Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

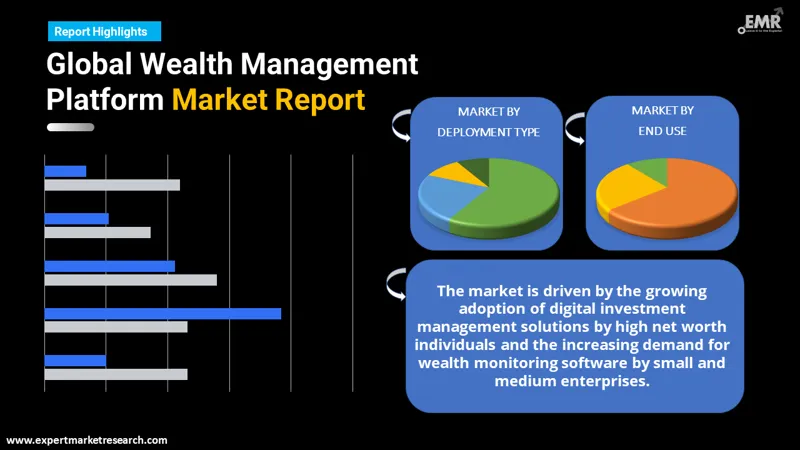

The global wealth management platform market was valued to reach a market size of USD 5667.16 Million in 2025. The industry is expected to grow at a CAGR of 8.90% during the forecast period of 2026-2035. Key factors driving the wealth management platform market include the increasing demand for customized investment solutions, which has arisen from growing investor participation and the need for efficient, data-driven decision-making in asset management, amidst growing volatility in the market, thus aiding the market to attain a valuation of USD 13293.65 Million by 2035.

Base Year

Historical Period

Forecast Period

Japanese asset management companies recorded USD 6.36 trillion in assets for FY2022, increasing by 2%. This increase is mainly based on a growing need for investment products and services and for wealth management platforms, which are rising as investors strive for diversified portfolios and sophisticated tools in asset management and investment decision-making, thus boosting the growth of the wealth management platform market.

Bank-managed assets in Japan increased from USD 1.05 trillion to USD 1.19 trillion, which shows a rise in investor confidence. This positive trend in bank assets suggests a growing need for digital wealth management solutions, thereby pushing wealth management platforms to upgrade their offerings, personalize services, and accommodate the growing participation of investors.

Assets under management in Europe increased to USD 30.39 trillion in 2022, which in turn fuelled the demand for advanced wealth management platforms. Such asset growth is reflective of the general trend in terms of increased investor participation and diversification, forcing the platforms to provide more holistic and accessible wealth management tools to cater to different needs across investors in the region.

Compound Annual Growth Rate

8.9%

Value in USD Million

2026-2035

*this image is indicative*

The wealth management platform market is growing profoundly, driven by the digital tools' increasing adoption rate and the growing need to have efficient asset management solutions in place. As investors need more control over their respective portfolios, platforms are gradually integrating advanced technologies such as AI, machine learning, and big data analytics. These assist in better decision-making with more personalized investment strategies that improve the overall customer experience. In addition, the growing interest in low-cost, self-directed investment options is leading to an increased demand for robo-advisors and automated wealth management services.

Market trends are represented through hybrid platforms, combining man-to-machine with AI-empowered tools to enhance the experience of novice investors and more-experienced ones, respectively. Moreover, with the introduction of alternative investment access such as private equity and real estate, beyond traditional stocks and bonds, it is one of the expanding capabilities of the wealth management platform. Another significant trend incorporates mobile-first solutions that grant users on-the-go ways to manage their wealth, thereby bolstering the growth of wealth management platform market.

In response to the growing demand from customers, companies are now paying heed to user-friendly interface creation and transparent, low-fee structures. They're focusing on educational content in the service, so consumers know how to make a decision while investing. Companies such as Charles Schwab, Betterment, and Wealthfront set trends by creating innovative, accessible ways for managing wealth that range to accommodate diverse investor requirements.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The growth of the wealth management platform market is being driven by the increasing trend of high-net-worth individuals (HNWIs) adopting digital investment management solutions, which is expected to further stimulate industry growth. The high net-worth individuals (HNWIs) are expecting more control and transparency in wealth management solutions. HNWIs can use the wealth management platform to gain more transparency and control over their wealth management. It also uses numerous analytical technologies to assist consumers in better strategizing their wealth goals, thereby driving the wealth management platform demand growth.

The increasing demand for the wealth management platform market to improve the decision regarding portfolio management and trading decisions is driving the market revenue. The wealth managers are using the software platforms to handle the financial data of several clients to support them with the most profitable decision-making. Another aspect driving the market demand is the growing digitalisation of investment and banking firms.

During the last five years, the entire wealth management ecosystem had to endure rising regulatory pressures and cybersecurity threats, among others. To meet the challenge of regulation, firms invested both in technology-for compliance technology-and governance frameworks. A factor that has come to counter the threat of cyber crimes has been strong preventive measures and frequent audits, boosting the wealth management platform demand growth. The driving force of more stringent requirements from more demanding digital technologies saw companies update their legacy systems by embracing newer cloud technologies and incorporating AI into analytics. These proactive approaches have only improved resilience and strengthened offerings in a fast-moving market.

Key trends in wealth management platforms include robo-advisors, hybrid models, mobile-first solutions, and expanded access to alternative investments for diversified portfolios.

Robo-advisors are gaining momentum in the wealth management platform market since they are relatively low-cost, efficient, and accessible. These AI-based platforms help manage portfolios using algorithms in creating personalized investment strategies on the basis of goals, risk tolerance, and financial circumstances of an investor. These appeal to young, digitally savvy investors seeking cost-effective and hands-off solutions to their investment needs. Betterment and Wealthfront, among others, are leaders in this trend, offering personal diversified portfolios to users at the same time as lowering the demand for human advisors. The robo-advisors are democratizing the management of wealth by bringing investment opportunities closer to more people, thus augmenting the wealth management platform demand growth.

Hybrid models of wealth management that combine the benefits of robo-advisory services with human advisors are becoming popular. This is a strategy that satisfies the investor, who demands personalization through AI-driven portfolio management and direct access to human expertise on complex financial decisions. Platforms like Personal Capital and Charles Schwab are adopting this hybrid approach and combining automated investment solutions with clients' abilities to seek out the advice of financial advisors. These platforms combine the best of both worlds - digital and human - to satisfy the needs of different investors, thus providing a more holistic and customizable experience that mixes automation with personal financial advice.

As mobile technology advances, wealth management platforms are becoming mobile-centric, enabling investors to manage their portfolios on-the-go. With increasing demands for greater convenience and flexibility, it offers real-time access to investing information, portfolio performance data, and even financial planning tools on mobile-first platforms. The companies that have grabbed the trend of this idea include Robinhood and Acorns, making wealth management easily accessible to young investors in terms of easy-to-navigate mobile apps. Easy tracking and making decisions, without the need to wait and without a long procedure, has enhanced overall user experience, thereby boosting the wealth management platform market revenue.

Wealth management platforms are also expanding their services to incorporate alternative investments such as real estate, private equity, and cryptocurrencies. More and more investors are seeking diversification beyond traditional assets such as stocks and bonds, and platforms are responding to these requests by providing access to a broader range of investment opportunities. Platforms like Fundrise and Yieldstreet are at the forefront of this expansion, offering alternative asset classes to retail investors. This trend allows wealth management platforms to cater to the growing demand for diverse investment options and to appeal to more sophisticated investors looking to enhance returns while reducing risks through diversification.

Many services, such as portfolio management, tax advice, and investment management, can be offered through wealth management platforms, making them an attractive service to investors, and holding tremendous market potential. By streamlining operations and reducing errors, process automation improves efficiency and decision-making. Advanced analytics and financial advisory tools also allow for the flexibility of running one's wealth effectively and making better investment decisions, thereby unlocking the doors of wealth management platform market opportunities. These can leverage the growing demand for integrated and seamless financial solutions to expand its customer base and power the industry growth.

Artificial intelligence, directed toward predictive analytics, is one of the new emerging technologies in the platform of wealth management. Firms have been making use of AI to look through large sets of financial data so that market trends can be predicted for better investment strategies. For example, algorithms based on AI technology are used by BlackRock in the Aladdin platform for providing insight in formulating basis decisions by the portfolio manager thus building the wealth management platform market dynamics and trends. Technology allows a better crafting of the investment strategy according to the particular needs of the clients, maximises asset allocation efficiency as well as provides superior portfolio performances to the client.

North America is expected to lead the market for wealth management platforms throughout the forecast period, because of its early adoption of emerging technologies and increasing availability of data. The region has a good technological infrastructure, along with advancements in artificial intelligence, machine learning, and big data analytics, making it an innovation hub in wealth management. This growth is further fueled by the increasing digitization in the banking sector, where banks are increasingly offering digital wealth management solutions to cater to tech-savvy investors. Demand is being driven by robo-advisors, mobile-first platforms, and hybrid models that combine human expertise with AI-powered services. In step with growing consumers' preference for going online, North American wealth management platforms are shifting in favour of services that are more client-tailored, data-led and cost-efficient in dealing with the diversity of different kinds of investors.

Government officials in the region have focused their efforts on credit seekers to promote people's financial inclusion to stimulate economic growth, shaping new trends in the wealth management platform market globally. In addition, technological advancements are fostering financial technologies or fintech firms, further enhancing the wealth management platform market demand. The market growth can also be attributed to the region's increasing number of high-net-worth individuals (HNWIs). These HNWIs are increasingly subscribing to advanced financial advisory solutions.

A prominent threat to the wealth management platform market is growing cybersecurity attacks. More firms are getting exposed to risks of data breaches since digital solutions become progressively widespread and in turn will undermine client trust with heavy financial and reputational losses. Additionally, keeping in tune with changing regulations as well as ensuring robust security adds to this complexity, leading to wealth management platform market challenges. The financial institutions need to continuously invest in some of the best class cybersecurity technologies and employee training to combat these risks, which requires that fair balance between innovation and protection needs for sensitive client information.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Wealth Management Platform Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

On the basis of deployment type, the market can be divided into the following:

On the basis of end use, the market can be divided into the following:

Based on region, the market can be segregated into:

By Deployment Type Analysis

Both on-premises and cloud deployment types of wealth management software are in demand, catering to diverse client needs. On-premises solutions offer enhanced security and control for firms dealing with sensitive data. Traditionalist institutions are attracted to this kind of approach. On the other hand, cloud-based platforms provide scalability, flexibility, and low-cost entry, making it attractive for the startup or small firms' use. As per wealth management software platform market analysis, the ability to access real-time data and analytics from anywhere boosts operational efficiency and client engagement, which collectively accelerates overall growth in the wealth management software market.

Market Analysis by End Use

The demand for wealth management software is highly driven through various end-use channels. Banks seek strong compliance and client relation management solutions. A trading firm has high-end analytics to achieve market insights and aid trade execution. As per wealth management software industry analysis, brokerage firms enjoy streamlined operations, enhanced client interfaces for efficiency as well as engagement. Investment management firms focus on portfolio management tools to track their asset allocations and performance lines. It is also adopting technology for customised solutions by the "Others", which includes family offices and financial advisors, in order to build a holistic ecosystem addressing the varied wealth management landscape.

North America Wealth Management Platform Market Opportunities

One of the key opportunities in the North America wealth management platform market lies in the rise of robo-advisors. As investors continue to look for low-cost, automated investment options, robo-advisory solutions can prove to be a great opportunity for traditional firms to tap into the market through integrations in their offerings. For example, firms like Wealthfront integrate automated financial planning and investment management and appeal to the younger, tech-savvy clients. Traditional wealth managers can therefore enhance their service portfolio through the integration of these digital tools, attract new clients, and be at the cutting edge of this evolving financial landscape.

Europe Wealth Management Platform Market Dynamics

The two key dynamics the Europe wealth management platform market relies on include: changes in regulation, growing demand for customized services by clients, and technological innovation. Regulatory conditions like that of MiFID II promote fair transparency regarding compliance. On the other hand, clients seek customized investment solutions. For instance, Nutmeg develops immense attraction owing to its robo-advisory service offered to clients as a customized investment strategy. It also brings competition to the development of fintech startups, challenging the large traditional firms to develop new innovations and improve their offer, hence indirectly benefiting clients with better services and easier access.

Asia Pacific Wealth Management Platform Market Trends

The Asia Pacific wealth management platform market is undergoing a trend of high adoption toward increased digitalization and the incorporation of technology. Financial institutions are leveraging AI and data analytics to gain better insights and personalise services. It is also an emerging investment requirement that stems from this changing pattern, with clients seeking sustainable investment options. This trend is reflected in platforms offering ESG-oriented portfolios, which allow the demands of younger, socially responsible investor preferences while advocating for increased transparency and accountability in asset management.

Latin America Wealth Management Platform Market Insights

One of the main factors driving the growth of the Latin America wealth management platform market is the increasing number of high-net-worth individuals in the region. As money grows, there is always a basic need for people to seek tailored investment strategies and personalised financial solutions, thus fueling the growth of the Latin America wealth management platform market. For instance, a BTG Pactual platform uses sophisticated analytics and digital tools to offer tailored wealth management solutions. This focus on personalization not only attracts the rich and affluent but also increases client retention, thus ensuring long-term relationships in a competitive market.

Middle East and Africa Wealth Management Platform Market Drivers

Digital demand among high-net-worth investors is the other significant driver for the Middle East and Africa wealth management platform market. With increasing regional wealth, clients look for simpler ways to manage their assets in a more efficient way. A company such as Sarwa is leveraging this trend by offering a user-friendly digital investment platform with automated portfolio management and financial planning tools. With the evolution of digitalization, client interaction has been improved on, and it meets the expectations of an environment with tech-savvy clientele.

Wealth management platform market players are boasting client experiences with advanced technology and smooth integration. They continuously eye customizable solutions for streamlined operations and improved engagement of their clients. Wealth management platform companies are further developing highly integrated platforms which support multi-asset as well as multi-currency portfolios. There is a growing emphasis on digital solutions to attract a younger group of investors and reach a wide client base with key financial hubs but still being in touch with the emerging client needs and market dynamics.

Founded in 2000, Avaloq Group AG is headquartered in Zurich, Switzerland. With the wealth management platform that Avaloq offers, private banks and wealth managers will be able to find suitable solutions for end-to-end operations. The solutions they offer include digital banking, investment management tools, and core banking systems which focus on customising, automating, and enhancing client experiences.

Temenos AG was founded in 1993 and is headquartered in Geneva, Switzerland. The company's solution is a cloud-native wealth management system, offering its customers investment management, financial planning, and client relationship management. Their solutions focus on scalability, flexibility, and superior user experience designed to meet financial institutions' needs.

Founded in 1968, with headquarters in Jacksonville, Florida, United States, Fidelity National Information Services, Inc. (FIS) is a financial wealth management solutions provider of portfolio management, trading, and compliance products to asset managers, banks, and financial advisors with a focus on using technology to enhance the workflow of these organisations and help increase client engagement.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other wealth management platform market key players include Prometeia S.p.A, and Backbase B.V, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 5667.16 Million.

The wealth management platform market is assessed to grow at a CAGR of 8.90% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 13293.65 Million by 2035.

The major drivers of the market include the increasing digitalisation, technological advancement, enhancement of customer service, and the lowering of the operational cost and presence of leading wealth management platform providers.

Rising shift toward digital investment management solutions across high net worth individual and increasing demand for wealth monitoring software by small and medium enterprises are the key industry trends propelling the growth of the market.

The market is broken down into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

Based on deployment type, the market is divided into on-premises and cloud.

Banks, trading firms, brokerage firms, and investment management firms, among others, are the end users of the industry.

The competitive landscape consists of Avaloq Group AG, Temenos AG, Fidelity National Information Services, Inc., Prometeia S.p.A, and Backbase B.V, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Deployment Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share