Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Vietnam aquaculture market attained a volume of 5.02 Million Tons in 2025 and is projected to expand at a CAGR of 4.60% through 2035. The market is further expected to achieve a volume of 7.87 Million Tons by 2035. Export-driven processors are prioritizing automation and feed efficiency investments to defend margins as labor costs rise and United States buyers seek fixed-price, long-term sourcing contracts.

Government-supported infrastructure spending and private processing investments are resulting in a positive impact on the market dynamics. At the same time, exporters are securing multi-year agreements with United States importers by offering antibiotic-free products and supplying stable volumes. These factors are lowering the reliance on the spot market and are also stimulating capital investment in hatcheries, feed systems, and secondary processing lines.

According to the Vietnam aquaculture market analysis, feed accounts for over 55% of shrimp farming costs in the country. The market is being reshaped by upstream technology upgrades rather than capacity expansion. In December 2025, De Heus and Minh Phu signed a cooperation agreement to promote the sustainable development of the shrimp industry value chain. The system adjusts feed rates using biomass sensors and dissolved oxygen data.

The Vietnam aquaculture market growth is also being supported by structural export alignment and production specialization. Shrimp and pangasius are still the main demand driving factors, but the way the products are positioned is changing. Processors are not only producing frozen whole formats but also value-added SKUs such as cooked, peeled, and seasoned seafood. This change is connected to the buyer's requirements from United States retail and foodservice chains. Reports suggest that Vietnam exported nearly USD 1.9 billion worth of seafood to the United States in 2025, up by 3% from the previous year. Companies are also investing in downstream processing automation, cold storage, and traceability systems to secure contract continuity and pricing power. In June 2025, Barramundi producer Australis Aquaculture commenced construction on a new state-of-the-art processing facility in Vietnam.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.6%

Value in Million Tons

2026-2035

*this image is indicative*

Major producers are implementing sensor-based feeding, pond automation, and data dashboards to ensure yield consistency. Since feed accounts for the biggest share of operating costs, feed optimization has become the top priority. Real-time monitoring systems to reduce overfeeding and mortality risks are being rolled out by companies like Minh Phu and Sao Ta Foods. In May 2025, Bac Lieu launched a high-tech shrimp farming model, making it a key driving factor for the Vietnam aquaculture market growth. As export buyers require steady volumes, tech-enabled farms are becoming the ideal supply partners, thus, changing the criteria for supplier selection.

Vietnam aquaculture companies are scaling up their value-added processing capacity. The demand from the United States and European Union buyers is gradually changing to seafood that is ready-to-cook and ready-to-eat. These companies are investing in portioning lines, glazing control systems, and automated packaging. The government export promotion programs are facilitating this transformation as they give priority to processed goods in trade negotiations. In December 2025, De Heus and Hung Nhon Group announced plans to invest VND 10 trillion (USD 380 million) to develop a high-tech agricultural ecosystem in Tay Ninh province. From the point of view of exporters, value addition not only deepens margin resilience but also lessens the risk of being affected by the fluctuations of raw material prices, which in turn leads to strengthening long-term buyer relationships, redefining the Vietnam aquaculture market dynamics.

Sustainability compliance has become a commercial necessity in the Vietnam aquaculture market. To meet these requirements, exporters install antibiotic residue monitoring, implement traceability software, and carry out wastewater treatment system upgrades. This has been caused by the EU and United States import inspections becoming more stringent. To address this, firms are incorporating the requirements of certification into farm management systems. At the same time, government agencies are adapting their standards to those of the ASC and BAP frameworks. In December 2025, the Vietnamese Ministry of Agriculture and Environment launched a national traceability system and announced plans to pilot origin tracking for durians for six months, aiming for a national roll-out starting July 1, 2026.

Aquaculture byproduct utilization is emerging as a secondary growth engine. Pangasius processors are extracting collagen, gelatin, and fish oil from waste streams. This reduces disposal costs while creating new revenue channels. In October 2025, the USSEC and VINAFIS partnered to promote sustainable aquaculture and boost feed quality through United States Soy. For exporters, byproduct monetization improves yield economics and smooths earnings volatility. Buyers also view circular practices favorably during supplier audits, redefining the entire Vietnam aquaculture market dynamics.

Vietnam seafood aquaculture exporters are concentrating on sealing long-term contracts with international buyers. United States-based foodservice distributors and retail chains are placing a greater emphasis on volume stability rather than spot pricing. As a result, suppliers have been pushed to make investments in cold storage, inventory planning, and production forecasting, accelerating the Vietnam aquaculture market value. Multi-year contracts not only lead to higher capacity utilization but also make the capital expenditure more reasonable. In October 2025, the government announced that Vietnam's Vinh Long province is set to develop a large-scale aquaculture economic zone worth an estimated USD 1.5 billion annually, aiming to boost seafood exports and strengthen its position in global markets.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Vietnam Aquaculture Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

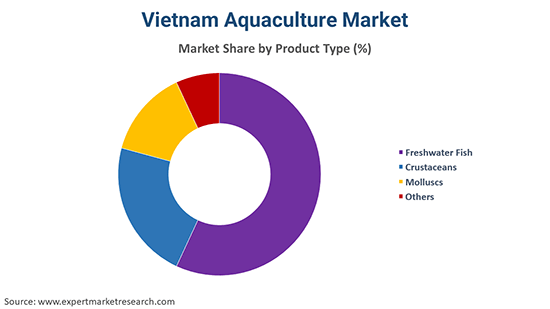

Market Breakup by Product Type

Key Insight: Freshwater fish continues to experience the benefits of scalability, cyclical harvest patterns, and stable processing volumes for contract-based supplies, accelerating demand in the Vietnam aquaculture market. Crustaceans grow through their positioning, traceability, and export-driven differentiation strategies for higher margins. Molluscs are niche but continue to support livelihoods through small-scale farming in coastal and inland areas. Other species are largely home-market based and price-sensitive.

Market Breakup by Environment

Key Insight: According to the Vietnam aquaculture market report, freshwater aquaculture provides predictable production cycles, scale, and input management for large-scale firms. Brackish water systems provide higher margins but pose risks of disease, climate change, and price volatility. In August 2025, Vietnam officially launched a pilot project to provide safe and sustainable water solutions for communities in the Mekong Delta facing severe salinity intrusion. Marine aquaculture is currently constrained by the complexity of regulations, infrastructure, and exposure to environmental factors. Environmental considerations are increasingly driven by corporate risk tolerance, capital resources, and longer-term commitments from buyers, particularly in export markets.

Market Breakup by Distribution Channel

Key Insight: Traditional retail continues to absorb large domestic volumes through wet markets and wholesalers. Specialized retailers focus on certified seafood and higher margin urban consumers. Supermarkets are accelerating packaged seafood penetration with standardized cuts and branding requirements, contributing to the Vietnam aquaculture market penetration. Online channels remain limited, constrained by cold chain costs and trust issues. Distribution strategies increasingly mirror product positioning. Export-oriented processors prioritize channels that stabilize pricing. This structure favors disciplined processors managing risk across domestic and export demand cycles carefully.

Market Breakup by Region

Key Insight: Southern Vietnam remains the production and export hub due to infrastructure depth. Central Vietnam provides growth through shrimp focused expansion. The Northern Vietnam aquaculture market supports domestic consumption and freshwater farming. Regional specialization shapes investment priorities. Export-oriented capital flows in the southern region of the country. Domestic distribution anchors the north. Species mix, logistics access, and labor availability define regional roles. Companies allocate assets based on reliability, margin potential, and compliance readiness.

By product type, freshwater fish accounts for the largest market share due to scalable inland farming economics

Freshwater fish remains the key contributor to the Vietnam aquaculture market revenue growth due to predictable production cycles and strong processor integration. Pangasius farming benefits from controlled pond systems and stable feed sourcing. Large-scale exporters prefer freshwater fish because volumes are easier to forecast. Processing plants run at higher utilization rates. Companies are refining fillet yields rather than expanding acreage. Investment focus stays on trimming loss reduction and automation upgrades. Freshwater species also support byproduct monetization through collagen and fish oil extraction. Export contracts favor consistency over variety, which plays well for pangasius processors serving long-term buyers. In December 2025, FAI and Fresh Studio launched a new partnership to develop and publish Vietnam's first pangasius welfare assessment protocol.

Crustaceans are growing at the fastest pace as shrimp exporters reposition toward premium formats. Black tiger and whiteleg shrimp dominate export portfolios. Companies are upgrading feeding systems and pond monitoring to stabilize yields. Shrimp attracts higher margins but also higher risk. Export buyers demand antibiotic free certification and traceability. Processors respond by tightening farm control. Investments target cooked shrimp and ready-to-eat formats.

Fresh water environments secure the largest share of the market due to controlled farming conditions

Fresh water systems continue to dominate the Vietnam aquaculture market due to control and repeatability. Export processors favor freshwater supply chains due to planning accuracy that supports long-term contracts. Mature infrastructure, river-adjacent processing clusters, and simpler waste recovery further strengthen operational efficiency. Fresh water farming also aligns with byproduct extraction strategies. In December 2025, Dutch feed producer De Heus announced that the company is working with local partners to roll out a recirculating aquaculture system combined with integrated multi-trophic aquaculture (RAS-IMTA) in Ca Mau province, initially covering 100 hectares with plans to expand to 1,500 ha.

Brackish water environments are also expanding their share in the Vietnam aquaculture market due to shrimp profitability potential. Coastal regions enable intensification models, with farmers investing in aeration and biofloc systems to boost output. Export buyers drive compliance upgrades, while disease control challenges favor larger operators. Companies integrate hatchery control to reduce biological risk. Brackish systems support higher pricing but they remain volatile. Growth depends on technical capability rather than geography, encouraging capital-intensive models.

Traditional retail dominates domestic distribution due to fragmented wet market demand

The traditional retail sector leads the country’s aquaculture market in terms of sales through wet markets and wholesalers, where freshness is a major factor in purchase decisions. Price sensitivity is still high, and branding has limited effects. The fragmented market chain enables processors to dispose of lower-quality production efficiently. The industry views this category as a volume stabilizer, where they absorb production fluctuations. According to the Vietnam aquaculture market analysis, shrimp remains a cornerstone of the country's fisheries export strategy, contributing approximately 35–40% of the industry's total export revenue.

Supermarkets represent the fastest-growing distribution segments across the Vietnam aquaculture market dynamics due to the increasing demand for packaged seafood products. Retailers demand standardized cuts, packaging, and quality. Processors are investing in portioning, branding, and cold storage upgrades to meet these demands. Contract sales are increasing, thus ensuring price stability. Market growth is expected to benefit processors with packaging facilities, consistent performance, and retail contracts, rather than focusing on being the cheapest source.

Southern Vietnam locks in the dominant position in the market due to dense processing clusters infrastructure

Southern Vietnam anchors the market as national aquaculture hub through the Mekong Delta production system. Pangasius and shrimp processors operate near farming zones, reducing transport losses. Processing density supports continuous plant utilization. Companies invest in automation, yield optimization, and wastewater control. Buyers view the south as the lowest risk sourcing base for consistent volumes and specifications. This perception sustains pricing power even during weak global seafood cycles and supports reinvestment across processing operations locally. Research suggests that the Kiên Giang province is aiming for its aquaculture sector to annually produce 484,800 tons of seafood by 2030.

The Central Vietnam aquaculture market growth is led by coastal shrimp farming. Brackish water systems are expanding with higher intensity models. Exporters invest in this region selectively due to disease exposure, while infrastructure improvements are uneven but improving. Smaller processors focus on niche contracts. Hatchery quality and feed control receive attention. Investors prefer phased capacity additions and processors balancing compliance costs with yield gains are gaining buyer confidence steadily.

Competition in the market is defined by execution quality rather than expansion speed. Prominent Vietnam aquaculture market players prioritize automation, feed efficiency, and traceability systems. Export buyers favor suppliers with predictable output. Margin protection outweighs volume ambition.

Vietnam aquaculture companies face consolidation pressure as certification costs rise. Partnerships with feed and technology providers are increasing. Companies that integrate farming, processing, and waste recovery achieve stronger resilience. The market rewards reliability, while scale alone no longer guarantees competitiveness. Export-oriented firms are reallocating capital toward systems that lower variability. Digital monitoring, standardized operating procedures, and contract-based sourcing models are shaping competitive positioning.

Established in 2003 and headquartered in Ho Chi Minh City, Vietnam, Hung Vuong Corporation operates across pangasius farming and processing. The company supplies frozen and processed fish to export markets. It emphasizes feed management and vertical integration to stabilize costs.

Founded in 1997 and headquartered in Dong Thap Province, Vietnam, Vinh Hoan Corporation is a leading pangasius exporter. The company invests in high efficiency processing and byproduct utilization. Collagen and gelatin production supports margin stability.

Established in 2020 and based in Vietnam, Quoc Viet Co. Ltd focuses on shrimp feed and farming support. The company develops feed formulations aimed at improving survival rates. It works closely with farmers through technical advisory models. Quoc Viet strengthens upstream integration to improve shrimp productivity, consistency, and export compliance alignment for processors.

Founded in 1992 and headquartered in Ca Mau, Vietnam, Minh Phu is Vietnam’s largest shrimp exporter. The company invests in smart farming, traceability platforms, and value-added shrimp processing. Minh Phu emphasizes antibiotic-free production and integrated supply control to meet demanding buyer specifications across major international markets.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Unlock the latest insights with our Vietnam aquaculture market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate volume of 5.02 Million Tons.

The market is projected to grow at a CAGR of 4.60% between 2026 and 2035.

The market is estimated to grow in the forecast period of 2026-2035 to reach a volume of about 7.87 Million Tons by 2035.

Companies are investing in automation strengthening traceability expanding value-added processing securing long-term contracts and optimizing feed systems to protect margins.

The key trends guiding the growth of the aquaculture market include the rising disposable incomes and growing government initiatives such as the launch of new Regional Centre of Excellence and others, aiming to develop brackish shrimp industry by 2030 in the region.

The major regions in the market are Southern, Northern, and Central Vietnam.

Freshwater fish, crustaceans, molluscs and others are the leading aquaculture product types in the market.

The leading environments in the aquaculture are the fresh water, brackish water, and marine water.

The market is broken down into traditional retail, specialised retailers, supermarkets and hypermarkets, online retailers, and others.

The key players in the market include Hung Vuong Corporation, Vinh Hoan Corporation, Quoc Viet Co. Ltd, and Minh Phu, among others.

Disease risk volatility rising compliance costs labor shortages export price pressure and capital intensity continue challenging Vietnamese aquaculture companies.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Environment |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share