Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United States e-cigarette and vape market attained a value of USD 31.25 Billion in 2025. The market is expected to grow at a CAGR of 25.00% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 291.04 Billion.

Innovation in device technology is sharpening the user experience and differentiating e-cigarette and vape products in the United States. Some of the advances include temperature control, battery enhancements, modular designs, app integration, IoT features, and biometric authentication. In February 2024, Arizona-based Iveda launched IvedaAI Sense, an AI sensor that detects smoke, vapor particles, and bullying incidents with high precision and accuracy. Smart devices are also emerging as a major market segment.

The United States e-cigarette and vape industry is profoundly influenced by stringent Food and Drug Administration (FDA) oversight, particularly via the Premarket Tobacco Product Application (PMTA) process as over 99% of applications for flavored products were denied. Only 34 products currently hold the FDA approval. This rigorous framework raises entry barriers, increases compliance burdens, and discourages new entrants while propelling demand toward authorized products.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

25%

Value in USD Billion

2026-2035

*this image is indicative*

Heightened awareness of the health risks related to tobacco is driving the United States e-cigarette and vape market development. As per the American Lung Association, tobacco use is responsible for 480,000 deaths each year in the country. Many adult smokers are turning to e-cigarettes as perceived safer alternatives to combustible tobacco products. Public health campaigns, government support for smoking cessation, and clinical endorsements of vaping as a harm reduction tool are reinforcing this shift.

Diverse flavors like fruit, mint, dessert, and menthol attract users and support retention by enhancing the overall vaping experience and allowing for personal preference. These flavors are particularly appealing to adult users transitioning from traditional cigarettes, helping them find satisfying alternatives. In November 2024, AYR launched Later Days, a new fruit-flavored vape collection designed to offer flavorful, satisfying alternatives for adult vaping consumers. Flavor variety also plays a key role in brand differentiation and user engagement, encouraging trial and repeat purchases.

Public health concerns, especially around youth usage, remain a critical driver for the United States e-cigarette and vape market growth. Increased scrutiny from health authorities, educators, and parents has led to stricter regulations and marketing restrictions aimed at preventing underage access. Simultaneously, the development of age-gating technologies and tamper-proof packaging reflects industry efforts to address these concerns. The heightened visibility of youth vaping continues to drive innovation, policy action, and public dialogue.

A growing appetite for premium, personalized vaping experiences is evident in the United States. In June 2024, The Cannabist Company partnered with premium vape brand The Bloom Brand to launch high-quality cannabis products in New Jersey and Virginia. Higher‑income users increasingly seek sleek, customizable devices with exclusive features, trimming the market toward tech‑driven, luxury offerings aligned with wellness and self‑expression trends. This reflects the industry's shift toward elevated product experiences that combine innovation, quality, and lifestyle appeal for discerning consumers.

Environmental concerns over disposable devices and e-waste are increasing, adding to the United States e-cigarette and vape industry value. This is prompting brands to explore recycling programs and eco-friendly design solutions as both a compliance measure and a means to appeal to environmentally conscious consumers. For instance, V‑Cycle runs a United States-focused battery recycling program specifically for disposable vapes. They collaborate with vape stores to collect devices, dismantle them, recycle materials, and even repurpose batteries into new consumer products like power banks.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “United States E-Cigarette and Vape Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

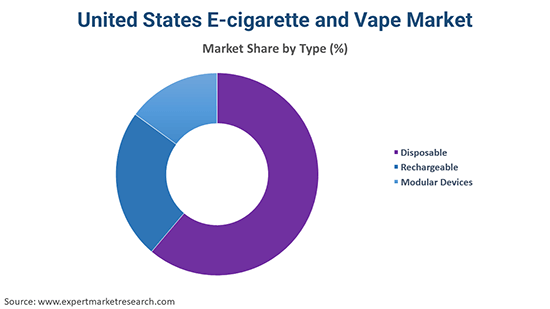

Market Breakup by Type

Key Insight: The disposable segment leads the market due to ease of use, low upfront cost, and accessibility. These single-use devices are pre-filled, pre-charged, and require no maintenance, making them especially appealing to new users and casual vapers. In August 2025, British American Tobacco revealed plans to enter the United States by launching its first disposable vape, targeting growing demand for convenient vaping. With rising youth and first-time adult users, disposables continue to lead the market despite increasing regulatory scrutiny due to environmental and health concerns.

Market Breakup by Component

Key Insight: E-liquid is the most crucial component in the United States e-cigarette and vape market, as it is essential for all vaping devices. This flavored liquid, typically containing nicotine, propylene glycol, vegetable glycerin, and other additives, drives continuous consumer demand. Brands offer a wide range of flavors and nicotine strengths, catering to diverse user preferences. In June 2024, Urban Tale launched in the United States with 12 nicotine salt e-liquid flavors, targeting trendsetters seeking smooth, flavorful vaping experiences.

Market Breakup by Composition

Key Insight: Tobacco-flavored e-cigarette and vape hold a significant place in the United States, especially among smokers transitioning from traditional cigarettes to vaping. These products provide a familiar taste, helping users replicate the smoking experience while potentially reducing harm. In July 2024, R.J. Reynolds launched SENSA, a zero-nicotine product expanding its modern oral portfolio for adult tobacco consumers seeking nicotine-free options. Tobacco further remains important as regulations increasingly restrict flavored e-liquids.

Market Breakup by Battery Mode

Key Insight: The automatic segment dominates the United States e-cigarette and vape market due to their user-friendly design. In December 2022, VAPE JET launched a fully automated system that fills hundreds of vape cartridges per hour with high consistency, accuracy, and precision. Popular pod systems like JUUL and Puff Bar also use automatic activation, which contributes significantly to their widespread adoption. Their compact size and ease of use make them the preferred choice for many consumers seeking hassle-free vaping.

Market Breakup by Distribution Channels

Key Insight: The online segment is thriving due to its convenience, wide product selection, and often competitive pricing. Consumers can access a vast range of e-liquids, devices, and accessories from national and international brands through websites like VaporDNA, DirectVapor, and the official brand stores of JUUL or Vuse. Online platforms also provide detailed product information, reviews, and customer support, making it easier for consumers to explore new products.

Market Breakup by Region

Key Insight: California leads the United States e-cigarette and vape market growth, driven by its large, health-conscious population and progressive regulations. The state has a strong presence of vape shops and e-liquid manufacturers, especially in the San Francisco and Los Angeles areas. California’s stringent vaping laws, including flavor bans in some cities, have also pushed the market toward nicotine salt e-liquids and disposable devices. For instance, California retailers starting, January 1, 2026, can only sell vape, nicotine pouch, and tobacco products listed on the state’s approved unflavored list.

Rechargeable & Modular E-Cigarette and Vape to Witness Popularity in the United States

Rechargeable e-cigarettes and vapes offer flexibility, long-term cost savings, and a customizable vaping experience, making them popular among more experienced or frequent users. These devices allow for refilling e-liquids and recharging batteries, supporting various nicotine strengths and flavors. In May 2025, Preston-based Vape and Go phased out single-use products for launching compliant, refillable, and rechargeable vape alternatives. Vape pens and pod-based systems also exemplify this segment.

Modular devices represent a large United States e-cigarette and vape industry share as they cater to a niche group of advanced users. These customizable systems allow users to modify wattage, coil resistance, and airflow, offering a tailored vaping experience. Popular among hobbyists and vaping enthusiasts, several major brands dominate this space. Modulars further remain influential in shaping innovation and vape culture. Regulatory complexity and the steep learning curve limit their broader market appeal.

Atomizers & Vape Mods to Attain Traction in the United States

The atomizer is the key unit which vaporizes e-liquid, and hence it forms the core unit of e-cigarettes. This is a very important section in device performance and consumer satisfaction. Companies are manufacturing sophisticated atomizers that provide improved taste and vapor generation. In August 2025, Eleaf released Mini iStick 20W with EN Drive Atomizer, providing miniaturized design, and improved flavor delivery for users. Advances in coil technology, including ceramic coils and mesh heating elements, are further elevating this category.

Vape mods are a significant part of the United States e-cigarette and vape industry because they provide unique vaping experiences. Mods are advanced products with variable wattage, temperature control, and adjustable airflow, which make them most favored by advanced vapers. While standard e-cigarettes provide simple vaping experiences, mods enable vapers to customize their experience in cloud making, flavor strength, or nicotine output. These brands take over this segment, usually bringing in high-performance products for hobbyists and vapers.

Surging Demand for Nicotine-free & Flavored E-Cigarette and Vape in the United States

Flavored e-cigarette and vape are popular in the United States due to their wide appeal and customization options. In June 2024, the FDA authorized four menthol-flavored e-cigarette products in the United States. This marked the first non‑tobacco flavored e-cigarette products to receive marketing approval. Consumers can choose from fruit, dessert, mint, and even cocktail-inspired flavors, which enhance the vaping experience beyond traditional tobacco taste. This segment attracts both new and experienced vapers who seek variety and enjoyable sensory experiences. Companies thrive on flavor innovation, releasing new blends regularly.

Nicotine-free e-liquids represent a niche segment in the United States e-cigarette and vape market, catering to users who enjoy vaping purely for flavor or the sensory aspect without the addictive stimulant. This category appeals to hobbyists and those experimenting with vaping as a lifestyle choice. Brands offering nicotine-free options often highlight natural ingredients and artisanal flavor blends to attract these consumers. Nicotine-free products also contribute to market diversity and growing interest in non-nicotine vaping.

Manual E-Cigarette and Vape to Gain Interest in the United States

Manual battery mode e-cigarette and vape devices, which require the user to press a button to activate the heating element, hold a considerable share in the United States. This segment appeals mainly to experienced vapers who desire more control over their vaping experience, such as adjusting power levels and managing puff duration. Devices like box mods and some advanced vape pens typically feature manual activation, allowing customization and enhanced performance. Manual devices also attract enthusiasts looking for personalized settings and higher vapor production, making them important for the advanced user market.

Offline Channels to Boost E-Cigarette and Vape Sales in the United States

The offline segment of the United States e-cigarette and vape industry, which includes brick-and-mortar vape shops, convenience stores, and tobacco retailers, remains essential. Physical stores provide in-person product experience, immediate purchase, and personalized advice, appealing especially to local communities and new users. Many consumers prefer offline shopping for device maintenance, troubleshooting, and sampling flavors. In October 2024, convenience stores accounted for around 70% of all tobacco-related purchases in c-stores across the United States.

Surging E-Cigarette and Vape Penetration in Texas & Florida

Texas is one of the largest United States by population and shows increasing adoption of vaping products and e-cigarettes. As per the U.S. Census Bureau show, Texas added 562,941 residents between July 2023 and July 2024. The state’s diverse population and strong tobacco history fuel demand for both traditional tobacco flavors and innovative vaping options. Texas also hosts several vape conventions, reflecting a dynamic and expanding market that continues to attract new consumers.

Florida is a significant market for e-cigarette and vape in the United States. Due to its warm weather and high volume of tourists, Florida has many vape stores. The state indicates high demand for flavored e-liquids and disposable products, serving a wide demographic that includes young adults. Florida's regulatory landscape is not as tight as California's, so more products are available in stores. The state also has a high Hispanic population that will drive flavor and marketing trends.

Major players in the United States e-cigarette and vape industry are emphasizing innovation, branding, and navigating regulation. Businesses place highest value on product innovation, creating products with extended battery lives, customizable options, and better nicotine delivery systems. Most brands provide a wide variety of flavors to appeal to a wide cross-section of users, although recent regulations have resulted in an increase towards tobacco and menthol variants. Strategic alliances and celebrity endorsements are used to enhance brand awareness, particularly for younger consumers.

Some firms invest heavily in digital marketing, leveraging social media and influencer campaigns while adapting to increasing advertising restrictions. To expand market share, leading players engage in mergers and acquisitions, acquiring smaller competitors or innovative startups. Additionally, companies focus on retail expansion, both online and offline, ensuring broad accessibility. With growing regulatory scrutiny, compliance is critical. Players invest in legal expertise and advocacy to influence policy and navigate FDA requirements.

Reynolds American Inc., founded in 2004 and headquartered in Winston-Salem, the United States, is known for its innovation in reduced-risk products, including the Vuse e-cigarette line. It has achieved significant market presence by combining traditional tobacco strength with new vaping technology.

Imperial Brands Plc, established in 1901 and based in Bristol, the United Kingdom, has expanded globally through acquisitions. The company introduced the Blu e-cigarette brand early on and continues to invest in next-generation products focused on harm reduction and consumer preferences.

Altria Group, Inc., founded in 1985 and headquartered in Richmond, the United States, leads with its extensive tobacco portfolio and investments in vaping and cannabis sectors. The company developed the popular MarkTen vape and emphasizes regulatory compliance and product innovation.

Philip Morris International Inc., created in 2008 with headquarters in New York City, the United States, focuses on smoke-free alternatives like IQOS, a heated tobacco product. Its innovation centers on reducing health risks, with significant global market penetration and a strong commitment to harm reduction.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the United States e-cigarette and vape market are British American Tobacco, and Turning Point Brands, among others.

Download your free sample report on United States e-cigarette and vape market trends 2026 today! Gain exclusive insights into product innovations, regulatory impacts, and consumer preferences shaping the industry. Stay ahead with expert data-driven forecasts and competitive analysis to optimize your market strategies. Don’t miss out on this essential resource for navigating the evolving U.S. vape market landscape.

United States Heated Tobacco Products Adoption

United States Nicotine Replacement Therapy Challenges

United States E-Liquid Market Trends

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 31.25 Billion.

The market is projected to grow at a CAGR of 25.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 291.04 Billion by 2035.

Key strategies driving the market include product innovation, flavor diversification, strategic partnerships, and digital marketing. Companies focus on regulatory compliance, harm-reduction messaging, and expanding distribution channels. Mergers and acquisitions also play a role in market consolidation and growth, enhancing competitiveness and consumer reach.

The key trends guiding the growth of the market include the continuous development of new products and increasing awareness among consumers.

The major regions in the market are New York, California, Florida, and Texas, among others.

The major types of e-cigarettes and vapes in the market are disposable, rechargeable, and modular devices.

The significant components in the market are atomizer, vape mod, cartomizer, and e-liquid.

The leading compositions in the market are tobacco, flavours, and nicotine-free.

The major battery modes in the United States market for e-cigarettes and vapes are automatic and manual.

The significant distribution channels for e-cigarettes and vapes in the United States market are online and offline.

The key players in the market report include Reynolds American Inc., Imperial Brands Plc, Altria Group, Inc., Philip Morris International Inc., British American Tobacco, and Turning Point Brands, among others.

The automatic segment dominates the market due to their user-friendly design.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Component |

|

| Breakup by Composition |

|

| Breakup by Battery Mode |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share