The Australia trade finance market was valued at USD 1051.49 Million in 2025. It is expected to grow at a CAGR of 3.80% from 2026 to 2035, reaching USD 1526.79 Million by 2035. As per the analysis by Expert Market Research, the market is expected to be driven by the emerging requirements such as sustainable financing.

Trade finance encompasses the financial instruments and products that enable companies to facilitate international trade and commerce. It streamlines transactions for importers and exporters, making business operations more efficient.

Australia, with its robust network of 95 banking institutions, supports a diverse trade finance market. This comprehensive network provides a wide array of financial services and solutions tailored for businesses engaged in international trade.

Digitalisation is significantly transforming the Australia trade finance market, with a growing number of financial institutions adopting advanced digital platforms and technologies. The integration of blockchain, artificial intelligence, and machine learning is streamlining trade finance processes, reducing paperwork, and enhancing both transparency and security in transactions.

Sustainability is increasingly becoming a focal point in trade finance, with financial institutions and businesses prioritising environmentally and socially responsible practices. Green trade finance products that support sustainable projects and commodities are gaining momentum in the market.

Fintech companies are making notable steps in the trade finance sector by offering innovative solutions that challenge traditional banking models and supporting the Australia trade finance market growth. These companies provide more flexible, efficient, and accessible trade finance options, particularly for small and medium-sized enterprises (SMEs).

Additionally, supply chain finance is experiencing substantial growth, driven by the need for working capital optimisation and effective supply chain management. This financing solution allows businesses to enhance cash flow and strengthen supplier relationships.

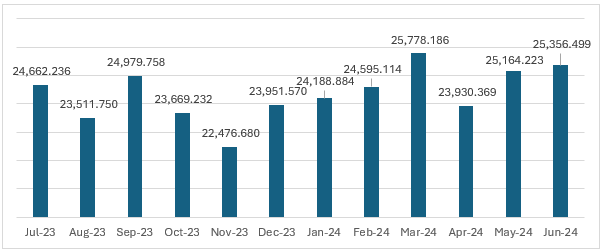

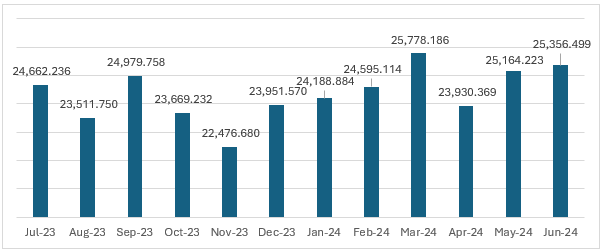

Figure: Australia's Total Imports (July 2023 -June 2024) (USD Million)

As per the Australia trade finance market analysis, the expansion of trade corridor is supporting market growth. Australia’s trade finance market is experiencing growth due to the expansion of trade corridors with key partners in Asia, Europe, and the Americas. The establishment of new trade agreements and partnerships is promoting smoother and more efficient cross-border trade.

In July 2024, ANZ announced a significant milestone as the first major Australian bank to successfully execute a cross-border payment into Australia in near real-time. This achievement follows the launch of ‘Express Payments,’ which leverages the New Payments Platform (NPP) network.

Top Trade Finance Companies in Australia:

1. HSBC Bank Australia Limited

| Headquarters: |

Sydney, Australia |

| Establishment: |

1965 |

| Website: |

www.hsbc.com.au |

HSBC Australia employs more than 2,000 people through a network of branches and offices based in metropolitan areas of Sydney, Melbourne, Brisbane and Perth. HSBC offers trade finance solutions such as borrowing base finance, warehouse/inventory finance, pre-export and prepayment finance, and other commodity financing structures. HSBC offers the trade finance solutions for the entire supply chain from production to transformation to marketing.

2. Ebury Partners Australia Pty Ltd

| Headquarters: |

Sydney, Australia |

| Establishment: |

2009 |

| Website: |

www.ebury.au |

Ebury Partners Australia Pty Ltd is a finance specialist working with more than 45,000 businesses and organisations across the world. In FY 2022, USD 34 billion was transacted through the company. The company has a workforce of more than 1,600 employees across 21 countries. The company’s corporate products include payments and collections, business lending, FX risk management, and digital platforms.

3. State Bank of Australia

| Headquarters: |

Sydney, Australia |

| Establishment: |

2004 |

| Website: |

aus.statebank |

SBI Australia offers a wide range of services including deposits, remittances, trade finance solutions, syndicated loans etc. The trade finance services offered by the company include Service Information Buyers Credit, Suppliers Credit, Letter of Credit, Import Document Collection, LC Advising Service, Confirmation of Export LCs, Export Collections, Export LC Negotiation, Bank Guarantees, and Stand-by letter of Credit (SBLC).

4. Scottish Pacific Business Finance Pty Ltd

| Headquarters: |

Sydney, Australia |

| Establishment: |

1988 |

| Website: |

www.scotpac.com.au |

The company offers a wide range of flexible funding solutions, like Invoice Finance, Trade Finance, Asset Finance, and business loans. Scottish Pacific Business Finance Pty Ltd supports more than 85,00 businesses. The company offers trade finance solutions such as business loans, invoice finance, asset finance, and tradeline.

5. Westpac Banking Corporation

| Headquarters: |

Sydney, Australia |

| Establishment: |

1817 |

| Website: |

www.westpac.com.au |

Westpac offers a wide range of consumer, business and institutional banking and wealth management services through a portfolio of financial services brands and businesses. Westpac is considered Australia’s first bank and oldest company, one of the four major banking organisations in Australia and one of the largest banks in New Zealand. Westpac offers short term, fixed rate finance for the shipment of goods.

6. ANZ Group Holdings Ltd.

| Headquarters: |

Melbourne, Australia |

| Establishment: |

1835 |

| Website: |

http://www.anz.com.au/ |

Over 8.5 million retail and business clients are served by Australia and New Zealand Banking Group Limited, which operates in nearly 30 locations and offers banking and financial products and services. According to the Australian Banking Act, ANZ Group Holdings Limited is a permitted non-operating holding company.

Share