Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United States yogurt market size is valued at approximately USD 14.27 Billion in 2025. The market is assessed to grow at a CAGR of 4.30% between 2026 and 2035, reaching a value of USD 21.74 Billion by 2035.

Base Year

Historical Period

Forecast Period

The United States yogurt market growth is expanding due to the various health advantages it offers such as lowering blood pressure and sugar level.

In adults, the consumption of yogurt reduces the chance of obesity by 23%, accompanied by a 5% rise in calorie consumption, according to the National Center for Biotechnology Information.

As per the American Gastroenterological Association (AGA), 60-70 million Americans face gastrointestinal issues, that impact daily life, fueling yogurt market growth for gut health benefits.

Compound Annual Growth Rate

4.3%

Value in USD Billion

2026-2035

*this image is indicative*

Yogurt is a dairy product made by fermenting milk by two specific types of bacteria - Streptococcus thermophilus and Lactobacillus bulgaricus. The benefits of yogurt are a healthy gut, enhanced immunity, lower blood pressure, and strengthened bones. It is abundant in protein, calcium, zinc, vitamins such as B and D, and other essential nutrients.

The yogurt market in United States is expanding due to increasing awareness about gut health benefits, driven by the consumption of probiotic-rich foods. According to the American Gastroenterological Association (AGA), gastrointestinal (GI) disorders affect 60–70 million Americans and can significantly interfere with daily living.

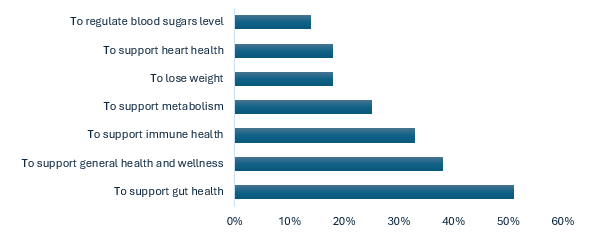

SUPPORTING GUT HEALTH, GENERALHEALTH AND WELLNESS AND IMMUNE HEALTH ARE TOP REASONS FOR CONSUMING PROBIOTICS

Factors such as the availability of single-serve cups of yogurt, high-protein diets, and nutritional awareness contribute to the United States yogurt market growth.

As per the National Library of Medicine, people who include yogurt in their diet tend to experience improved diet quality, reduced body weight, and a lower body mass index (BMI). Among adults, there is a 23% decrease in the risk of being overweight or obese, coupled with a 5% increase in calorie intake.

Further, the increasing engagement in recreational sports and fitness is boosting the United States yogurt market development. Chobani, LLC in October 2021, introduced a special edition of its Complete Shake featuring Peloton instructor Cody Rigsby. This edition claims 25 grams of fine-quality protein including essential amino acids crucial for muscle building. It caters to both pre-and post-workout snacks for athletes and fitness professionals.

The market is fueled by advancements in the lifestyle of people, sustainable choices, and the increasing presence of e-commerce platforms

Growing awareness of health and well-being is a major driver for the United States yogurt market. Consumers are well-educated about the advantages of a healthy diet and view yogurt as a nutritious snack. Its protein, calcium, and probiotic content aids digestive health and provides essential nutrients.

Increasing awareness regarding environmental sustainability is driving consumers towards food options with reduced carbon footprints. Yogurt production is viewed as less resource-intensive and has gained popularity among eco-conscious individuals. Also, plant-based yogurts made from almonds, soy, oats, and cashews are enabling relatively greater options for the consumer, thus, pushing the yogurt market in the United States.

Widespread retail availability has simplified yogurt purchasing power. Consumers can easily find and buy their preferred options of yogurt online and it can be delivered in minutes to their doorsteps. In stores strategically placing yogurt products in displays has promoted impulse buying, further fueling the growing demand.

The demand for yogurt is driven by health consciousness and environmental sustainability. Consumers prefer smaller carbon footprints and can easily find and purchase yogurt varieties online, with delivery to their homes in just minutes. Store availability and online shopping have simplified yogurt purchasing power. In fact, online delivery channels such as Amazon Fresh and Uber Eats deliver yogurt within 1 hour.

United States Yogurt Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup Product Type

Market Breakup by Distribution Channels

Market Breakup by Region

Flavoured yogurt dominates the United States yogurt market share due to its ability to offer convenience and on-the-go consumption

Based on the United States yogurt market analysis, flavoured yogurt emerges as the largest segment as it offers convenience for on-the-go consumption providing swift means to access the nutritional advantage of yogurt. Yogurt comes in different flavours –strawberry, blueberry, peach, raspberry, mango, coconut, chocolate, and vanilla.

Plain yogurt thrives in the food industry, and its popularity stems from the discovery that it can lower the chances of developing heart disease and osteoporosis, in addition to assisting with weight control. It is produced by heating milk, introducing bacteria, and fermenting until it achieves a pH of around 4.5, resulting in variable thickness and smooth texture. It is commonly utilised in the cooking of curries and sauce or enjoyed as a snack.

The United States yogurt market growth is supplemented by the convenience provided by the e-commerce channel

The United States yogurt market is categorised by distribution channels into hypermarkets and supermarkets, convenience stores, online retail, and specialty stores, among other channels. These avenues empower customers to compare products from different companies along with their pricing, facilitating well-informed decisions about their purchases.

Manufacturers can also build safe relationships through offline channels, which can result in long-term collaborations and improved brand awareness. As per the United States yogurt market report, the online distribution channel is also expanding with various platforms promising deliveries the same day, contributing to its rapid growth. Doordash and Instacart are a few of the delivery platforms that deliver groceries including yogurt within an hour.

To fortify their position in the United States yogurt market, companies are producing yogurt with enhanced nutrition, such as high protein, low fat, and various flavours.

Danone was founded in 1919 and is headquartered in Paris, France. It is a world-leading food company pioneered in innovative food, drinks and specialized nutrition that has a positive impact on health. Issac Carasso was the founder of Danone and started making yogurt using cultures from the Pasteur Institute to help children with intestinal infections. It makes whole milk, low fat, fruit on the bottom, smoothies’ yogurt in coffee, strawberry, and mango flavours.

Chobani LLC was founded in 2005 and is headquartered in New York and the United States. It produces Yogurt, oat milk, and dairy and non-dairy creamers. In addition, Chobani strives to end child hunger, protect the environment, and assist underprivileged groups, immigrants, and refugees. It makes Greek yogurt low in fat and sugar in almond, cheesecake, vanilla, banana, and blueberry flavours.

FAGE USA Dairy Industry, Inc. was founded in 2005 and is headquartered in New York. It manufactures a variety of dairy products, including Greek yogurt, dairy desserts, milk, dairy creams, and packaged cheese. Their products are derived from cows fed a non-GMO diet, and the yogurt is sugar-free, making it a naturally nutritious option. FAGE's yogurt is a rich source of protein and calcium. They offer plain and blended Greek yogurts available in various flavours such as strawberry, mango, and vanilla.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the United States yogurt market report include General Mills, Inc., Lactalis Group, Dairy Farmers of America, Inc., Tillamook County Creamery Association, and Hain Celestial Group Inc., among others.

The Far West stands out as a significant area, primarily because of its increasing dairy production, a crucial factor in meeting the rising demand for yogurt in the United States.

Yogurt consumption in the United States increased fivefold, as indicated by loss-adjusted food availability data from the USDA, Economic Research Service (ERS). The leading dairy-producing states in 2022 were California in the Far West, Wisconsin in the Great Lakes, Idaho in the Rocky Mountain region, Texas in the Southwest, and New York in the Mideast. Together, these five states contributed over 50% of the dairy supply in the U.S., consequently driving up demand in their respective regions.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The US yogurt market is projected to grow at a CAGR of 4.30% between 2026 and 2035.

The revenue generated from the yogurt market in the US is expected to reach USD 21.74 Billion in 2035.

The increasing demand for low-calorie, high-protein, nutritional snacks such as Yogurt, that aid in boosting the immune system, lowering blood pressure, and promoting heart health is primarily driving the US Yogurt market.

Based on the product type the market has been categorized into - Set Yogurt, Greek Yogurt, Yogurt Drinks, Frozen Yogurt, and others.

Based on the yogurt type, the market has been categorised into regular yogurt, concentrated yogurt, probiotic yogurt, set yogurt, bio live yogurt, and stirred yogurt, among others.

The various distribution channels of the market are supermarkets and hypermarkets, convenience stores, speciality stores, and online retail, among others. Currently, supermarkets and hypermarkets hold the largest market share.

Some of the major players in the industry are Danone SA, Chobani Global Holdings, LLC, General Mills Inc., FAGE USA Dairy Industry Inc., Lactalis Group, Dairy Farmers of America, Inc., Anderson Erickson Dairy Co., Tilamook County Creamery Association, Hain Celestial Group Inc. among others.

Chobani Greek Yogurt is the frontrunner, recognized for its thick consistency, diverse flavour options, and appeal stemming from its rich protein content, low sugar levels, and beneficial probiotics.

It is abundant in essential nutrients, with a notable presence of calcium, a vital mineral crucial for maintaining strong teeth and bones.

While most individuals don't encounter adverse effects from yogurt, a frequent issue is temporary bloating and gas.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share