demand for powerful machinery in construction and infrastructure projects, where large telehandlers are essential for lifting heavy loads and reaching significant heights. Compact telehandlers are also gaining traction due to their manoeuvrability and ability to operate in confined spaces, making them ideal for urban construction sites and various applications in agriculture and warehousing.

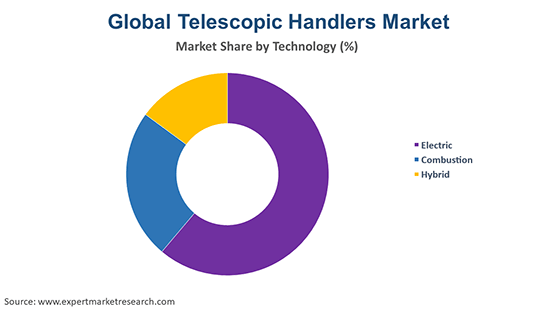

Market Insights by Technology

The combustion technology segment currently holds the highest share, primarily due to its long-standing presence and established usage in various industries. The hybrid segment also has a notable presence as companies look for more versatile solutions that balance performance with reduced emissions, impacting the telescopic handlers market dynamic and trends.

Market Insights by Lift Height

Telehandlers with a reach of over 15 meters dominate the market in terms of revenue and demand.

Handlers above 15 metres are used in large-scale construction, especially in high-rise projects like the Burj Khalifa in Dubai and new skyscrapers in Mumbai, with significant growth in Asia and the Middle East. This segment is also driving innovation, with manufacturers focusing on creating more powerful, efficient, and environmentally friendly models in this range. Models under 5 metres are popular in agriculture and small-scale construction, with demand growing in Europe and North America. Ongoing small-scale construction activities include residential buildings in rural U.S. towns and agricultural projects like greenhouses in the UK. The 5-15 metre range is widely used in mid-sized construction, such as bridge building in Germany and utility projects in France, growing at 6% annually.

Market Insights by Lift Capacity

The popularity of 3 to 10-ton telehandlers in telescopic handlers market is increasing due to its use in mid-sized construction and infrastructure projects like roadworks in Berlin and utility installations in Paris. These telehandlers are essential for lifting and moving heavy materials in the construction sector, enhancing job site productivity. Their ability to manoeuvre in confined spaces makes them ideal for loading and unloading goods. They further assist in transporting equipment and materials across challenging terrains.

Models under 3 tons are commonly used in small-scale construction, agriculture, and warehouse operations, such as residential construction in the U.S. and farm equipment handling in the UK. Models over 10 tons are used for heavy-duty applications in large-scale construction and mining, with ongoing examples like the Dubai Creek Tower project and mining operations in Australia, reflecting significant demand in Asia and the Middle East.

Market Insights by End Use

The construction sector holds the largest share due to the industry's extensive use of telehandlers for lifting and moving heavy materials, which enhances efficiency and productivity on job sites as well as telescopic handlers market opportunities. The agriculture sector is also a significant user of telehandlers as farmers utilise these machines for tasks such as handling bales, loading feed, and managing materials, benefiting from their versatility and adaptability to various attachments.

In the oil and gas sector, telescopic handlers are used for material handling on offshore platforms and rigs, with increasing demand driven by exploration projects in the Middle East and North America. According to 2024 data from the U.S. Energy Information Administration (EIA), oil production in the U.S. is expected to rise by 3% in 2024, driving demand for handling equipment in offshore and onshore operations.

In manufacturing, they aid in loading and material handling, particularly in heavy industries like steel, with growth attributed to automation. As per telescopic handlers market report, the transport and logistics sector relies on handlers for efficient warehouse operations, boosted by the rise of e-commerce. In power utilities, these machines are used in maintenance and installation, particularly in renewable energy projects like wind turbines. The International Renewable Energy Agency (IRENA) reported in 2024 that global renewable energy capacity increased by 7% last year, with significant growth in wind energy installations, further boosting demand for material handling equipment in the sector.

North America Telescopic Handlers Market Trends

The market in the region is expected to grow due to major investments in infrastructure. As per the telescopic handlers industry analysis, the US government has committed to a USD 1.2 trillion investment under the Infrastructure Investment and Jobs Act, which is expected to enhance construction activities and increase demand for telehandlers.

JCB announced the construction of a new USD 500 million factory in San Antonio, Texas, which will produce Loadall telescopic handlers and aerial access equipment. This facility is expected to create 1,500 new jobs and enhance JCB's manufacturing capacity in North America, where the company has seen substantial growth.

Asia Pacific Telescopic Handlers Market Drivers

The Asia Pacific accounts for a significant share in the industry owing to the growing investments in infrastructure development in emerging nations like China and India. Moreover, the increasing demand for compact and robust telescopic handlers in growing economies across the region has significantly contributed to the growth of the telescopic handlers industry.

Meanwhile, the growing demand for electric and hybrid telescopic handlers and the growing investments in research and development activities by the manufacturers aid the market. The growing construction industry and the high infrastructure spending by the governments across the region have paved the way for regional industry growth.

Europe Telescopic Handlers Market Opportunities

European countries are increasingly focusing on sustainability, which drives demand for eco-friendly machinery like electric and hybrid telehandlers. The European Green Deal aims to make Europe climate-neutral by 2050, promoting sustainable practices across various sectors, including construction and manufacturing, which can increase telescopic handlers industry revenue. This comprehensive framework encourages investments in eco-friendly technologies, including electric and hybrid machinery.

Companies are launching new models with advanced features tailored for the European market, such as Bobcat’s rotary telehandlers designed for improved visibility and safety during operation. These innovations are crucial as they meet the evolving needs of the construction sector.

Latin America Telescopic Handlers Market Growth

Latin America is witnessing growth due to improvements in trade agreements and infrastructure development initiatives. Brazil has allocated approximately USD 1.4 billion to transport infrastructure projects in the first seven months of 2023. The Brazilian government currently has 172 ongoing infrastructure investment projects across various sectors such as urban mobility, power distribution, and mining, which directly increase the telescopic handlers market value in construction activities.

Countries like Brazil are focusing on enhancing logistics capabilities, which include investing in telehandler technology for efficient material handling. The rise of e-commerce is creating new opportunities for logistics providers in Latin America, increasing the demand for versatile equipment such as telehandlers that can handle various materials efficiently.

Middle East and Africa Telescopic Handlers Market Dynamics

The region is investing heavily in infrastructure projects to support economic growth. Countries like the UAE are enhancing port facilities and transportation networks, which boosts demand for telehandlers capable of handling heavy loads in challenging environments, contributing to the telescopic handlers market revenue. There is a growing trend towards adopting advanced technologies such as IoT and automation within the logistics sector in the Middle East, enhancing operational efficiency and safety standards for equipment like telehandlers.

New companies are developing electric and hybrid telehandlers to reduce emissions and operating costs. These machines are particularly suitable for indoor and urban construction sites where low noise and zero emissions are essential. Startups are integrating automation and robotics into telehandler operations to increase telescopic handlers industry revenue. For example, some are creating autonomous telehandlers capable of performing tasks without human intervention, improving precision and safety on job sites.

Third Wave Automation

Founded in 2018, Third Wave Automation focuses on developing autonomous forklifts and telehandlers for warehouse operations. Their technology enables machines to operate independently, enhancing efficiency and safety in material handling tasks. In 2021, they raised $40 million to further their development efforts.

Polymath Robotics

Polymath Robotics offers plug-and-play autonomy software designed to convert industrial vehicles, including telehandlers, into autonomous machines. Their hardware-agnostic approach allows for easy integration, aiming to improve productivity and safety across various industries.

The report gives a detailed analysis of the following key players in the global telescopic handlers industry, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds. Companies are investing in developing new models with advanced features to improve efficiency and safety. For instance, the introduction of electric and hybrid telehandlers addresses environmental concerns and offers cost-effective solutions.

JCB Manufacturing Inc is a subsidiary of J.C. Bamford Excavators Limited (JCB), a British multinational company founded in 1945. JCB specialises in manufacturing equipment for construction, agriculture, waste handling, and demolition.

Bobcat Company, established in 1947, is an American manufacturer of compact equipment for construction, agriculture, landscaping, and other industries. Their product line includes skid-steer loaders, compact excavators, and utility vehicles.

Manitou Group, founded in 1957 and headquartered in Ancenis, France, specialises in manufacturing handling, lifting, and earthmoving equipment for construction, agriculture, and industrial markets. Their products include telehandlers, forklifts, and aerial work platforms.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other major players in the telescopic handlers market are Liebherr-International Deutschland GmbH. Caterpillar Inc. and Deere & Company, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 7.27 Billion.

The telescopic handlers market is assessed to grow at a CAGR of 5.00% between 2026 and 2035.

The major drivers of the market include the rapid advancements in the infrastructure in the emerging economies, thriving construction sector, and the rising investments in various sectors.

The key trends guiding the growth of the market include the surging demand for technologically advanced systems in construction machinery, increasing investments in R&D activities by key players, and the extensive applications of telescopic handlers in the transport, construction, and agriculture sector.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Compact and large are the major types of the product.

The different technologies considered in the market report are electric, combustion, and hybrid.

Less than 5 metres, 5-15 metres, and more than 15 metres are the different lift heights of the product.

Less than 3 tons, 3-10 tons, and more than 10 tons are the various lift capacities of the product.

Construction, forestry, agriculture, oil and gas, manufacturing, transport and logistics, and power utilities, among others, are the significant end uses of the product.

The major players in the market are JCB Manufacturing Inc., Bobcat Company, Manitou Group, Liebherr-International Deutschland GmbH, Caterpillar Inc., and Deere & Company, among others.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 11.84 Billion by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Technology |

|

| Breakup by Lift Height |

|

| Breakup by Lift Capacity |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share