Global carbon credits market use is prompting climate action with the help of financial engineering

Carbon credits are certifications issued to their owners allowing them to release some metric tons of carbon in the form of carbon dioxide or other greenhouse gases (GHGs). One carbon credit is equal to 1 metric ton of carbon dioxide or its equivalents in other greenhouse gases. Such permits are sometimes referred to as carbon allowances. Provided that the system of carbon credit is in place, its main objective is to limit the release of GHGs in the atmosphere. Delegates to the Glasgow COP26 climate change conference reached an agreement in November 2021 to provide for a carbon credit offset trading market at the global level.

The concept of carbon market

Carbon markets can be understood as a system that enables corporations and investors to purchase carbon credits as well as carbon offsets. This system counteracts the environmental issue while at the same time offering a new avenue for investment. New problems will almost always generate new markets and the current climate change crisis coupled with increasing global emissions is no different. The renewed interest in carbon markets is still quite recent. Carbon trading markets were established with the Kyoto Protocols in 1997 but the growth and investment of the new regional markets has increased significantly.

Carbon pricing strategies are upheld by several states in the USA, even though there is currently no national carbon market. While California’s cap and trade policies remain unmatched, the east coast states also clinched their modern carbon market through the Regional Greenhouse Gas Initiative (RGGI), which encompasses eleven such states for carbon conservation.

2023 saw Washington State introduce its cap and invest program while the program for Oregon had already begun in 2022, marking another turn in America’s state level carbon markets.

Due to the interaction of new mandatory emission trading systems and increased pressure from consumers, firms are beginning to seek out the voluntary market for carbon offsets. There has also been a public policy push due to changing social norms regarding climate change and carbon emissions. Given the constant changes in state, federal, and international regulations, the demand for understanding carbon credits by business and market will only grow.

Difference between carbon offsets and carbon allowances

While the terms ‘allowance’ and ‘offset’ are often used interchangeably, they refer to two different components in carbon markets. In a compliance carbon market, carbon allowance means the right to emit 1 tCO2e, while carbon offset is a reduction of 1 tCO2e from the global emission pool.

The 1 tCO2e reduction can be generated in many ways, which is why carbon offsets can be further divided.

- Avoidance: Refraining from an activity that would emit GHGs

- Reduction: A change in activity that results in lower GHG emissions.

- Removal: This refers to the taking and storage of GHG emissions that have already been introduced to the atmosphere.

Moreover, there are two categories of carbon markets, called compliance and voluntary. In compliance markets (e.g. national or regional emissions trading schemes) participants respond to a mandate created by a regulatory authority. In the world of voluntary carbon markets, there is no formal requirement to achieve any specific target. Rather, climate mitigation is being sought by non-state actors like companies, cities or regions that try to voluntarily offset their emissions to meet mitigation targets such as climate-neutral, net zero emissions.

Cap-and-trade programs

Cap-and-trade programs already exist in one form or another in many countries, including Canada, the EU, the UK, China, New Zealand, Japan, and South Korea, and many others are also considering implementation.

In 2024, 46 national and 37 subnational jurisdictions have enacted carbon pricing programs. Recent initiates add Indonesia’s carbon trading system launched in late 2023, Vietnam’s pilot program from 2024, and Malaysia’s emissions trading system targeted for early 2025. Together, these markets account for about one-fourth of global greenhouse gas emissions.

This provides a strong incentive to companies to cut their emissions from their business operations to remain under their caps.

The basic idea behind a cap-and-trade program is that it reduces the immediate burden on companies to meet emissions targets and adds market incentives to reduce carbon emissions faster.

How carbon credits are produced

Businesses can often create and sell carbon credits by reducing, capturing, and storing emissions through different processes. Some of the well-known carbon offsetting projects include renewable energy projects, improving energy efficiency, carbon and methane capture and sequestration, and land use and reforestation, among others.

Furthermore, as per the recent industry reports, more than 80% of the listed companies are not following their net-zero targets, highlighting the necessity for strategies and tools to achieve the climate goals, including the selective and strategic use of carbon credits.

Possible risks in Carbon Market

The carbon market faces several interconnected risks that stakeholders must carefully consider. Invalidation risk involves the potential revocation of carbon credits after issuance due to non-compliance or evolving methodologies. Political risk emerges from governmental actions or inactions that could adversely impact carbon projects, including the possible revocation of carbon rights. Reputational risk manifests when carbon credits are perceived as greenwashing, potentially leading to negative public perception and legal actions against investors. Price risk stems from the highly volatile nature of carbon prices and the financial implications of evolving compliance policies. Non-delivery risk occurs when carbon credits fail to be delivered as expected, whether due to natural disasters like forest fires or company insolvency. Reversal risk involves previously removed or avoided carbon being released back into the atmosphere, often due to land-use changes. Finally, counterparty risk arises when trading partners may default on their contractual obligations, potentially due to fraudulent activities.

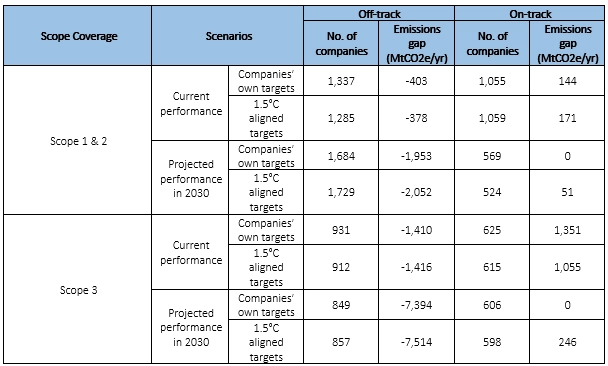

These risks are further complicated by current performance data showing significant emissions gaps across both Scope 1 & 2 and Scope 3 emissions, with many companies currently off-track in meeting their targets. The projected performance for 2030 indicates an even wider emissions gap, particularly in Scope 3 emissions, highlighting the complex challenges facing the carbon market ecosystem.

Table: Summary of companies’ emissions performance gap, as of September 2023

Recent Developments in the Global Carbon Credit Market

- Set to provide an opportunity for carbon credit purchases and sales, Indonesia announced at the beginning of January 2025 of its plan to open its national carbon credit market for international buyers for the first time on January 20 with 1.7 million carbon credits up for trade. These credits can be bought by countries as part of Nationally Determined Contributions (NDCs), representing a major milestone in the global carbon credit market.

- In July 2024, the Indian government introduced comprehensive regulations for the upcoming compliance carbon market as part of the Carbon Credit Trading Scheme (CCTS). These regulations outline the essential design features of the compliance mechanism under the CCTS, representing a major step forward in India's developing carbon pricing framework. The Bureau of Energy Efficiency (BEE) released a draft of the regulations in November 2023 and improved them through a thorough consultation process with stakeholders.

- A new set of global standards for the carbon credit trade market has been established during the United Nations Climate Change Conference in Baku, Azerbaijan, also known as COP29. Referred to as Article 6.4, delegates reached an agreement on the rules for creating a system that facilitates the trading of carbon credits between countries and companies, all under the oversight of a centralized U.N. body. This includes guidelines for validating, verifying, and issuing credits. The new agreement has the potential to lower the cost of implementing national climate plans by USD 250 billion annually by promoting cross-border cooperation.

Market Structure with Major Market Participants in the Global Carbon Credit Market

The carbon market ecosystem comprises diverse participants working together to facilitate emissions reduction and trading. Project developers like BlueSource, Finite Carbon, and 3Degrees focus on creating verifiable carbon reduction initiatives, particularly in forestry and nature-based solutions. These projects generate carbon credits that are crucial for the market's functioning.

Major corporations participate as credit buyers, with companies like Shell, Volkswagen, and Takeda actively purchasing credits to offset their emissions and meet sustainability goals. Their involvement helps finance new carbon reduction projects and demonstrates corporate commitment to climate action.

Market intermediaries such as Numerco, SCB Group, and Emstream play a vital role in facilitating transactions and ensuring market liquidity. They bridge the gap between credit generators and buyers, making the market more efficient.

The market's integrity is maintained through a robust regulatory framework. Government agencies like BEE, CER, and EPA provide oversight, while verification organisations such as Gold Standard and Verra ensure credit quality. Trading infrastructure, including established exchanges and specialized platforms, enables efficient credit trading.

Furthermore, projects span various categories, from renewable energy and forestry to methane capture and blue carbon initiatives. This diversity ensures multiple pathways for emissions reduction while catering to different buyer preferences and environmental needs.