Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United Kingdom homeware market size was valued at USD 15.34 Billion in 2025. The market is projected to grow at a CAGR of 4.10% between 2026 and 2035, reaching a value of USD 22.93 Billion by 2035.

Base Year

Historical Period

Forecast Period

Furniture, textiles, tableware, décor, appliances, and related products are pushing the United Kingdom homeware growth.

In 2023, a report by UKFT and Oxford Economics highlighted the substantial £62bn economic impact of the UK fashion and textile industry.

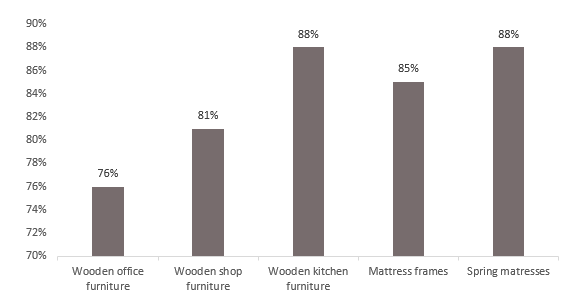

BFM's UK Furniture Review 2022 underscored the prevailing influence of UK manufacturers, constituting approximately 80% of wooden furniture.

Compound Annual Growth Rate

4.1%

Value in USD Billion

2026-2035

*this image is indicative*

Homeware encompasses items designed for home improvement, specifically catering to indoor furnishings and arrangements. This market category encompasses a variety of products, including furniture (e.g., sofas, tables, chairs), textiles (e.g., curtains, bed linens), appliances (e.g., refrigerators, air conditioners), floor covering products (e.g., carpets, mats), and decorative items (e.g., vases, statues), tableware and others.

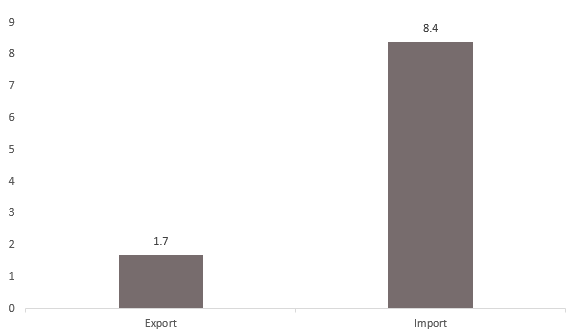

UK EXPORTS AND IMPORTS OF FURNITURE AND FURNISHINGS IN 2021, IN £ BILLION

They contribute to offering a sense of ease, coziness, gentleness, a feeling of ease, and convenience, improving the visual attractiveness of a residence, and promoting a well-ordered and uncluttered living environment.

The United Kingdom homeware market growth is supplemented by changing lifestyle preferences of customers, the increasing presence of e-commerce platforms, boosting sustainability, and enhancing economic conditions.

A combination of evolving customer tastes, urbanization, and lifestyle changes drives the continual growth of the homeware market in the United Kingdom. People are investing in a diverse array of homeware items, including furniture, decor, kitchenware, and textiles, highlighting a growing focus on both the aesthetic and functional aspects of their homes.

The widespread availability of homeware products in stores has simplified the buying experience. Consumers can easily order their favorite homeware product items like textiles, appliances, furniture, and décor with quick home delivery through online platforms such as Amazon and Ikea.

Integrating recycled or reclaimed materials into the manufacturing of home goods can significantly reduce the environmental footprint of the production process and promote a sustainable product life cycle. Utilizing recycled materials sourced from different places with diverse compositions not only helps conserve resources but also has positive effects on water and air quality.

The homeware market attracts significant crowds, fueling local commerce and driving economic growth. The rising demand for homeware items like furniture, decorations, and kitchenware, not only boosts business activity but also brings about economic advantages, enhancing community prosperity. Moreover, this surge in demand creates job opportunities in both retail outlets and manufacturing facilities, thereby playing a crucial role in the development of the local economy.

Consumers are increasingly investing in home essentials, emphasizing both aesthetics and functionality. The surge in demand is propelled by the prompt home delivery services offered by online platforms and retail stores.

Integrating recycled materials promotes environmental sustainability and generates employment opportunities in the retail and manufacturing sectors. This trend contributes to local economic growth, highlighting the interconnectedness of consumer choices with broader socio-economic impacts.

United Kingdom Homeware Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Market Breakup by Distribution Channel

Market Breakup by Region

Based on product type, furniture dominates the United Kingdom homeware market share

Furniture comprises items like tables, chairs, beds, desks, dressers, and cupboards, typically placed in a residence or any structure to enhance its livability or functionality. According to the UK Furniture Review by BFM in 2022, incorporating data from the Office for National Statistics, PRODCOM, and HMRC, underscores the significant presence of UK manufacturers that are pushing the United Kingdom homeware market development.

PROPORTION OF MARKET HELD BY UK MANUFACTURERS IN PRODUCT CATEGORIES

Home textiles encompass various fabric elements utilized in household settings, including cushion covers, napkins, towels, bedspreads, upholstery, and more. A report by UKFT and Oxford Economics in 2023, reveals the UK fashion and textile industry's substantial £62bn contribution to the economy, equivalent to £1 in every £34 of the total gross value added (GVA).

Home appliances encompass essential household devices like air conditioners, dishwashers, refrigerators, and more. Floor coverings, such as carpets and laminates, define the home space. The home decor market involves art, accessories, furnishings, and lighting, including candles and decorative items. Tableware items, including cutlery, glassware, and serving utensils, are used for both practical and decorative purposes during meals.

The commercial sector is witnessing growing development in the United Kingdom homeware market

The United Kingdom homeware market, based on distribution channels, is divided into hypermarkets and supermarkets, convenience stores, online retail, specialty stores, and other channels. These channels provide consumers with the ability to compare products and prices across different companies, facilitating well-informed purchasing decisions.

Traditional offline channels present manufacturers with opportunities to build secure relationships, fostering long-term collaborations and increasing brand awareness. Furthermore, the online distribution channel is growing, with platforms promising same-day deliveries, contributing to its rapid expansion.

The competitive landscape is characterized by the growing number of programme, collaborations, and focus on improving customer satisfaction in the United Kingdom homeware market.

Robert Bosch GmbH was founded in 1886 and headquartered in Germany, Bosch is a company that specializes in a diverse range of home appliances. Their product line includes mixers, grinders, cooking, and baking appliances such as gas cooktops, built-in ovens, microwaves, chimneys, food processors, washers, dryers, refrigerators, freezers, and various other kitchen devices.

DFS Furniture plc was founded in 1969 and headquartered in the United Kingdom, this company focuses on offering an extensive array of furniture for living spaces. Their product lineup encompasses sofas, sofa beds, corner sofas, leather sofas, fabric sofas, recliners, garden furniture, footstools, mirrors, accent chairs, chairs, rugs, and scatter cushions.

Inter IKEA Holding B.V. was founded in 1991 and is headquartered in the Netherlands. Specializing in wood-based furniture manufacturing, this home furnishing company provides a variety of products and services, including textiles, furniture for various living spaces, lighting, home smart solutions, and kitchen essentials.

Dyson Direct, Inc. was established in 1991 and is headquartered in Singapore. Specializing in household appliances, this company focuses on crafting innovative products such as vacuum cleaners, air purifiers, hand dryers, bladeless fans, heaters, hair dryers, and lights, demonstrating a dedication to creative design and manufacturing.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the United Kingdom homeware market report are Koninklijke Philips N.V., MasterBrand Cabinets, LLC, Gerflor Group, Conair LLC, Victoria PLC, Villeroy & Boch AG, and Abingdon Flooring Ltd, among others.

In 2021, the UK government implemented energy efficiency regulations in England. This led to lower operational expenses, improved repair procedures, and increased longevity for appliances like refrigerators, washing machines, and televisions. Stringent measures were enforced to combat 'premature obsolescence,' fostering a surge in appliance sales.

Further, the Scottish Government's 2023 Affordable Housing Supply Program data reveals a diverse range of affordable homes, including social rent, affordable rent, and affordable home ownership. The off-the-shelf purchases, rehabilitations, and new builds is boosting homeware sales, marking the highest completion of 10,582 homes, a 9% increase since the series began in 2000, thus accelerating the United Kingdom homeware market growth. Additionally, the homeware market experienced expansion in Northern Ireland and Wales, particularly in tableware, floor coverings, and home décor.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the United Kingdom homeware market reached an approximate value of USD 15.34 Billion.

The market is expected to grow at a CAGR of 4.10% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach USD 22.93 Billion by 2035.

Key trends aiding the United Kingdom homeware market expansion are the changing lifestyle preferences of customers, the increasing presence of e-commerce platforms, boosting sustainability, enhancing the economic conditions of government initiatives and innovations, and increasing research and development (R&D) activities by key players.

The key products prevalent in the market in type are- home appliances, home textiles, floor covering, home décor, tableware, and others.

Key players in the industry are Robert Bosch GmbH, DFS Furniture plc, Inter IKEA Holding B.V, Koninklijke Philips N.V., MasterBrand Cabinets, LLC, Gerflor Group, Conair LLC, Victoria PLC, Villeroy & Boch AG, Abingdon Flooring Ltd and Others.

A homeware store, also known as a home decor retailer or homeware retailer, is a retail establishment that offers a variety of products related to home furnishings and decorations.

It pertains primarily to furnishings rather than larger furniture items. It involves homeware micro-trends characterized by a brief lifespan, comparable to the rapid changes commonly observed in the fast fashion industry.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share