Solid-state batteries (SSBs) are advanced energy storage devices that utilise solid electrolytes instead of liquid or gel-based ones. Known for their higher energy density, safety, and longer lifespan, SSBs are seen as the future of energy storage technology. They are widely used in various applications including electric vehicles (EVs), consumer electronics, and renewable energy storage. According to an Expert Market Research study, the global solid-state batteries market was valued at USD 796.92 million in 2024. Looking forward, the market is expected to grow at a CAGR of approximately 33.3% from 2025 to 2034, reaching a projected value of around USD 10.612 million by 2034. The growth is driven by the increasing demand for EVs, advancements in battery technologies, and the need for safer, more efficient energy storage solutions. Key factors propelling this growth include the desire for longer-lasting batteries, higher efficiency, and eco-friendly solutions, alongside a growing focus on technological innovations and scaling of solid-state battery manufacturing.

Latest Insights into the Global Solid-State Battery Market: Trends and Developments

In December 2024, QuantumScape Corporation (NYSE: QS), specialising in solid-state lithium-metal battery technology, announced the development, delivery, installation, and release of next-generation heat treatment equipment for its separator production process, Cobra. This milestone keeps the company on track to deliver higher-volume samples of its first planned commercial product, QSE-5, in 2025, marking a major step toward the commercialisation of solid-state batteries for electric vehicles.

In November 2024, Honda Motor Co., Ltd. unveiled a demonstration production line for all-solid-state batteries, developed independently for mass production. The line was built at Honda R&D Co., Ltd. (Sakura) in Sakura City, Tochigi Prefecture, Japan.

In November 2024, SAIC, one of the biggest Chinese automakers announced plans to begin mass production of its second-generation solid-state battery (SSB) in 2026. The battery will have an energy density of 400 Wh/kg. SAIC joined the competition alongside Chery, GAC, CATL, BYD, GWM, and other companies.

In November 2024, Chinese power battery giant CATL increased its R&D investment in all-solid-state batteries, expanding its R&D team for the program to over 1,000 people. CATL is currently focusing on the sulphide route and has recently entered the trial production stage of 20 Ah samples.

In September 2024, Toyota introduced plans to launch a passenger vehicle powered by solid-state batteries, enhancing EV performance. The Japanese Ministry of Economy approved Toyota’s plan to begin production by 2026, with mass production expected by 2030. The early model can deliver up to 1,000 km of range upon full charge and can be as fast as 10 minutes solving a major challenge in the EV market.

Solid-State Batteries vs. Lithium-Ion Batteries: A Comparative Market Analysis

Solid-state and lithium-ion batteries differ in key features. Solid-state batteries use a solid electrolyte, offering higher energy density (250-800 Wh/kg) compared to lithium-ion batteries (160-250 Wh/kg). This results in lighter, more energy-efficient batteries. Additionally, solid-state batteries have a longer lifespan due to their less reactive solid electrolytes, while lithium-ion batteries have a limited number of charge cycles. Solid-state technology also enhances safety by reducing risks like leakage or fire. In contrast, lithium-ion batteries use a liquid electrolyte to conduct lithium ions, leading to lower energy density and shorter lifespan. While solid-state batteries offer better performance and safety, they are still emerging in commercial applications.

The Role of Batteries in Electric Vehicle Growth

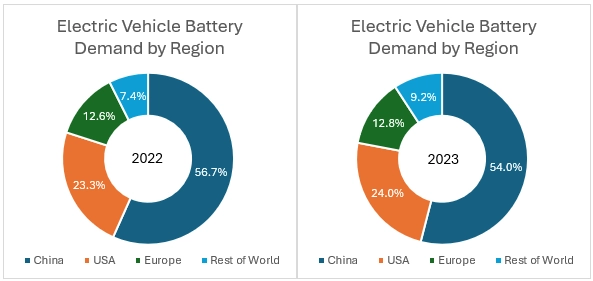

According to the International Energy Agency, global EV battery demand surged in 2023, reaching over 750 GWh, a 40% increase from 2022, driven primarily by higher electric vehicle sales, which contributed 95% to this growth. The United States and Europe led the electric vehicle market growth, with increases exceeding 40% year-on-year, while China saw a 35% rise. However, China's demand for EV batteries remained the largest, at 415 GWh, followed by Europe with 185 GWh and the U.S. with 100 GWh. The rest of the world saw a remarkable 70% growth in battery demand, reflecting the rise in EV sales. In China, plug-in hybrid electric vehicles (PHEVs) accounted for approximately one-third of electric car sales and 18% of the country's battery demand in 2023. This growing demand also signals a shift towards next-generation battery technology, with the market for solid-state batteries expected to grow rapidly in the coming years.

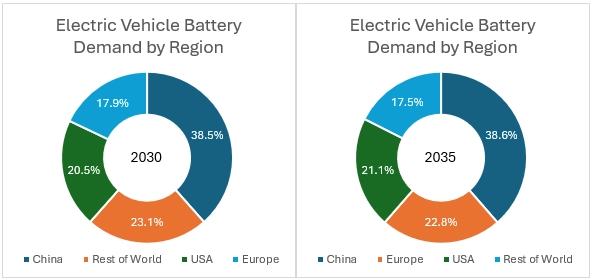

Electric Vehicle Battery Demand by Region

Outlook and Opportunities

The global market for solid-state batteries (SSBs) is set for substantial growth, particularly in sectors like electric vertical take-off and landing (eVTOL) aircraft and urban air mobility (UAM). According to a report in December 2024, demand for solid-state batteries in the low-altitude aviation sector is projected to reach 86 GWh by 2030 and 302 GWh by 2035, driven by advancements in energy density and safety.

Leading manufacturers, including Toyota, Nissan, and Samsung SDI, have initiated pilot production of all-solid-state batteries (ASSBs), with mass production expected to reach GWh levels by 2027. Semi-solid-state batteries, which are already deployed in electric vehicles, have achieved production scale with energy densities ranging from 300–360 Wh/kg. With increased production and technological advancements, their costs are expected to drop below CNY 0.4/Wh by 2035. As of May 2024, Chinese companies are planning to invest USD 830 million in all-solid-state battery R&D. Six companies, including CATL, BYD, China FAW Group, SAIC Motor, Beijing WeLion, and Geely Auto, received government support for R&D. The program, led by government ministries, encouraged these companies to develop all-solid-state battery technologies.

For ASSBs, initial production costs are anticipated to be high, but as production scales up and technologies advance, prices are expected to decrease. By 2030, the price of ASSBs could fall to around CNY 1/Wh if the scale of all-solid-state battery applications surpasses 10 GWh, with further declines to CNY 0.6–0.7/Wh by 2035, driven by rapid market expansion and large-scale production.

Final Take

Solid-state batteries represent a major leap forward in electric vehicle technology, offering several key advantages over traditional lithium-ion batteries. With higher energy density, enhanced safety, longer lifespan, faster charging, and improved sustainability, solid-state batteries are poised to play a crucial role in the future of electric vehicles. As research and development continue to progress, solid-state batteries could soon become the standard for EVs, driving further innovation in the automotive industry and helping to accelerate the global transition to electric transportation.